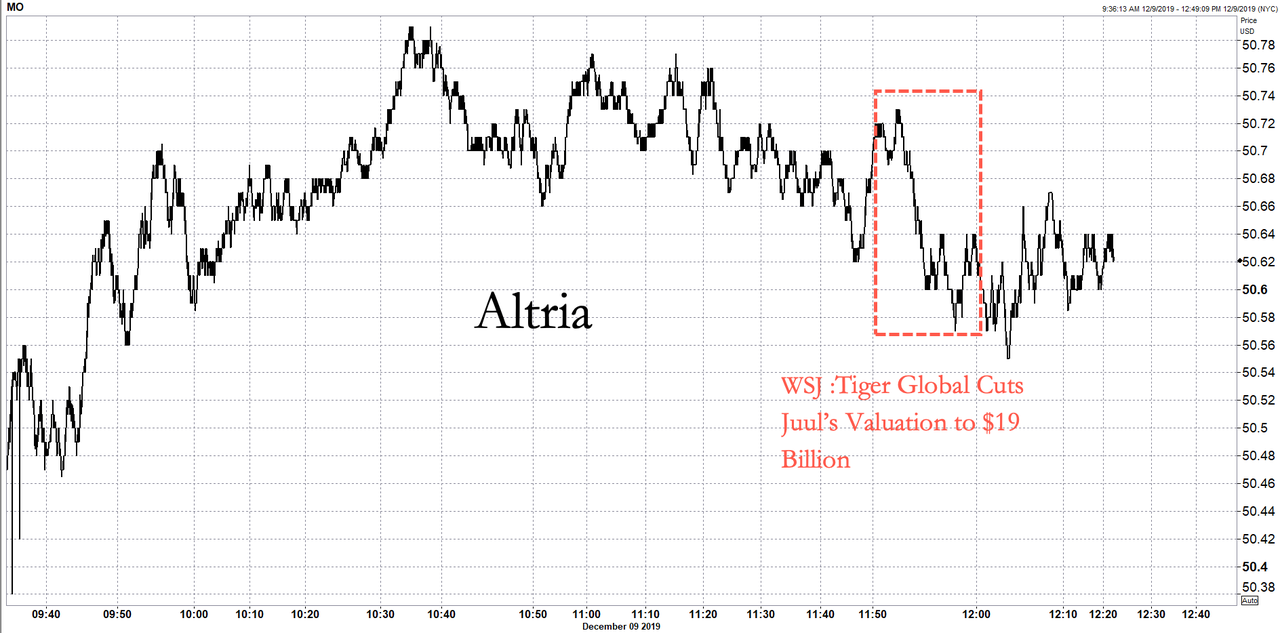

Altria Slides As Tiger Global Slashes Juul’s Valuation In Half

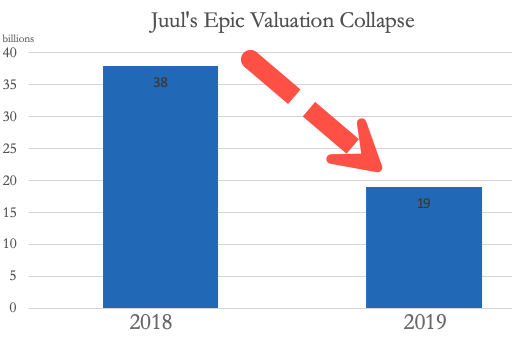

The Wall Street Journal published a story around noon detailing how Tiger Global Management, one of the lead investors behind e-cigarette startup Juul Labs Inc., cut the company’s valuation to $19 billion, a far cry from $24 billion in October and $38 billion last December.

The massive write-down has been nothing more than headaches for Marlboro-maker Altria Group Inc., who bought a 35% stake in the e-cigarette startup at a $38 billion valuation.

Shares in Altria slid around noon when the report crossed the wires.

Juul CFO Guy Cartwright told employees via an email Sunday night that the company had just experienced a massive drop in valuation.

“A lot has changed in the market in the past year… We’re still a very young company.” Cartwright said, “Achieving a $24 billion valuation less than three years into our journey is an incredible feat.”

He added that the decision for the government to pull all of its flavors except for tobacco and menthol was the main driver in the valuation drop.

Juul has been at the center of controversy surrounding the government’s crackdown on underage vaping.

The Food and Drug Administration and the Federal Trade Commission have also launched probes into the company.

Juul’s 50% collapse in valuation in less than one year has forced the company to cut 16% of its total workforce.

It seems that Silicon Valley’s precious unicorns are dropping like flies.

Tyler Durden

Mon, 12/09/2019 – 12:45

via ZeroHedge News https://ift.tt/2PsCyuX Tyler Durden