Global Market Rally Grinds To A Halt As US-China D-Day Looms

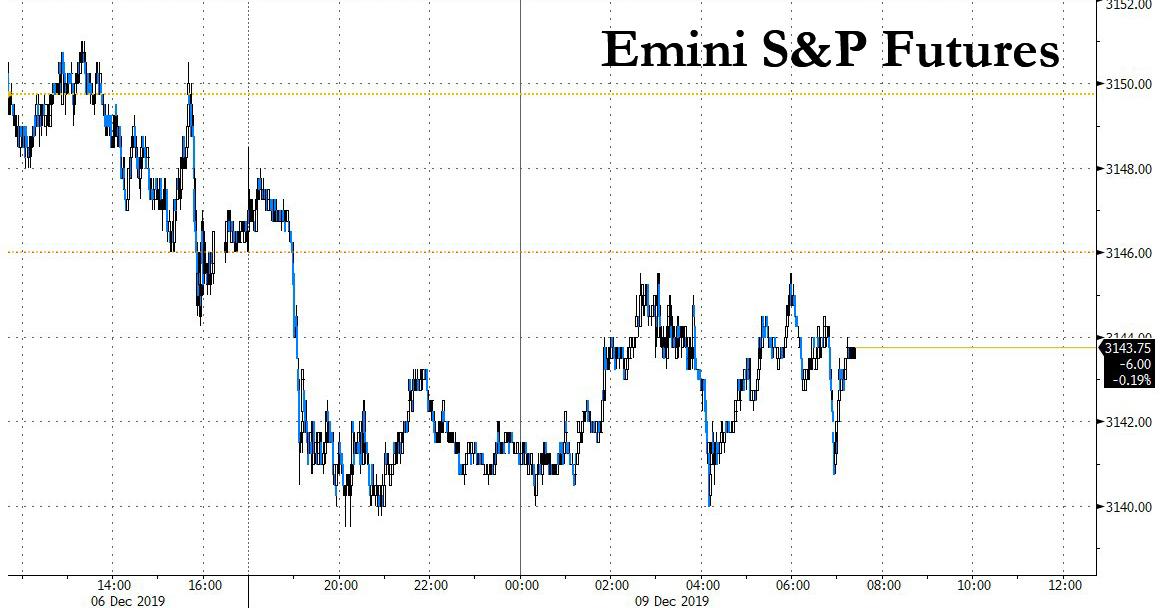

US futures and European stocks slumped, as did global treasury yields and the dollar, as traders shrugged off unexpectedly strong trade data from Germany instead focusing on the latest disappointing trade data from China ahead of an action-packed week that includes U.S. Federal Reserve and European Central Bank meetings and a UK election.

Markets had closed last week in an upbeat mood as blockbuster U.S. jobs data reassured investors about the U.S. economy and sent MSCI’s index of global stocks 0.8% higher but those gains stalled as worries about a Chinese economic slowdown returned. Indeed, futures on all main US equity indexes pointed to a soft start on Wall Street after the latest disappointing Chinese trade data which saw a 3rd consecutive drop in exports, while traders awaited news on whether Washington will go ahead with a planned Dec 15 tariff hike on Chinese imports.

While several major events loom for the week — the Fed meets on Wednesday and new ECB chief Christine Lagarde holds her first policy meeting on Thursday, the same day as Britain’s parliamentary election, but at the forefront of investors’ minds is the Dec. 15 deadline for the United States to impose a new round of tariffs on China. The latest overnight news on that front came from China which said on Monday that it hoped to make a trade deal with the United States as soon as possible, one which satisfies both sides, Assistant Commerce Minister Ren Hongbin told reporters on Monday.

Meanwhile, on Saturday, China top diplomat Yang spoke with US Secretary of State Pompeo on Saturday, and said the US has seriously violated international relations by passing the Hong Kong and Uighur bills, while he urged the US to correct its mistakes and immediately stop interfering with China’s internal affairs. China’s Xinjiang region Governor said the US bill on Xinjiang is a severe violation of international law, while the Governor added the US bill has no regard for facts and has made groundless accusations against the human rights situation as well as the Chinese government. Elsewhere, China Global Times Chief Editor tweets that “Because of US obstruction, WTO’s appellate body which settles disputes between members will be unable to function on Tuesday. And it is the most important platform to ensure fair trade.”

With time running out for the U.S. and China to reach a deal that would ward off an escalation in tariffs, markets will be watching closely for any signs of progress. White House economic adviser Larry Kudlow said Friday the two sides are haggling over the amount of American farm products Beijing is willing to purchase. Data showed China’s exports fell 1.1% in November, with those to the U.S. tumbling 23%, underscoring why the Asian nation may want to resolve the dispute.

“There’s no upside risks on the horizon,” Katrina Ell, an economist at Moody’s Analytics, said on Bloomberg TV. “It is weighted to the downside and that big downside risk is coming from the trade war.”

In the absence of bigger “trade optimism”, and following Friday’s market surge following the blockbuster payrolls report, global risk mood was on the back foot with the Stoxx Europe 600 Index fluctuating before turning lower, with falling energy companies offsetting rising miners and retailers. Europe’s energy sector was the biggest loser of the day, falling almost 1% as shares in Tullow Oil slumped 60% to 19-year lows due to issues at its main producing assets in Ghana and the resignation of its chief executive.

Earlier in the session, Asia managed to notch up small gains, climbing for a third day and led by energy producers, with Japan’s Nikkei adding 0.33% and MSCI’s Asia-Pacific shares outside Japan up 0.15%, though gains mostly fizzled in Hong Kong and Shanghai. China’s latest unexpected export drop strengthened the case for an initial trade deal with the US, as Chinese exports to the US tumbled for a 12th month, sliding 23% Y/Y.

Concerns about damage being done to the global economy by the trade war, were renewed after China released data showing its exports shrank for the fourth consecutive month in November. Chinese exports slid 1.1% in November from a year earlier, missing economists forecasts for a 0.8% gain.

Chinese shares closed 0.2% lower, their losses checked by a rise in imports that was interpreted as a sign that Beijing’s stimulus steps are helping to stoke demand.

Japan’s Topix rose to a 14-month high, driven by electronic companies and chemical producers, as Japan’s economy expanded in the third quarter at a much faster pace than initially reported. The Shanghai Composite Index edged higher, with Foxconn Industrial Internet jumping and Jiangsu Hengrui Medicine sliding. India’s Sensex advanced, supported by Housing Development Finance and Reliance Industries.

In rates, 10Y Treasury yields inched lower, in keeping with market jitters as investors awaited the central bank meetings. U.S. 10-year Treasury yields were down 2 basis points at 1.8242%. Yields on German 10-year yields held around -0.30%, down from around 0.24% at the end of 2018, as major central banks resumed policy stimulus this year. Caution before this week’s central bank meetings and trade war uncertainty lifted sentiment towards safe-haven bonds at the start of the week. Ten-year bond yields in higher-rated euro zone states were down 1 to 2 basis points.

As Reuters notes, markets have been largely working on the assumption that the Dec. 15 tariffs, covering consumer goods such as cellphones and toys, will be dropped or postponed, given Trump will be unwilling to risk a year-end equity selloff. However, with less than a week to go, there is precious little movement.

In FX, the U.S. dollar, which bounced on Friday after data showed U.S. job growth increased in November by the most in 10 months, was down marginally against a basket of currencies and the euro. The strong labor market data in the United States allayed fears about a slowdown in the world’s largest economy which had been fanned by a series of weak figures on business and consumer activity.

“The clouds of recession still remain well offshore despite troubled economies elsewhere in the world and a trade war,” said Chris Rupkey, chief financial economist at MUFG Union Bank.

China’s yuan fell after the country’s exports unexpectedly declined. Chinese exports slid 1.1% in November from a year earlier, missing economists forecasts for a 0.8% gain. Exports to the U.S. dropped for a 12th month. China’s car sales extended their slump, all but ensuring a second straight annual decline. Volatility is reduced ahead of a series of risk events in coming days including Fed and ECB rate decisions, a U.K. election and a deadline for higher U.S. tariffs on China.

The biggest currency mover was the British pound which rose to a new 7-month high of $1.3180 as investors raised their bets on a Conservative Party victory – and a majority in parliament – in the general election.

Oil prices weakened after the disappointing Chinese trade data, with Brent futures down more than 1% at $63.73 per barrel after gaining about 3% last week on the news that OPEC and its allies would deepen output cuts.

In geopolitical news, White House National Security Adviser O’Brien warned US has many tools to deal with North Korea if it reneges on denuclearization commitments. Subsequently, North Korean Official notes that Pyongyang has nothing to lose, in response to US President Trump. Elsewhere, USTR Lighthizer and US Democrats are reportedly nearing a deal for Congress to pass USMCA, although hurdles remain according to reports citing sources familiar with the discussions.

Today, French President Macron hosts meeting on Ukraine in Paris with Russian President Putin, German Chancellor Merkel and Ukranian President Zelensky. No major economic data is scheduled. Chewy, MongoDB are among scheduled earnings.

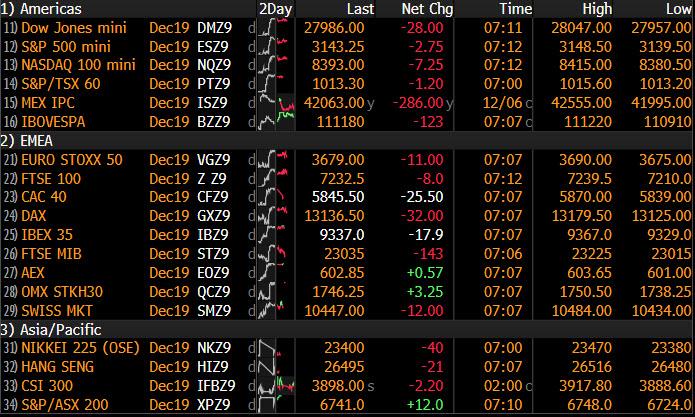

Market Snapshot

- S&P 500 futures down 0.1% to 3,141.75

- STOXX Europe 600 down 0.2% to 406.62

- MXAP up 0.3% to 165.55

- MXAPJ up 0.2% to 526.11

- Nikkei up 0.3% to 23,430.70

- Topix up 0.5% to 1,722.07

- Hang Seng Index down 0.01% to 26,494.73

- Shanghai Composite up 0.08% to 2,914.48

- Sensex up 0.07% to 40,475.24

- Australia S&P/ASX 200 up 0.3% to 6,730.03

- Kospi up 0.3% to 2,088.65

- Brent Futures down 0.6% to $63.98/bbl

- Gold spot up 0.2% to $1,463.05

- U.S. Dollar Index down 0.09% to 97.61

- German 10Y yield fell 1.9 bps to -0.305%

- Euro up 0.07% to $1.1068

- Brent Futures down 0.6% to $63.98/bbl

- Italian 10Y yield fell 2.0 bps to 1.002%

- Spanish 10Y yield fell 3.0 bps to 0.463%

Top Overnight News from Bloomberg

- Polls in the Sunday newspapers all put the Conservatives in the lead. There were some signs that Jeremy Corbyn’s opposition Labour Party was closing the gap, but not by enough to keep the Conservatives out of powe.

- The Chinese government has ordered state offices and public institutions to remove foreign computer equipment and software within three years, the Financial Times reported

- Japan’s economy expanded in the third quarter at a much faster pace than initially reported, driven by stronger capital investment and private consumption ahead of October’s sales tax increase

- The September mayhem in the U.S. repo market suggests there’s a structural problem in this vital corner of finance and the incident wasn’t just a temporary hiccup, according to a new analysis from the Bank for International Settlements

- Support for Angela Merkel’s junior coalition partner fell to 11% in a weekly Forsa poll, matching an all-time low reached in June. Another poll gave the SPD a 1-percentage-point bump

- Hong Kong saw its biggest pro-democracy protest in months on Sunday, signaling more unrest to come in 2020 as the movement that began in June to fight China’s increasing grip on the city shows its staying power

- At least 15 central banks are set to hold their final monetary policy meetings of the year this week, with the Federal Reserve and the European Central Bank taking center stage. While rate setters in Washington and Frankfurt are predicted to maintain policy, their colleagues in Brazil, Russia, Turkey and Ukraine are all forecast to cut rates.

- The September mayhem in the U.S. repo market suggests there’s a structural problem in this vital corner of finance and the incident wasn’t just a temporary hiccup, according to analysis from the Bank for International Settlements.

- First it was Japan. Then Europe. Now investors are scanning the world for the next outbreak of stagnant inflation and tumbling yields.

Asian equity markets were mixed as the tailwinds from Friday’s stellar US NFP report was offset by mostly weaker than expected Chinese trade data including a surprise contraction in Exports and with some hesitation observed heading into a risk-packed week. ASX 200 (+0.3%) and Nikkei 225 (+0.3%) saw a firm start to the session led by outperformance in energy names following the OPEC+ agreement, although both indices briefly retraced the majority of their gains amid heavy losses in Australia’s gold miners and as recent JPY strength suppressed the effect of a firm upward revision to Q3 GDP. Hang Seng (U/C) and Shanghai Comp. (+2.4%) traded indecisively after the largely disappointing Chinese trade data and as China continued to voice discontent with US “interference” regarding the Hong Kong protests and Uighur Muslims. Furthermore, China reportedly denied entrance into Macau for the President of the American Chamber of Commerce in Hong Kong and have also ordered government offices and public institutions to remove all foreign computer equipment and software in 3 years. Finally, 10yr JGBs declined on spill-over selling from T-notes and with the pressure also a function of the gains in stocks, firm GDP revisions and tepid BoJ Rinban announcement valued at JPY 180bln.

Top Asian News

- Japanification the Scourge Threatening to Go Global in 2020

- Five Dead After Volcano Erupts Off New Zealand’s East Coast

- Yes Bank Poised to Reject $1.2 Billion Offer From Braich

- Singapore Has a Property Glut That Could Take Years to Clear

European equities kick the week off broadly lower, albeit marginally [Eurostoxx 50 -0.2%] after the NFP optimism waned and as sub-par Chinese data dented the mood. Sectors are mostly in the red – and with no clear standouts and little by way of a split between cyclicals and defensives to reflect the risk tone, although material names are underpinned by the Friday’s surge in base-metal prices. In terms of individual movers: Osram Licht (+14.4%) soared to the top of the pan-EU index after AMS (-3.0%) announced it has succeeded on its second attempt with a EUR 4.6bln bid for Osram which comes after it lowered the necessary acceptance rate to 55% vs. Prev. 62.5%. Elsewhere, Tesco shares (+5.4%) are supported after confirming exploration of options for its Thai and Malaysian units (which account for 10% of Co’s sales), including a possible sale which could fetch up to USD 9bln. Meanwhile, Just Eat (+0.5%) shares are underpinned after Prosus increased its offer for the Co. to GBP 7.40/shr, valuing the Co. at approx. GBP 5.1bln; additionally, acceptance level for the deal has been reduced to a simple majority. Number 10 shareholder Cat Rock (owns 2.6% of Just Eat) noted that Prosus’ offer needs to be at least GBP 9.25.shr to compete with Takeaway.com’s offer. Takeaway.com believe that their offer for the Co. remains ‘far superior’ to the Prosus one. On the flip side, Tullow Oil (-59.0%) shares plummeted after the Co. was hit by a double whammy in the form of a production outlook downgrade and the departure of its CEO. Other downside movers include the likes of Sanofi (-0.5%) and Kerry Group (-0.9%) – both on M&A news – with the former acquiring Synthorx for USD 2.5bln, whilst the latter is reportedly mulling acquiring DuPont’s Nutrition business – which could be valued around USD 25bln.

Top European News

- Prosus Raises Just Eat Bid as Food Delivery War Intensifies

- Tullow’s Old Guard Is Out as Poor Production Sees CEO Quit

- Tesco Considers Sale of Asian Supermarkets in Pivot to U.K.

- ‘Quantitative Failure’ Risk Mounts for Central Banks in 2020s

In FX, sterling is off best levels, but still firmly bid as the clock ticks down to Thursday’s GE and polls continue to flag victory for the Tories, albeit to varying degrees and ahead of the final YouGov MRP due to be published tomorrow evening. Indeed, the Pound continues to outperform G10 counterparts and is defying a broadly risk-off start to the week on the back of disappointing Chinese trade data that is undermining high beta currencies and those with closest connections naturally. Cable extended gains to circa 1.3181 at one stage, while Eur/Gbp probed just below 0.8400 before running into offers and bids respectively.

- AUD/CAD/NZD – Predictably, the Aussie is bearing the brunt of the aforementioned smaller than forecast Chinese trade surplus that was largely due to an unexpected drop in exports, with Aud/Usd hovering around 0.6425 and Aud/Nzd retesting support ahead of 1.0400, like a 1.0407 Fib that only just held las Friday. Meanwhile, the Kiwi is pivoting 0.6550 vs its US peer and the Loonie is trying to pare losses in wake of starkly contrasting NA labour data in a relatively tight range either side of 1.3250 ahead of Canadian housing starts and building permits.

- JPY/EUR/CHF – All narrowly mixed against the Greenback, as the DXY meanders between 97.602-725 parameters, but with the Yen benefiting from a grinding safe-haven bid and picking away at stops said to be sitting south of 108.50, while the Euro is straddling 1.1065 and Franc 0.9900 in the run up to ECB and SNB policy meetings hot on the heels of the Fed.

- SEK/NOK – The Scandi Crowns are also feeling the adverse effects averse sentiment, as Eur/Sek rebounds towards 10.5500 and Eur/Nok nudges off sub-10.1000 lows on the back of technically delayed and mixed monthly Norwegian GDP prints for October.

- EM – The Lira looks somewhat unimpressed with Turkey’s efforts to spur bank lending via targeted RRR tweaks, as Usd/Try trades close to 5.800 and multi-month peaks.

In commodities, the energy complex continues to drift lower following last week’s OPEC-induced surge in prices which received tailwinds from a blockbuster US jobs report. WTI Jan’20 futures have re-dipped below the 59/bbl mark whilst Brent Feb’20 futures gave up the USD 64/bbl in EU trade, with the magnitudes of the moves relatively tepid compared to Friday’s upside action. Analysts at ING believe that the action taken by OPEC+ (500k BPD deeper cuts and Saudi’s 400k BPD voluntary cuts on top of earlier curtailed output) will continue to support prices, thus the bank sees ICE Brent averaging USD 60/bbl in Q1 next year, with Q2 outlook contingent on the cartel’s next move in early March. ING note that upside risks to their forecast includes significant supply disruptions and meaningful progress on the US-China front. On that note, BofA expects Brent could be boosted to USD 70/bbl in the case of strong OPEC+ compliance and positive economic developments. Elsewhere, spot gold holds onto most of Friday’s losses with prices fluctuating within a relatively tight band ahead of its 21 DMA at USD 1464.65/oz and a risk-packed week. Copper has pared some of Friday’s gains as prices are modestly pressured by the latest Chinese trade data (which came in narrower than forecasts in USD and CNY terms) but cushioned by the breakdown, in which imports topped estimates and China copper imports hit a 13-month high on improved factory activity. Finally, iron ore prices feel little reprieve after November iron ore imports from China fell for a second straight month.

US event calendar

- Nothing major scheduled

DB’s Jim Reid concludes the overnight wrap

What’s the financial market’s favourite Christmas song of all time? We will find out on Thursday as that’s the final question in the second of our monthly EMR surveys of market participants that we launch today. Last month, we had nearly 700 responses but the success and longevity of the survey relies on you filling it in. So I would really really appreciate it if as many of you as possible could do so up to the close at 5pm GMT on Wednesday. The link is here. It should take less than 5 minutes to fill in and we’ve simplified it from last month while asking a few more market related questions. We have decided to compile the longer-term questions on things like inflation on a quarterly basis. So this one is very market driven with a couple of specific 2020 questions. As before, you don’t have to answer all the questions, just skip the ones you don’t want to. We will hopefully be able to build up a time series of responses soon. All feedback and questions welcome. Long-time readers will know my favourite Xmas songs but I’ll keep my powder until the results on Thursday.

Nice to be back working as I was in the dog house all day yesterday as I accidentally let Bronte out of the back garden gate and she went missing for 3.5 hours. My mistake arose as I looked around for Bronte, couldn’t see her and opened the gate to slip out. Little did I know she was in my blind spot immediately behind my feet. Long-time readers will know the last time I lost her was at a motorway service station in France three years ago. That was a bit more stressful than yesterday as she was seen crossing the motorway a few times but we did worry a lot yesterday afternoon before my wife finally found her and managed to catch her sprinting across the nearby golf course, which after yesterday I may not see for a while. Sadly as she turns 5 this week we are always going to have to accept that she’s a wandering dog with absolutely no ability to ever go off lead. I hope we have better fortune bringing up our children. I’ll come back to you for proof either way in 2030.

While we’re on that year, a reminder that last week we released the latest edition of Konzept magazine ( link ), which has the title “Imagine 2030”, with over 20 articles looking at what the world might look like at the end of the next decade. If you want to know about a world of electric but not autonomous cars by then, the end of credit cards, whether we’ll still be using cash, the future of crypto currencies, how you will consume food, the rise of the drones, the outlook for India and China, what Europe needs to do to compete and catch-up, and what we think will be the main populism battleground in 2030 then do have a read.

Rewind 10 years and we have an interesting week ahead with the highlight probably the U.K. election on Thursday. Central banks will also be taking centre stage with a number of monetary policy meetings, most notably from the Fed (Wednesday conclusion) and the ECB (Thursday) where we will welcome Mrs Lagarde to the stage for the first time. Data releases to watch out for include US CPI (Wednesday) and retail sales (Friday), but trade might end up trumping (no pun intended) everything else as we build to Sunday’s tariff escalation deadline.

Reviewing these in more detail now and first the U.K. The weekend polls showed a wide spread of Tory leads from 6pts to 15pts but with the average edging back above 10pts after recently dipping below. A reminder that anything below a 6-7 point lead is around hung parliament territory. Our UK team put out a note towards the end of last week (link here ) in which they assess the policy stances of the parties in terms of the challenges facing the UK economy. They analyse the market implications of the different elections scenarios, ranging from a sizeable Conservative majority to a Labour majority, with various scenarios for a hung parliament in between.

With regards to the FOMC mid week, the Fed are not expected to move policy by anyone I can find but the meeting won’t be without interest as they will release the latest Summary of Economic Projections, with market participants focusing on the dot plot as usual for clues as to whether member’s rate biases are changing. Friday’s payrolls number (more below) will likely give them some confidence in the outlook. Regarding the ECB a day later on Thursday, although the market is similarly expecting no changes in interest rates, the meeting will be closely watched as it’s the first monetary policy decision since President Lagarde came to office. It’ll be interesting to see what she says in the subsequent press conference, and whether there are any updates on the upcoming strategic review. In their preview out late last week (link here), our European economists write that they expect the Governing Council “will likely remain cautious and view the balance of risks as still tilted to the downside.” Yet they also say that they think Lagarde will make an immediate change, and they say that “we expect the willingness to use “all instruments” to be conditioned on an assessment of the possible side effects of policy.” Lastly on central banks, next week also sees monetary policy decisions from Brazil on Wednesday, Switzerland and Turkey on Thursday, and Russia on Friday.

Looking at data releases to watch out for, the main highlights comes from the CPI release on Wednesday and the retail sales figures on Friday. For the CPI, the consensus reading is expecting a +0.2% mom increase in both the main CPI and core CPI, while for retail sales a +0.4% mom increase is expected. In more details on the CPI and detailing DB’s above consensus call, our economists suggest the gap between trimmed mean CPI and core CPI was 14bps in October, while the gap between the sticky CPI ex-shelter and core CPI was 19bps. These divergences are in the top 8% and 3% of historical experience, respectively. This note (link here) shows that these gaps can be very useful in predicting the change in the month-over-month core CPI print the following month, implying a strong monthly core CPI print for November. As such, the team expect November core CPI to rise +0.26% month-over-month.

From Europe, the highlights include the Euro Area industrial production data on Thursday, which has seen a consistent yoy decline for every month since November 2018. The consensus is actually expecting this will deepen into October, with the yoy number falling to -2.2%, (vs. -1.7% in September). We’ve also got the ZEW survey from Germany tomorrow, which last month showed some signs of stabilisation, as the current situation reading rose to -24.7, having been at a 9-year low the previous month. The expectations reading also rose to a 6-month high. Lastly on Tuesday we’ll get the monthly GDP data from the UK for October.

Back in Germany, the SPD conference over the weekend saw the party’s new leaders strike a more emollient tone on whether or not to stay in the coalition, with co-chairwoman Saskia Esken saying that “if there is a willingness to talk there’s always the chance to keep going”. They have released a list of demands they want to see implemented however, including a €12 per hour minimum wage, further action on climate change, and more investment spending. Whether their coalition partners in the CDU will agree to this is another matter, however, and CDU leader Annegret Kramp-Karrenbauer said that “This coalition is for the country, not trauma therapy for ruling parties”. One opinion poll out from Forsa put the Social Democrats on 11%, at a joint-record low, although an Emnid poll out over the weekend put them up 1pt to 16%

Looking at our screens overnight, Asian equities are mixed as investors await those central bank meetings and crucial trade news, with the Nikkei (+0.37%) and the Kospi (+0.35%) both up, while the Hang Seng (+0.02%) and the Shanghai Comp (-0.03%) have seen little change. S&P 500 futures are trading slightly lower, down -0.14%. The moves come as Japanese data overnight saw the final reading of Q3 GDP come in above expectations and the initial estimate, with +0.4% growth qoq, while yoy growth was up to +1.8%. Some of the strength will be consumers bringing forward purchases ahead of the October 1 consumption tax hike, but this is nonetheless a strong reading ahead of the BoJ’s decision next week.

The other important release over the weekend was the trade data from China, which showed exports down -1.1% yoy in November in USD terms, (vs. +0.8% expected), while exports to the US were down -23.0% yoy, in the biggest contraction since February. The trade balance was also lower than expected, at $38.73bn (vs. $44.50bn expected), and the figures demonstrate the importance for both economies of getting a trade deal, particularly with the December 15 deadline coming up on Sunday. Also on trade, overnight the Wall Street Journal reported that US Trade Representative Lighthizer and the House Democrats are nearing a deal for Congress to pass a revised version of the USMCA.

Recapping Friday’s news now before briefly reviewing last week and it was a bumper US jobs report that set the tone for markets, with nonfarm payrolls up +266k in November (vs. +180k expected), while there was an upward revision of +41k to the previous two months. The number was supported by the return of over 40,000 GM workers following a strike, but this still exceeded all analysts’ expectations on Bloomberg. This marks the strongest month since January, and saw the three-month rolling average rise to +205k, also the best since January. The unemployment rate ticked down a tenth to 3.5% (vs. 3.6% expected), in line with the joint-lowest rate since 1969, while the U6 measure that also includes those marginally attached to the labour force and the underemployed, fell to 6.9%, its joint lowest level since 2000. Meanwhile, wage growth was at +3.1% (vs. +3.0% expected), while the October number was revised up two-tenths to +3.2%.

Bolstered by the jobs report, the S&P 500 recovered to end the week up +0.16% (+0.91% Friday), with Friday’s session the strongest for the index in 5 weeks. Equities were further supported by positive noises on trade from Director of the National Economic Council, Larry Kudlow, who said on CNBC that “The deal is still close”. Added to this, the market then got the University of Michigan consumer sentiment reading, which surprised to the upside with a 99.2 reading (vs. 97.0 expected), a 7-month high. The other indicators were also supportive, with the current conditions reading up to 115.2 (vs. 112.8 expected), a 12-month high, while the expectations reading rose to 88.9 (vs. 87.5 expected), a 5-month high.

European equities were also up as the news was released, with the STOXX 600 -0.02% for the week (+1.16% Friday). US Treasuries sold off following the report, however, with 10yr yields up +6.1bps on the week (+2.6bps Friday) to 1.836%, a 3-week high, while the 2s10s curve steepened by +5.8bps (+0.3bps Friday). In Europe, 10yr bunds ended the week +7.4bs (+0.8bps Friday), while the spread of Italian 10yrs over bunds rose +4.6bps (-2.8bps Friday)

The other big mover on Friday was oil, which surged after the news that OPEC+ would be reducing output by 500,000 barrels per day, and Saudi Arabia also said they would be making a further cut of 400,000 b/d below their official output target. Brent Crude ended the week up +3.14% (+1.58% Friday), its strongest performance in 6 weeks, while WTI was up +7.30% (+1.32% Friday) in its strongest performance since June.

In terms of other data on Friday, we got disappointing German industrial production figures for October, which fell by -5.3% yoy (vs. -3.6% expected), the biggest annual contraction since November 2009. Capital goods drove the decline, with an -8.4% yoy contraction, and the release comes after negative data from Germany on factory orders earlier in the week, as well as retail sales the week before, suggesting a poor start heading into the fourth quarter.

Ahead of Thursday’s general election, one of the big stories in FX markets last week was the strengthening pound, which rose +1.66% against the dollar (-0.13% Friday), and reached its highest level against the euro since May 2017. Friday’s head-to-head debate didn’t seem to offer a clear winner, with a snap YouGov poll on which leader performed best showing that 52% of viewers preferred Prime Minister Johnson, while 48% opted for Labour leader Corbyn.

Tyler Durden

Mon, 12/09/2019 – 08:02

via ZeroHedge News https://ift.tt/33ZBxzL Tyler Durden