Profit “Inequality”: Is It Possible That S&P 500 Companies Make Money And No One Else Does?

Submitted by Joseph Carson, Former Director of Global Economic Research, Alliance Bernstein

Inequality has been used to describe the widening gap between household income and wealth. Yet, is it also appropriate to use “inequality” as a way to describe the growing and unexplained gap between the earnings of S&P 500 companies and everyone else? Appropriate or not there is something unusual at work with the profit data, as it appears the only firms making any money nowadays are those in the S&P 500.

According to the Bureau of Economic Analysis (BEA), in Q3 2019 the annualized after-tax operating profits of all US companies, large and small, public and private, totaled $1.881 trillion. That represented an increase of approximately $220 billion from the level of after-tax operating profits recorded in 2015.

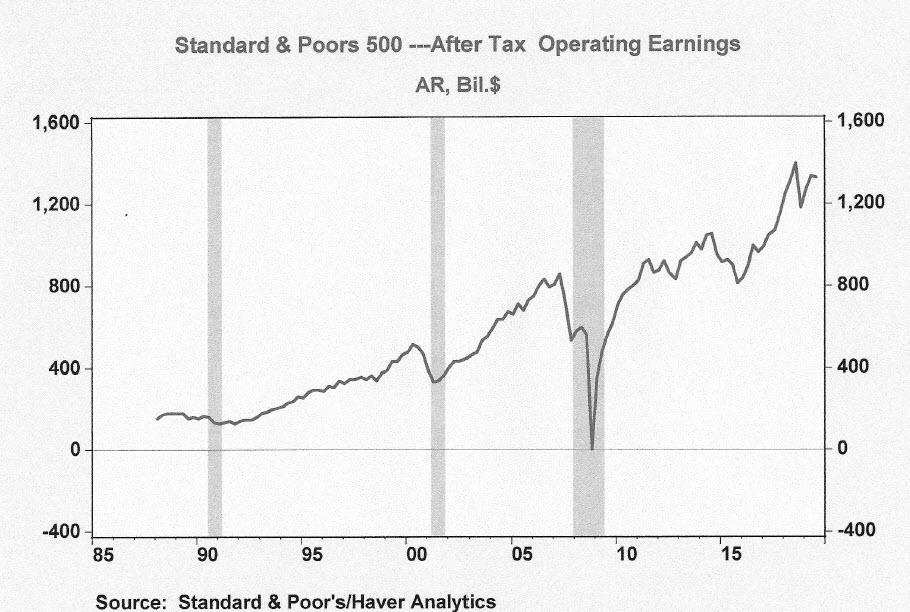

Over the same 4-year period, after-tax operating profits for S&P 500 companies increased from $885 billion to an annualized rate of $1.327 trillion in the third quarter of 2019, an increase of $442 billion.

It’s possible to estimate the after-tax earnings of non-S&P 500 companies by simply subtracting the S&P 500 after-tax operating earnings from the aggregate GDP profit number. The residual after-tax profits –an estimate for non-S&P 500 companies – comes to $555 billion in Q3 2019, down sharply from the $779 billion recorded in 2015.

The key takeaway here is that over the past 4 years S&P 500 companies after-tax profits increased 50%, while the earnings of everyone else recorded a decline of roughly 30%.

How can that possibly be an accurate picture of the earnings of all the companies operating in the US? According to the Internal Revenue Service (IRS), there are more than 6 million firms operating in the US. Since the start of 2015 US firms have added nearly 12 million workers to their payrolls – of which over 80% of the new jobs occurred at non-S&P 500 companies. It’s just not plausible that firms would be adding working and continue to lose money at the same time.

Now it must be noted that the comparison of operating profits is based on data from two different sources. Total corporate profit data comes the GDP report and the primary source is the tax-accounting records companies provide to the IRS. S&P 500 companies report their earnings on a financial accounting basis. The key differences between the two accounting frameworks reflects timing of when some receipts and expenses are recorded as well as the fact that capital gain income is excluded from the GDP measure but can be included in S&P reported profits.

Also, the estimate of S&P 500 profits represents an aggregated sum of company earnings reported on a per share basis. So a change in the number of shares outstanding has the potential to influence the numbers and skew the comparisons of the reported and estimated profit numbers.

Nonetheless, it worth pointing out that in the past 30 years only during the dot.com boom of the late 1990s did a similar profit picture occur; that is, reported earnings of the S&P 500 increased over a span of few years, while the estimated profits of all other companies tanked. And that apparent “inequality” in profits lead to a false narrative around corporate profitability, record high P/E multiples and an eventual crash in equity prices.

It is impossible to say with any certainty what factors are causing the gap between the reported earnings of the S&P 500 companies and the profits of all other firms. But it is simply not credible for anyone to believe that only companies making a profit nowadays are those included in the S&P 500. Many questions over the accuracy of “reported” profits of S&P 500 companies remain unanswered.

For investors, the argument being used by equity analysts and strategists that the equity market is not expensive is based on “reported” and not “actual” profits. The real market multiple based on “actual” profits is considerably higher than what is being sold to investors.

Tyler Durden

Mon, 12/09/2019 – 15:15

via ZeroHedge News https://ift.tt/2YvdLum Tyler Durden