Stocks Slide As Bond Yields, Dollar Erase Friday Jobs Spike

It appears Friday’s “goldilocks” jobs data has not cheered the bond and FX traders as much as the equity algos after all…

Source: Bloomberg

Maybe – bearing in mind last December – it’s time to leave ‘the game’ for now…

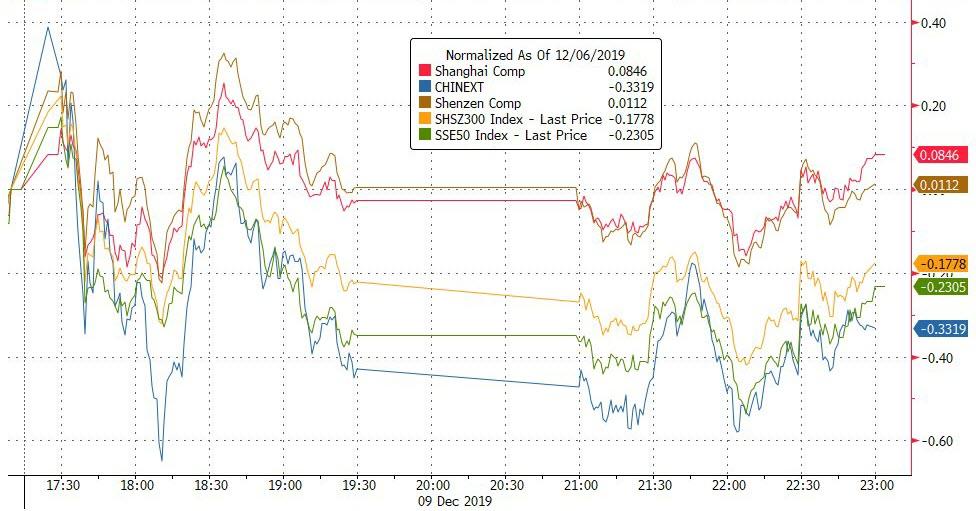

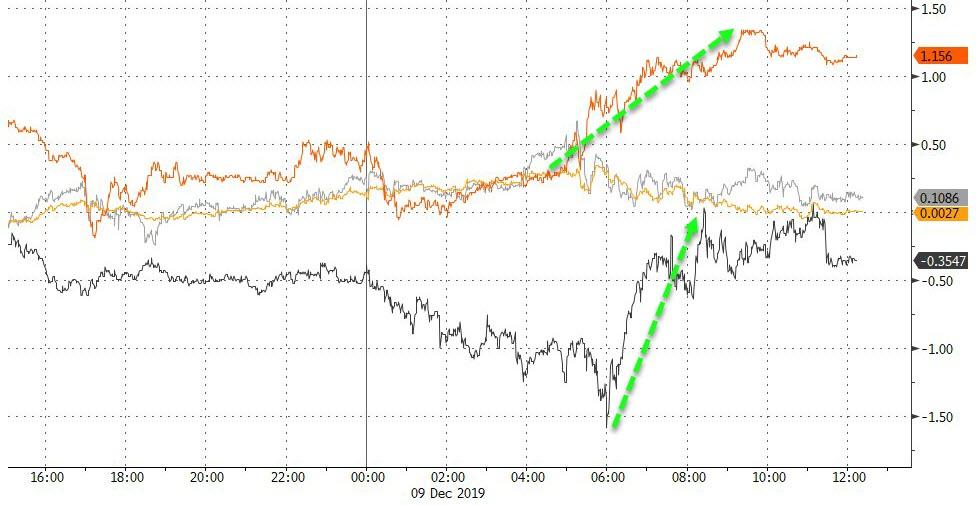

China stocks were mixed, not enjoyng any lift from US exuberance on Friday…

Source: Bloomberg

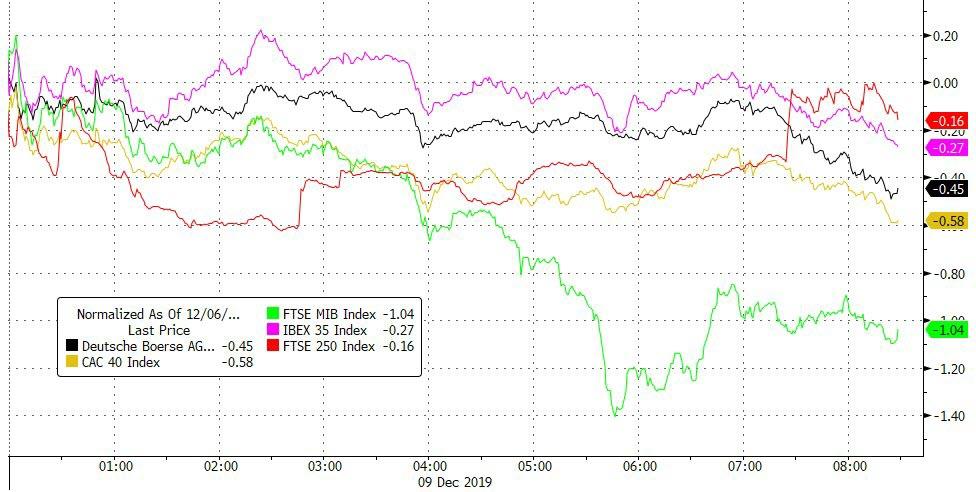

European stocks were all lower on the day led by Italy…

Source: Bloomberg

US markets were also all lower today with no trade-hype headlines to save the day – Nasdaq (AAPL) was the laggard as Small Caps managed to relatively outperform…

Very weak close for stocks.

The S&P found support at VWAP overnight but the opening ramp was quickly faded as Europe closed and really never recovered…

VIX was significantly higher today, topping 15.50

Notably, the machines attempted a short-squeeze today but it didn’t ignite the momo…

Source: Bloomberg

Small moves today but cyclicals underperformed…

Source: Bloomberg

Treasury yields were mixed today with the short-end around 1bps higher and long-end around 1bps lower…

Source: Bloomberg

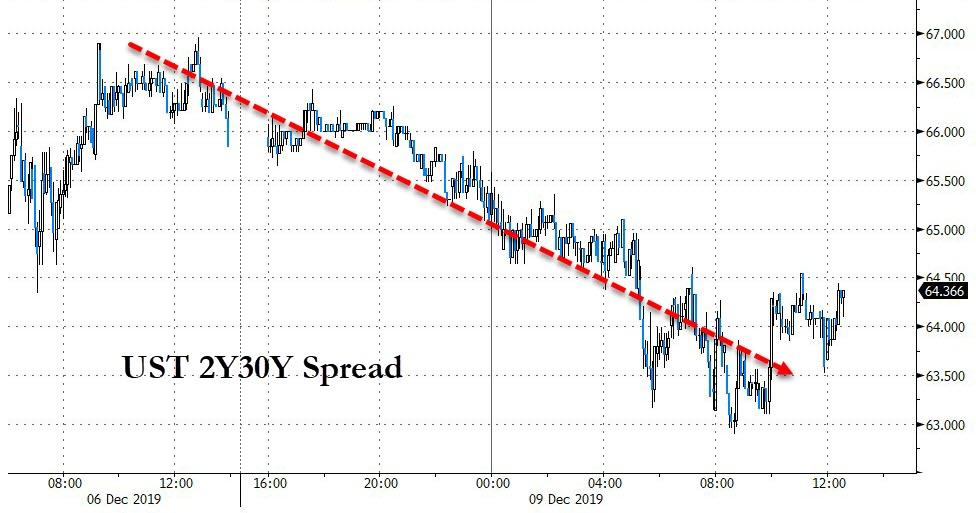

The yield curve has continued to flatten since the payrolls print…

Source: Bloomberg

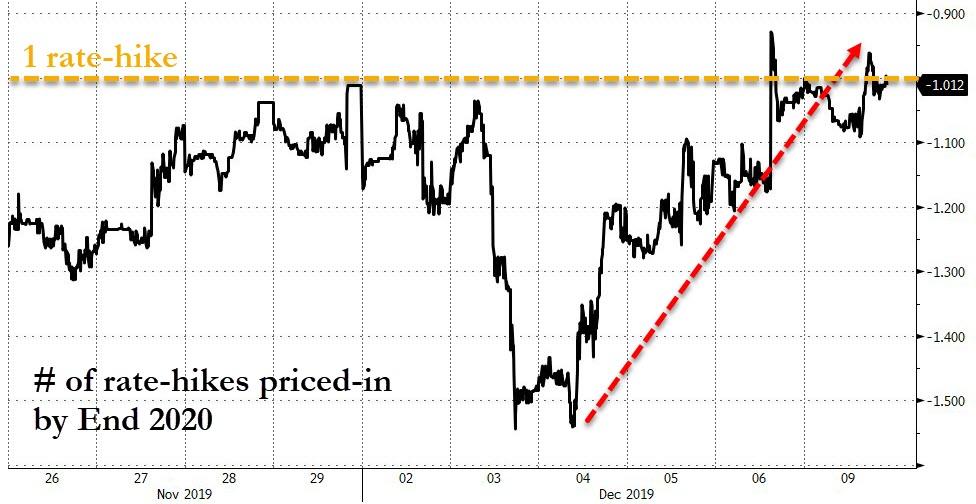

Notably the last few days have seen the market price out a significant amount of easing for the next year…

Source: Bloomberg

The dollar fell for the 6th day in the last 7 – erasing much of Friday’s jobs spike…

Source: Bloomberg

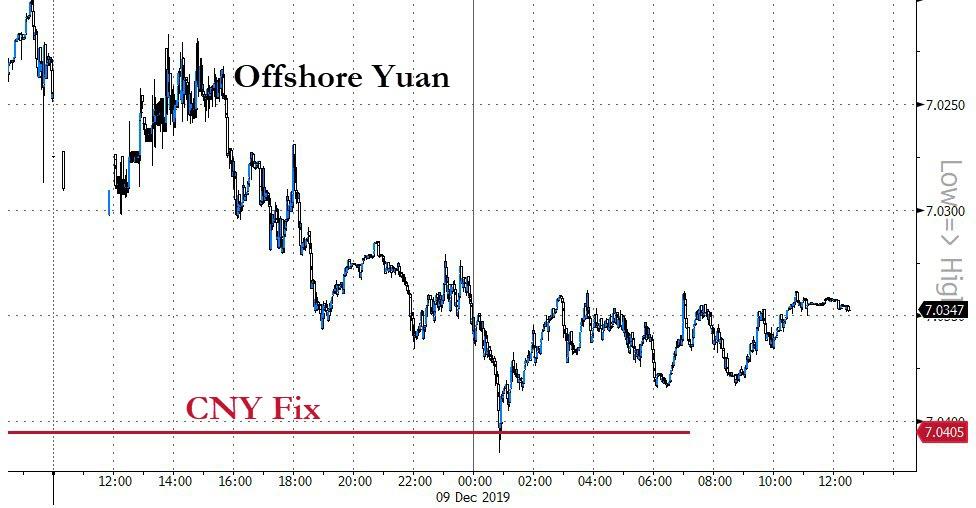

Yuan fell notably overnight but found support at the fix…

Source: Bloomberg

Cryptos are modestly lower from Friday’s close with two significant legs down today…

Source: Bloomberg

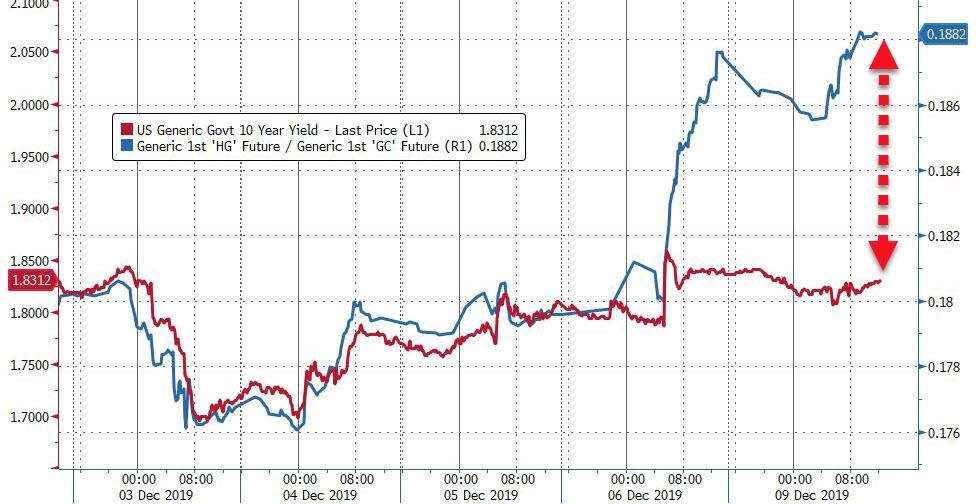

Copper had a big day, oil was lower as OPEC hopes faded and PMs were flat…

Source: Bloomberg

Copper futures pushed up to their highest since July…

In fact, if copper (relative to gold) was right, then 10Y Yields should be 20-25bps higher…

Source: Bloomberg

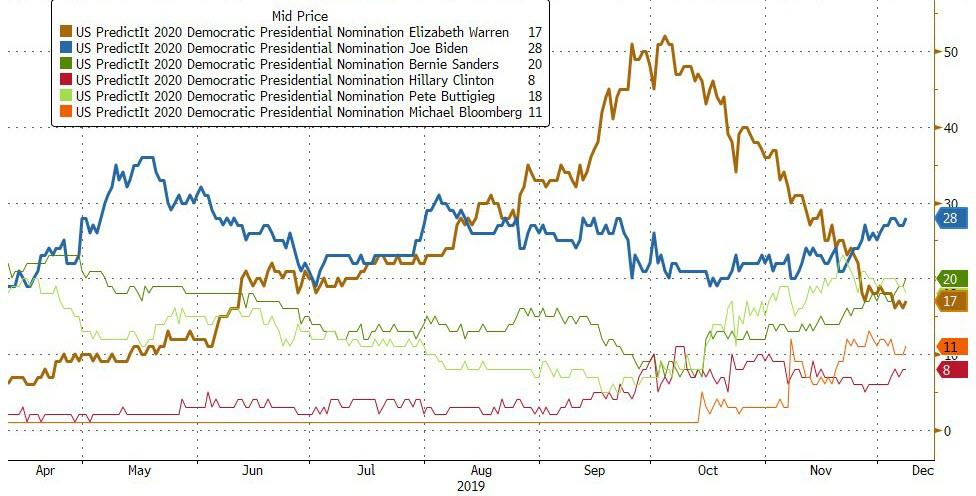

Finally, it appears Elizabeth Warren’s Tax-the-Everything-&-Everyone Plan jumped the shark as she is now in 4th place (in betting markets) with Biden re-accelerating…

Source: Bloomberg

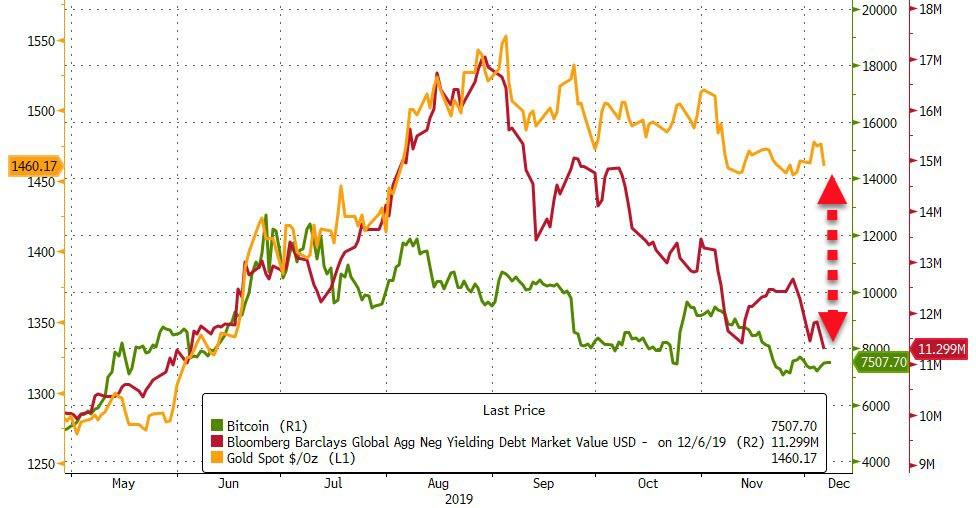

And while the volume of negative-yielding bonds in the world has fallen, gold has held its value as bitcoin has slipped lower…

Source: Bloomberg

And 2019 is 2013…

Source: Bloomberg

…for now…

Source: Bloomberg

Tyler Durden

Mon, 12/09/2019 – 16:01

via ZeroHedge News https://ift.tt/2YvFkUB Tyler Durden