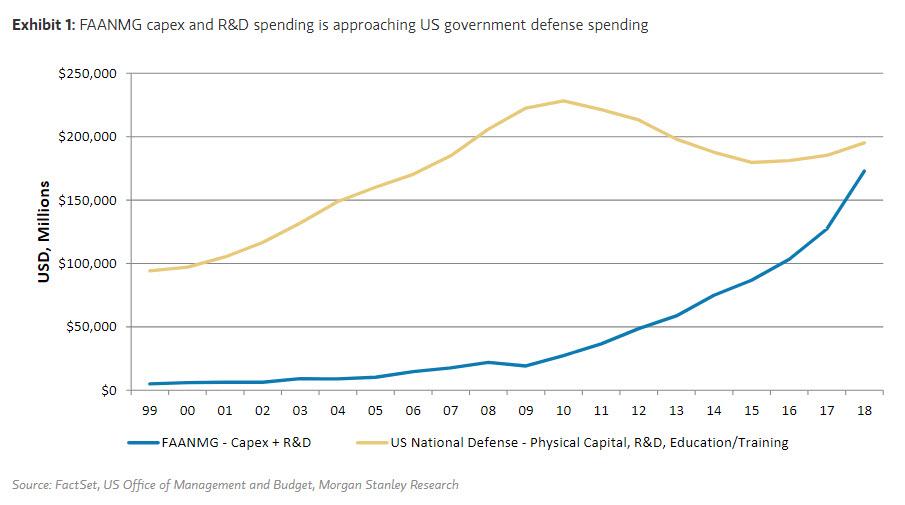

The FAANMG Capex And R&D Budget Is Rapidly US Government Defense Spending

Authored by Adam Virgadamo, Morgan Stanley equity strategist

Wrapping up our annual gathering this past week, three common themes across regions and sectors stood out. As 2020 unfolds, we’ll have more to say on these topics, but in the meantime, here are the broad outlines of our dialogue.

Disruption: Few themes are as evergreen as identifying disruptors and the disrupted, so it was no surprise that we spent much of our day on the subject. Our ideas around the poster children for disruption – e-commerce and the retail industry – came full circle as our retail teams argued that traditional retailers need to disrupt themselves, innovating in order to reinvent their cost structures. Innovation isn’t just driving down costs, but also transforming the way businesses grow – e.g., using digital technologies to scale up, it’s taken upstart Luckin Coffee just two years to match the store count that Starbucks needed 20 years to build in China. We also discussed the hype around 5G, the opportunities it may bring in an increasingly urbanized and data-centric world, and its limitations in transforming manufacturing processes (where investors may need to wait for 6G). And since no discussion of disruption would be complete without addressing the proliferation of the public cloud, we debated the ultimate size of the addressable market and growing risks that not only tech hardware companies but also software firms could see increased disintermediation from the cloud platforms themselves.

Spheres of influence: The new theme this year was the movement of the US and China away from integration. The idea of diverging spheres of influence – separate universes of economic activity, technological standards and political influence – came up again and again. Intensifying competition for technological leadership, as well as limited market access for companies seen as too closely aligned with one side or the other, will affect fundamentals and multiples. Long term, identifying exposure to these trends will create alpha. For example, we think that China’s buildout of a semiconductor industry is likely to have meaningful implications for US and European players. Whether it’s in big data and AI, payment & networking standards, innovation in biotech, consumer products or social networks, the theme of US-China divergence is bound to be relevant. This new reality also raises the possibility that large global firms may turn their ecosystems into their own spheres of influence, a dynamic that could matter for the FAANMGs (Facebook, Amazon, Apple, Netflix, Microsoft, Google) and BATs (Baidu, Alibaba, Tencent) of the world. Some food for thought on this: the annual capex/R&D budget for FAANMG is rapidly approaching a similar measure for US government defense spending (Exhibit 1).

Environmental, social, and governance (ESG): The ESG theme is also hardly new, but this year saw a sharpening of focus. Investors are increasingly looking to incorporate ESG into their processes, and some of the world’s largest firms are asking how they can better highlight their ESG initiatives. Trends such as the shunning of fast fashion and “flight shaming” came up, but no ESG topic seems to have more mind share than climate change and a carbon price. Autos aren’t exactly an ESG-friendly sector, and the prevailing wisdom is that a price on carbon could potentially devastate the industry, but our autos analyst has a slightly different take. Might a carbon price force innovation in electric vehicle production that kicks off the greatest replacement cycle in history – 1 billion cars x $25,000/car = $25 trillion? We also debated whether the shift of auto firms from internal combustion to electric engines would be enough to qualify the stocks for ESG-minded portfolios. In other words, should ESG investors look at the rate of change in ESG factors? This second derivative discussion highlighted that ESG processes are still evolving and the relative importance of the “E”, the “S” and the “G” differs across industries.

Tyler Durden

Sun, 12/08/2019 – 20:10

via ZeroHedge News https://ift.tt/2YyR4FF Tyler Durden