Diesel Demand Slump Signals Manufacturing Recession Is Still Raging

The U.S. economy is decelerating into an election year and could print below-trend growth by 2H20.

Manufacturing, employment, and inflation have all been in downturns for one year, hence why the Federal Reserve has been quick to slash interest rates, as President Trump has been begging for negative interest rates, quantitative easing, and emergency tax cuts.

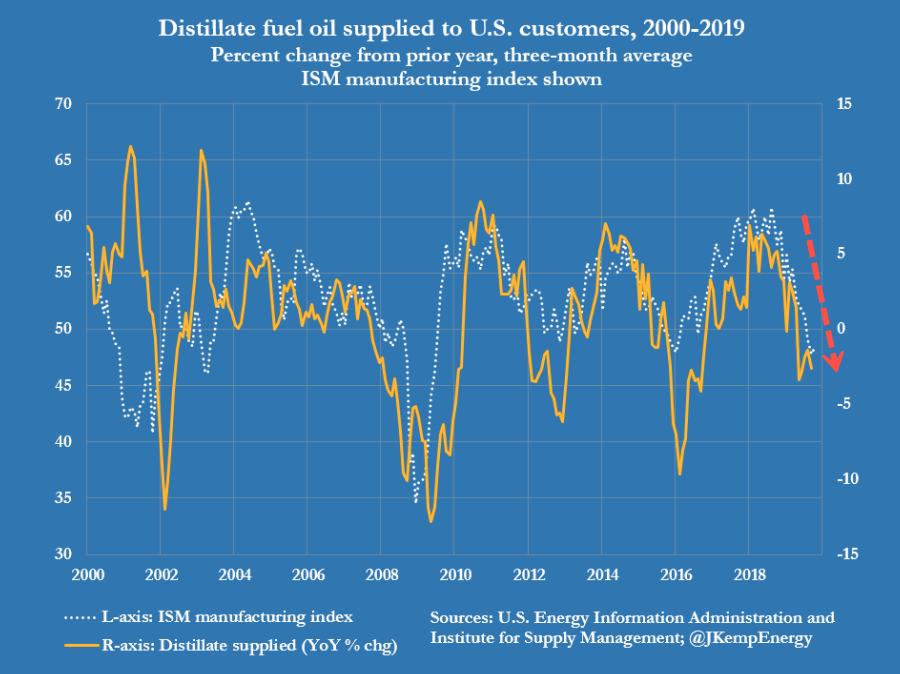

New data from Reuters’ John Kemp shows how manufacturing continues to decelerate into year-end as there’s little evidence that growth will trough and zoom higher in early 2020.

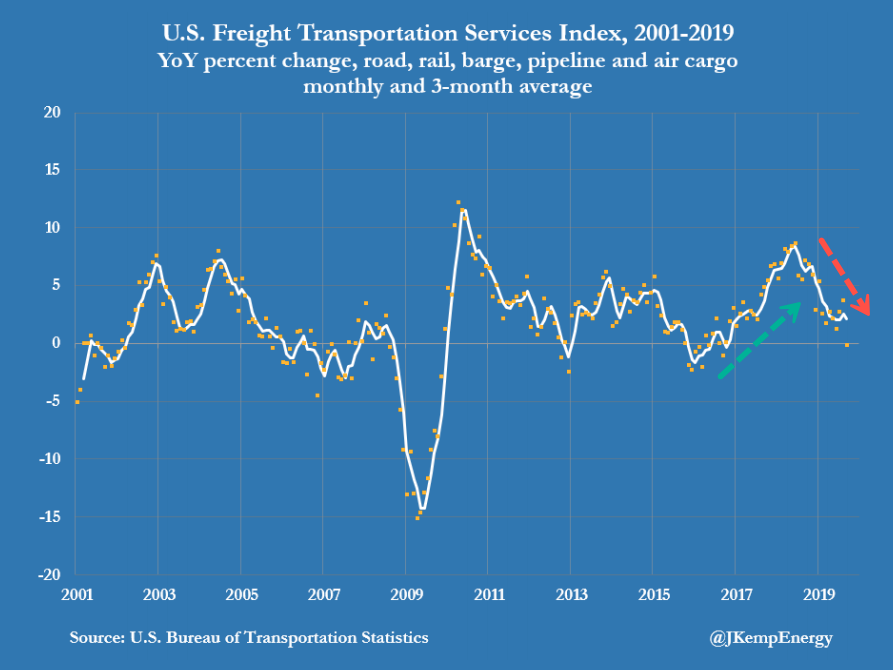

Kemp says waning diesel consumption is a significant warning sign of manufacturing output continuing to contract and volume of freight plunging. These factors have put downward pressure on spot oil prices.

U.S. Energy Information Administration (EIA) data shows consumption of diesel was down 3% in Q3 versus a year earlier.

Kemp notes that diesel is used by “trucking firms, railroads, manufacturers, construction firms, oil and gas drillers, and farmers, so diesel consumption is tightly coupled with the manufacturing cycle.”

He said the drop in diesel consumption relative to gasoline shows that the manufacturing recession is worsening as the consumer is generating slower growth.

Consumption growth of diesel has plunged across the world.

Manufacturing downturns in China, India, Europe, South America, and the U.S. have contributed to declining demand.

As the global economy decelerates into 2020, diesel demand will continue to decline, forcing oversupplied conditions and lower prices.

Tyler Durden

Tue, 12/10/2019 – 14:15

via ZeroHedge News https://ift.tt/3587yqJ Tyler Durden