Futures Jump On WSJ Report Next Round Of Tariffs To Be Delayed

Following chatter earlier this morning, a WSJ report claiming that the White House and China had agreed to delay a planned tariff hike scheduled for Sunday sent equity futures soaring.

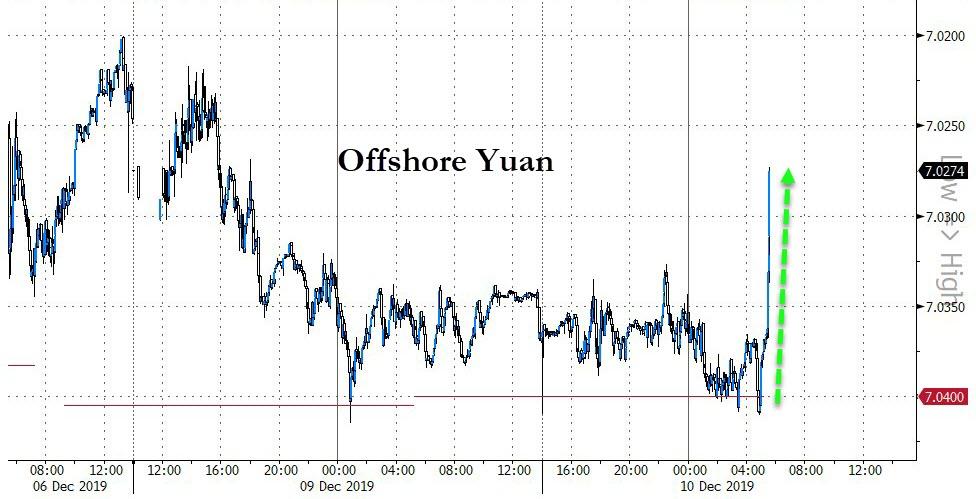

The yuan, a popular gauge of trade-deal sentiment, also rallied on the report.

Though earlier reports hinted that such a delay was in the works, as we mentioned below.

As 2019 comes to a close, the Trump Administration is shifting its focus to working with Mexico, Canada and Nancy Pelosi (despite all the furor around impeachment) to pass USMCA (Nafta 2.0). But although negotiations with China will be put on hold temporarily, a mini-deal to delay the next round of US tariffs from taking effect on Dec. 15 is still possible, according to a report by SCMP.

Meanwhile, on Monday, Secretary of Agriculture Sonny Perdue said the US likely won’t move ahead with imposing new tariffs on a $160 billion swath of Chinese goods, including toys and smartphones, on Sunday, and that talks are progressing on the subject of IP.

Additionally, Commerce Secretary Wilbur Ross told Fox Business that American and Chinese negotiators are working “around the clock” on a deal, but added that it’s more important to win a good deal for the US than to put off the tariffs set to take effect on Sunday. Ross added that the Phase One deal would focus on agriculture and trade. On the other hand, Ross said the US is “within millimeters” of winning a deal on USMCA.

Ross sat for an interview with Marie Bartiromo, where he bashed the Dems for insisting on insignificant changes to enforcement and digital commerce mechanisms that ultimately delayed the deal with little added benefit. Ross added that the final deal is still being drafted.

According to SCMP, Washington has other reasons to hold off on the next round of tariffs: If the US follows through, Beijing could retaliate by introducing its “undesirable entities” list, which it has long threatened. The list would allow Beijing to retaliate against specific US companies, including blocking them from doing business in China.

“I don’t expect a final deal by the 15th. There are still difficult things to work out and Lighthizer is focused on the USMCA end game at the moment. That said, I’m not betting on tariffs either,” said Clete Willems, a partner at law firm Akin Gump and former deputy director of the US National Economic Council. “Another round of tariffs would likely yield the unreliable entities list from China, further political hardening, and all but end the chances of a deal before the election. I don’t think either side wants that.”

Ross insinuated that Dems were holding off on passing the plan, which would create more than 170,000 jobs, because they don’t want to distract from impeachment.

Whatever Beijing decides to do in retaliation to the tariffs, it’ll likely be big. Because adding another 15 percentage points of tariffs on $160 billion of goods being imported to the US will have a tsunami-like impact on China’s already-faltering economy, one analyst said.

If the US does follow through with tariffs on Sunday, it’s extremely likely that the trade talks will collapse.

Chinese analyst Lu Xiang said that the implementation of the 15 per cent tariff on around US$160 billion of Chinese goods would be “treated as a natural disaster.”

“If we see US tariffs on Sunday, it would mean the talks collapse,” said Lu, a research fellow on US-China relations with the Chinese Academy of Social Sciences. “The final decision is in the hands of [US President Donald] Trump. But China has prepared for the worst scenario.”

Of course, at this point, it’s impossible to tell which headlines carry weight, and which are merely just the Trump Administration panic-pumping stocks.

Tyler Durden

Tue, 12/10/2019 – 08:39

via ZeroHedge News https://ift.tt/2Pxpapn Tyler Durden