Gundlach: Trouble Brewing In Debt Markets As The ‘Real Turmoil’ Is Only Beginning

Last week, DoubleLine’s Jeff Gundlach sat down with Yahoo Finance to discuss how US stocks would get absolutely crushed in the next recession. In a continuation piece via Yahoo, Gundlach suggested that trouble is brewing in debt markets as interest rates hover around zero.

Gundlach said the 2020s could exhibit socio-economic chaos as the debt bomb the US is sitting on ignites into the next recession.

“It’s pretty interesting because the 20s in the 20th century, the 20s were super boom times. And weirdly, I think the 20s this time will be very much different than that, with real turmoil,” Gundlach said.

Gundlach said the decades of can-kicking would finally stop in the 2020s, and the US will have to face realities relating to its debt situation.

“[We’re] going to have to face Social Security, health care, all of these things, deficit-based spending — all of that is going to have to be resolved during the 2020s because the compounding curve is just so bad,” he said.

The billionaire investor said interest costs on the debt would soar from 1.25% to at least 3% by 2027. “That’s a big, big increase. And that’s coming,” he warned.

“And when you do that, it kind of says, ‘Hey, GDP is going to be knocked by 2%-2.5% because we have to pay interest,'” he added, which suggests that the 2020s could be a lost era situated in a low growth period with social-economic instabilities.

He said the Federal Reserve understands what’s coming down the pipe, and it’s why everyone is starting to talk about MMT – as it could be the policy prescription pitched by lawmakers and the Fed to lift the US out of the next financial downturn.

Gundlach said, “they [Fed] knows that this problem is going to really hit the headlines when the next economic downturn comes, and I think it’s foolish to believe that there will be no economic downturn for the next ten years considering where we are right now.”

In an earlier segment of the interview, which we covered last week, Gundlach said 2019 was the year when investors could pick “just about anything…Just throw a dart, and you’re up 15-20%, not just the United States, but global stocks as well.” He warns that it could all change in 2020, as a recession is fast approaching.

Gundlach: Stocks ‘Will Get Crushed’ In The Next Downturn https://t.co/XnT4JO7dSj

— zerohedge (@zerohedge) December 4, 2019

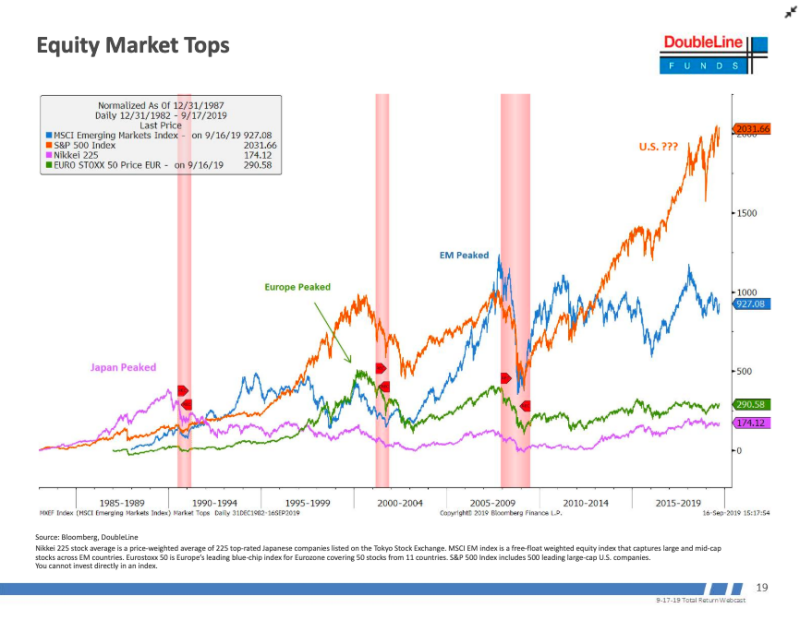

He shared his “chart of the year,” which divides global equities into four regions (the US, Japan, Europe, and Emerging Markets). What it shows is an alarming market top forming in US stocks, similar to what happened with the Nikkei 225 in the early 1990s or the Euro Stoxx 50 Index in the late 1990s or MSCI Emerging Markets in 2007/2008.

“My belief is that pattern will repeat itself,” said Gundlach, who has spent much of 2019 warning of a downturn ahead of the 2020 elections.

“In other words, when the next recession comes, the United States will get crushed, and it will not make it back to the highs that we’ve seen, that we’re floating around right now, probably for the rest of my career, is what I think is going to happen,” he added — suggesting that a recovery won’t be seen for years.

Last month, Gundlach warned about the levels of government debt, and the US equity markets are not sustainable. He told investors that they should brace for significant disruptions.

“The corporate bond market in the United States is rated higher than it deserves to be. Kind of like securitized mortgages was rated way too high before the global financial crisis. Corporate credit is the thing that should be watched for big trouble in the next recession.”

Full the full interview watch here:

Tyler Durden

Tue, 12/10/2019 – 11:05

via ZeroHedge News https://ift.tt/38pZlQV Tyler Durden