Traders On Tenterhooks As Banks Delay Bonus Decisions Into New Year

Few bankers would disagree with the notion that high salaries and fat bonuses are what draws most people to seek a career in finance. Which is why shrinking bonus pools have become such a problem for banks trying to compete with Silicon Valley for the “top talent.”

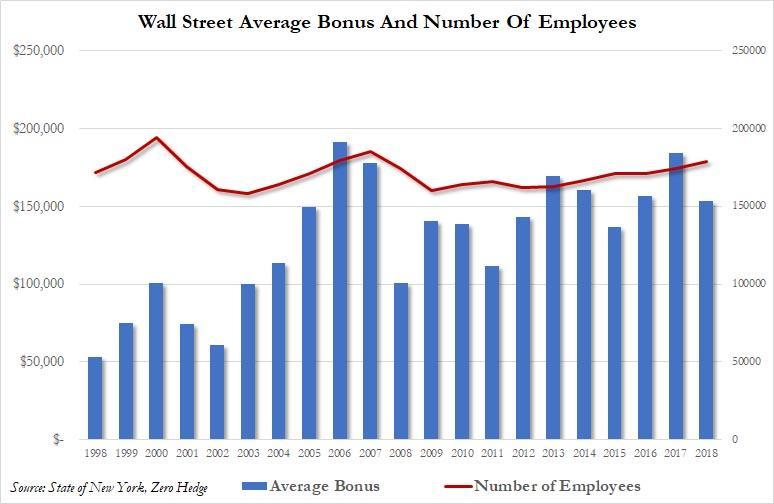

In 2018, the average bank bonus pool contracted by 17%…

…Largely thanks to the explosion of volatility during the fourth quarter. For these numbers, there’s one important caveat: the figures for 2018 don’t include stock options or other forms of deferred compensation for which taxes have not yet been paid.

Ultimately, New York State Comptroller Thomas DiNapoli determined that Wall Street pay shrank by 5.6% last year (the NY Comptroller collects and releases data about the financial services industry, including data pertaining to profits and compensation, every six months or so).

Stocks are back near all-time highs, which should inspire confidence in the bottom line. But with last year’s Q4 surprise still fresh in their memories, bosses are waiting to dole out bonuses until the very last minute, wary of the possibility of history repeating itself, Reuters reports.

The result: Some bankers might find themselves working hard through the holiday in a last-ditch push to guarantee a healthy bonus, as some banks might wait until early January to finalize their bonus numbers.

But because there is so much uncertainty about what might happen in overnight lending in late December, and the ripple effects it could have on other markets, many executives are taking the unusual step of waiting to divvy up bonus pools until the year is completely finished.

“There may be people working New Year’s because they’ve got to finalize this January 10 or 15,” said compensation consultant Alan Johnson. “People are going to be particularly vigilant to make sure that they’re going to be paying the right amount, figuring it out right up to the end of the year.”

One banker told Reuters that the reason for the delay is to avoid sticky situations like what occurred at one big bank.

At one bank last year, trading heads were told in late-December that millions of dollars needed to be shifted from their bonus pool to other divisions, a source familiar with the matter told Reuters on the condition that the bank and person not be named. The industry is trying to avoid situations like that again this year, Johnson said.

Johnson’s firm publishes a closely watched annual report forecasting where Wall Street bonuses are headed. It found that most employees will likely see a decline from last year, especially in equities trading where bonuses could fall 10-15%. Investment bankers can generally expect to see declines of 5-10%, Johnson Associates predicted.

Despite the market’s performance, 2019 was actually a tough year for banks thanks to the Fed’s ‘mid-cycle adjustment’, subdued demand for loans, weak trading revenue and declines in other areas in investment banking. Though Reuters doesn’t speculate about what these declines might be, we wouldn’t be surprised if all of those unicorn IPO flops (Uber, Lyft, Peloton etc.) had something to do with it.

Even bankers who worked on blockbuster deals (of which there were more than a few this year) might not walk away with the blockbuster bonuses that they’ve likely come to expect.

During the first nine months of the year, Goldman Sachs Group Inc (GS.N) and the capital markets divisions of JPMorgan Chase & Co, Bank of America Corp and Morgan Stanley reported declines of 1-8% in revenue and 8-18% in profit. Citigroup Inc (C.N) was an outlier, reporting flat revenue and a 1% gain in year-to-date earnings.

Even those who worked on big deals or in business areas or that did well – say, bankers who worked on Bristol-Myers Squibb’s $74 billion acquisition of Celgene, or traders who generated a lot of revenue helping companies manage falling rates are not assured of a rich bonus.

Almost one year ago, the website efinancialcareers.com published an article entitled “This is what bankers really do when they get their bonuses.”

They shared six steps: Step 1, they try to determine whether the amount they received was close to what they expected, then they try to tabulate what they will owe in taxes (since bonuses are taxed at a higher rate). Next, they pick three numbers: The real number (which is shared with their family members), the “highball” number (shared with friends and colleagues to try and impress them) and the “lowball” number (used to convince junior employees that you are seriously underpaid for the work you do).

In other words, Deutsche Bank might be the only bank trying to do more with less.

Tyler Durden

Tue, 12/10/2019 – 17:05

via ZeroHedge News https://ift.tt/2LIwyNC Tyler Durden