China Quietly Ramps Up Oil Production In Iran

Authored by Simon Watkins via OilPrice.com,

The supergiant Azadegan oil field, comprising major north and south sites, is as important to Iran’s overall strategic plan to survive the current sanctions environment and to prosper when they are lifted as the flagship South Pars supergiant gas field and the added-value products of its petrochemicals sector. Last week Iran’s Petroleum Engineering and Development Company (PEDEC) announced that five new development wells and an appraisal well are to be spudded in North Azadegan to maintain current production levels. OilPrice.com understands from various senior energy sources in Iran that this is only part of the picture, with much bigger plans having been agreed for rollout in the coming six months with the help of China and Russia.

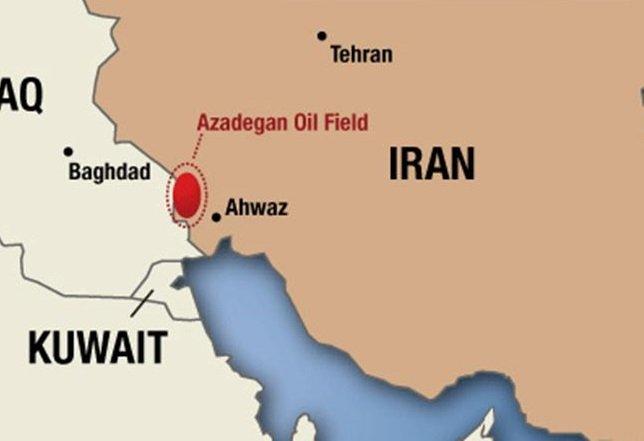

Located around 80 kilometres west of Ahvaz, close to the Iraqi border, the entire 900 square kilometre Azadegan field is the third-largest hydrocarbon reserve in the world after the Ghawar oil field in Saudi Arabia and the Burgan oil field in Kuwait. Its total reserves are estimated at about 42 billion barrels of oil, with around 7 billion barrels currently deemed recoverable. The first exploration well was drilled in 1976 but, despite its potential, a long lead time across the four main layers – Sarvak, Kazhdomi, Godvan, and Fahilan – of the site has meant that the pace of production has been slower than at many neighbouring fields, especially those over the border in Iraq.

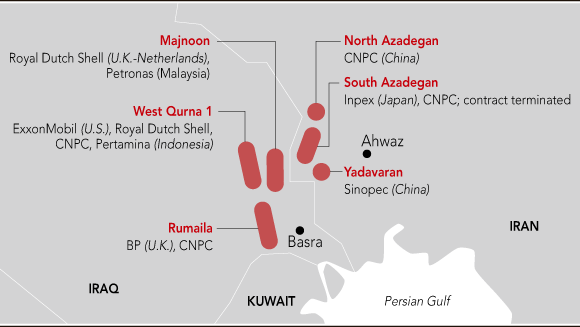

A key reason for this was the attitude of Chinese firms active in Iran around that time, which can be broadly characterised as doing the minimum necessary to generate some oil flows from the fields back into China whilst not spending too much money. This attitude, though – particularly when Iran was already in the process of negotiating the Joint Comprehensive Plan of Action (JCPOA) in the run-up to its being agreed in 2015 – resulted in the National Iranian Oil Co. (NIOC) cancelling China National Petroleum Corp’s (CNPC) contract to develop Phase 11 of the South Pars natural gas field in 2013. A year later – with CNPC having drilled only 7 of the 185 wells it had planned at the South Azadegan field – the NIOC also cancelled this development contract with the Chinese company as well. CNPC was further warned at that time that its contract for North Azadegan would go the same way if it did not up the development tempo, which it did, increasing production from around 15,000 barrels per day (bpd) at that stage to around 35,000 bpd within a year or so.

As it stands, with CNPC still the key foreign developer at North Azadegan, the relationship dynamic between Iran and China has shifted again. With re-imposed U.S. sanctions still in place, Iran cannot afford to alienate China and over the past few months has offered it extremely advantageous deals to return to previous developments or to take on an even greater role in existing ones. The most notable of these have been South Azadegan and Phase 11 of the supergiant South Pars non-associated gas field, although others are in the offing.

“The understanding agreed between Iran and China when the French [Total] started to wobble on continuing with Phase 11 [of South Pars] after the U.S. pulled out of the JCPOA was that China would assume Total’s entire stake [to 80.1 per cent] and really push production,” a senior oil industry source who works closely with Iran’s Petroleum Ministry told OilPrice.com last week.

“At the same time, China would also be allowed to go into South Azadegan to create a unified field development programme with its North Azadegan activities,” he said.

“When the details of the deals began to leak out, though, South Pars [Phase] 11 and South Azadegan had to be put on the back burner but the plans will go ahead within the next six months,” he added.

In this hiatus, though, China has been advancing its reach into neighbouring Iraq, as highlighted recently here.

From China’s perspective, its ‘One Belt, One Road’ vision – which will absolutely change the global geopolitical power balance forever – is totally dependent on Iran’s participation for three key reasons.

-

First, Iran is closely involved in the affairs of those countries that constitute the Shia crescent of power – Jordan, Lebanon, Syria, Iraq, and Yemen – which allows China to hold the U.S in check in those areas.

-

Second, it is a direct land route into Europe, via both Turkey and the Former Soviet Union states and Russia.

-

And third, it has huge oil and gas reserves currently going cheap.

These broad factors underpin the game-changing 25-year comprehensive strategic partnership signed earlier this year in Beijing by Iran’s Foreign Minister, Mohammad Zarif, and his China counterpart, Wang Li.

All of this means in the short-term that China needs to make continued solid progress on North Azadegan until such time as the Islamic Revolutionary Guard Corps (IRGC) tells President Hassan Rouhani that the Iranian public and moderate MPs will be able to tolerate China’s further multi-layered expansion in Iran. Currently, North Azadegan is producing just shy of 80,000 bpd but the Phase 2 plan – including the spudding of the new wells – is aimed at boosting this output to at least 100,000 bpd. More specifically, China is expected by Iran to ensure that the output from North Azadegan when combined with the output from South Azadegan (currently being developed by Iranian firms) is at least 250,000 bpd. South Azadegan is now producing a steady 105,000 bpd with spikes to 115,000 bpd plus, according to the Iran source.

Longer-term, Iran’s plan is to increase the recovery rate from all of its oil fields, beginning with those in the massive West Karoun area (in which North and South Azadegan are located, along with North and South Yaran, and Yadavaran, among others) to at least 25 per cent from the current 4.5 per cent (it was 5.5 per cent before U.S. sanctions were re-imposed). By comparison, the average recovery rate from Saudi Arabia’s oil fields is around 50 per cent, with plans to raise that to 70 per cent.

As the West Karoun fields together are estimated to contain at least 67 billion barrels of oil in place, for every one per cent increase in the rate of recovery that can be achieved the recoverable reserves figure would increase by 670 million barrels, or around US$34 billion in revenues with oil even at US$50 a barrel. Once China has also taken over at South Azadegan, according to the Iran source, it will be expected to increase the output from the three fields – North and South Azadegan and Yadavaran – by at least 500,000 bpd within three years from the signing of the South Azadegan deal (expected within the next six months).

Tyler Durden

Wed, 12/11/2019 – 17:45

via ZeroHedge News https://ift.tt/2LJZepJ Tyler Durden