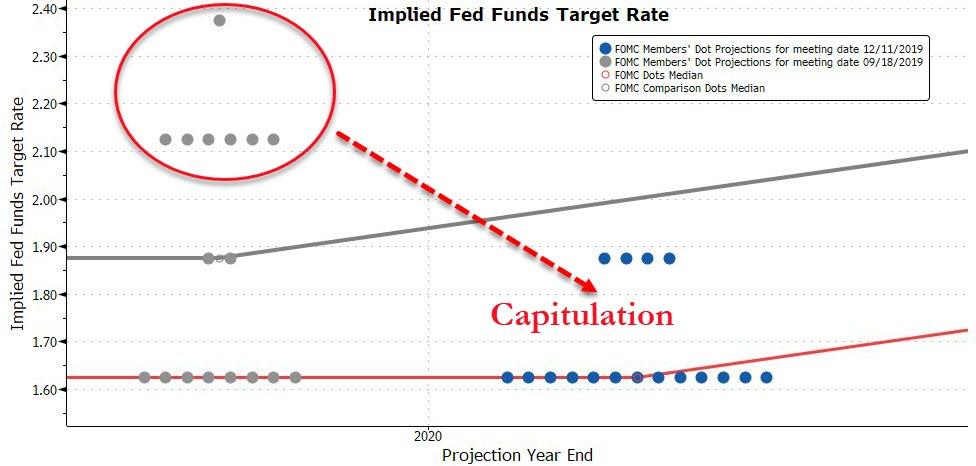

Dollar Dumps To 5-Month Lows As Stocks, Bonds Jump On Fed Fold

The fed officially capitulated…

Source: Bloomberg

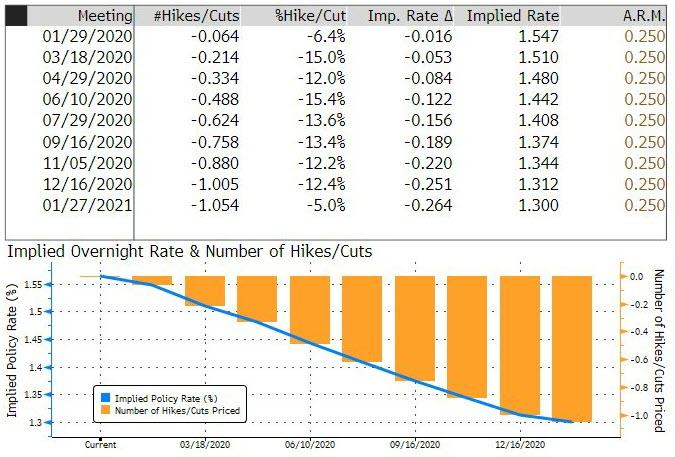

…removing any expectations for rate changes until the end of 2020 at the earliest…

Source: Bloomberg

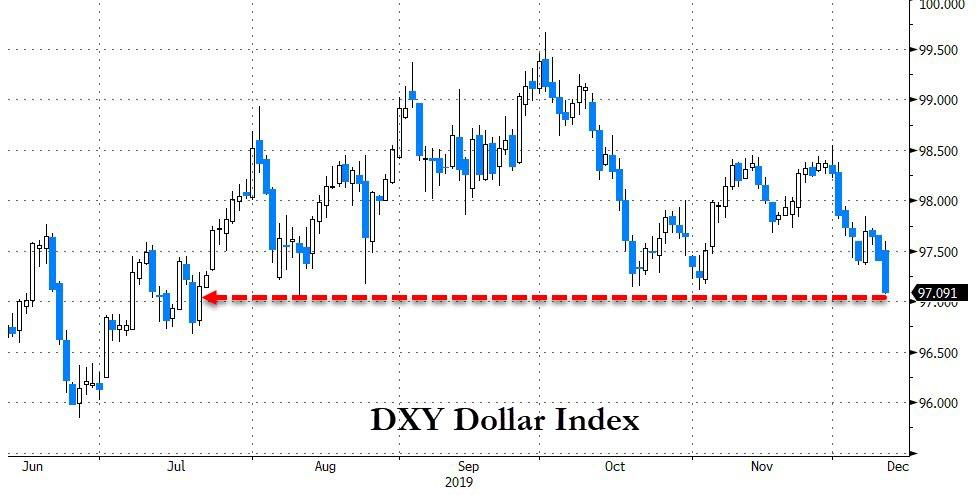

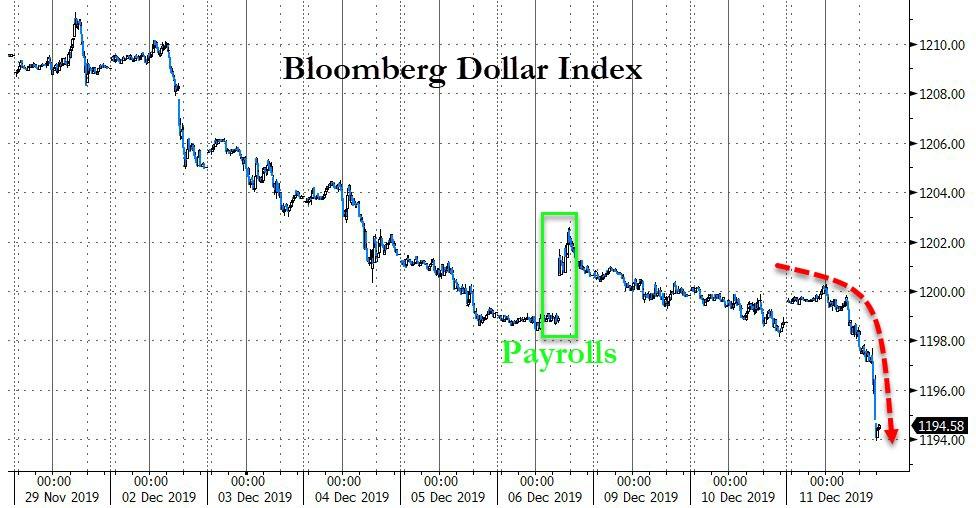

Which sparked initial weakness in the dollar, dumping it to 5-month lows

Source: Bloomberg

But when Powell admitted he would consider bond purchases (not just Bill purchases), the dollar and Treasury yields tumbled…

Source: Bloomberg

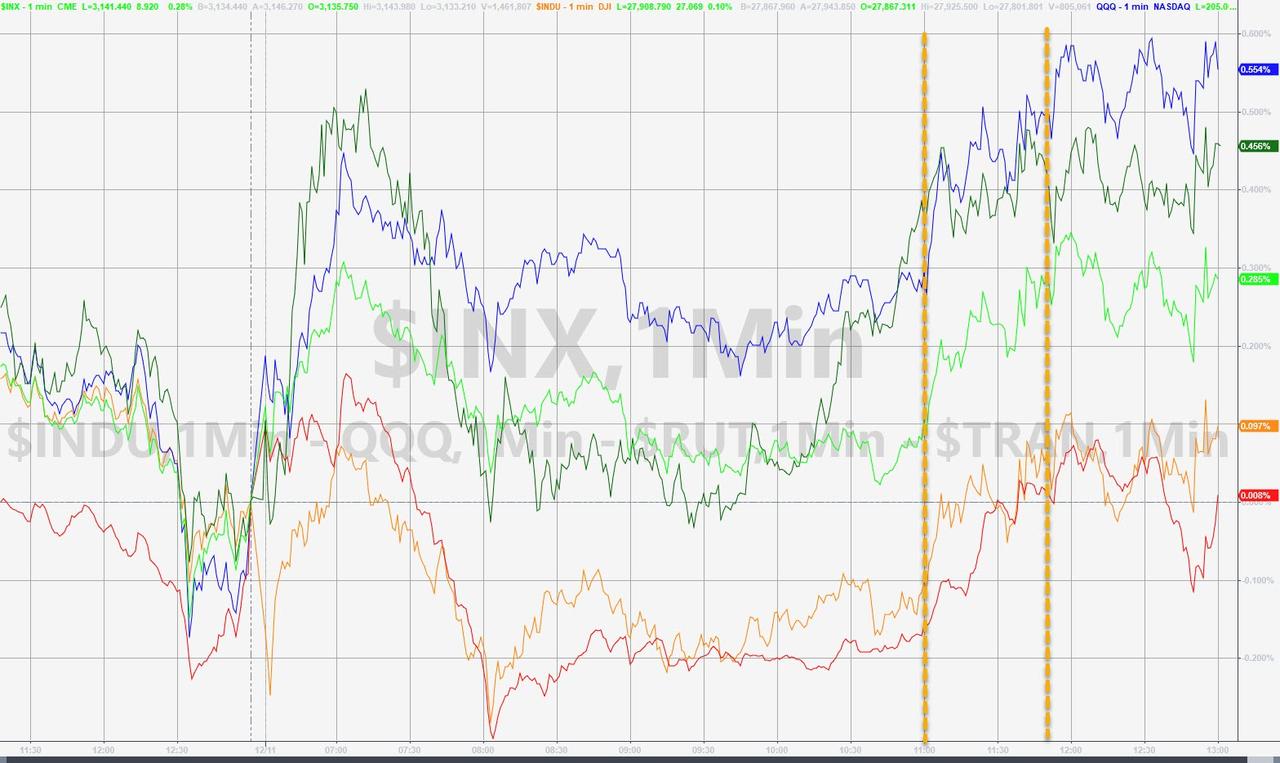

Stocks were broadly higher on the day (though Small Caps lagged)…

The S&P dived briefly in the last few minutes on Navarro comments but bounced off vwap…

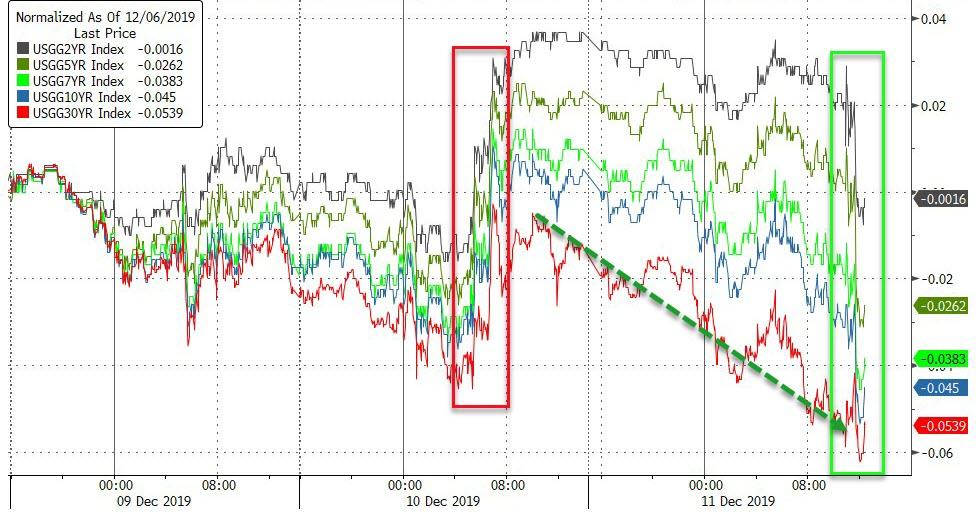

Treasury yields tumbled across the entire curve by 4-5bps (the belly was a modest outperformer)…

Source: Bloomberg

And the yield curve is tumbling…

Source: Bloomberg

Today was the biggest drop in the dollar in two months, down 8 of the last 9 days…

Source: Bloomberg

Cable roundtripped yesterday’s “Johnson might not win by a mile” fears, as the latest polls suggested that he will…

Source: Bloomberg

With the most hedging since the Referendum vote…

Source: Bloomberg

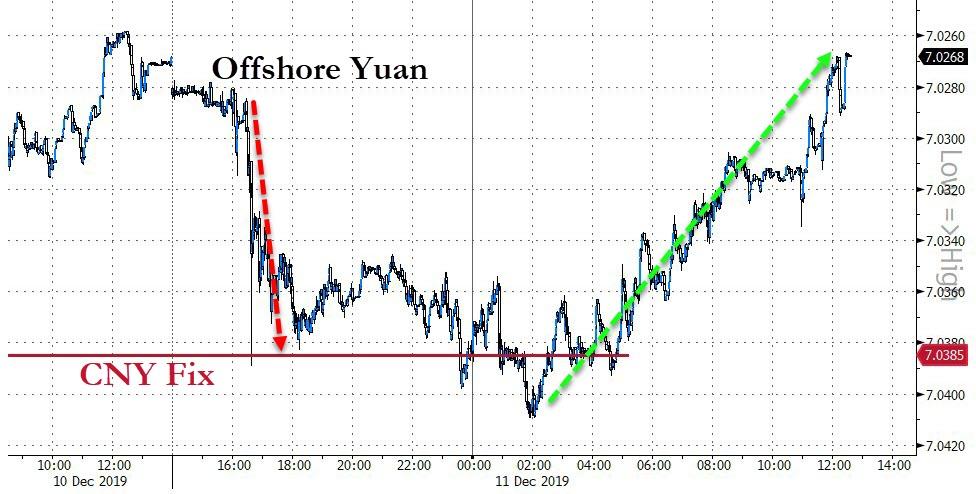

Yuan also roundtripped on the day, despite more

Source: Bloomberg

Cryptos continue to limp lower…

Source: Bloomberg

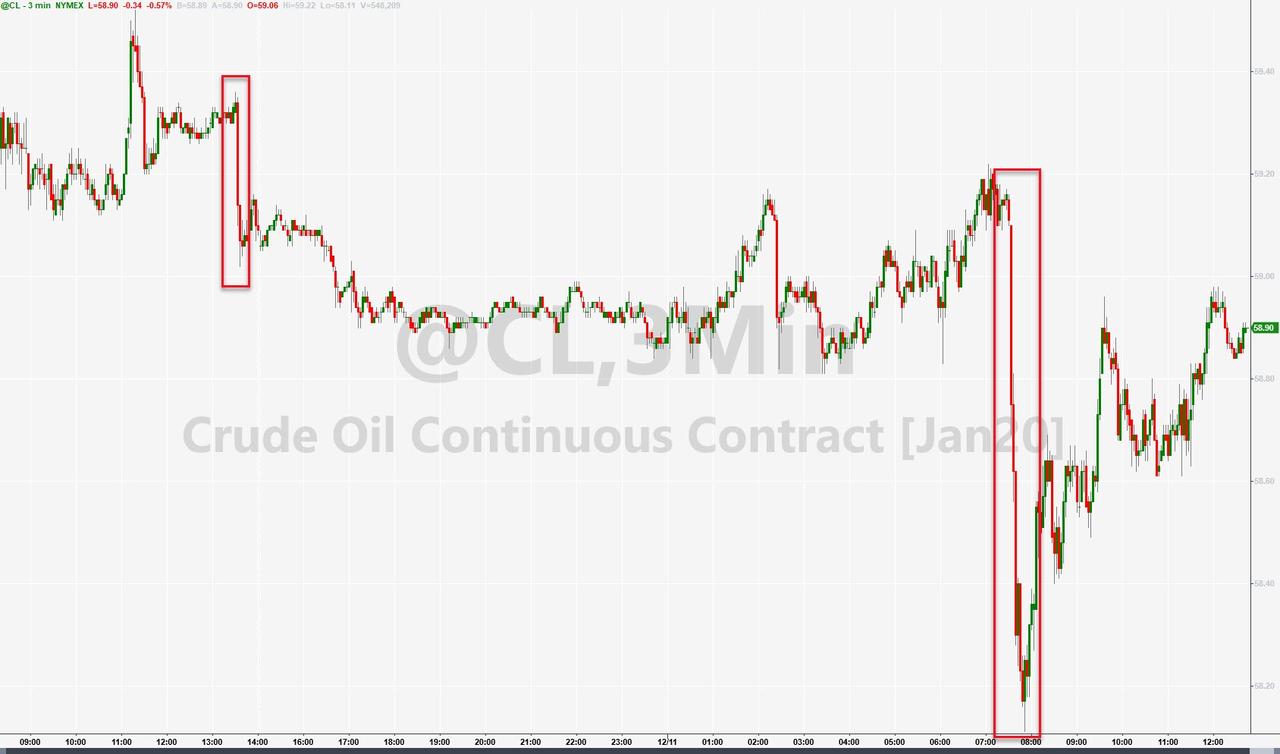

Copper continued its charge higher today, crude was weaker as PMs gained on a weak dollar and Fed promises…

Source: Bloomberg

Oil prices tumbled after last night’s API and this morning’s DOE data showed a surprise crude build (but the machines bought the F’ing dip…

Silver soared back today as the dollar skidded – erasing a large part of the payrolls panic puke…

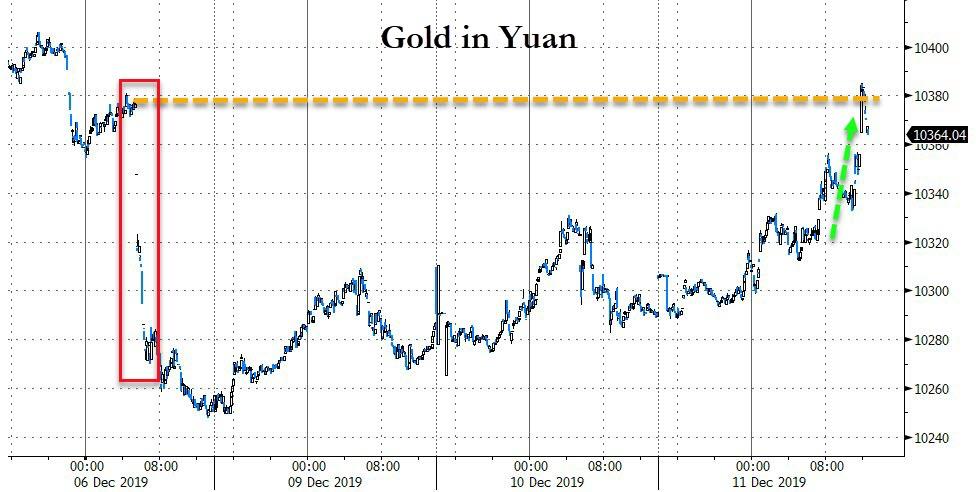

And gold did run the stops above the payroll sprint before fading back…

And gold in yuan erased the payrolls plunge…

Source: Bloomberg

So, summing it all up – it seems Powell and his merry men (and women… and any non-binary members of the FOMC) are not all-seeing… and we will have to 3wacth the ‘turn’ repo rate to see if they really can hold this shitshow together through year-end…

Oh and about that Aramco IPO – remember the last time a massive sovereign energy firm went public at over a trillion dollars…

Source: Bloomberg

Tyler Durden

Wed, 12/11/2019 – 16:02

via ZeroHedge News https://ift.tt/38w6YFm Tyler Durden