FOMC Leaves Rates Unchanged, Signals No Action Until 2021 Earliest

Here are Bloomberg’s key takeaways from today’s FOMC decision:

-

The Fed leaves federal funds target range unchanged at 1.5%-1.75%, as expected, following three straight cuts; the FOMC says rates are currently “appropriate” to support growth, jobs and inflation, while officials omit prior language that said “uncertainties about this outlook remain”

-

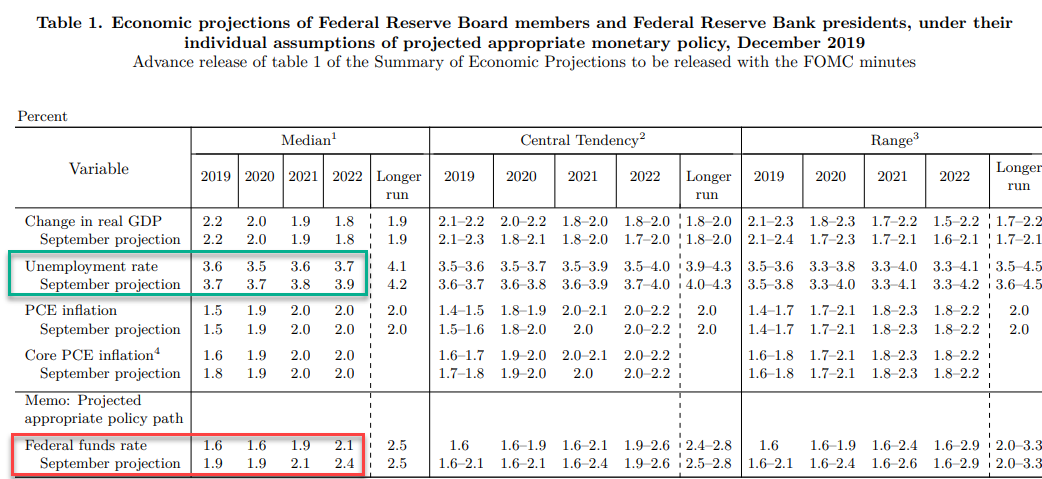

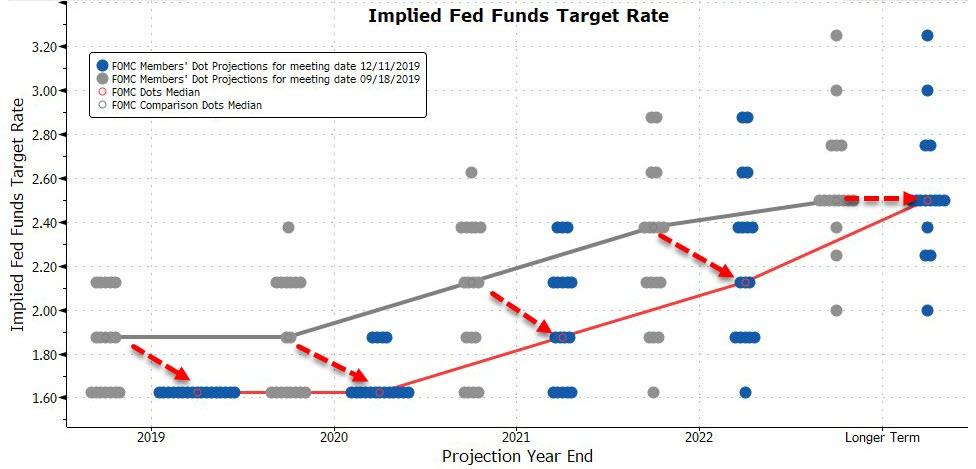

The dot plot of policy makers’ rate projections shows 13 of 17 officials expect no change in borrowing costs through the end of 2020; most see higher rates as likely in 2021, with a further increase expected in 2022. There was little change in forecasts for economic growth, unemployment and inflation.

-

The Fed reiterates its plan from October to address strains in money markets, including buying Treasury bills through at least the second quarter, with no new announcements (so far). The interest on excess reserves rate (IOER), which the Fed uses as tool to control the main federal funds rate, was also left unchanged at 1.55%.

-

The statement’s language on the economy was unchanged. The FOMC said the labor market and household spending were strong, while business investment and exports were weak. The Fed said it will continue to monitor information “including global developments and muted inflation pressures.”

-

The 10-0 decision is the first unanimous vote since May 1; Kansas City Fed President Esther George and the Boston Fed’s Eric Rosengren endorsed the rate hold after dissenting from all three rate cuts.

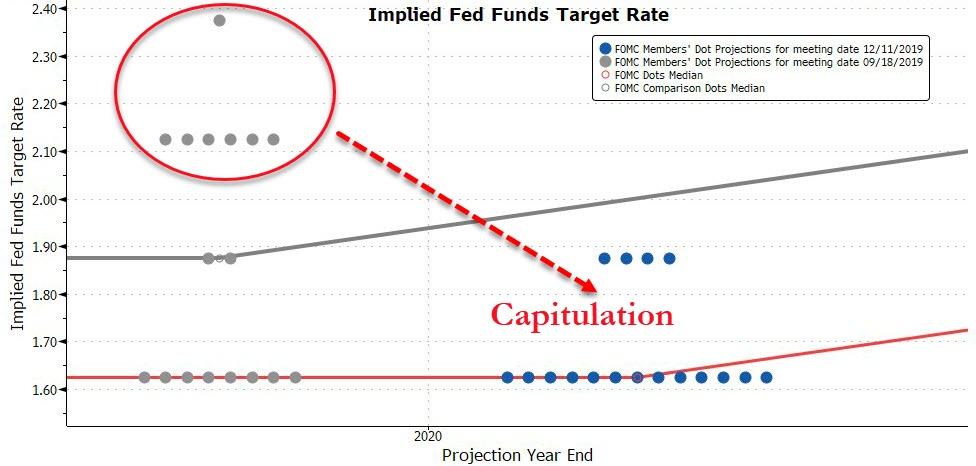

The Fed capitulated on rates…

-

2019 median Fed funds 1.6% vs 1.9%

-

2020 median Fed funds 1.6% vs 1.9%

-

2021 median Fed funds 1.9% vs 2.1%

-

2022 median Fed funds 2.1% vs 2.4%

-

Longer run Fed funds median at 2.5% compares to previous forecast of 2.5%

This is what that capitulation looks like…

Source: Bloomberg

And as The Fed cuts its rate forecast it also lowers its unemployment rate forecast (leaving GDP and inflation forecasts the same)…

* * *

Since The Fed cut rates in October, stocks have surged, bonds and the dollar have flatlined, and gold has leaked lower…

Source: Bloomberg

However, the yield curve is significantly flatter (despite a brief steepening)…

Source: Bloomberg

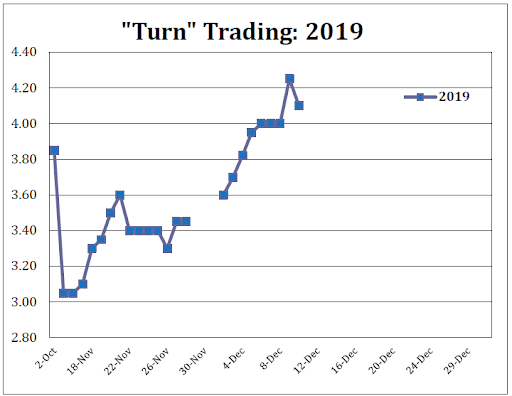

Oh, and as a reminder, repo rate for the ‘turn’ are soaring…

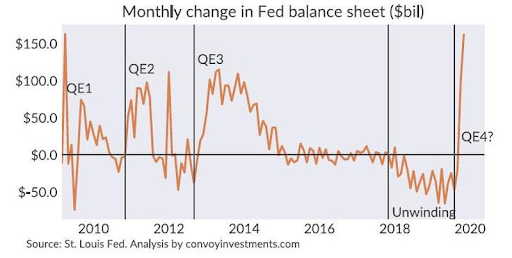

Despite endless daily repo liquidity and a balance-sheet that is expanding at its fastest rate ever…

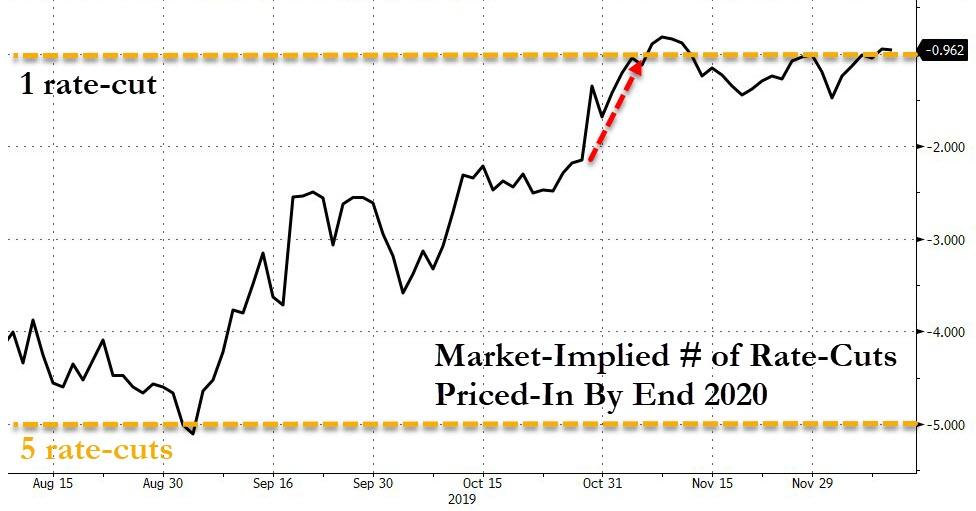

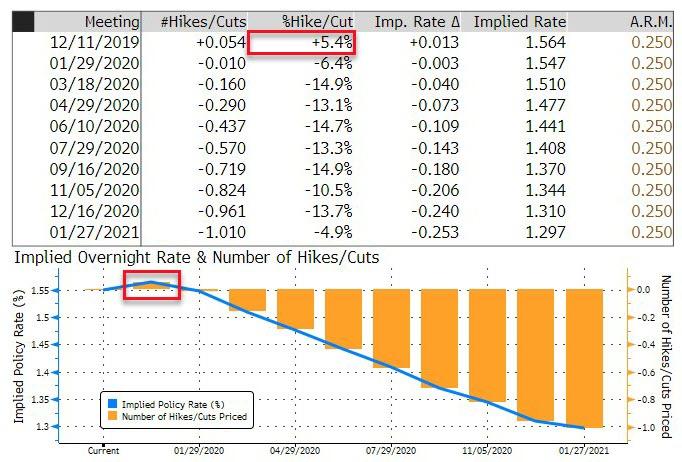

The last few months have seen the market price-out most of the uber-dovish sentiment, with less than one rate-cut now priced-in before the end of 2020…

Source: Bloomberg

Which has left the market pricing in a 5% chance of an actual rate-hike today!!!!

Source: Bloomberg

* * *

So what can Powell say today? Expectations are for marginal language changes at most but as MacroHive’s Bilal Hafeez notes,m there are three main scenarios:

-

Base-case: With the trade deal uncertainty still hanging over the economy and markets, the Fed will maintain a cautious tone but likely refrain from delivering new easing measures (either rate cuts or a new facility, like the SRF or more QE). Data has been mixed but last week’s solid employment report gives the Fed some cloud cover to take a wait-and-see approach into 2020. The FOMC will likely reiterate that policy remains appropriate and that rates will remain on hold for 2020. At this meeting the press conference matters more than the statement and Summary of Economic Projections (SEP) forecasts. We expect Chair Powell to downplay concerns over the repo operations. He will likely state that reserves in the system are slowly returning, but that the Fed remains on alert around year-end.

-

Hawkish-case: It’s a low probability outcome, but we are re-introducing the hawkish case in this preview in the event the Fed is increasingly more confident that it has managed to ‘soft land’ the economy. Although we do not think SEP projections have the same sort of cache as before, the risk is that their path will maintain the upward bias for 2021 and 2022.

-

Dovish-case: Building upon the base case scenario, which is already leaning to the dovish side, the Fed could deliver a dovish message in a couple ways. The most straightforward way would be to flatten the dot plot and suggest hikes are no longer on the cards as far as the eye can see. In many ways, recent Fed speeches suggest that they would only raise rates if inflation is consistently running above their 2% target. Related to this would be if Chair Powell mentions that the Fed is close to making a change on their 2% target and would be introducing a new framework that would allow for periods of inflation overshooting ahead.

* * *

As expected, The Fed held rates steady:

-

*FED LEAVES RATES UNCHANGED

-

*FED SAYS RATES ARE “APPROPRIATE” TO SUPPORT GROWTH, JOBS

-

*FED REMOVES REFERENCE TO “UNCERTAINTIES” AROUND OUTLOOK

but all eyes are on the Dot-Plots, as they collapse to a relatively flat view of the rate-path ahead…

Source: Bloomberg

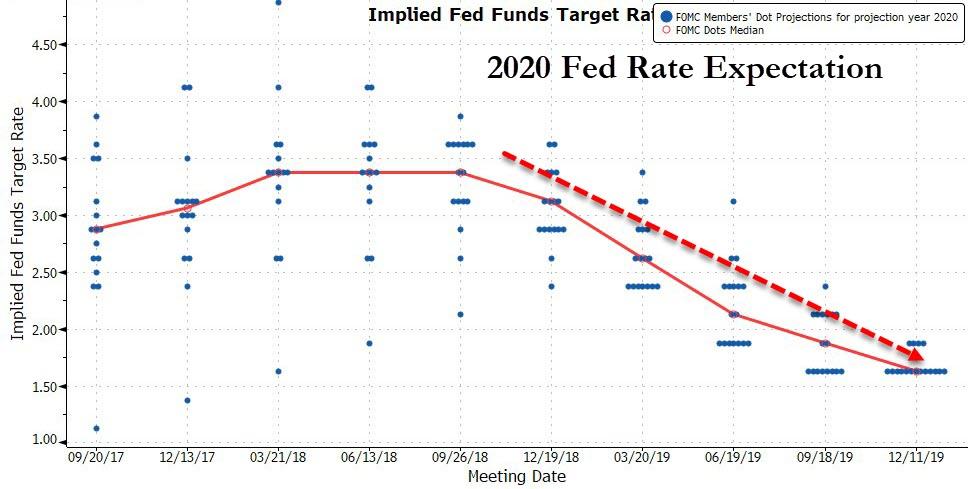

And the 2020 terminal rate has been ratcheted lower and lower in the last year…

Source: Bloomberg

It would be a shocker to everyone if markets move on this announcement.

* * *

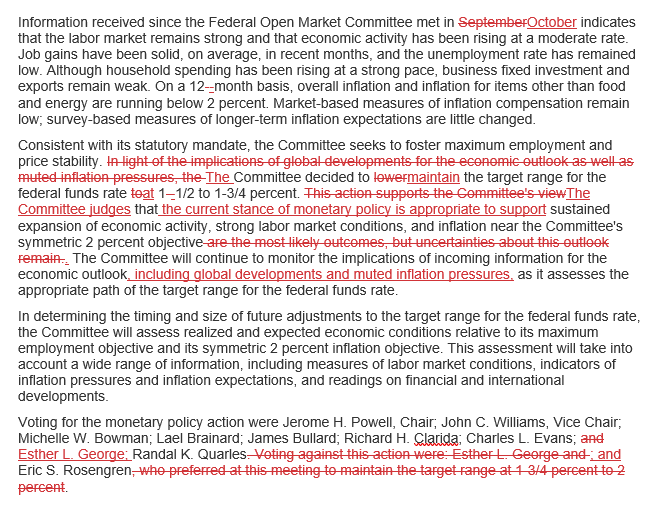

Full Statement Redline below…

Tyler Durden

Wed, 12/11/2019 – 14:04

via ZeroHedge News https://ift.tt/2qMrqks Tyler Durden