FOMC Preview: Here’s What The Fed Will Say Today

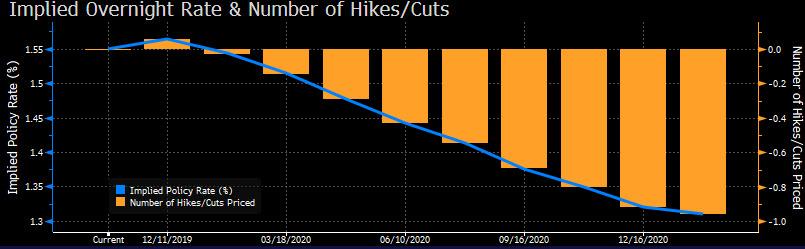

With traders eager to put 2019 in the rearview mirror, especially now that repo market icon Zoltan Pozsar is warning a market crash looming in just a few days (which the Fed will then use to trigger QE4), several key hurdles remain of which one is of course this Sunday’s decision on a new round of China tariffs and the other is today’s FOMC meeting, although as DB’s Jim Reid writes, “in fairness it’s probably hard to get too excited given that the Fed is firmly on hold for now with the recent data helping to underscore that position.” Indeed, markets have priced in no rate moves for a long time (if anything, tiny odds hint at a hike today)…

… and the view from the bank’s economists is that the meeting statement should largely mirror the communique from the last meeting.

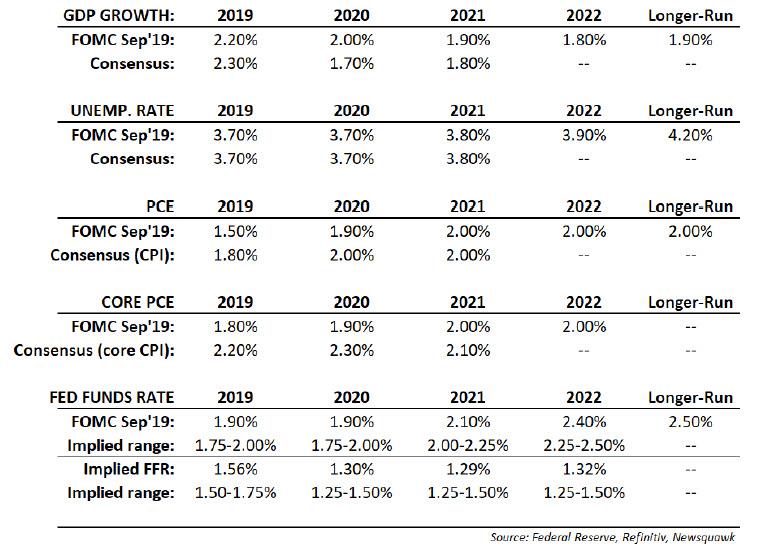

While the Fed’s job has been made slightly complicated by the fact that today’s policy meeting comes ahead of the possible boosting of tariffs on US imports of Chinese goods on 15th December, we will also get the latest summary of economic projections although consensus expects only very modest changes, most notably downgrades to the median views on inflation and long-run unemployment.

The dot plot should adjust 25bps lower to account for the rate cut in October and still show an upward drift over time to a neutral level that drifts lower every quarter as the world’s massive and growing debt load means the hard ceiling on interest rates continues to drop.

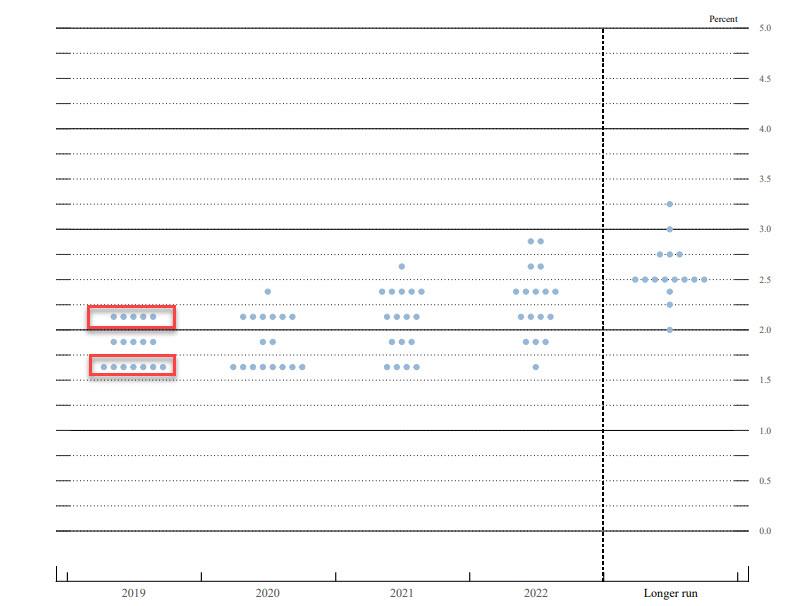

And speaking of the dot plot, recall that there has been a sharp bifurcation in the FOMC between hawks and doves…

… and as Bloomberg notes, unless that split erodes entirely it’s not necessarily that relevant whether the marginal dot that determines the median actually lies. As a reminder, the September (shown above) dot plot median had rates unchanged for the rest of the year; six weeks later, the Fed cut again just as the repo market fireworks were exploding.

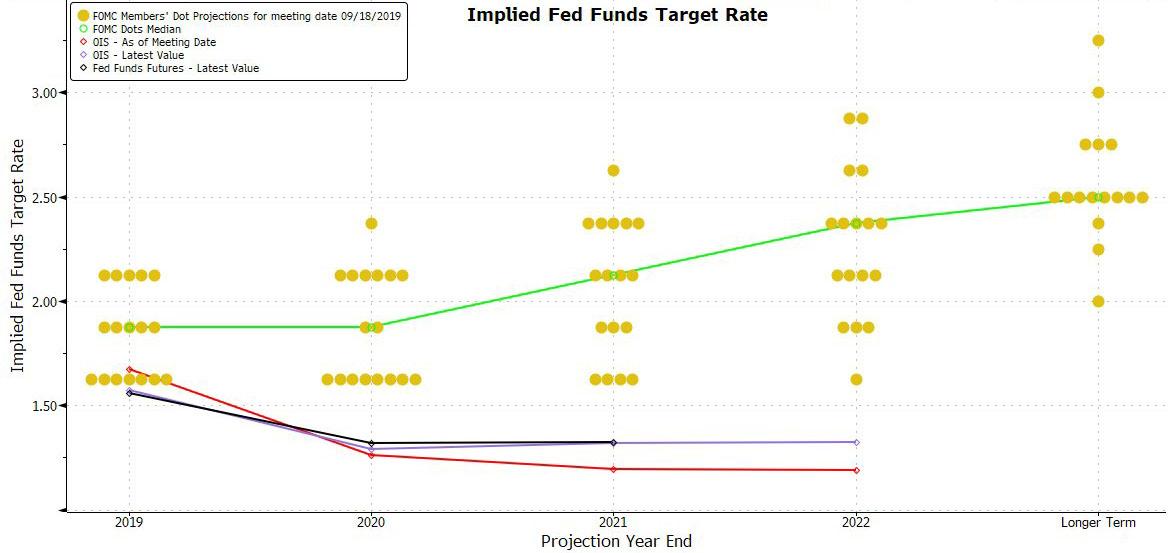

And speaking of the “dots” credibility, there remains the issue of the gaping divergence between the Fed’s own longer-term forecast and what the market expects: as shown below, the FOMC consensus rate path has the fed funds at 2.375 in 2022, while the OIS has that rate at more than 1% less, or 1.326%.

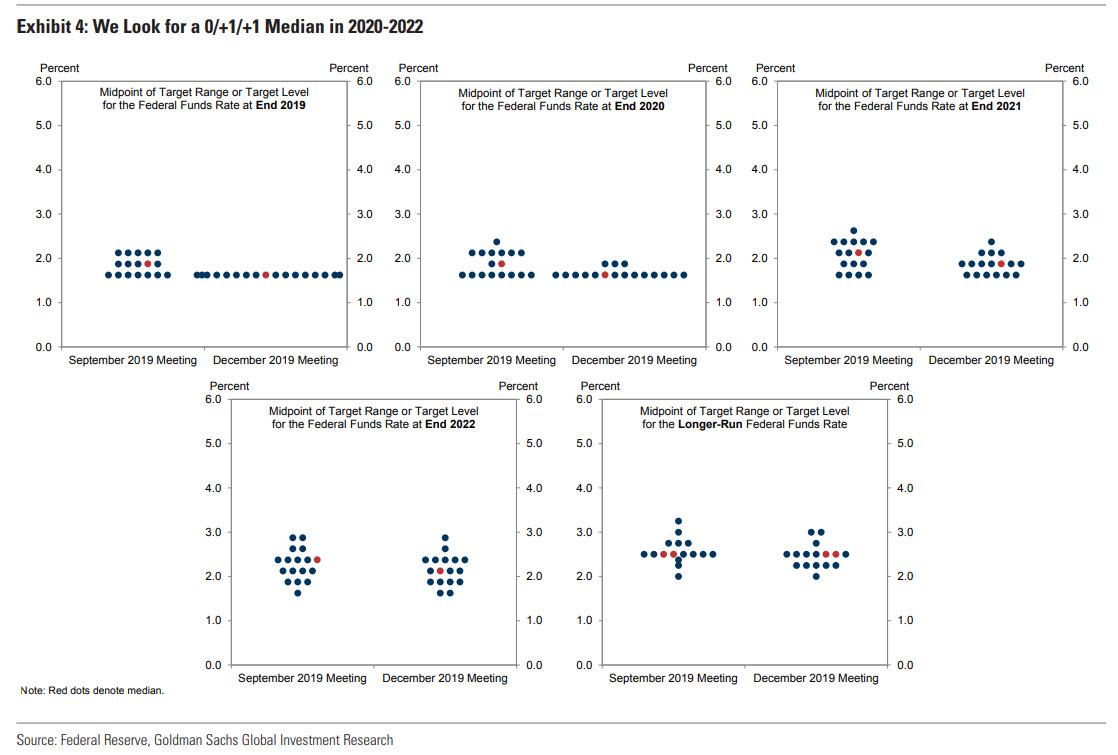

For those who do care about the dots, Goldman notes that at the September meeting, the median dot showed 50bp of cuts in 2019, no action in 2020, and one hike in each of 2021 and 2022, returning the funds rate to 2.25-2.5%. The biggest surprise of the September meeting was the forceful pushback to the September cut by five participants who submitted end-2019 dots of 2-2.25%, with one of them likely also projecting a 2020 hike to 2.25-2.5%.

Recent comments from Fed officials indicate that most now agree that policy is now in a good place, therefore expect for the great majority (14/17) of the 2020 dots to show an unchanged policy rate. Goldman expect three of the participants who opposed the 2019 cuts to project a hike in 2020 and do not expect any dot to show a fourth cut. Beyond 2020, the median dots will again show one hike in each of 2021 and 2022, returning the funds rate to 2.0-2.25%, as shown in Exhibit 4. The risks to Goldman’s estimate of a 1.75-2% median for 2021 are slightly to the downside—if most participants view an inflation overshoot as a necessary condition for a hike, they might expect to keep policy on hold for longer. While average inflation targeting has not been formally adopted, Powell’s comment in October that the FOMC “would need to see a really significant move up in inflation that’s persistent before we even consider raising rates to address inflation concerns” hints at downside risk. In contrast, the risks to Goldman’s estimate of a 2-2.25% median for 2022 are slightly to the upside—participants might expect policy normalization to neutral over a 3-year horizon if they follow the Yellen-like balanced approach of also putting substantial weight on the labor market overshoot.

That leaves Powell’s press conference which Reid believes will echo recent remarks, which indicate that the Committee sees policy in a good place barring a “material reassessment” to the outlook. In this context, expect the Chair’s comments to reflect his implicit message from October that, while the bar to cutting rates is high, the bar for hiking is even higher.

In other words, the Fed will likely never hike again, but will cut should stocks unexpectedly drop. However, if Pozsar is right, the Fed will need to launch QE4 in the next few days to offset what is expected to be a liquidity black hole in the coming days.

Some other things to keep a watch for: will the Fed discuss a permanent standing repo facility (unlikely, if this hasn’t been unveiled so far), especially since as of right now there has yet to be any indication that funding conditions over the year end “turn” are set to implode.

Looking ahead, beyond the December meeting, Goldman sees a high bar for policy moves in either direction, and expects the funds rate to remain unchanged in 2020. Combined with the recent acceleration in job growth, the bank expects a modest acceleration in growth and core inflation next year to further strengthen the FOMC’s view that additional cuts are not warranted. Consensus expects growth to accelerate modestly, mostly reflecting a boost from easier financial conditions and a fading drag from the trade war absent further escalation. Firmer wage growth and positive base effects in the first quarter of next year are likely to push core PCE inflation to just shy of the 2% target in 2020, which should also reduce the case for cuts. But don’t expect rate hikes any time soon either: Chair Powell set a high bar for rate hikes by linking potential hikes to a significant and persistent move up in inflation

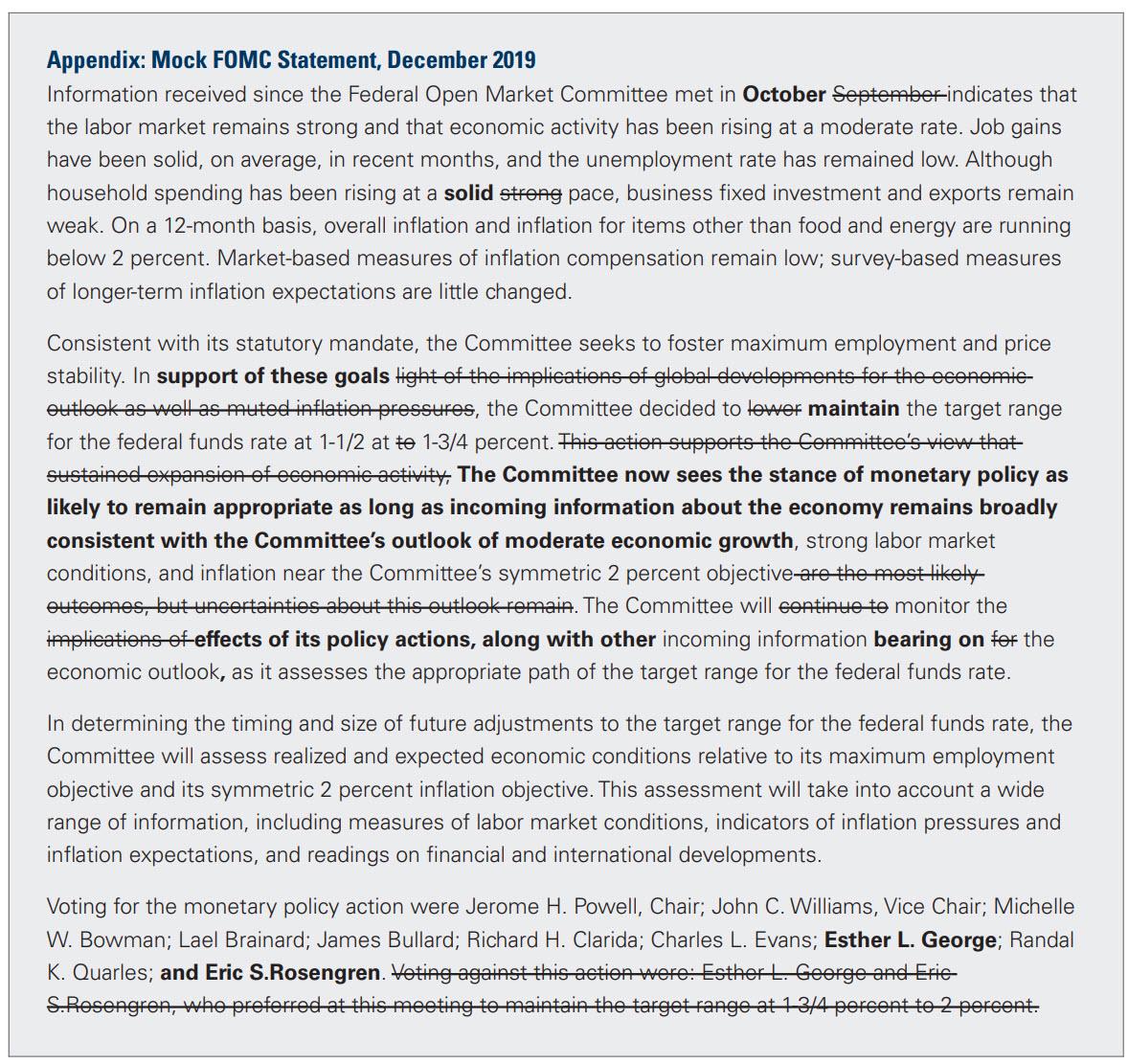

Courtesy of Goldman, this is what the Fed’s redlined statement will most likely look like.

* * *

Below we provide a detailed take on what to expect from the Fed today at 2pm courtesy of RanSquawk

The FOMC is expected to leave rates unchanged at 1.50-1.75%. Attention will be on the forward guidance elements, updated forecasts and ‘dot plot’. In his press conference, Chair Powell may be asked to clarify what factors the Fed needs to be in place that would amount to a “material reassessment” of the outlook – both on the upside and downside – that may result in the FOMC changing its policy stance.

Ultimately, Powell is expected to reiterate an optimistic view of the US economy, though caution on familiar risks while reiterating a data-dependent outlook (NOTE: the FOMC precedes a potential boosting of US tariffs on Chinese imports on 15th December). Rate decision will be published along with updated economic projections at 200 pm ET; the post-meeting press conference with Chair Powell will commence at 230 pm ET.

RATES:

The FOMC is expected to leave the federal funds rate target between 1.50-1.75%, according to analysts surveyed and market pricing. Ahead, markets price just over one rate cut in 2020. Some are will also be closely watching whether the Fed tweaks its interest on excess reserves (IOER) rate; the IOER was cut to 1.55% in October (cut by the same magnitude as the FFR target). But since then, the effective federal funds rate (EFFR) has fallen below the midpoint of the target range (currently 1.625%); Rabobank says that in order to get EFFR back to the midpoint, the IOER rate could be raised, and a 5-10bps technical hike to the IOER rate could achieve. A 10bps rise to the IOER may signal the FOMC is anticipating further downward pressure on the EFFR due to its balance sheet expansion policy (the opposite of what was seen in June’18, Dec’18, Sep’19 when balance sheet normalisation contributed to higher EFFR).

POWELL’S TONE:

The Fed’s job has been made slightly complicated by the fact that the 11th December policy meeting comes ahead of the possible boosting of tariffs on US imports of Chinese goods on 15th December. Given that the outlook is still subject to some uncertainties, Chair Powell may recycle his optimistic but cautious outlook. In remarks made towards the end of November, Powell stuck to that script; he was optimistic about the state of the economy, and feels monetary policy settings are appropriate after the FOMC’s three ‘insurance cuts’; the Fed chair said the current stance would remain appropriate as long as economic data was consistent with moderate growth (despite some wobbles, it does seem to be).

Powell said policymakers’ favourable outlook was founded on strong household spending (next retail sales report is out Friday, after the Fed meeting, and is expected to rise; CB’s gauge of consumer confidence has come off highs, though is stabilising at elevated levels). However, Powell cautioned the Fed would respond accordingly if developments caused a ‘material reassessment’ of economic outlook, adding that ‘yellow flags’ included muted inflation (CPI data is released on the Wednesday of the Fed meeting, and is seen rising slightly; though the UoM’s data last week showed inflation expectations falling a touch) and weakness in manufacturing (ISM’s recent manufacturing survey provides little to cheer about); at the previous meeting, Powell said that the Fed would mull hikes if inflation was running away, but there doesn’t seem to be many signs of that at present. Powell also noted that weak foreign growth was hurting exports, and it increased the risk that weakness could spread more broadly (and the 15th December tariffs might have the potential to exacerbate these risks, potentially hitting the consumer sector too). In Powell’s November remarks, he said lower monthly job gains suggest economy with somewhat less momentum than previously thought (the recent jobs data came in well-above trend rates, though analysts still see a cooling of momentum ahead).

DOT PLOT:

The September dot plot did not pencil in an October rate cut, seeing the end 2019 dot at 1.9% (target range 1.75-2.00%); given the Fed cut in October, the midpoint is now 1.625% (1.50-1.75%), meaning a mark-to-market lowering of the 2019 dot will be seen. The projections for the rest of the forecast horizon will be more useful; the September dot plot envisaged rates would be unchanged in 2020 (1.9%, target range 1.75-2.00%), with one 25bps hike in both 2021 (2.1%, target range 2.00-2.25%) and 2022 (2.4%, 2.25-2.50%), with the long-run projection at 2.50%. Despite the market looking for the 2020+ dots to be lowered, UBS thinks there is a risk of a hawkish outcome; the bank sees five to seven dots showing one to three hikes in 2020, illustrating the hawkish skew within the Committee that was evident this year. In 2021, UBS thinks Powell will want to keep rates constant, and will have most of the Governors and Williams with him; but still thinks that those dots will fall short of the median, implying a view of a rate hike in 2021, and the bank also thinks the dots will imply another rate hike in 2022.

While Powell did say a significant and persistent rise in inflation will be needed to raise rates, UBS argues that it appears not all participants agree; accordingly, Powell will likely roll-out the familiar argument that the dots reflect each individual participant’s view, and either way, he will likely pursue the line that the Committee sees itself as remaining extremely accommodative until inflation rises. UBS will also be taking a signal from the inflation projections; the bank thinks that by 2022, the FOMC will believe that an ever-tightening labor market (read the Phillips curve) will not only have kept inflation persistently at target, but will begin to push it above target, and the SEP may reflect this view by showing a 0.1ppts overshoot of the inflation target in 2022.

REPO OPERATIONS:

Fed Vice Chair of Supervision Quarles recently said the central bank had identified some areas where existing supervision of the regulatory framework may have contributed to repo market stress seen in September, which Powell may be quizzed on, particularly in light of any front-end funding pressure into the year end.

The Fed is expected to eventually establish a Standing Repo Facility (SRF) to help alleviate funding stresses, which can occur around tax payment seasons, and quarter/year-ends. Oxford Economics explains that the facility would enable banks to swap Treasury holdings for cash, allowing these banks to reduce cash reserve holdings, and instead hold Treasuries in the knowledge that Treasuries can be swapped for cash at any time to meet liquidity/capital requirements. The SRF would be in addition to the continuation of Treasury bill purchases and ongoing Fed repo operations. The Fed in October started buying T-bills at a pace of USD 60bln per month, which has seen bank reserves rise to levels last seen in June; Oxford Economics argues that, given that the level of reserves is close to what the Fed judges as sufficiently necessary to meet demand, the Fed might decide to scale back the size of monthly bills purchases in Q1 (perhaps to USD 30bln) and in Q2 (perhaps reducing it to USD 20bln).

Tyler Durden

Wed, 12/11/2019 – 10:14

via ZeroHedge News https://ift.tt/2EjXPSJ Tyler Durden