Repocalypse 2.0 On Deck? “Turn” Repo Rates Are Blowing Out

Earlier today, repo market icon Zoltan Pozsar scared the living daylights out of cross-asset traders everywhere with what could be called a doomsday prediction in which the former NY Fed and Treasury staffer warned that as a result of collapsing systemic liquidity and a drought of “excess reserves”, the coming days could see a lock up in the FX swap market (in the process sending the US Dollar soaring), which would then translate to a violent deleveraging of massively levered hedge funds, and a liquidation first in the bond then stock market.

Yet while Pozsar had seemingly no concerns staking his hard-earned reputation on the outcome of a potentially catastrophic event that would subsequently be used by the Fed as a catalyst for QE4, he was far less confident about “when” it would occur:

it’s hard to have a definitive answer: it depends. It depends on how equities do, which depends on the trade deal and other random tweets. It depends on how auctions go, which depends on the equity market and the curve slope relative to actual funding costs.

Still, now that the genie is out of the bottle, everyone will become a cross-asset expert, trying to isolate even the smallest notable deviation from the norm as the horseman of the coming market apocalypse, and focusing first and foremost on the most direct indication that something is (again) broken in the repo market: the overnight general collateral repo rate.

However, what concerned market watchers will find when they pull up the recent O/N G/C repo rates is… nothing. Indeed, after the turbulent repo moves in mid/late September, and one outlier event in mid-October, the past two months have seen O/N repo barely move.

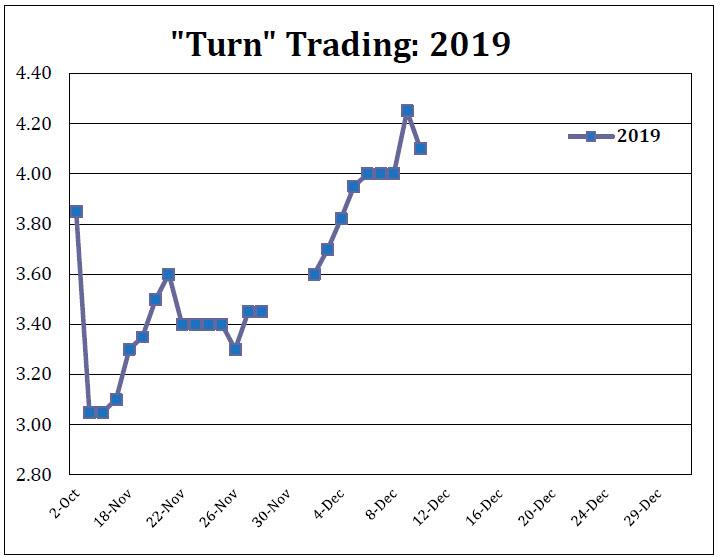

A very different picture however emerges when looking at forward, or “turn” repo rates, those that capture the year-end interview of Dec 31-Jan 2 (hence “turn”), where the past month has seen a sharp, consistent increase in repo rates, which peaked in the past two days around 4.10%-4.20%.

While one can argue that the rising repo pressure on the “turn” was due the traders starting to frontrun the dismal events laid out by Pozsar, there is a more conventional explanation for the upward pressure on the Turn, which as another repo expert, Curvature’s Scott Skyrm writes today, is “due to an abundance of collateral sellers, without any significant new cash entering the market – through end user cash investors or through the Federal Reserve.” Or, as he summarizes, “Basically, more sellers than buyers” of collateral.

That said, following today’s modest drop in the “turn”, we may have found ourselves in a very brief holding pattern, as the market is waiting for the specifics in the next round of Fed RP Operations to be announced on Thursday.

And this is where things get interesting: if Pozsar is right, nothing the Fed announces on Thursday short of QE4, will help relieve the pressure on the “turn” into year end, which the Credit Suisse strategist sees rising ever higher, until it forces dealers to freeze either the FX swap market, or the repo market, or – devastatingly – both. Everything else would, or perhaps should, be ignored by the market as the reserve hold in the financial system is massive and growing by the day as the Fed’s T-Bill QE failed to plug the liquidity drain.

Skyrm, on the other hand, has a more sanguine view, and expects the Fed to announce a $50 billion (at least) term operation for Monday December 23 (double the current term ops) and a $50 billion (at least) term operation for Monday, December 30. Of course, even Skyrm hedges, noting that “if the Fed announces operations of $25 billion or less on those days then Turn rates will immediately spike higher. However, in the past the Fed has always provided enough liquidity to the market and I still have faith.”

The Curvature analyst may have faith, but if Zoltan Pozsar is right – and he traditionally has been – in his apocalyptic forecast, the Fed has not been providing enough liquidity since mid-September, and certainly not in the correct format, and it will fail to do so in the coming days, forcing the “worst case scenario” Pozsar described, one in which the “year-end in the FX swap market is shaping up to be the worst in recent memory, and the markets are not pricing any of this.” It is only once markets “start pricing this”, especially after the liquidity-draining Dec 16 tax deadline, that the Fed will have no choice but to respond to the violent market repricing lower, finally launching the QE4 that mega dealers such as JPM have been begging for all along.

So who will be right: Pozsar, and his fatalistic forecast for a market crash in the coming days (that triggers QE4), or Skyrm’s cautious optimism? The answer will be revealed by the “turn” repo rate: if it resumes rising, and hits 5%, 6%, 7% or more, then all bets are off.

Tyler Durden

Tue, 12/10/2019 – 20:44

via ZeroHedge News https://ift.tt/3457aYJ Tyler Durden