Bianco: Mom-And-Pop Aren’t The Ones Getting Suckered By FOMO

Authored by Jim Bianco via Bloomberg.com,

The current bull market is historic. According to Goldman Sachs Group Inc., it’s been 10.7 years since the last 20% correction, the longest such run in more than 120 years. In 2019 alone, the S&P 500 Index has surged more than 25%, with recent gains being attributed in part to investors chasing performance as trade optimism lifted the market. Many on Wall Street use the acronyms FOMO (fear of missing out) and TINA (there is no alternative) to explain it.

But if there are buyers who feel compelled to pile in to stocks at this time, they don’t include retail investors. In fact, when it comes to this group — and it’s a big one — the opposite is happening. According to Refinitiv Lipper, individual investors are slated to withdraw more than $135 billion from equity mutual funds and exchange-traded funds this year, the most since they started keeping records in 1992. Meanwhile, bond mutual funds and ETFs should see record inflows of over $250 billion this year. Why aren’t these investors chasing good performance?

What we’re witnessing is a transformational shift that has been unfolding for years, one that’s also changing the very job description of the equity portfolio manager. With a good portion of American investors now aging and focused more on capital preservation than appreciation, investment flows are no longer motivated by performance, and the money trail shows it. Driving all this is the single most important influence in investing today, the modern wealth manager.

According to Investment Adviser Association, the U.S. has 13,000 registered investment advisory firms, employing more than 436,000 wealth managers and directing more than 43 million accounts with a combined net worth of nearly $84 trillion. In other words, most of the wealth in the U.S. is now being directed, or at least influenced, by a wealth manager.

The yearly survey conducted by TD Ameritrade Institutional stated that 88% of wealth managers use ETFs, the most popular investment vehicle in their arsenal. It’s estimated that two-thirds or more of all ETFs are held in accounts directed by wealth managers. It is not an understatement to say the ETF is the tool that created the wealth management industry. Prior to its creation, a wealth manager (stockbroker in days gone by) needed a large bank to back them. The ETF freed the wealth manager from this infrastructure, allowing them efficiently create client portfolios on their own. Today, half of the 13,000 wealth manager firms are one or two employees.

Now, who are the 43 million clients of wealth managers? Demographics tell us they are older, as they have the bulk of the money. They have witnessed two 50% corrections in the stock market over the last 20 years, 2001 and 2008. These events colored their outlook, so they worry more about capital preservation over appreciation. This is where the wealth manager comes in, and the overwhelming solution is a variation of the 60/40 portfolio — that is, one weighted 60% in equities and 40% in bonds.

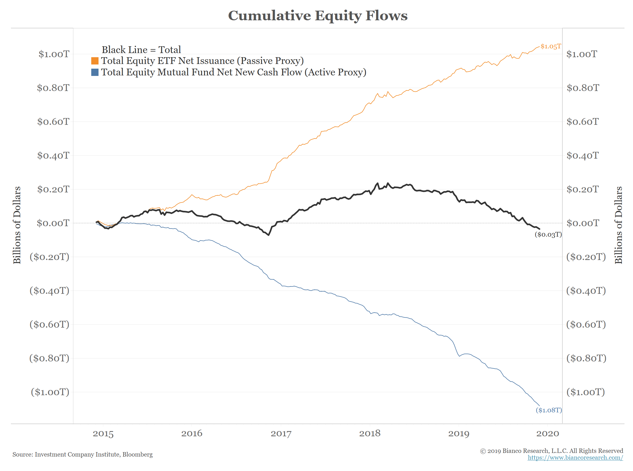

This desire for safety is changing the face of active money management. The chart below shows the cumulative cash flows for open-ended mutual funds (the proxy for actively managed funds, in blue), ETFs (the proxy for passively managed funds, in orange) and the combination of the two (black):

Investors are running away from active managers and toward passive investment choices, as seen in the surge in ETFs. But it is more than substituting into lower cost-equity vehicles. As the black line shows, they aren’t adding to their overall equity investment holdings at all. The last five years combined has seen virtually no new money flow into the stock market. Which is to say, FOMO and TINA aren’t the way investment money moves and haven’t been for years.

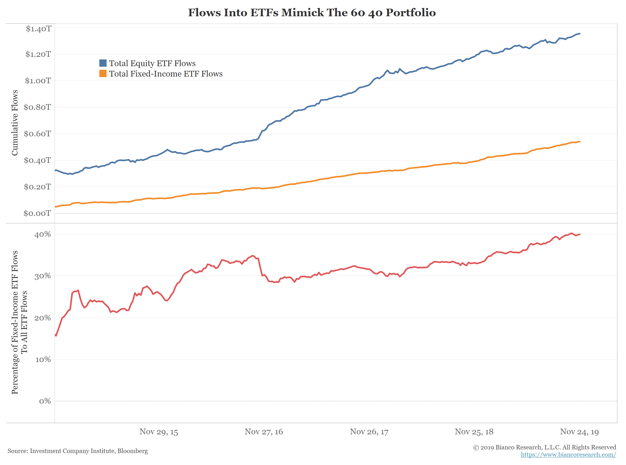

Where is the money going, then? The next chart breaks down the cumulative inflows into all long-term ETFs detailed by stock (blue) and fixed income (orange). The bottom panel (red) shows the percentage of money flowing into fixed-income ETFs.

Over the last five years, 40% of the flows into ETFs went into bond ETFs, almost perfectly tracking the 60/40 portfolio structure recommended by most wealth managers. My colleague Ben Breitholtz at Arbor Data Science detailed these flows further here.

This simple but powerful trend is changing the landscape of investing like no other post-crisis trend. The public is getting what it wants, and it wants wealth managers holding their hand and positioning them for capital preservation via a 60/40 portfolio. They aren’t performance chasers looking for the next star manager to make them rich. Fund-management companies also understand they aren’t getting paid via inflows for stock picking, so they have re-oriented toward marketing objectives to reflect this reality.

For strategists who haven’t grasped this concept and continue to look for the public to chase the hot hand, here’s a tip: That era is over.

Tyler Durden

Fri, 12/13/2019 – 15:55

via ZeroHedge News https://ift.tt/2LQMbCX Tyler Durden