Deal On, Risk Off

The great deal ever… is done-ish. And the market’s reaction was…

Stocks gave back some of their gains from yesterday, selling on the news today…

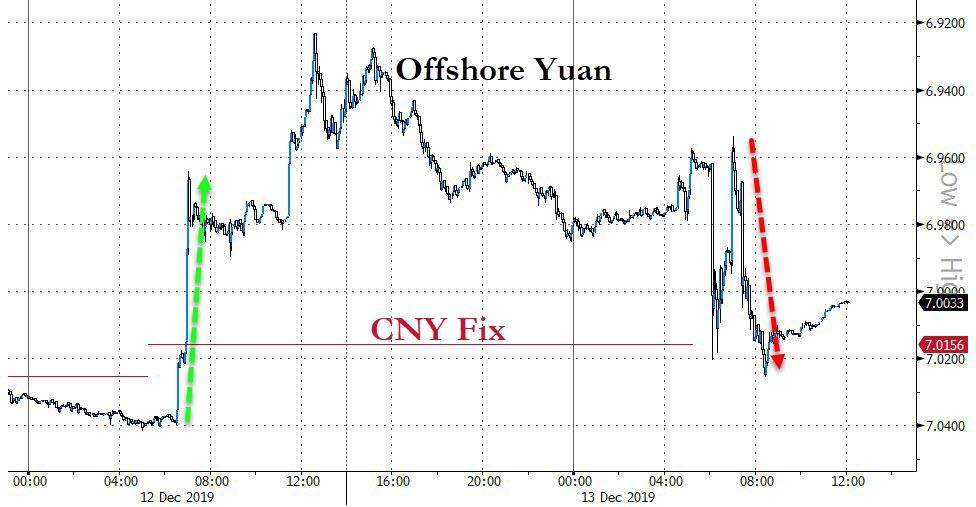

But yuan collapsed, erasing all the gains…

Source: Bloomberg

And Treasury yields plunged, erasing all the losses from yesterday…

Source: Bloomberg

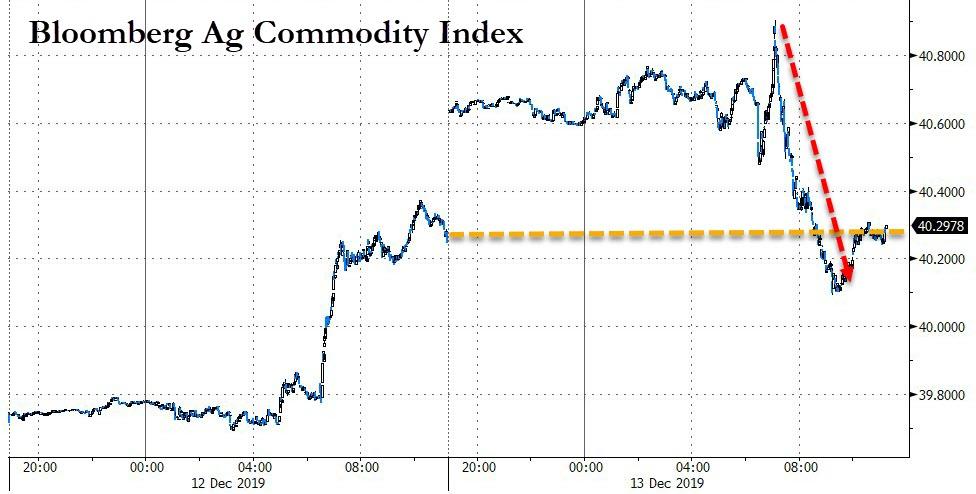

And despite the headlines of massive Ag purchases, Ag prices sold on the news too…

Source: Bloomberg

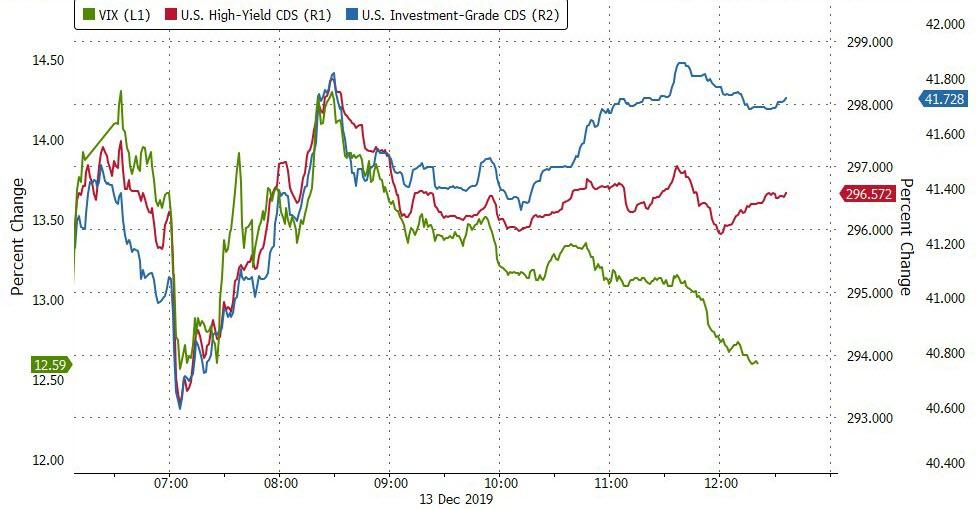

VIX was total chaos… spiking early above 14 and then getting monkeyhammered back to a 12 handle in the last hour…

Source: Bloomberg

So what did all this “phase one” trade-deal complete malarkey achieve? Stocks are up 8%; bonds, the dollar, and gold are down 2%…

Source: Bloomberg

On the week, Nasdaq outperformed and Small Caps lagged, barely holding gains…

S&P was glued back to VWAP for much of the afternoon after selling off on the ‘news’ of the deal…

Credit notably decoupled from equity protection today…

Source: Bloomberg

Treasury yields tumbled today, ending the week 1-2bps lower…

Source: Bloomberg

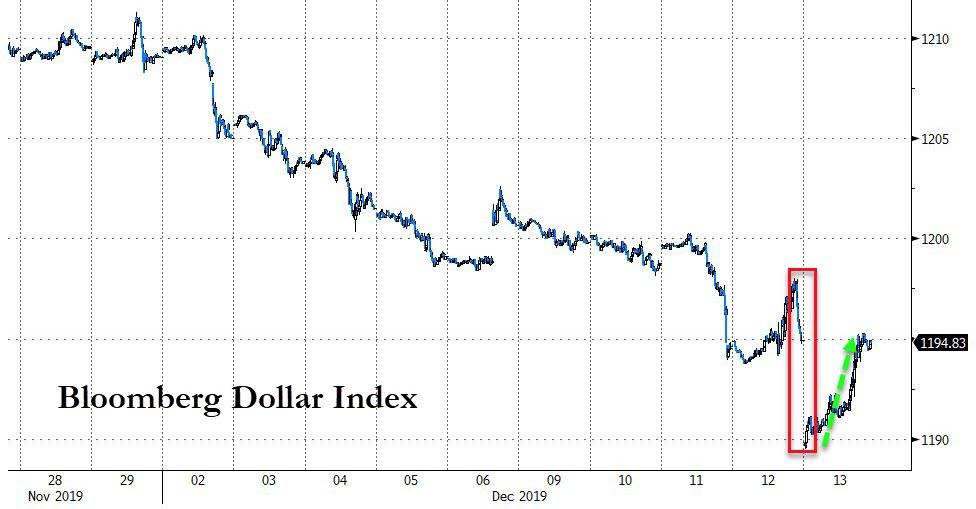

The Dollar fell for the 2nd week in a row, testing down to 5-month lows before a huge rebound back to unchanged today…

Source: Bloomberg

Cable rallied for the 3rd week in a row to its highest since May 2018… spiking overnight but fading back during the day

Source: Bloomberg

Cryptos bounced back a little late in the week but only Bitcoin Cash ended barely green…

Source: Bloomberg

Commodities are broadly higher on the week, buoyed by the trade deal and a weaker dollar…

Source: Bloomberg

Copper, oddly, tumbled on the day as the deal was completed… after breaking out during the early part of the week…

Gold ended the week at pre-payrolls levels…

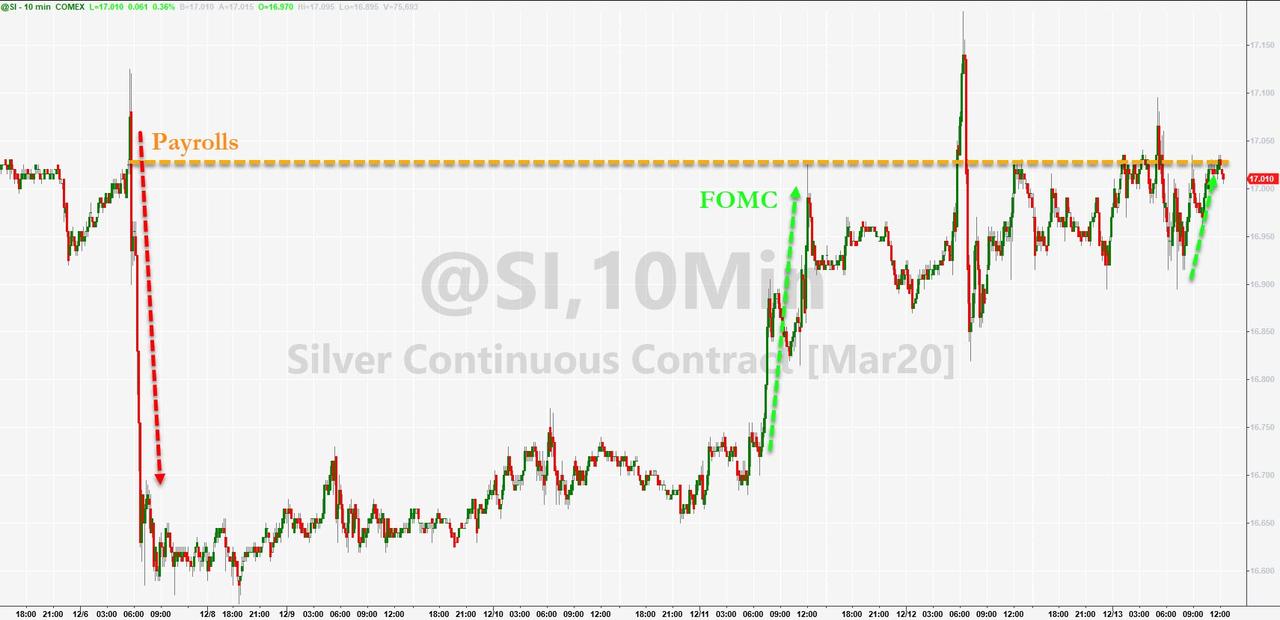

So did Silver…

Finally, you are here…

And US economic data is at its most disappointing in over 3 months…

Source: Bloomberg

Trade accordingly!

Tyler Durden

Fri, 12/13/2019 – 16:00

via ZeroHedge News https://ift.tt/2LRXH0B Tyler Durden