Meet The Banker Who Had To Tell Aramco That A $2 Trillion IPO Valuation Wasn’t Happening

As Aramco’s valuation jumped notably after its IPO – briefly topping the magical $2 trillion valuation level, one banker could be breathing a sigh of relief.

Achintya Mangla, one of JPMorgan Chase & Co.’s most senior bankers, told Aramco Chairman Yasir Al-Rumayyan prior to its IPO that there was “no way” investors were going to value Aramco at $2 trillion. In response, Al-Rumayyan “erupted” with expletives in both English and Arabic, according to Bloomberg. After all, Al-Rumayyan now likely had to tell his boss, the crown prince, the bad news.

The prince had long insisted on the $2 trillion valuation for Aramco, who pumps 10% of the world’s oil. Nobody had been able to convince the price along the way that global investors wouldn’t agree. Those who argued with him were pushed aside, like Khalid Al-Falih, who was fired as Aramco chairman and oil minister earlier this year.

When bankers pitched underwriting the IPO for Aramco this year, they told Al-Rumayyan that $2 trillion “wasn’t out of the question”. An initial valuation of $1.7 trillion to $2.4 trillion was tossed around.

But the valuation was becoming unsustainable as the IPO drew closer. Everywhere bankers pitched the IPO in September and October, they were told that the valuation was too high. One manager in Switzerland had a valuation as low as just $800 billion.

Bankers took notes on the feedback: the consensus valuation was about $1.2 trillion. Some investors said they could go slightly higher. “Up to $1.5 trillion based on dividend,” was the feedback from Franklin Templeton, for instance.

But the problem for many investors was the dividend yield. At $2 trillion, the yield would fall to less than 4%, which is well below what other oil and energy names are paying currently. Wellington Asset Management said the yield needed to rise to 7% or 8% to make the company a worthwhile investment. This implied a valuation of $900 billion.

Mangla’s job in October was to break the bad news to the client, speaking on behalf of all of the banks on the deal. And he wasn’t the only one who tried to break the bad news. Jonathan Penkin, a senior equity capital markets banker at Goldman Sachs was told not to speak at any more meetings after he tried to talk about the valuation later in October. Motassim Al-Ma’Ashouq, the top Aramco executive in charge of the IPO preparations was also told to stand down.

Karen Young, a Middle East specialist at the American Enterprise Institute in Washington and a specialist in the political economy of the Middle East said: “Saudi Arabia has always had this problem: top-down decision making. There’s a culture of fear. Savvy and able technocrats don’t feel comfortable speaking up.”

Saudi Arabia also “drew a blank” with strategic investors, who often agree to buy into an IPO earlier than others. Everywhere Aramco’s banks pitched – China, Singapore, Russia – they were told “thanks, but no thanks.”

Al-Rumayyan felt betrayed by the banks who once told him $2 trillion was possible and Aramco had a choice to face: delay the IPO and wait for a higher valuation, or cut the valuation and make the deal enticing to foreign investors.

Riyadh had another solution: sell the Aramco shares at home and ignore foreign investors. The government had the idea of pressuring wealthy local families and bringing in friends from places like UAW and Kuwait to help with the deal. Even after these reinforcement, Aramco had to settle for a $1.7 trillion valuation.

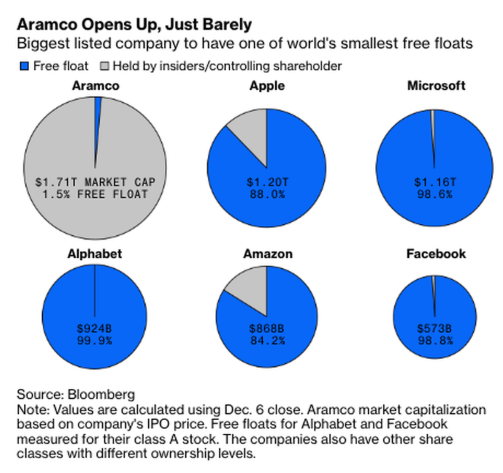

The IPO is a “shadow” of Aramco’s previous aspirations, but has still allowed the crown prince to claim victory. Last Thursday the company announced it had raised $25.6 billion, beating the $25 billion set by Alibaba and Aramco now has the highest valuation of any company in the world. Banks, on the other hand, face the prospect of not getting paid for nearly four years of work on the IPO. Many people were surprised the IPO happened at all.

On the first day of Aramco trading, its valuation went limit up 10%, giving it a market value of $1.88 trillion.

“Those who have not subscribed in Aramco will be chewing their thumb to the point that I will be worried about them that they go and fix themselves in the hospital,” oil minister Prince Abdulaziz concluded.

And during the second day of trading, the magical $2 trillion level was crossed (but not maintained)…

Source: Bloomberg

Shares jumped almost 10% in the first 90 minutes of trading Thursday, breaching the 37.51 SAR, the level which values Aramco over $2 trillion.

But prices faded in the back half of the session and closed at 36.75 SAR, or below MbS’ target.

Tyler Durden

Thu, 12/12/2019 – 21:05

via ZeroHedge News https://ift.tt/2qLtlWj Tyler Durden