Santa Claus Has Come To Town: Stocks Soar To All Time Highs On Trade And Tories

While China steadfastly refuses to confirm that the “Phase One” trade deal, announced with much pomp and circumstance, by Donald Trump on Thursday, has been agreed upon, algos don’t care and between “news” the trade war is over – similar to how the trade war was “over” in December 2018, May 2019, and October 2019 – and the Tories blowout victory in the UK, have unleashed a sea of green in global capital markets, sending stocks across the world to new all time highs as two of the darkest clouds on the global investment horizon has now been cleared.

The double dose of delight sent safe-haven sovereign bonds and the Japanese yen lower as markets scaled back expectations of more interest rates cuts around the world.

“Global investors have been given two of the biggest gifts on their Christmas list and should be appreciative for a while at least,” said Westpac FX analyst Sean Callow. “Global equity indices such as MSCI World should set more record highs and sterling could push above $1.36.”

For those who missed the the past 24 hour rumorgasm, here is a brief rundown:

- China and the US have reportedly struck an agreement on some tariff reductions and a delay to the tariffs that were due to come into effect on December 15th according to sources which added that China has agreed to purchases $50BN in agricultural goods in 2020, while other source reports also stated the US will announce the trade deal today.

- Fox Business’ Lawrence tweeted that a source stated the December 15th tariffs will not go forward and there will be a small reduction in tariffs on some Chinese goods as a gesture of good will, while Phase Two of the negotiations will begin after 2020 elections. Furthermore, the source said a signing ceremony will not happen with President Xi and there will be a rollout of the agreement by the White House Friday, while the Chinese have requested that the language of the never be made public.

- However, China leaders are yet to accept the deal (referring to the ‘big deal’ US President Trump tweeted about) due to a number of issues: USD 50bln purchases is a hard target, other trade partners complaining at a reallocation who could challenge the WTO., CNBC’s Yoon citing sources.

- Though Beijing sees the benefit of an imminent deal, it still wants to ensure that China does’t appear to have been pressured into making concessions, according to WSJ.

- Meanwhile, China’s Foreign Ministry reiterates that China is committed to resolving issues but the deal needs to be mutually beneficial, without commenting on the deal.

So in short, no there is no deal – yet – but there may be, hence more optimism.

Meanwhile, the British pound reached its highest since mid-2018 as UK election results showed a blowout victory for Boris Johnson and the Tories, and wiped out any chance of a victory by the left-wing Labour opposition or a hung parliament, which had been a worry for investors.

Prime Minster Boris Johnson won a landslide majority in Britain’s Parliament, giving him the power to deliver Brexit, though trade talks with the European Union were set to drag on for months yet and a hard Brexit may still take place at the end of 2020. The pound had started to see some profit-taking but was still up almost 2% at $1.3390. It reached its highest levels against the euro since mid-2016. UK shares exposed to the domestic economy surged as soon as they opened.

“Over the next 1-2 months I think it is about long-term buyers of sterling returning to the market that might have been on the sidelines up until this point,” said NatWest Markets head of G10 FX strategy Paul Robson. Sovereign wealth funds could now start buying UK equities again and foreign direct investment could pick back up, he said.

Trade optimism had already lifted Wall Street to record highs, and markets bought not only the rumor but also the news (which has yet to be confirmed by China): U.S. equity futures all pointed to a fresh all time high on Wall Street, while stocks marched upward from Beijing to Paris. E-Mini futures for the S&P 500 rose 0.4% to another peak. On Thursday, the Dow closed up 0.79%, the S&P 500 gained 0.86% and the Nasdaq rose 0.73%.

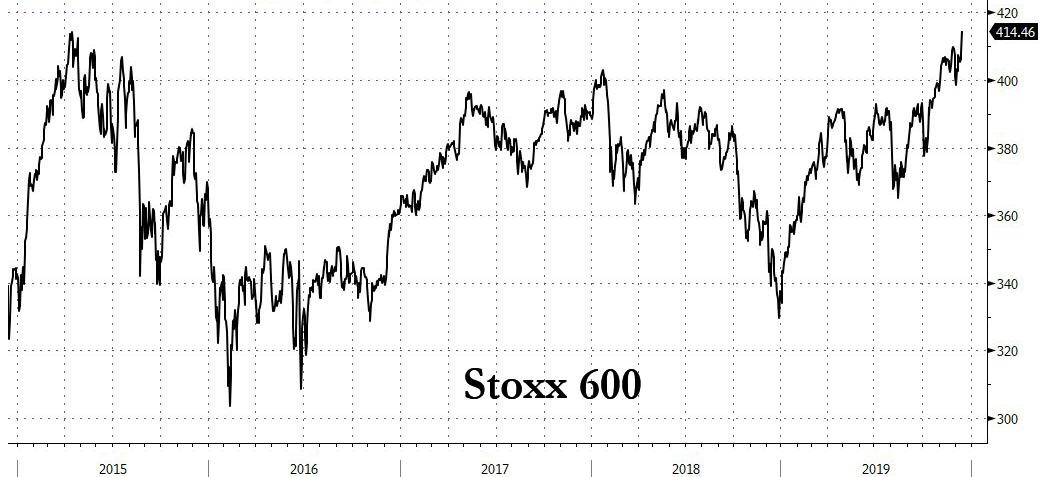

Europe’s Stoxx Europe 600 Index vaulted above its record-high close, rising 1.5% higher on the twin boosts, while in Britain the FTSE 250 index soared as much as 5.4%, the most in nine years. Shares in all major Asia markets climbed.

“If the U.S. cuts the current tariffs to some extent as reported, that is not something markets have priced in, so we could see a further leg up,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities in Tokyo.

Earlier in the session, MSCI’s broadest index of Asia-Pacific shares outside Japan jumped 1.5% to its highest since late April, as Asian stocks advanced, heading for their biggest gain since June. Nearly all markets in the region rose, with Hong Kong leading gains and Vietnam retreating. Technology and finance were among the strongest sectors. The Topix climbed to a 14-month high, buoyed by Toyota Motor and Keyence. Japan’s finance ministry plans to issue about 4.4 trillion yen ($40 billion) in bonds to finance an extra budget to support economic growth. The Shanghai Composite Index posted its biggest gain since August, with Kweichow Moutai and China Life Insurance offering strong support. China signaled more effective fiscal policy to stabilize a slowing economy. India’s Sensex advanced for a third day, driven by financial firms. The country’s inflation galloped to its highest level in more than three years

That was bad news for bonds, and yields on U.S. 10-year Treasuries shot up to 1.91%, a rise of 12 basis points in just two sessions. Germany’s 10-year government bond yield touched a six-month high at -0.217%. Ten-year gilts underperformed but halved their opening losses as the curve bear flattens. Interest rate futures slipped as investors priced in less chance of a rate cut by the Federal Reserve next year – a move seen across most developed nations including the UK. Peripheral bonds tighten with Italy outperforming, the 10y spread ~5bps tighter on the session

Other safe harbors also took a beating, with the yen sliding across the board. The dollar gained to 109.60 yen having risen 0.7% overnight. The dollar fared less well elsewhere, slipping 0.5% to 96.792 against a basket of currencies, as the pound and the euro both benefited from the UK election result. The dollar also fell to an 18-week low against the yuan, since any trade truce would be seen as a boon for the export-heavy Chinese economy. It was at 6.9762 yuan having shed 1.2% overnight.

However, the yuan eased in offshore trading, after punching through 7 per dollar with the biggest advance in a year on Thursday, after it emerged that China has refused to endorse Trump’s trade deal.

The risk on surge also lifted commodities, with oil prices rallying on hopes a trade deal would support global growth and Chinese demand. U.S. crude jumped above $60 a barrel for the first time since September.

“Risk appetite ran wild after Trump signaled that he made a deal with China and that will only be positive for global demand forecasts for crude,” said Edward Moya, senior market analyst at OANDA.

Spot gold was flat at $1,467.60 per ounce.

Market Snapshot

- S&P 500 futures up 0.4% to 3,180.75

- STOXX Europe 600 up 1.6% to 414.10

- MXAP up 1.6% to 168.98

- MXAPJ up 1.6% to 543.17

- Nikkei up 2.6% to 24,023.10

- Topix up 1.6% to 1,739.98

- Hang Seng Index up 2.6% to 27,687.76

- Shanghai Composite up 1.8% to 2,967.68

- Sensex up 1.1% to 41,037.61

- Australia S&P/ASX 200 up 0.5% to 6,739.68

- Kospi up 1.5% to 2,170.25

- German 10Y yield rose 2.5 bps to -0.244%

- Euro up 0.4% to $1.1175

- Brent Futures up 1.1% to $64.90/bbl

- Italian 10Y yield rose 2.8 bps to 0.886%

- Spanish 10Y yield fell 0.5 bps to 0.445%

- Brent Futures up 1.1% to $64.90/bbl

- Gold spot up 0.1% to $1,471.57

- U.S. Dollar Index down 0.6% to 96.86

Top Overnight News

- The size of his parliamentary majority gives Boris Johnson a free rein to take Britain out of the European Union in January after almost four years of gridlock. The decisive win means he can also define Britain’s future relationship with the EU

- The Scottish National Party took back most of the districts it lost two years ago, galvanizing the party in its pursuit of the independence referendum leader Nicola Sturgeon says is necessary after her country opposed leaving the European Union

- If Christine Lagarde carries on as she started, she may turn out a lot less trigger-happy than her predecessor as European Central Bank president

- European Central Bank Governing Councilmember Francois Villeroy de Galhau says focusing quantitative easing on green assets wouldn’t be a sufficient response to the challenges of climate change

- Britons are expecting a slightly slower inflation than a few months ago and fewer expect interest rates to rise over the coming year, a Bank of England survey published Friday showed

- Boris Johnson’s decisive win in the U.K. election clears the way for his government to speedily name the next Bank of England governor, handing them part control of an economy that continues to limp along and which will soon face fresh Brexit risks

A broad heightened appetite for risk was seen overnight with the Asia-Pac majors bolstered and US equity futures extending on Wall St’s fresh record levels as markets reacted to reports that US and China have struck an agreement on some tariff reductions and a delay to the December 15th tariffs, while China is said to have agreed to purchases of USD 50bln in agricultural goods in 2020. In addition, focus was dominated by the UK election results in which PM Johnson’s Conservatives are on course for an overwhelming 86-seat majority according to exit polls. ASX 200 (+0.5%) and Nikkei 225 (+2.6%) were lifted with financials after banking regulator APRA advised ADIs it will delay finalizing consultation on implementation of product responsibility requirements until H1 next year but with hefty losses in gold miners restricting gains for the index, while the Japanese benchmark broke through the 24k milestone to print its highest since October 2018 with a somewhat disappointing Tankan survey doing little to contain the rally. Hang Seng (+2.6%) and Shanghai Comp. (+1.8%) were also buoyed on the flurry of positive trade rhetoric as aside from the source reports of an agreement being reached in principle, there had also been optimistic comments from US President Trump regarding a trade deal and WSJ initially noted US negotiators offered to cut existing tariff rates by up to 50% although no official announcement has been made yet from either side. Finally, 10yr JGBs retraced some of the prior day’s losses which had been the by-product of the dramatically improved trade climate, with the rebound also helped by the BoJ’s presence in the market for over JPY 1.1tln of JGBs concentrated in 1yr-10yr maturities.

Top Asian News

- Thai Political Risk Climbs as Opposition Party Plans Protest

- After 50% Returns, 2020 May Be Even Better for Indian IPOs

- Abe’s India Visit Postponed as Violent Protests Intensify

- Cash Woes at India Shadow Lenders Risk More Bad Debt at Banks

European bourses are boosted in early trade [Eurostoxx 50 +1.40%] with upside seen across the board on the back of positive US-China trade developments, coupled with tailwinds from the landslide victory by the market-friendly Conservatives in the UK General Election. UK’s FTSE 100 (1.8%) initially lagged its peers amid FX dynamics as Sterling soared in light of last night’s election exit polls. The index then recovered and now outperforms the European equity sphere as Sterling gives up some gains and large-cap election/Brexit sensitive domestic stocks receive impetus. Banking names such as RBS (+11.1%), Barclays (+9.0%), Lloyds (+8.0%) and homebuilders including Taylor Whimpey (+13.3%), Persimmon (+11.6%) and Barratt Developments (+10.5%) all jumped to the top of the index amid more certainty surrounding Brexit under a Tory government. Meanwhile, UK utility companies (SSE +9.5%, Centrica +8.5%) join the top ranks amid dwindled prospects of privatisation under the Conservatives, whilst BT (+8.0%) similarly benefits as Labour previously noted it wanted to nationalise the Co. Sectors are all in the green with some underperformance seen across defensives, whilst substantial outperformance is experienced in financials, utilities and consumer discretionary amid the aforementioned movers. Outside of the UK, other notable movers include Delivery Hero (+15.5%) whose shares spiked higher amid source reports that the Co. are reportedly approaching an agreement to purchase Woowa in a potential USD 4bln deal. Airbus (AIR FP) trades higher after Qantas airways selected the Co. as its preferred supplier over Boeing. PSA (+3.1%) shares are supported amid speculation that it may sign its merger with Fiat Chrysler (+2.0%). Elsewhere, SAP (+1.8%) shares are buoyed by the overall risk sentiment and sub-par guidance from rival Oracle (-1.9% pre-market). On the flip side, Henkel (-3.3%) receives a double whammy from a guidance cut and a broker downgrade.

Top European News

- Johnson Wins Crushing Majority in Election That Upends Britain

- Delivery Hero Buys Biggest Korean Takeout App in $4 Billion Deal

- U.K.’s Jeremy Corbyn to Step Down as Labour Party Leader

- Finnair CEO Sees Cash Flow Funding $4.5 Billion Fleet Plan

In FX, sterling has come off the boil, but still bubbling on the back of Thursday’s UK GE that culminated in a clear win for the Conservative Party and hands PM Johnson a convincing majority to get Brexit done, in his very own words. The Pound rebounded after exit polls confounded pre-vote surveys suggesting a much closer contest between the Tories and main protagonist Labour, with Cable peaking just above 1.3500 and Eur/Gbp breaching 0.8300 at one stage. However, some of the euphoria and relief has subsequently waned and the former probed sub-1.3400 territory before returning to the big figure where the heftier of 2 large option expiries reside (1.4 bn compared to 1 bn at 1.3450).

- EUR/NZD/CHF/CAD/AUD – All firmer against the Greenback that has lost more ground almost across the board, initially on dovish FOMC vibes then US-China Phase 1 and tariff impulses before Sterling’s election exertions pushed the DXY over the edge (through 97.000 and now meandering between 96.922-712). The single currency has recouped all and more of its post-ECB presser losses and hurdled key chart resistance in the form of the 200 DMA (1.1154), but stopped just short of 1.1200 in contrast to the Kiwi that has now cleared 0.6600 and recouped some declines relative to the Aussie. Indeed, Aud/Nzd has pulled back towards 1.0450 as Aud/Usd pivots 0.6925 and could be hampered by large option expiries rolling off between 0.6885-0.6900 (1.6 bn). Elsewhere, the Franc has bounced within 0.9808-62 parameters and Loonie likewise in a 1.3151-86 band, with the latter also benefiting from positive USMCA developments.

- JPY – The lone G10 loser on further safe-haven unwinding rather than a bleak Japanese Tankan it seems, as Usd/Jpy leaps from just below 109.00 and above 109.50.

- EM – The Yuan has given up some gains vs the Dollar, but crucially or interestingly the Cnh is holding between 6.9850-9275 even though the PBoC fixed the Usd/Cny midpoint at 7.0000+. Similarly, the Lira remains firm and over 5.8000 despite Turkey’s Defence Ministry declaring that the order for a 2nd Russian S-400 missile system consignment could be struck soon. Elsewhere, the Rouble has largely taken the expected 25 bp CBR rate cut in stride and is still on track to extend its winning run beyond 62.5000.

In commodities, there is little to report thus far with WTI and Brent futures advances amid the broad risk appetite in the market which emanated from the positive US-China trade headlines and the fallout from the UK General Election. The benchmarks have surpassed 60/bbl and 65/bbl respectively, with the former dipping back below. Eyes will remain on the official announcement of the trade deal from the US side and any comments from the China side confirming whether the two sides struck a deal – sources however noted that China thinks a USD 50bln purchase of ag good is a “hard target”, according to CNBC’s Yoon. Elsewhere, gold prices remain relatively flat downside from safe-haven outflow is countered by a weaker Buck. The yellow metal hovers in a narrow

US Event Calendar

- 8:30am: Retail Sales Advance MoM, est. 0.5%, prior 0.3%

- Retail Sales Ex Auto MoM, est. 0.4%, prior 0.2%

- Retail Sales Ex Auto and Gas, est. 0.4%, prior 0.1%

- Retail Sales Control Group, est. 0.3%, prior 0.3%

- 8:30am: Import Price Index MoM, est. 0.2%, prior -0.5%; Import Price Index YoY, est. -1.2%, prior -3.0%

- 8:30am: Export Price Index MoM, est. 0.1%, prior -0.1%; Export Price Index YoY, prior -2.2%

- 10am: Business Inventories, est. 0.2%, prior 0.0%

DB’s Jim Reid concludes the overnight wrap

An early “Early Morning Reid” today as I’ve been up all night watching the UK election results unfold and will need to get a little bit of sleep soon. The Conservative Party looks set for a very strong majority with estimates at 3:30am, after 293 out of 650 seats declared, with a projected +65-75 seat majority – notably ahead of most sensible recent predictions but a bit below the exit poll +86 seat prediction. With the exit poll release, Sterling immediately rallied +2% and briefly edged up a bit more and above $1.35 soon after. As we go to print, it’s trading at $1.346 (+2.3% overnight). Remember it was at $1.2033 in early August. Well done to our readers who in the survey results we published yesterday (more below but link here ) said that of all the FX majors, Sterling was their favourite currency over the next 12 months. A good start with only 364 days to go. Interestingly readers also thought President Trump had an 80% chance of winning next year. Perhaps the severe rejection of the hard left in the UK might have implications for the Democratic nomination. Will they look at how hard it is to win an election in a like-minded country from the far left? One to ponder. Anyway, the clear election result combined with positive news on the chances of an imminent phase-one US/China trade deal has made it a very good 12-18 hours for risk.

More on trade below but what next for the UK? The Brexit Withdrawal Agreement will pass soon, possibly before year-end and the UK will leave the EU by the end of January. Then the fun and games with the future relationship will begin immediately after. The big question is whether Mr Johnson will stand by his commitment to have the transition end on December 31st next year and in reality only have a loose ‘harder’ relationship with the EU or whether he decides to pivot and go for a more ambitious, ‘softer’ relationship that will take time to negotiate and will require an extension to the transition agreement. Difficult to tell at the moment. The big majority allows him to freedom to choose either path. A separate longer-term issue that will bubble in the background is the expected very strong SNP performance in Scotland. The independence issue won’t go away even though the big Tory majority gives little scope for it to come to fruition.

Back to yesterday’s big trade news now, and markets rose after a tweet from President Trump that said “Getting VERY close to a BIG DEAL with China. They want it, and so do we!” Sentiment was further boosted by a Dow Jones story, which reported sources saying that that the US had offered to cut existing tariff rates by up to 50% on $360bn worth of Chinese imports, while also cancelling the new tariffs scheduled to come into effect from Sunday. Later in the US session Bloomberg reported that Mr Trump had signed off the phase-one deal presented to him by his advisors earlier that evening with just the legal text to finalise. If agreed, this would be more positive than recently hoped as it’s happening sooner and with more tariff cuts. Let’s see if we hear from China soon on this.

The Trump tweet initially saw the S&P 500 climb +1.09% in the first hour of trading before closing +0.86% and at a record closing high as did the NASDAQ (+0.73%) but the Dow Jones (+0.79%) didn’t quite hit record levels but settled just below. The Philadelphia semiconductor index did surge by +2.71% to record highs though. Interestingly the US financial index finally surpassed the 2007 all-time highs. 10yr Treasury yields also rose on the news, up +10bps at 1.8922%, with the 2s10s curve steepening by +5.8bps. In Asian trading 10yr yields are up another +2bps and the curve another +1bps steeper. Earlier in Europe, the STOXX 600 was up +0.33%, while yields followed the US higher too, with bund yields up +5.2bps, along with OATs (+4.7bps) and BTPs (+2.8bps). Safe havens suffered, however, with gold down a few tenths, having been +0.81% at its intraday high, while the Japanese Yen weakened around -0.6% against the US dollar.

In the rest of Asia, markets are strong with the Nikkei (+2.43%), Hang Seng (+1.72%) and Shanghai Comp (1.20%) all up alongside S&P 500 futures (+0.42%). The onshore Yuan has risen the most in a year on the trade news up around 1%.

A reminder we published the results of our second monthly investor survey (link here) yesterday. On the whole market participants were less pessimistic on the global economy than last month and a bit more neutral (there’s not yet a bias towards thinking things are improving) even though they were more worried about the trade war than their sanguine view last month. After last night’s news they may be more optimistic again now. Results generally showed a more positive view over 3 months than over the next 12 months for most risk assets. Finally the global financial community’s favourite ever Xmas song is Last Xmas by Wham followed by Fairytale of New York. Very good choices! See the link for much more.

The other main event outside the election and trade news yesterday came from Christine Lagarde’s first monetary policy decision as ECB President. The Governing Council left interest rates unchanged, in line with expectations, while the statement maintained its language from Draghi’s last meeting in saying that the ECB’s Governing Council “expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics”. As in October, the statement said that asset purchases would conclude “shortly” before interest rates were increased.

In terms of what the ECB expects for those inflation dynamics, their newly published forecasts showed HICP inflation at +1.2% in 2019, the same as in September, and at +1.1% in 2020, up a tenth. For 2021 and 2022, they then see inflation rising to +1.4% and +1.6%, respectively. Whether the market is buying this is another matter, but five-year forward five-year inflation swaps did rise +1.77bps to 1.272%, their highest level for nearly three months. For real GDP growth, this year was revised up a tenth to +1.2%, while next year was down a tenth to +1.1%, before +1.4% growth in 2021 and 2022.

The statement didn’t mention the upcoming Strategy Review, but after her statement Lagarde touched on the issue, saying it would be “comprehensive”, would start in January, and be completed before the end of next year. She also told markets not to “over-interpret” her comments, and said that “every president has his or her own style of communicating”. On the question of whether she was a hawk or a dove on monetary policy, she said “I’m neither a dove nor a hawk. My ambition is to be this owl that’s often associated with a little bit of wisdom.” The euro strengthened as Lagarde spoke, although the moves were reversed following the tweet from President Trump to end yesterday unchanged against the dollar. The Euro then rose again with GBP after the exit poll, and is trading up +0.43% in Asia.

Looking briefly at other central bank announcements yesterday, the SNB kept rates on hold at -0.75% with President Jordan defending the continued policy of negative interest rates. Elsewhere, the Central Bank of Turkey cut rates by 200bps to 12.0% (vs. 12.5% expected). In spite of the bigger-than-expected cut, the Turkish lira ended the session +0.51% against the US dollar.

Back to yesterday and weekly initial jobless claims in the US rose to 252k (vs. 214k expected), which is the highest reading since September 2017. The 4-week moving average moved up to 224k, the highest level since May. That said, the spike did reflect some volatility around the Thanksgiving holiday. Also in the US, the PPI reading came in at +1.1% yoy (vs. +1.3% expected). Meanwhile from Europe, the industrial production data for the Euro Area was in line with expectations, with a -0.5% contraction in October, while the previous month was revised down two-tenths to a -0.1% decline. The yoy reading was -2.2%, the 12th successive month in which the Euro Area has seen an annual fall in industrial production.

To the day ahead now, and in addition to the political ramifications of the UK election, highlights to watch out for include US retail sales figures for November and business inventories for October, while from Europe, we’ll get Italian industrial sales and orders for October as well. In terms of central banks, we’ll hear from the ECB’s Villeroy and Holzmann, along with New York Fed President Williams, and the Russian central bank will be making its latest policy decision.

Tyler Durden

Fri, 12/13/2019 – 07:35

via ZeroHedge News https://ift.tt/2PI38R6 Tyler Durden