Diamond Crisis Worsens As De Beers Signals Rough Times Ahead

De Beers, the world’s largest diamond miner, has seen plunging profit margins as the diamond crisis deepens in 2019 and set to worsen in 2020.

We’ve been documenting the global diamond crisis that has unfolded in the last several several years.

De Beers has spent the back half of the year slashing diamond prices as global markets remained oversupplied into the holiday season, mostly reflecting demand woes for top markets in the US, Europe, and China.

Macroeconomic headwinds have primarily been the reason for waning diamond demand as a global trade recession appears to be nearing.

De Beers will mine one million carats less than previously thought in both 2020 and 2021, Bloomberg said, citing a recent investor deck. That equates to about 1% of the global diamond output and outlines how the world’s largest miner is slowing its expansion as the industry is plagued with oversupply and lackluster demand woes.

De Beers wholesales diamonds in ten sales per year in Botswana’s capital, Gaborone, and the buyers normally cannot challenge price and quantity. Buyers have become increasingly frustrated with the cost of rough diamonds sold by the company as prices of cut ones have plummeted.

To address oversupplied conditions, De Beers has lowered prices of rough stones, which has cut into profits.

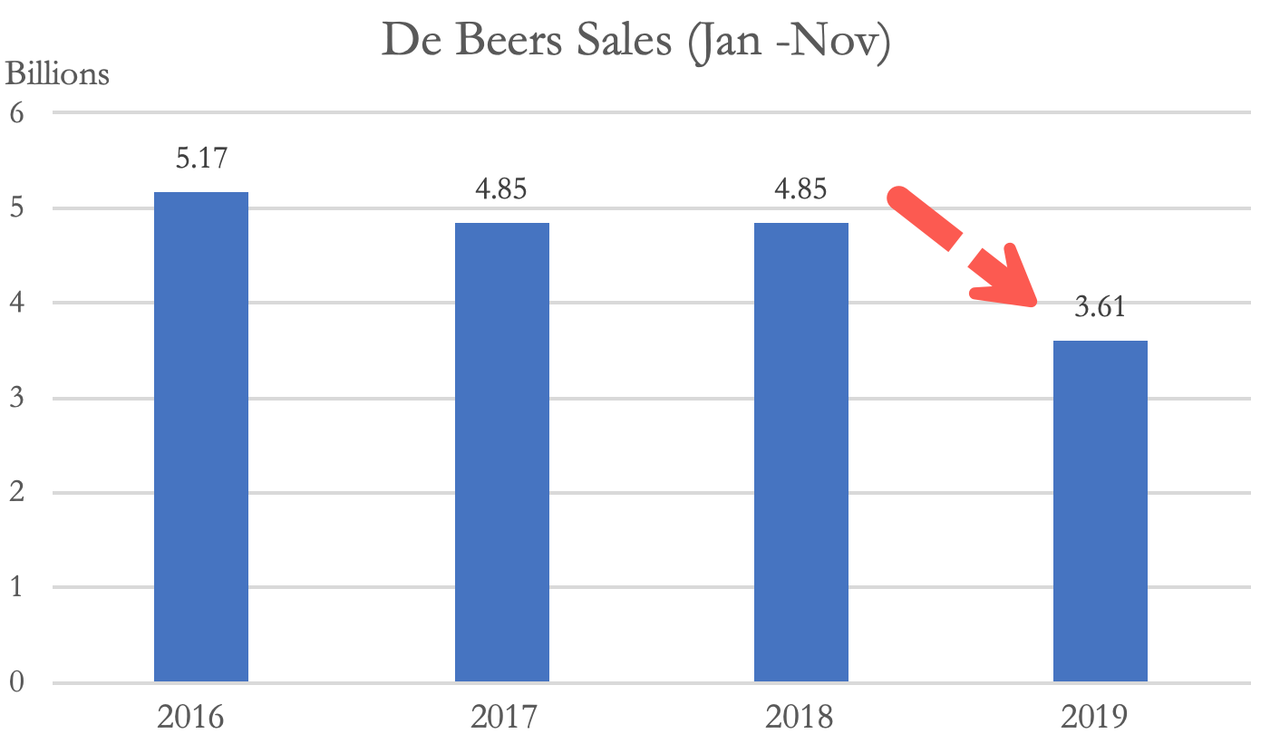

Diamond sales between Jan. to Nov. were $1.2 billion lower than the same period in 2018.

De Beers, which frequently sets the price of diamonds to its clients, slashed prices by 5% last month in hopes to stimulate demand.

Glancing at a composite of spot diamond prices, the IDEX Diamond Index shows how oversupplied conditions have weighed down prices in the last 12 months.

A 5-year chart of the IDEX Diamond Index shows spot prices have remained in a downturn trajectory.

Several months ago, a diamond analyst in New York City said markets remained oversupplied, resulting in weak global sales.

“The current malaise in the market is due to oversupply,” said Paul Zimnisky, an independent global diamond industry analyst, who said diamond buyers had too much inventory.

With no end in sight in the global synchronized slowdown, it seems unlikely the consumer can revive the global diamond industry in 2020.

Tyler Durden

Sat, 12/14/2019 – 09:55

via ZeroHedge News https://ift.tt/2LStU86 Tyler Durden