“No Hurry To Buy” – Manhattan Luxury Rents Surge As Buyers Wait For The Crash

New Yorkers are in no hurry to buy homes.

After years of torrid growth, the New York City real-estate market has screeched to a halt this year with the number of sales, particularly in the luxury space (ground-zero for the trend excluding a few major deals), falling to the lowest level in decades thanks to Bill de Blasio’s “Mansion Tax” and the capping of SALT deductions included in President Trump’s tax deal.

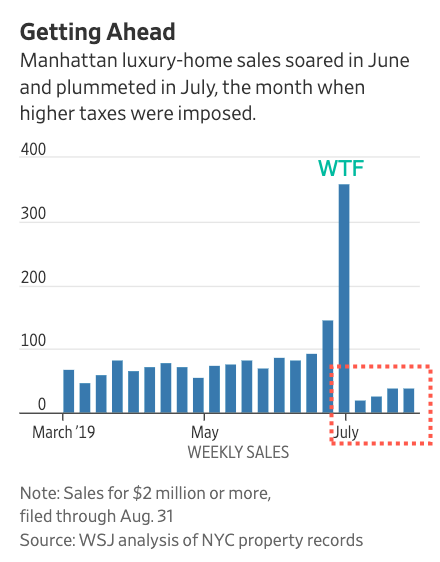

Sales of luxury apartments in Manhattan have plunged, excluding a surge in June as buyers tried to lock in deals before the new city-wide tax took effect on July 1.

With more wealthy New York families choosing to rent, landlords in Manhattan’s best neighborhoods have had a good year, capped off by a surge in rents last month. In the beginning of the year, there were fears that heavily inflated rents would start falling across the city as the rapidity of gentrification pushed rents beyond levels that many working New Yorkers were capable of paying. But a still-tight rental market and booming economy have conspired to send Manhattan rents up 8.7% YoY in November, according to data provided to Bloomberg by appraiser Miller Samuel and brokerage Douglas Elliman Real Estate.

Units were leased for a median of $3,502 (minus concession):

Source: Bloomberg

Units leased for a median of $3,502 after subtracting the value of concessions – just $19 short of the record high, reached in July, according to a report Thursday by appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. While rents have climbed in every month in 2019, November’s 8.7% jump from a year earlier was the biggest since September 2012 and followed two much-smaller increases.

“What we’re seeing is tremendous price growth in the luxury rental market,” Jonathan Miller, president of Miller Samuel, said in an interview. “It’s not so much that individual units are rising much, but the mix is shifting.”

The “super-luxury” end (top 5%) of the market saw the biggest gains, with median monthly rents climbing to $13,000 minus concessions.

The resurgence of demand for rentals has allowed some landlords to skip the lease incentives that have become so popular in New York City real-estate.

Across all price levels, the share of new leases with landlord incentives has been declining steadily. About 39% of agreements signed in November – not including renewals – came with a sweetener such as a free month. While that’s down from 42% a year earlier, the rate is still significant, according to Miller.

With the whole world wondering how much longer the decade-long economic boom will last, more buyers are opting to stay on the sidelines and wait for a better deal. In the meantime, they need somewhere to live, so they rent. Now they just need to hope that everybody’s anxieties about the global economy morph into a full-blown recession sooner rather than later. According to Jeff Gundlach and a growing number of market luminaries, they might be on hold for a while.

Tyler Durden

Fri, 12/13/2019 – 20:25

via ZeroHedge News https://ift.tt/2EixTqy Tyler Durden