“The Art Of The Deal” & How To Lose A “Trade War”

Authored by Lance Roberts via RealInvestmentAdvice.com,

This past Monday, on the #RealInvestmentShow, I discussed that it was exceedingly likely that Trump would delay, or remove, the tariffs which were slated to go into effect this Sunday, On Thursday, that is exactly what happened.

Not only did the tariffs get delayed, but on Friday, it was reported that China and the U.S. reached “Phase One” of the trade deal, which included “some” tariff relief and agricultural purchases. To wit:

“The U.S. plans to scrap tariffs on Chinese goods in phases, a priority for Beijing, Vice Commerce Minister Wang Shouwen said. However, Wang did not detail when exactly the U.S. would roll back duties.

President Donald Trump later said his administration would cancel its next round of tariffs on Chinese goods set to take effect Sunday. In tweets, he added that the White House would leave 25% tariffs on $250 billion in imports in place, while cutting existing duties on another $120 billion in products to 7.5%.

China will also consider canceling retaliatory tariffs set for Dec. 15, according to Vice Finance Minister Liao Min.

Beijing will increase agricultural purchases significantly, Vice Minister of Agriculture and Rural Affairs Han Jun said, though he did not specify by how much. Trump has insisted that China buy more American crops as part of a deal, and cheered the commitment in his tweets.”

Then from the USTR:

“The United States will be maintaining 25 percent tariffs on approximately $250 billion of Chinese imports, along with 7.5 percent tariffs on approximately $120 billion of Chinese imports.”

Not surprisingly, the market initially rallied on the news, but then reality begin to set in.

Art Of The Deal Versus The Art Of War

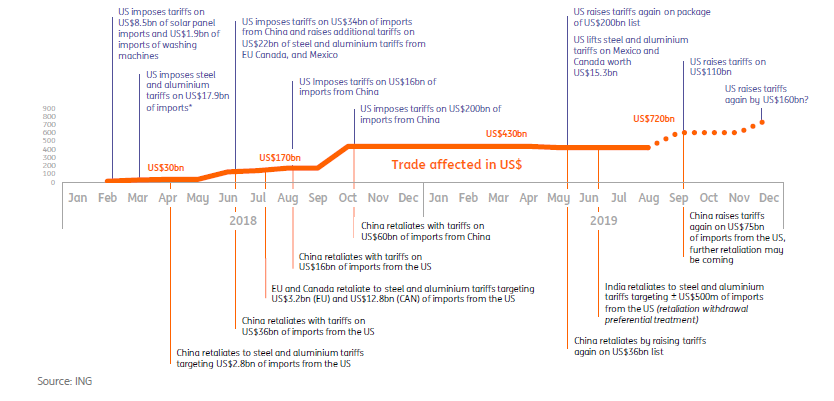

Over the past 18-months we have written numerous articles about the ongoing “trade war,” which was started by Trump against China. As I wrote previously:

“This is all assuming Trump can actually succeed in a trade war with China. Let’s step back to the G-20 meeting between President Trump and President Xi Jinping. As I wrote then:

‘There is a tremendous amount of ‘hope’ currently built into the market for a ‘trade war truce’ this weekend. However, as we suggested previously, the most likely outcome was a truce…but no deal. That is exactly what happened.

While the markets will likely react positively next week to the news that ‘talks will continue,’ the impact of existing tariffs from both the U.S. and China continue to weigh on domestic firms and consumers.

More importantly, while the continued ‘jawboning’ may keep ‘hope alive’ for investors temporarily, these two countries have been ‘talking’ for over a year with little real progress to show for it outside of superficial agreements.

Importantly, we have noted that Trump would eventually ‘cave’ into the pressure from the impact of the ‘trade war’ he started.

The reasons, which have been entirely overlooked by the media, is that China’s goals are very different from the U.S. To wit:

-

China is playing a very long game. Short-term economic pain can be met with ever-increasing levels of government stimulus. The U.S. has no such mechanism currently, but explains why both Trump and Vice-President Pence have been suggesting the Fed restarts QE and cuts rates by 1%.

-

The pressure is on the Trump Administration to conclude a “deal,” not on China. Trump needs a deal done before the 2020 election cycle AND he needs the markets and economy to be strong. If the markets and economy weaken because of tariffs, which are a tax on domestic consumers and corporate profits, as they did in 2018, the risk-off electoral losses rise. China knows this and are willing to “wait it out” to get a better deal.

-

China is not going to jeopardize its 50 to 100-year economic growth plan on a current President who will be out of office within the next 4-years at most. It is unlikely as the next President will take the same hard-line approach on China that President Trump has, so agreeing to something that won’t be supported in the future is doubtful.”

As noted in the second point above, on Friday, Trump caved to get the “Trade Deal” off the table before the election. As noted in September, China had already maneuvered Trump into a losing position.

“China knows that Trump needs a way out of the “trade war” he started, but that he needs something he can “boast” as a victory to a largely economically ignorant voter base. Here is how a “trade deal” could get done.

Understanding that China has already agreed to 80% of demands for a trade deal, such as buying U.S. goods, opening markets to U.S. investors, and making policy improvements in certain areas, Trump could conclude that ‘deal’ at the October meeting.”

Read the highlighted text above and compare it to the statement from the WSJ: on Thursday:

“The U.S. side has demanded Beijing make firm commitments to purchase large quantities of U.S. agricultural and other products, better protect U.S. intellectual-property rights and widen access to China’s financial-services sector.”

What is missing from the agreement was the most critical 20%:

-

Cutting the share of the state in the overall economy from 38% to 20%,

-

Implementing an enforcement check mechanism; and,

-

Technology transfer protections

These are the “big ticket” items that were the bulk of the reason Trump launched the “trade war” to begin with. Unfortunately, for China, these items are seen as an infringement on its sovereignty, and requires a complete abandonment the “Made in China 2025” industrial policy program.

The USTR did note that the Phase One deal:

“Requires structural reforms and other changes to China’s economic and trade regime in the areas of intellectual property, technology transfer, agriculture, financial services, and currency and foreign exchange.”

However, since there is no actual enforcement mechanism besides merely pushing tariffs back to where they were, none of this will be implemented.

All of this aligns with our previous suggestion the only viable pathway to a “trade deal” would be a full surrender.

“However, Trump can set aside the last 20%, drop tariffs, and keep market access open, in exchange for China signing off on the 80% of the deal they already agreed to.”

Which is precisely what Trump agreed to.

This Is The Only Deal

This is NOT a “Phase One” trade-deal.

This is a “Let’s get a deal on the easy stuff, call it a win, and go home,” deal.

It is the strategy we suggested was most likely:

“For Trump, he can spin a limited deal as a ‘win’ saying ‘China is caving to his tariffs’ and that he ‘will continue working to get the rest of the deal done.’ He will then quietly move on to another fight, which is the upcoming election, and never mention China again. His base will quickly forget the ‘trade war’ ever existed.

Kind of like that ‘Denuclearization deal’ with North Korea.”

Speaking of the “fantastic deal with N. Korea,” here is the latest on that failed negotiation:

“Reuters reported Thursday via Korean Central News Agency (KCNA) that, even if denuclearization talks resumed between both countries, the Trump administration has nothing to offer.

North Korea’s foreign ministry criticized the Trump administration for meeting with officials at the UN Security Council and suggested that it would be ready to respond to any corresponding measures that Washington imposes. ‘The United States said about corresponding measure at the meeting, as we have said we have nothing to lose and we are ready to respond to any corresponding measure that the US chooses,’ said KCNA citing a North Korean Foreign Ministry spokesperson.”

While Trump has announced he will begin to “immediately” work on “Phase Two,” any real agreement is highly unlikely. However, what Trump understands, is that he gets another several months of “tweeting” a “trade deal is coming” to keep asset markets buoyed to support his re-election campaign.

Not Really All That Amazing

While Trump claimed this was an “amazing deal” with China, and that America’s farmers need to get ready for a $50 billion surge in agricultural exports, neither is actually the case.

China did not agree to buy any specific amount of goods from the U.S. What they said was, according to Bloomberg, was:

- CHINA PLANS TO IMPORT U.S. WHEAT, RICE, CORN WITHIN QUOTAS

Furthermore, there is speculation the agreement is primarily verbal in terms of purchases, and the actual agreement of the entire trade deal will never be made public.

The source says a signing ceremony will not happen with President Xi. There will be a rollout of the agreement by the White House Friday. The Chinese have requested that the language of the never be made public. #China #Trade

— Edward Lawrence (@EdwardLawrence) December 13, 2019

But let’s put some hard numbers to this.

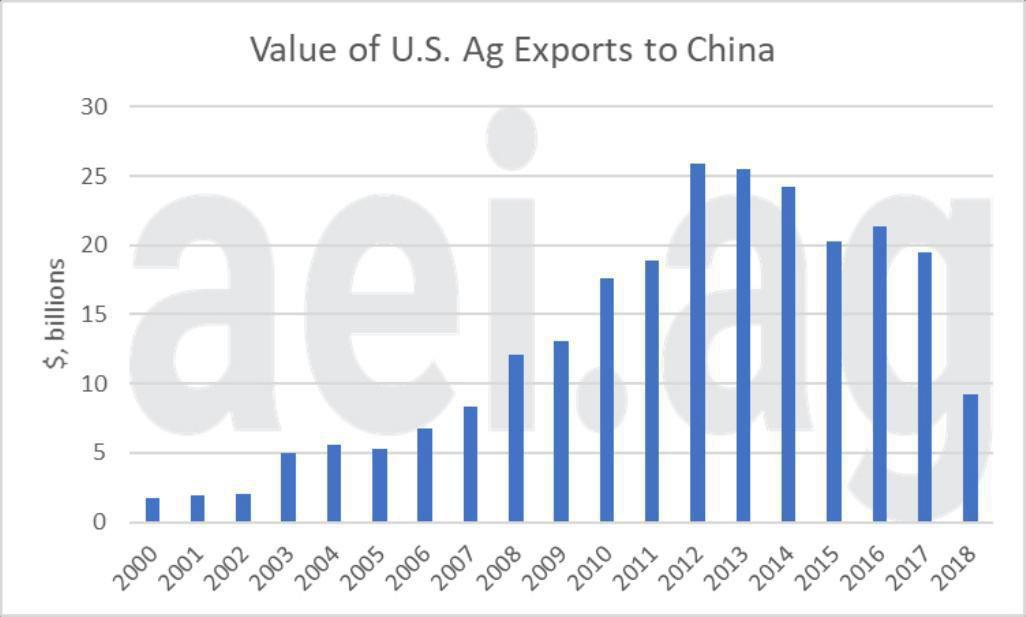

Currently, China is buying about $10 billion of farm produce in 2018. That is down from a peak of $25 billion in 2012, which was long before the trade war broke out.

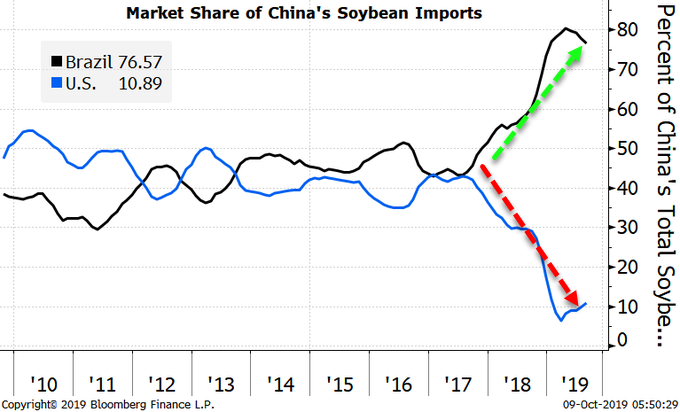

Since the trade war was started, China has sourced deals from Brazil and Argentina for pork and soybeans to offset the shortfall in imports from the U.S. These agreements, and subsequent imports, won’t be cancelled to shift to the U.S. since at any moment Trump could reinstate tariffs.

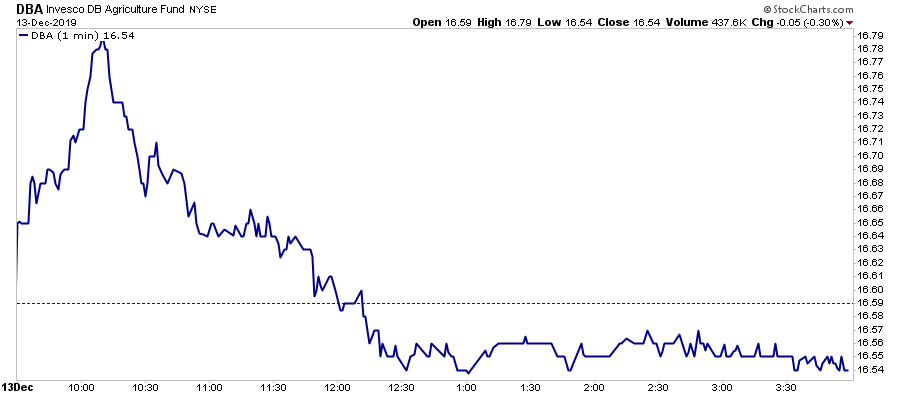

More importantly, as noted by Zerohedge on Friday, if this “deal” was as amazing as claimed, the agricultural commodity index should be screaming higher.

Importantly, even if China agrees to double their exports in the coming year, which would be a realistic goal, it would only reset the trade table to where it was before the tariffs started.

While China may have “agreed” to buy more, it is extremely unlikely China will meet such levels. Given they have already sourced products from other countries, they will import what they require.

Since most don’t pay attention to the long-game, while there will be excitement over a short-term uptick in agricultural purchases, those purchases will fade. However, with time having passed, and the focus of the media now elsewhere, Trump will NOT go back to the table and restart the “trade war” again. As I wrote on May 24, 2018:

“China has a long history of repeatedly reneging on promises it has made to past administrations. What the current administration fails to realize is that China is not operating from short-term political-cycle driven game plan.

As we stated in “Art Of The Deal vs. The Art Of War:”

“While Trump is operating from a view that was a ghost-written, former best-seller, in the U.S. popular press, XI is operating from a centuries-old blueprint for victory in battle.”

Trump lost the “trade war,” he just doesn’t realize it, yet.

No More “Trade Tweets?”

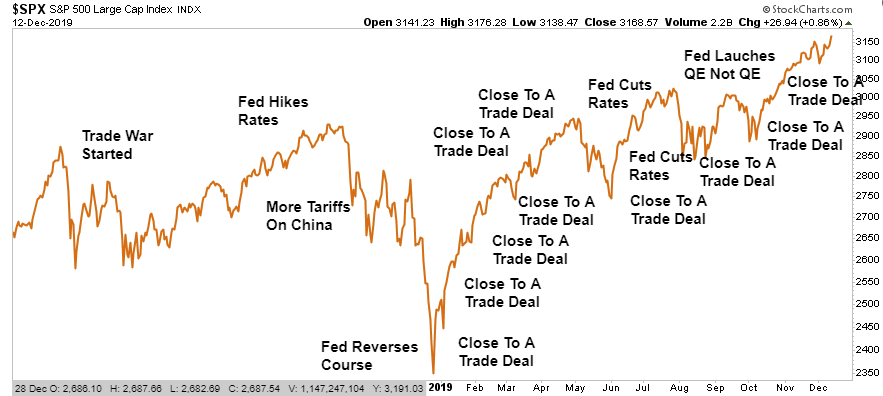

Since early 2018, and more importantly since the December lows of last year, the market has risen on the back of continued “hopes” of Federal Reserve easing, and the conclusion of a “trade deal.”

With the Fed now signaling that they are effectively done lowering rates through next year, and President Trump concluding a “trade deal,” what will be the next driver of the markets. While will the “algo’s” do without daily “trade tweets” to push stock markets higher?

While I am a bit sarcastic, there is also a lot of truth to the statement.

However, what is important is that while the Trump administration are rolling back 50% of the tariffs, they are not “removing” all of them. This means there is still some drag being imposed by tariffs, just at a reduced level.

More importantly, the rollback of tariffs do not immediately undo the damage which has already occurred.

-

Economic growth has weakened globally

-

Corporate profit growth has turned negative.

-

Tax cuts are fully absorbed into the economy

-

The “repo” market is suggesting that something is “broken.”

-

All of which is leading to rising recession risk.

In other words, while investors have hung their portfolios hopes of a “trade deal,” it may well be too little, too late.

Over the next couple of months, we will be able to refine our views further as we head into 2020. However, the important point is that since roughly 40% of corporate profits are a function of exports, the damage caused already won’t easily be reversed.

Furthermore, the Fed’s massive infusions of liquidity into the overnight lending market signal that something has “broken,” but few are paying attention.

Our suspicion is that the conclusion of the “trade deal” could well be a “buy the rumor, sell the news” type event as details are likely to be disappointing. Such would shift our focus from “risk taking” to “risk control.” Also, remember “cash” is a valuable asset for managing uncertainty.

With the market pushing overbought, extended, and bullish extremes, a correction to resolve this condition is quite likely. The only question is the cause, depth, and duration of that corrective process.

I am not suggesting you do anything, but just something to consider when the media tells you to ignore history and suggests “this time may be different.”

That is usually just about the time when it isn’t.

Tyler Durden

Sat, 12/14/2019 – 16:30

via ZeroHedge News https://ift.tt/2qWcv7o Tyler Durden