Nomura: Here’s What Happens After This Week’s ‘Quad-Witch’ Meltup

The S&P 500 has soared higher in the last week, since briefly dipping amid trade-deal concerns…

This melt-up is exactly what Nomura’s Cross-Asset Strategy MD Charlie McElligott expected as he warned traders on 12/10:

“HOWEVER, in the base-case that we DO indeed get the tariff delay / rollback announcement sometime this week / weekend in conjunction with the market carrying so much “downside” protection (both as per the above S&P downside as well as the large Net “Long Vega” position for VIX ETNs), it sets up a scenario into next week’s terrible holiday illiquidity where we could very likely get an impulse “GAP HIGHER” as said hedges are shed”

So, now that the melt-up has begun – and as we enter the oh-so-bullish “quad-witch” week – we turn once again to McElligott for a guide to the path ahead – is it Santa Claus rally all the way (tracking 2013’s year), or will there be a coal in the stocking of those seeing goldilocks only?

The ambiguous “Phase 1” China / US trade-deal relief has seen an investor universe which was “long crash” / tail-hedge protection (against the perceived risk of a “no deal” imposition of the Dec tranche of tariffs) yet-again disappointed, then acting in-turn as a catalyst behind the powerful “long delta, short vol” trade thereafter – sending Stocks soaring and vol collapsing.

But, McElligott notes, the next “local” stop for the S&P is dependent upon two key inputs into the end of this week’s “Quad Witch” options expiration:

-

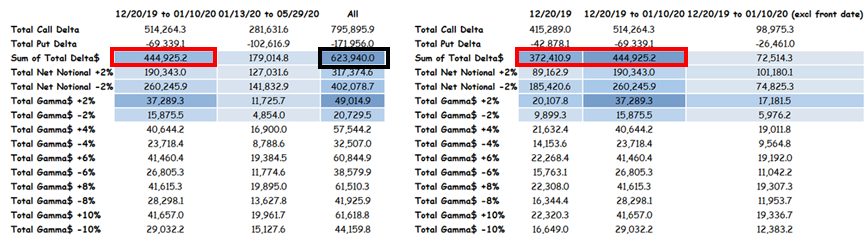

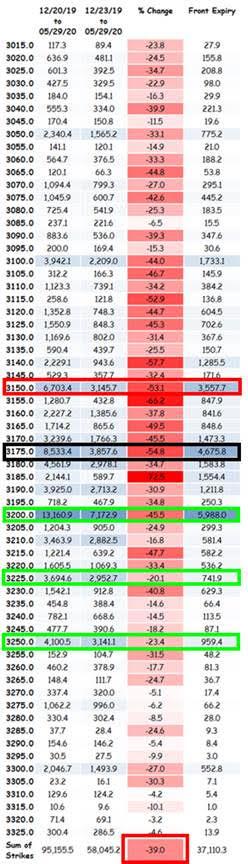

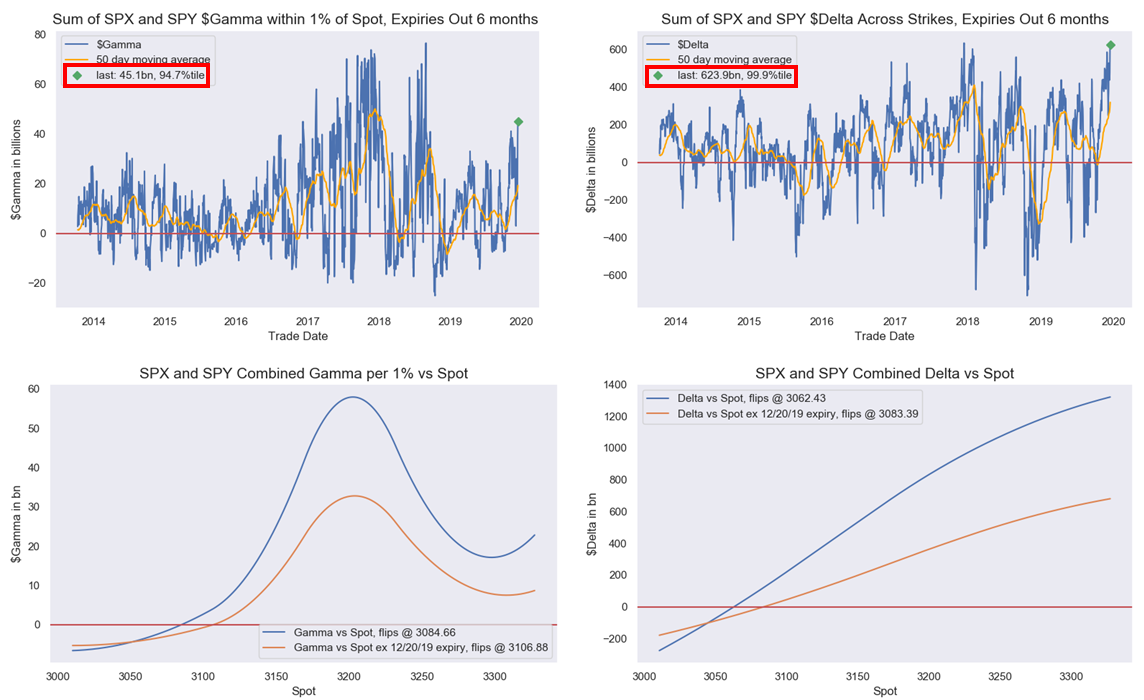

Large SPX / SPY consolidated options $Gamma located “here,” as we currently pin between the two largest strikes on the board: 3175 ($8.5B) and 3200 ($13.2B), with upside potentials at 3225 ($3.7B) and 3250 ($4.1B) (see below).

-

The VIX complex, with incremental downdraft potential from VIX ETN “Longs” mechanically rolling, which then drives second-order $ into “roll-down” trades that take advantage of steeper VIX curve (and pressuring the front of the curve), after the recent flattening in VIX futs curve having likely “stopped-out” some of this systematic flow.

Also notable, as the Nomura MD points out, bonds haven’t played along with this huge ‘risk-on’ relief rally in stocks.

Despite “positives” in 1) US / China trade & Brexit / UK general election, 2) a headline U.S. CPI “beat” and 3) the overnight better China IP and Retail Sales #’s all over the past 1w, USTs remain surprisingly flat over the past week / unable to hold a sell-off, as we continue to see “dip buyers” / Receivers in any Duration pullback (particularly with foreign real$).

Taken collectively, this speaks to a constructive backdrop from Equities to Bonds via stimulative / “easy” U.S. financial conditions feedback-loop (GSUSFCI Index now making fresh 20 month lows)

-

Still-collapsing cross-asset volatility, as event-risk is cleared and “crash” hedges (US / China trade disaster, U.S. Recession, Brexit etc) decay harshly and are “puked” .

-

US Dollar Index -2.4% in less than 3 months à “easier” financial conditions catalyst as well .

-

A “goldilocks” U.S. economy (~2% GDP Growth) now being re-priced vs prior “imminent recession” fears of just a few months back .

-

And all stabilized by an “asymmetric” global Central Bank policy function (almost “no bar” to CUT in light of “still-benign” inflation against an impossibly “high bar” to hike as we move-forward), which perpetuates this “QE-like” stasis of an “everything works” market.

So, McElligott says, in this current best-case “heads I win, tails you lose” scenario just described, it is actually pretty rational that the best set-ups for Equities now are in “RENTING” SHORT-TERM UPSIDE VIA “OUTRIGHTS” (as opposed to last week’s advocated “risk-reversals,” as base vol has now reset lower); or conversely, HEDGING DOWNSIDE VIA “WINGY” TAILS WITH PUT SPREADS.

However, the cross-asset strategist points out that, as one would expect, some clients have asked:

“What is a LOCAL de-risking catalyst in a world suddenly full of “less bad” news?”

The answer is somewhat simple and yet ominous and precariously balanced – the options “flow” itself.

Per the 1) EXTREME SPX OPTIONS $DELTA– (99.9th %Ile since 2013, only saw this before in Dec ’17)…

…and 2) EXTREME SPX OPTIONS $GAMMA– (94.7th %ile) in the market, which unless it is “rolled” this week could then create a mechanical “de-risking” flow:

The net $Delta position (+$624B) is effectively entirely in the front-week- (+$372B) and front-month- (+$445B), and thus, set to “roll-off” this week

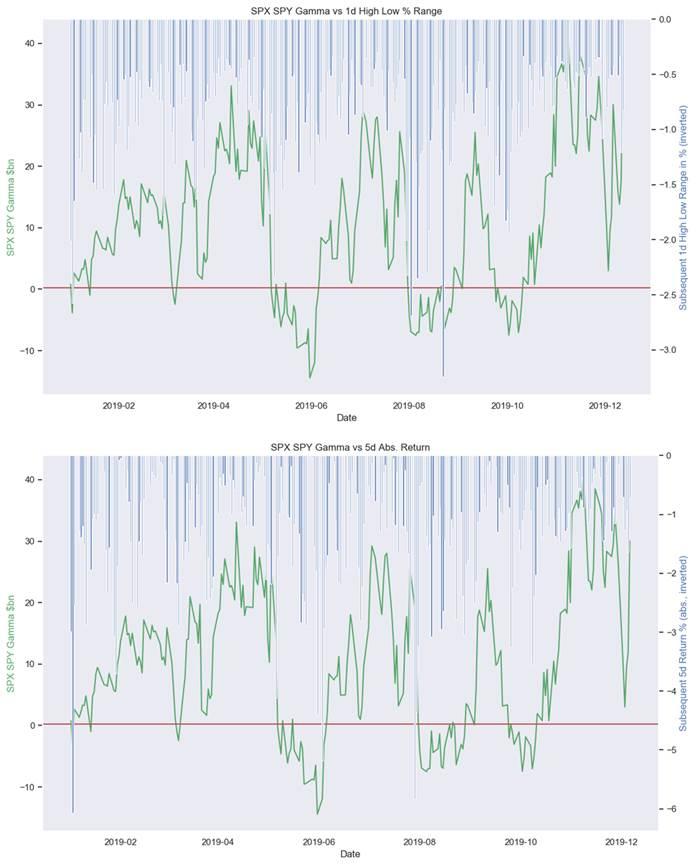

The net $Gamma position (+$45B per 1% move) would see a massive 39% “roll-off” this week as well, which as we have repeated previously ad nauseum would then provide scope for an “impulse” directional move, as we could then “untether” from the current “long $Gamma” dealer death-grip.

And as history has shown, “negative impulses” in gamma tend to matter – larger market ranges and bigger swings…

So, to sum up – do not be surprised if stocks continue their post-trade-deal meltup into Friday’s “quad witch” but after that, things could get volatile fast, and none of that is helped by the usual collapse in liquidity that occurs this time of year.

Tyler Durden

Mon, 12/16/2019 – 14:35

via ZeroHedge News https://ift.tt/34seE8g Tyler Durden