VIXtermination & Short-Squeeze Spark Stock Surge But Bonds, Yuan Decouple

Trade deal, done (ish). UK Election, done. China data, rebounding. Quad-Witch, soon. Fed injecting cajillions in liquidity, check! It’s the Rick Astley market to year-end (maybe…)

Everything is awesome if we look at stocks, but bonds and yuan appear much less enthused at the path ahead…

Source: Bloomberg

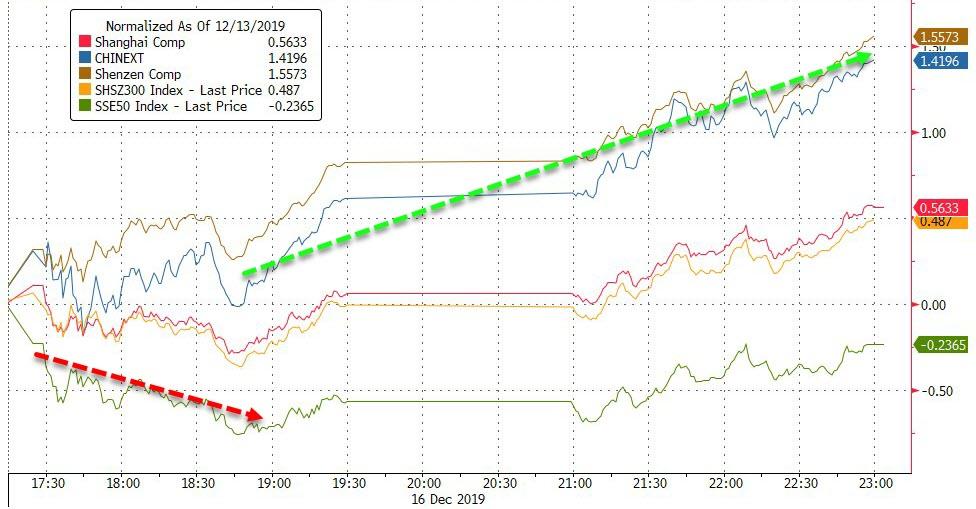

Chinese markets were higher overnight as they caught up with the US gains from Friday’s trade deal (notably the largest Chinese stocks underperformed)…

Source: Bloomberg

European stocks were all higher today (post-trade-deal), but UK’s FTSE 250 soared most…

Source: Bloomberg

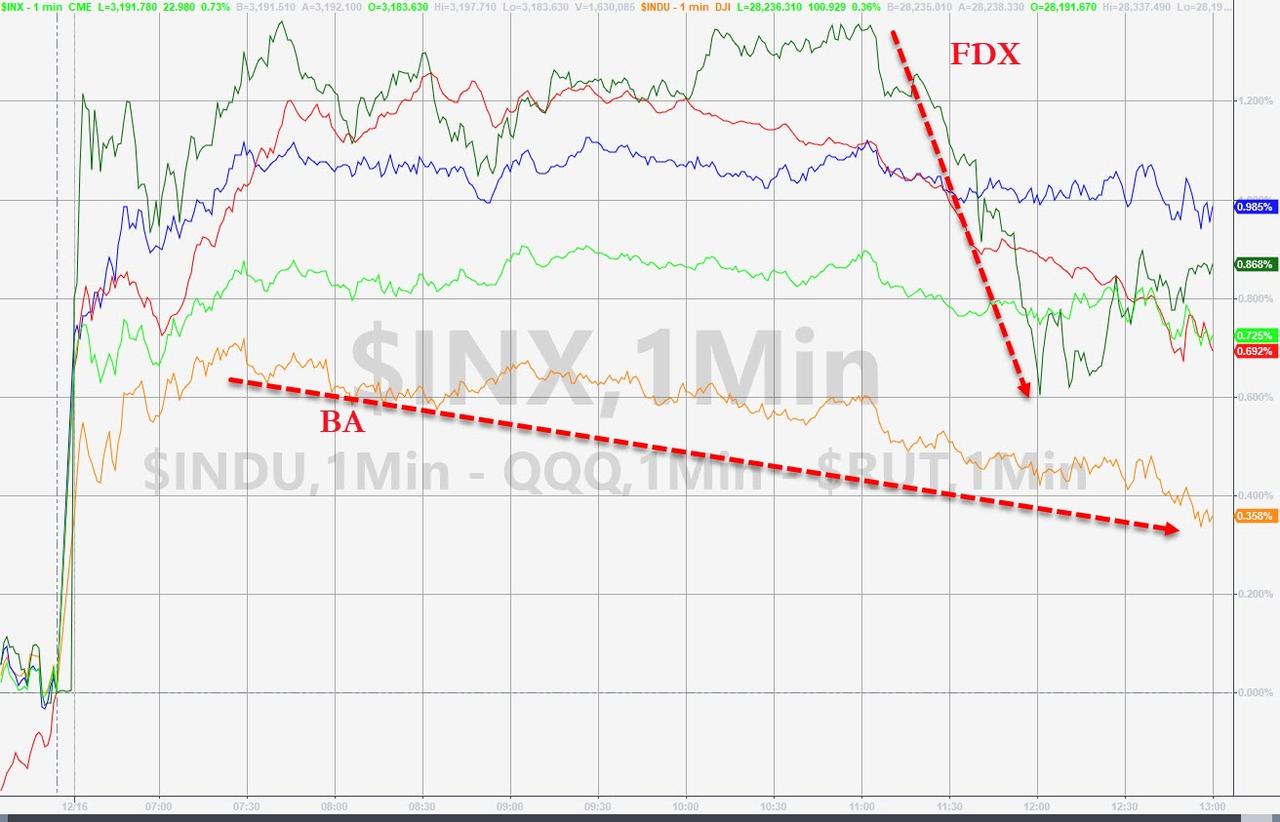

Boeing weighed on Dow Industrials and FedEx dragged Dow Transports lower, but all the US majors ended the day higher…

All the majors hit new record highs today

Source: Bloomberg

S&P drifted back towards VWAP late in the day…

Overall, since the Oct 11 “phase one” deal, German stocks have outperformed US and China has lagged notably (managing to get green overnight)…

Source: Bloomberg

Another day, another giant short-squeeze to rescue stocks…

Source: Bloomberg

And VIX was clubbed like a baby seal to an 11 handle once again…

Notably, Defensives actually outperformed today as cyclicals faded late on…

Source: Bloomberg

Late in the day, equity protection costs began to rise, even as IG credit protection slipped lower…

Source: Bloomberg

Treasury yields all rose today, but notably the short-end outperformed, belly underperformed (2Y +3.5bps, 7Y +6bps)

Source: Bloomberg

While stocks broke out of the recent range to new record highs, 30Y Yields stalled out at pre-deal levels…

Source: Bloomberg

The dollar fell for the 10th day in the last 12…

Source: Bloomberg

As we noted above, Yuan limped higher (certainly not as enthusiastically as stocks), to the PBOC fix level…

Source: Bloomberg

Cryptos were monkeyhammered lower today…

Source: Bloomberg

The weaker dollar helped lift all commodities (with gold scratching out a tiny gain) as copper outperformed…

Source: Bloomberg

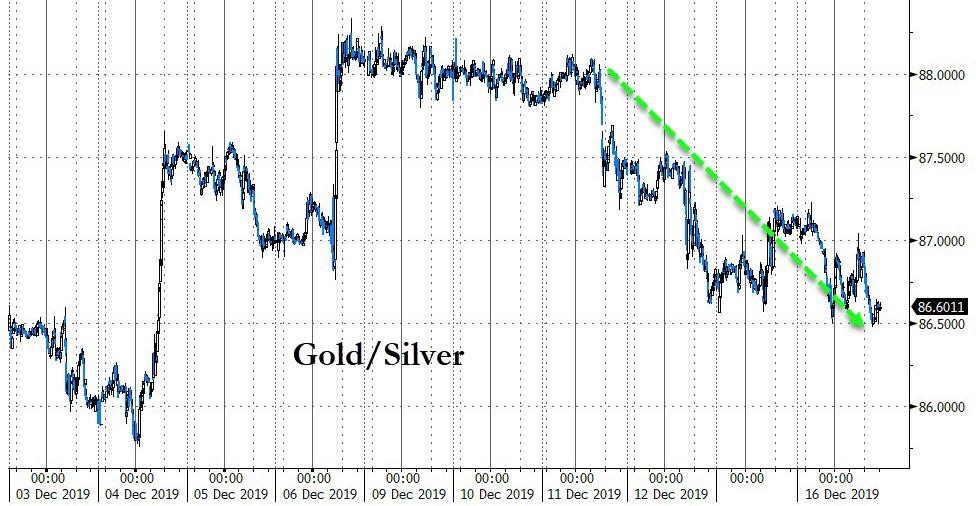

Silver has been outperforming gold in the last few days…

Source: Bloomberg

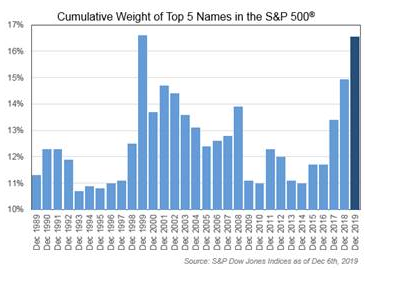

Finally, we note that the S&P has become top heavy again: the top five stocks (AAPL, MSFT, GOOGL, FB and AMZN) are at 16.5%, the highest weighting since 1999…

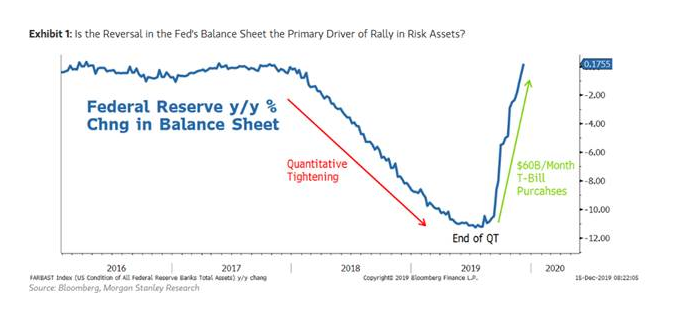

And don’t forget, it’s not the fun-durr-mentals, central bank liquidity is all that matters…

Trade accordingly.

Tyler Durden

Mon, 12/16/2019 – 16:00

via ZeroHedge News https://ift.tt/2EkAxvV Tyler Durden