What Will The Market Care About In 2020? Here Is Goldman’s Answer

Now that two of the market’s greatest unknowns – Brexit/the UK election, and the “Phase One” part of the US-China trade war (with the Phase Two supposedly on the “to do” list after the Nov 2020 elections) – appear to have found an interim, if not fully satisfactory, resolution, a recurring question among the trader community is what will the market care about in the coming year.

Conveniently, an answer to that question is the topic of a Goldman report published over the weekend, and which points out that despite the immediate newsflow vacuum now that stocks will no longer rally on “optimism” of an imminent deal announcement, there is still quite a bit to occupy traders. Starting with the Treasury-market, Goldman notes that activity here will depend crucially on the Fed’s reaction function and the current pace of growth (among other things).

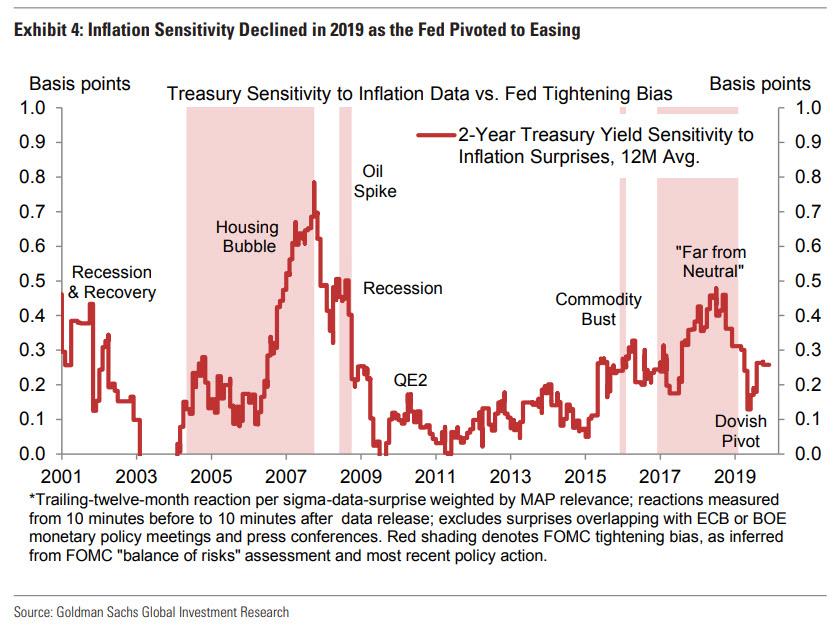

As shown in the chart below, sensitivity to inflation surprises picked up sharply in late 2017 and 2018 as the Fed hiked, as realized inflation moved towards the target, and as the risk of overheating entered the mainstream policy debate.

However, 2019 saw a reversal of all three trends, and inflation sensitivity declined arguably as a result.

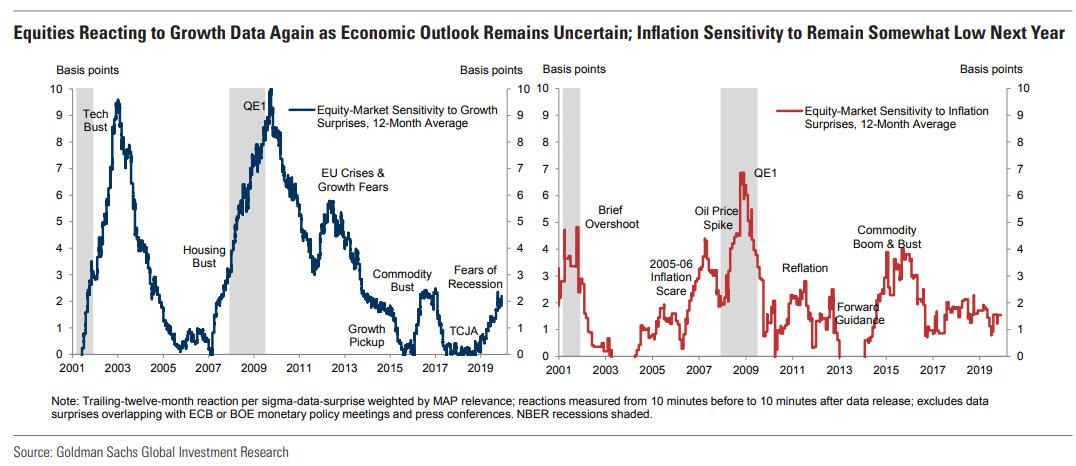

Following the sharp tightening in financial conditions at the turn of the year, the combination of renewed growth fears, declining core inflation, and the dovish Fed pivot resulted in a roughly 50% decline in inflation sensitivity. Equity-market inflation sensitivity also declined, albeit more modestly.

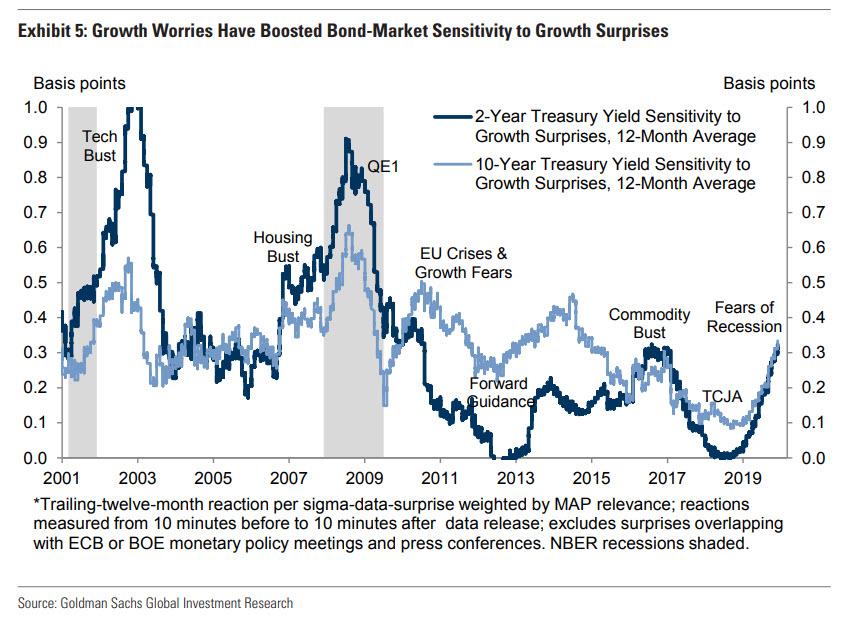

In contrast, sensitivity to growth data picked up sharply in 2019, reflecting slowing growth and the return of recession fears. In fact, growth sensitivity in the bond market is already back to its level during the shale bust and capex-driven growth scare of 2016-17.

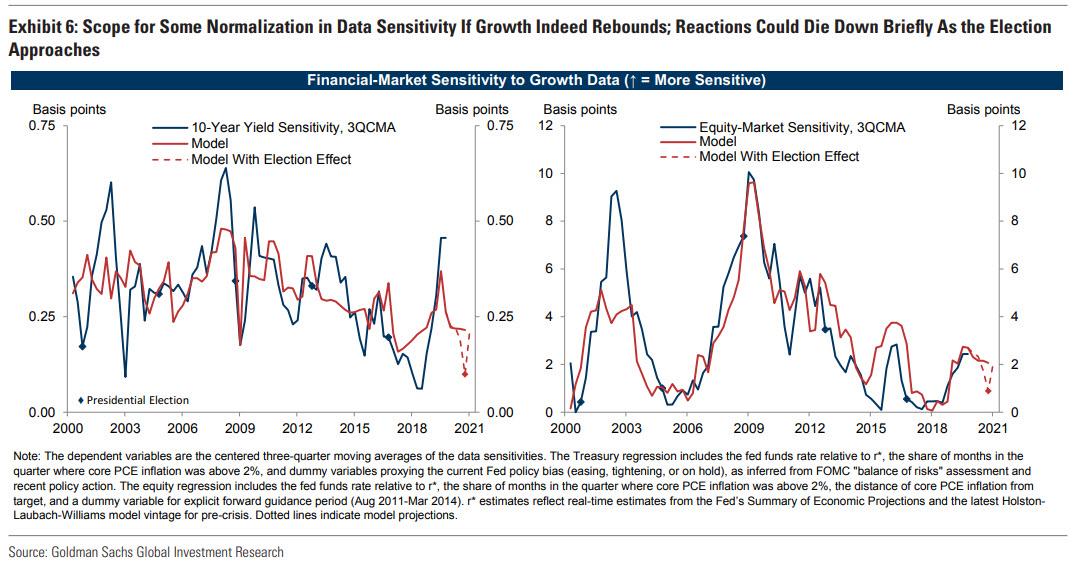

Looking ahead to 2020, Goldman expects another signal reversal, as its forecast of improving growth and diminished trade risks suggests scope for a modest pullback in sensitivity to growth data. Treasury-market sensitivity has already overshot relative to the bank’s predictions (see blue and red line in the left panel of Exhibit 6), and the end of the mid-cycle adjustment coupled with its expectation of firming US growth argues for more a normal degree of data sensitivity in early 2020.

Similarly, equity-market reactions to growth data could also wane a bit early next year if growth picks up.

It is also worth recalling that 2020 will be the year of the presidential election. As a result, Goldman analyzes the impact of elections on data sensitivity since 2000. Adding election dummy variables to the models shown in Exhibit 6, the bank finds a negative and significant “election effect” on growth sensitivity—with reactions to growth surprises attenuating in the quarter of presidential elections. Goldman analysts also find tentative evidence of attenuation in the quarter preceding the election (statistical power may be limited by the short sample).

The implications for 2020 are shown by the dotted lines above (i.e., a short-lived lull in data reactions in the coming fall 2020).

In contrast, the bank finds no such effects for inflation sensitivity. This may suggest that market participants view elections as more important for the growth outlook than for the near-term trajectory of core inflation (such that inflation news continues to be an important driver of price action, even if growth surprises are faded). In conclusion, Goldman expects inflation reactions to pick up gradually in 2020 as inflation rebounds towards the target and the Fed begins to contemplate its next move. All of that, of course, assumes that inflation will rebound next year as most on Wall Street now openly expect. However, if there is anything that 2019 once again vividly demonstrated, it is that when everyone expects something, the opposite happens.

Tyler Durden

Sun, 12/15/2019 – 19:20

via ZeroHedge News https://ift.tt/2swv5TO Tyler Durden