“Danger Of Peak Optimism” As Global Stock Rally Fizzles, US Futures Dip

After surging to all time highs virtually every day over the past week in a frenzied year-end FOMO panic by investors, on Tuesday the global stock rally finally fizzled as US equity futures struggled to break into the green while European shares fell even as Asian shares rose to the highest level since June 2018.

S&P500 index futures pointed to a weak opening after after rising just shy of 3,200 to a new record-high close…

… that was underpinned once again by the US-China Phase One trade deal which as we learned last night, has not even been finalized yet and China objects to several points of the deal.

Points by @USTradeRep irritating Chinese trade experts:1) assertion #China agreed to end “forcing” tech transfers (China balks transfers forced) 2) mention of devaluations (feels one-sided, and econ slowdown=weaker CNY) 3) no @wto reference to settle disputes(so again unequal)😬 pic.twitter.com/aQCpSsfcPT

— Eunice Yoon (@onlyyoontv) December 16, 2019

Boeing fell further in pre-market trading after deciding to halt production production of its best-selling 737 MAX jetliner in January, its biggest assembly-line halt in more than 20 years, as fallout from two fatal crashes of the now-grounded aircraft drags into 2020.

European shares pulled back after a record run on Tuesday as a sales warning from Unilever prompted investors to sell big consumer names, while concern that Britain will take a hard line on the Brexit transition dragged down UK domestic stocks. The European Stoxx 600 index fell 0.6% after soaring to record highs in the previous session. The biggest weak spot was consumer goods giant Unilever. Its shares tumbled 6%, on course for their biggest percentage drop since July 2015, after the company warned that 2019 sales would grow less than it had expected, citing tough trading conditions in West Africa and a slowdown in south Asia. Europe’s personal and household goods sector fell 2.1%, the most among regional subsectors.

“With Unilever, it’s a combination of technical breakdown on the charts, you’ve got the warning and the time of the warning is not ideal because the markets have already been rotating out of big UK defensive names,” Mark Taylor, sales trader at Mirabaud Securities. Taylor, however, suggested Tuesday’s broader market moves were “just reassessing some of the outsized moves that we’ve seen in the last few days.”

Elsewhere, European suppliers to Boeing declined after the U.S. company confirmed it would suspend production of its grounded 737 Max jet in January. Boeing European suppliers include Safran, -4.1%, Senior, -5.9%, BAE Systems, -1.6%, Rolls-Royce, -1.3%, Meggitt, -0.5%, while Boeing rival Airbus gained as much as 1.7% in Paris, up 0.5% in early trading.

U.K. shares were also volatile, and sterling sank the most since July versus the euro, tumbling below 1.32 vs the USD after newly elected Prime Minister Boris Johnson proposed a legal change that revived the chances of a no-deal Brexit. Earlier in Asia, a benchmark stock gauge rose to the highest level since mid-2018. European government bonds drifted higher. The dollar advanced against most of its biggest peers.

Earlier in the session, Asian stocks gained after U.S. equities reached new highs amid optimism over trade talks between the world’s two largest economies. The region’s benchmark MSCI Asia Pacific Index gained as much as 0.9% to its highest level since June 2018, led by shares in previously beaten-down markets like South Korea and Hong Kong. The Kospi index jumped to a seven-month high as semiconductor companies rallied. India’s Sensex headed for a record close. Yet, some warning signs are emerging in the region for technical traders. The 14-day relative strength index for Asia’s benchmark index has surpassed 70, entering overbought territory.

An index of emerging-market stocks also climbed to its highest level since June 2018, while currencies and bonds rallied as the positive momentum from the phase-one trade deal reverberated through markets. The MSCI equity index rose as much as 1.3%, the third time this month it has exceeded a gain of 1%. The currency gauge was at its best level in five months on a closing basis, and a Bloomberg Barclays index of local-currency bonds advanced for a fourth day to an all-time high.

“We are in danger of peak optimism because we don’t have a trade deal signed and there are still some things that can go wrong,” Kristina Hooper, chief global market strategist at Invesco, said. “There is this general euphoria because economic policy uncertainty has come down, but I do think it could lead to frothy markets that could be made vulnerable if something goes wrong.”

In FX, the Bloomberg Dollar Spot Index rose for the first day in three as the greenback traded stronger against all G-10 peers and the 10-year Treasury yield edged lower; euro bulls look for fresh impetus to challenge cycle highs while sterling meets renewed selling interest. The pound plunged more than 1%, briefly erasing all gains since the U.K. election exit poll, and gilts rallied as Prime Minister Boris Johnson looked to change the law to guarantee the Brexit transition phase is not extended beyond the end of 2020. ITV’s Peston tweeted that PM Johnson is to change the Withdrawal Agreement Bill to put into law that transition arrangements with EU, during which UK is in effect non-voting member of EU, must end 31 Dec 2020, which he noted will be seen as increasing the risk of delayed no-deal Brexit.

Risk-sensitive Antipodean and Scandinavian currencies followed the pound lower; Aussie was also weighed down by a lack of any buoyant commentary in Reserve Bank of Australia’s December meeting minutes. South Korea’s won led gains, while the Turkish lira remained under pressure after President Recep Tayyip Erdogan threatened to close two NATO bases in a spat with the U.S.

In commodities, West Texas-grade oil held near a three-month high. Looking ahead, tonight’s weekly API report is expected to show crude stocks declining by 1.75mln barrels over the last week, while in terms of products, gasoline stocks are forecast to build by 2mln barrels and distillates to draw by 500k barrels. Elsewhere, spot gold has seen some support in decent trade which coincided with downside in stocks. The yellow metal sees modest intraday gains but remains below recent resistance at USD 1480/oz. Palladium surged through $2,000 an ounce to a record, though it went on to erase the move and edge lower. Copper prices remain rangebound around the USD 2.80/lb, although modest downside in the red metal coincided with the release of China’s refined copper output which rose 19.6% Y/Y, hitting record highs. Finally, Dalian iron ore declined almost 3.0%, slipping for a second straight session amid rising shipments from large miners – Australian and Brazilian shipments rose 22.15mln tonnes last week, +462k tonnes W/W.

Looking at the day ahead, US releases include November’s housing starts, building permits, industrial production and capacity utilisation, along with October’s job openings data. Central bank speakers tomorrow include the ECB’s Rehn, Kazimir and Lane, the Fed’s Kaplan and Rosengren, and the BoE’s Carney.

Market Snapshot

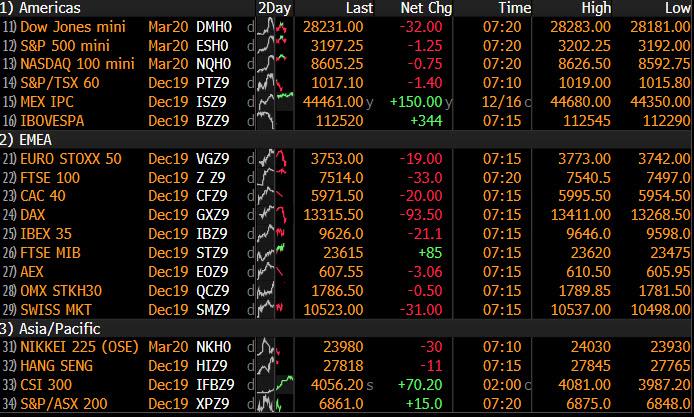

- S&P 500 futures down 0.06% to 3,192.25

- STOXX Europe 600 down 0.6% to 415.46

- MXAP up 0.8% to 170.29

- MXAPJ up 0.9% to 548.74

- Nikkei up 0.5% to 24,066.12

- Topix up 0.6% to 1,747.20

- Hang Seng Index up 1.2% to 27,843.71

- Shanghai Composite up 1.3% to 3,022.42

- Sensex up 0.9% to 41,311.07

- Australia S&P/ASX 200 down 0.04% to 6,847.28

- Kospi up 1.3% to 2,195.68

- German 10Y yield fell 0.3 bps to -0.28%

- Euro down 0.02% to $1.1142

- Brent Futures down 0.3% to $65.17/bbl

- Italian 10Y yield rose 3.5 bps to 1.125%

- Spanish 10Y yield fell 0.2 bps to 0.418%

- Brent Futures down 0.3% to $65.17/bbl

- Gold spot up 0.1% to $1,477.70

- U.S. Dollar Index up 0.2% to 97.23

Top Overnight News from Bloomberg

- Boris Johnson will change the law to ensure the Brexit transition phase is not extended, setting up a new cliff-edge for a no-deal split with the European Union at the end of 2020. The planned legislation will include legal text to prevent the government extending the transition period, even if no new trade terms have been secured in time, an official said

- Governments are getting set to cash in on a booming market in green bonds—debt that funds projects with environmental benefits. Fueled by the growing awareness that more radical action has to be done to combat climate change, and by the need to fund it, Europe is taking the lead

- The stalemate between Emmanuel Macron’s government and labor unions deepened as France headed into a third week of transport strikes over the president’s effort to reform the country’s pension system, threatening further chaos during the busy holiday season

- Escalating protests this year have led to about $5 billion being pulled from investment funds in Hong Kong — raising the risk that strain in the Asian financial hub could spread to other parts of the world, according to the Bank of England’s latest financial stability report

- U.S. Defense Secretary Mark Esper said Turkey’s threats to close two critical NATO installations are raising questions about its commitment to the military alliance

- ECB Governing Council member Olli Rehn said the outlook for inflation in the euro area is very subdued and the rate is “falling clearly below ECB target in coming years”

- ECB Governing Council member Francois Villeroy de Galhau says predictability of monetary policy is a powerful element and he is expects rates to remain at current low levels for a while

Asian equity markets traded mostly higher as the region took mild impetus from the gains on Wall St where all major indices notched fresh record highs once again due to the recent trade developments and in which desks noted a large equity buy program helping spur the pre-Christmas rally. ASX 200 (Unch.) and Nikkei 225 (+0.5%) both opened higher but with the advances in Australia later retraced amid weakness in financials and Westpac shares after APRA announced it is launching an investigation related to AUSTRAC breeches and doubled its capital requirement add-ons for the big 4 lender to AUD 1bln, while upside in Tokyo was also restricted by a pullback in JPY-crosses. Hang Seng (+1.2%) and Shanghai Comp. (+1.3%) rallied due to trade optimism and after local press reports suggested the potential for 2 targeted RRR cuts by the PBoC next year, although both were initially kept tepid by continued PBoC liquidity inaction and as China remained tight-lipped regarding agriculture purchase commitments. Finally, 10yr JGBs were subdued after spillover selling from USTs, with demand dampened by gains in stocks and after the 20yr JGB auction which pointed to showed results across all metrics.

Top Asian News

- Malaysia Reaches Deal to Restart $34 Billion Ex-1MDB Project

- India’s State-Backed Bonds Take China Alarm in Their Stride

- Hong Kong’s Economy Limps Into 2020 With Fate Tied to Protests

- Pakistan Court Orders Death to Ex-Military Ruler Musharraf

A mostly downbeat session for European equities thus far following on from a somewhat optimism APAC session, which saw Chinese bourses outperform on trade optimism and fresh-record tailwinds State-side. Europe’s bellwether – Euro Stoxx 50 (-0.7%) is largely weighed on by heavyweight Unilever (-5.8%) whose shares slumped amid a profit warning, with the company citing “challenges in certain markets”. Thus, the consumer staples sector (-1.7%) is seeing significant underperformance vs. its peers. DAX (-0.9%) underperforms vs the regions with a bulk of the losses attributed to downside in SAP (-3.5%) in light of a negative broker move at BofA. Meanwhile, the FTSE 100 (Unch) attempts to balance downside in Sterling with more a pronounced risk of a cliff-edge Brexit – after reports that PM Johnson is attempting to outlaw another extension beyond Dec 2020. UK Homebuilders have reverse a bulk of their post-election poll gains whilst banks mostly fail to benefit from BoE’s stress test green-light, which saw HSBC (+0.9%), Barclays (-3.2%), Lloyds (-4.7%), RBS (-2.0%) and Standard Chartered (+1.0%) all pass – albeit HSBC and Standard Chartered are less exposed to the UK given their overseas operations. Elsewhere, Airbus (+0.5%) benefits following Boeing’s (-1.3% pre-market) announcement that it is to freeze 737 Max production in January. That said, aero supplier Safran (-3.6%) alongside airline names suffer: easyJet (-4.3%), Ryanair (-3.1%), IAG (-2.5%), with the latter side-lining news that British Airways pilots agreed to back a revised pay off to end strikes. Last but not least, FTSE-listed NMC Health (-14.9%) plumbed the depth after activist short-seller Muddy Waters noted of serious doubt regarding the company’s financial statement, its asset values, cash balance, reported profits, and reported debt levels.

Top European News

- U.K. Wages Slow, Vacancies Fall in Brexit-Hit Labor Market

- Lloyds Had Most Disappointing BoE Stress Test Result: Citi

- Germany Takes Fight Over Opal Gas Pipeline to EU Top Court

- Uzbekistan Targets $6 Billion From IPOs and Bond Offerings

In FX, sterling has given up more of its GE-related gains as attention switches back to Brexit and the risk that a no deal departure from the EU could yet unfold if UK PM Johnson manages to prevent parliament from seeking an extension to the transition phase alongside the WAB motion that will be presented to the HoC on Friday. Cable retreated further from last week’s lofty 1.3500+ pinnacle through Monday’s session low before tripping stops on a break of 1.3200 and testing post-election result/exit poll levels circa 1.3159 that roughly align with a Fib retracement of the whole relief rally from voting day trough to peak. Meanwhile, Eur/Gbp extended its rebound to around 0.8470 from close to 0.8300 at one stage yesterday and under the big figure when the Pound hit aforementioned heights after the landslide Tory win. Note, some solace via the latest jobs data even though the claimant count and headline AWE were both weaker than forecast.

- AUD/NZD/CAD – The Aussie is underperforming on the back of latest RBA minutes underscoring a willingness to ease further if necessary and flagging a full assessment of the situation at the next policy meeting in February 2020. Aud/Usd has recoiled to just below 0.6850 and Aud/Nzd is back under 1.0450 as Nzd/Usd holds up a tad better between 0.6570-0.6605 in wake of another improvement in NZ business sentiment and expections on top of the Kiwi supportive cross flows. Elsewhere, the Loonie has lost momentum and slipped through 1.3150 ahead of Canadian manufacturing sales, and as the Greenback attempts to form a base, albeit at the expense of others, with the DXY hovering above 97.000 in a 97.058-303 band.

- EUR/CHF/JPY – All narrowly mixed against the Dollar, as Eur/Usd meanders from 1.1130 to 1.1160, Usd/Chf idles within 0.9820-45 extremes and Usd/Jpy remains anchored to 108.50 with rallies confined or capped ahead of early month highs/near double top resistance.

- NOK/SEK – Not quite all change, but a distinct turnaround in fortunes for the Scandi Crowns that started Norges Bank and Riksbank meeting week in the ascendency. Eur/Nok and Eur/Sek have both bounced after testing, but not breaking chart support back towards 10.0900 and 10.4800 respectively.

In commodities, WTI and Brent futures are contained within tight intraday ranges of around USD 0.5/bbl with little to report by way of fresh fundamental catalysts for the complex. Brexit-risk aside, the broader sentiment in the markets remains positive given the developments in the US-Sino sphere. ING notes that constructive energy fundamentals – including declining inventories – is reflected in the ICE Brent time spread, but they continue to meander deep in backwardation. “We expect downward pressure on oil prices to resume as we move into 1H20”, ING says, but the forecast remains contingent on the Phase One trade deal details alongside OPEC+ action to tackle surplus. In terms of commentary, JP Morgan raised Brent crude 2020 price forecast to USD 64.50/bbl from USD 59.00/bbl but sees prices in 2021 at USD 61.50/bbl, while it expects WTI prices averaging USD 60.00/bbl in 2020 and USD 57.50/bbl in 2021. Looking ahead, tonight’s weekly API report is expected to show crude stocks declining by 1.75mln barrels over the last week, whilst in terms of products, gasoline stocks are forecast to build by 2mln barrels and distillates to draw by 500k barrels. Elsewhere, spot gold has seen some support in decent trade which coincided with downside in stocks. The yellow metal sees modest intraday gains but remains below recent resistance at USD 1480/oz. Copper prices remain rangebound around the USD 2.80/lb, although modest downside in the red metal coincided with the release of China’s refined copper output which rose 19.6% Y/Y, hitting record highs. Finally, Dalian iron ore declined almost 3.0%, slipping for a second straight session amid rising shipments from large miners – Australian and Brazilian shipments rose 22.15mln tonnes last week, +462k tonnes W/W.

US Event Calendar

- 8:30am: U.S. Housing Starts, Nov., est. 1345k, prior 1314k; Building Permits, Nov., est. 1418k, prior 1461k

- 9:15am: U.S. Industrial Production MoM, Nov., est. 0.8%, prior -0.8%;

- Capacity Utilization, Nov., est. 77.4%, prior 76.7%

- Manufacturing Production, Nov., est. 0.9%, prior -0.6%

- 10am: U.S. JOLTs Job Openings, Oct., est. 7009, prior 7024

DB’s Jim Reid concludes the overnight wrap

For the third night in a row we tried to watch “The Irishman” on Netflix and for the third night in a row I dozed off but this time leaving only 20 mins to go. If you have to watch a film over 4 nights it’s either too long or you need to get more rest. I suspect in this case it’s the latter as it’s pretty gripping.

Yesterday there were more “booms” than a gangster movie as it was a day of multiple record highs, with even European equities getting in on the act as the STOXX 600 (+1.39%) saw its first record high since April 2015. It made me look back at the long-term graph and it’s stunning that last night’s level only puts it 4% above the high point in the pre-GFC years reached in June 2007. So a 12 and a half year journey of little progress outside of dividends. Over the same period the S&P 500 has more than doubled. Talking of the S&P 500, it ended the session up +0.71% at another record high (a bit less rare than European ones), as did the Dow Jones (+0.36%) and the NASDAQ (+0.91%), while the trade-sensitive Philadelphia semiconductor index outperformed to close up +0.96% – another record. The agreement of a Phase One trade deal and political clarity in the UK (and with it in the EU and with Brexit) continued to power the global rally.

However the big news overnight is that U.K. PM Johnson intends to change the law to guarantee that the transition phase on Brexit is not extended beyond the end of 2020. This has been reported by a number of media outlets and if true will be a jolt to those who believed that the PM will use his big majority to transition to a softer relationship with the EU. This will raise the stakes for negotiators on both sides to conclude a trade deal. However the EU have repeatedly made it clear that a comprehensive agreement is likely to take years. So the probability of a harder bare bones deal or a cliff edge Brexit in 12 months time has gone up this morning. Sterling dipped around -0.75% on the news but has rallied back a bit and is currently -0.26% against the US dollar.

In Asia overnight, equity markets are reaching fresh recent highs too, with the Nikkei up +0.47% and on track for its highest close since October 2018. Meanwhile, the Hang Seng (+1.12%), Shanghai Comp (+0.94%), and the Kospi (+1.10%) are also trading higher this morning, with S&P 500 futures up a little.

Other risk assets performed strongly as well yesterday, with Brent crude up +0.3% at a three-month high. With the market fleeing safe assets, sovereign debt sold off yesterday, with 10yr Treasury yields up +4.7bps to 1.87%, with the 2s10s curve steepening by +2.7bps. It was a similar story in Europe, with bunds (+1.5bps), OATs (+1.5bps) and gilts (+3.2bps) also selling off.

UK equities continued to surge following last week’s election, with the FTSE 100 up +2.25% in its best daily performance of 2019. In terms of what to expect now that the election is over, the Queen’s Speech will take place on Thursday, which is where the Queen outlines the government’s programme for the coming session of Parliament. Then on Friday, the Brexit legislation will be returning to Parliament, with the government aiming to ensure it passes so that the UK can leave the EU by the end of January.

In spite of the buoyant market sentiment created by the optimism on trade and Brexit, the PMIs out yesterday showed that it won’t be all plain sailing for the economy moving into next year. For the Eurozone, the composite PMI remained at 50.6 (vs. 50.7 expected) for a 3rd consecutive month, with the manufacturing PMI falling to 45.9 (vs. 47.3 expected), the 11th month in a row that the Eurozone manufacturing PMI has been in contractionary territory. In Germany, the composite PMI remained at 49.4 (vs. 49.9 expected), again with a further deterioration in the manufacturing PMI to 43.3 (vs. 44.6 expected). In France, things were somewhat better than in Germany, with the composite PMI at 52.0 (as expected), though this was still at a 3-month low. The notable figures were from the UK, where the composite PMI fell to 48.5 (vs. 49.5 expected), the lowest level since July 2016 in the immediate aftermath of the Brexit referendum, with both the services and manufacturing PMIs in contractionary territory, at 49 and 47.4 respectively. Indeed, the UK manufacturing reading was the worst since July 2012. The pound, which had rallied nearly +0.75% in the Asian session, gave it all back soon after the release and highlighted the challenges ahead for Mr Johnson. The hope will be that there will be a post-election bounce in the PMIs now but the overnight news adds to the uncertainty again.

Moving to the US data now, the preliminary reading for the composite PMI rose to 52.2, a 5-month high, while the NAHB’s housing market index rose to 76 in December (vs. 70 expected), its highest level since June 1999. And although the Empire State manufacturing survey came in slightly below expectations at 3.5 (vs. 4.0 expected), the reading of business conditions 6 months ahead rose to 29.8, a 5-month high.

Speaking of the US, our US economics team published their 2020 outlook over the weekend. In terms of the highlights, they upgraded 2020 growth by 0.2pp to 2.0%, mostly on more resilient consumer spending in the first half of the year. Capex should remain muted, however, as election uncertainty weighs even if trade tensions dissipate. The team now expect core PCE inflation to remain below the Fed’s target through 2022. This is a critical point given the conclusion to the Fed’s policy review in mid-2020, where they expect a dovish renaissance to the Committee’s reaction function. In particular, the team now sees a commitment to avoid the disinflationary fates of other major developed market economies pushing the Fed to cut rates by another 50bps in 2021, even in the presence of near-record low unemployment. For more details see their full outlook here: “A less than roaring start to the ‘20s and a renaissance in Fed policy”.

Yesterday we also released our latest Podzept, DB’s podcast series. In this edition we have a global economic update from Chief Economist Torsten Slok, where he discusses some of the highlights from his Monthly Chart Book, including the trade war, the Federal Reserve, and next year’s presidential election in the US and associated risks. Click here to take a further look or go straight to your usual podcast providers.

To the day ahead now, and the data highlights for markets to watch out for include the UK employment data, featuring the unemployment rate and average weekly earnings, along with the CBI’s industrial trends survey for December. From the Euro Area, we’ll get the trade balance for October, while the US releases include November’s housing starts, building permits, industrial production and capacity utilisation, along with October’s job openings data. Central bank speakers tomorrow include the ECB’s Rehn, Kazimir and Lane, the Fed’s Kaplan and Rosengren, and the BoE’s Carney.

Tyler Durden

Tue, 12/17/2019 – 07:49

via ZeroHedge News https://ift.tt/34t9cCl Tyler Durden