Non-GAAP Trade: To Hit Phase One Targets, China May Count Hong Kong Trade, Buy Ethanol

New details are emerging how China could “increase” imports from the US to about $200 billion over the next several years to comply with the Phase One trade deal, reported Bloomberg.

As a reminder, Trump’s “Phase One” deal which was “concluded” last week, has yet to be officially signed, and is expected be finalized (again) next month. Meanwhile, sources have said Beijing and Washington are working on creative ways to boost trade numbers. One way is to restart purchases of ethanol that would add around $10 billion per year in goods transshipped from the US to China.

Currently, the US doesn’t count shipments that arrive in Hong Kong then loaded on train or truck to the mainland as trade with China. The new plan would reroute shipments from the US to Hong Kong to mainland ports to boost trade figures.

In other words, we may be about to get another “adjusted” item to the lexicon of fudged financial terms: Non-GAAP Trade.

China is also expected to grant more waivers for importers of US farm products to bypass tariffs. China in November lifted a ban on US poultry shipments, with estimated exports worth $1 billion

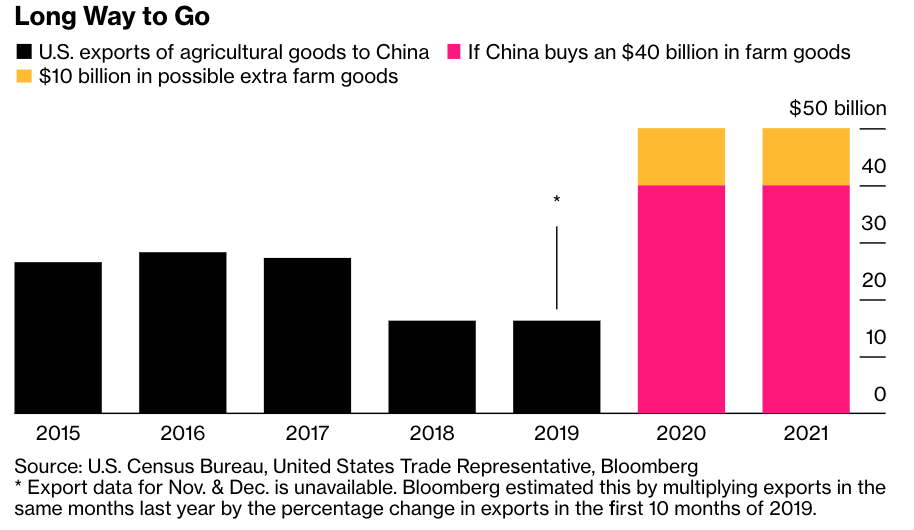

The ‘non-GAAP’ adjustments would be critical to hit the deal targets. As we noted before, the former USDA Chief Economist and USTR ag negotiator, Joe Glauber, has been “skeptical about the size of the Phase 1 deal” (a detailed explanation of why this is impossible can be read in the following thread).

1. So here is why I am skeptical about the size of the Phase 1 deal. US ag exports to China in FY 2017 were about $21.8 billion. Soybean exports accounted for $14.6 billion. pic.twitter.com/5LXRiZtjcU

— JoeGlauber–IFPRI (@JoeGlauber1) December 15, 2019

Shi Yinhong, a Chinese government adviser and international relations professor at Renmin University, echoed our own concerns and told the South China Morning Post (SCMP) that Beijing would find it challenging to hit the hard targets described by the US.

“For China, committing to and carrying out the phase one agreement is a huge challenge,” Shi said. “China will need to buy something like US$300 billion worth of US products in the next two years and lots more US agricultural goods. Does China need that amount of US soybeans?”

The proposed deal is 86 pages long, could be signed as early as next month by US Trade Representative Robert Lighthizer and Chinese Vice-Premier Liu He, but while Trump touts the deal as ‘totally done’ — the text of the agreement has yet to be translated.

There’s no question that China could increase purchases of US ag and other goods in the years ahead. Still, the damage inflicted by Trump’s economic war on China has already forced the country to diversify away from the US. For example, China has ramped up ag purchases with Argentina and Brazil, a move last month that infuriated Trump as he threatened both countries with tariffs.

China’s diversification trend comes at a time when bilateral trade between both countries is in decline.

Jia Qingguo, associate dean of international studies at Peking University, told the SCMP, “It is better to have a deal than no deal.” he added. “Just don’t have much expectation that it will significantly help alleviate tensions.”

Given the execution risks going forward and the lack of clarity on the trade deal and unrealistic hard targets, it seems that China will have trouble living up to any future agreement, and the real question is how long will the Phase One deal exist before it is scrapped.

Tyler Durden

Tue, 12/17/2019 – 09:05

via ZeroHedge News https://ift.tt/36O4n7Z Tyler Durden