One Trader Asks “Is This The Fed’s ‘Whatever It Takes’ Moment?”

Authored by Richard Breslow via Bloomberg,

It’s tempting to wonder whether there should be a reassessment as to the extent of all of the optimistic feelings that have just turbo-boosted markets. After all, this latest leg up in risk assets since the end of last week has been more than impressive, with sticker shock an understandable emotion. The latest impetus is largely predicated on all the good news from the tariff and Brexit fronts. And while a reevaluation may make sense from a policy-analysis point of view, it’s doubtful whether financial markets are prepared to do it quite yet. That’s apparently a debate for next month.

Was all of the news unambiguously good? Not to the extent declared by the participants. Can you poke holes in some of the details? Absolutely. Will it be nothing but smooth sailing going forward? Unlikely. But it appears to be good enough for now and the central banks will do the rest. You will continue to see liquidity being pumped into the financial system in heavy doses and investors are relying on that fact to sustain them.

This past September’s repo funding squeeze that was so jolting and scary may be the best thing that has happened to risky assets going into year-end. The turn may not happen totally without some volatility, but the rank fear that embraced the markets has largely dissipated. The Fed is planning what looks like some extreme operations. They are certainly proving a willingness to splash out. Soon we’ll find out just how clever they have been.

It’s as if word came down not to let those pressures happen again…Whatever it takes.

Equities, emerging markets and credit have been more than willing to take the gift and run with it. New highs or tights are taken as givens. Over-leverage and earnings challenges just aren’t on traders’ minds at the moment. Get a pullback of any consequence, on the other hand, and you will hear a lot about those subjects. Not to mention the flaws with Phase One.

Currencies and fixed-income markets are being more circumspect. In the new year, which camp proves to have been more longer-term prescient will go a long way to determine what sort of start we get off to. Either way, timing will be everything and it seems unlikely that volatility suppression will work nearly as efficiently as it has in the past.

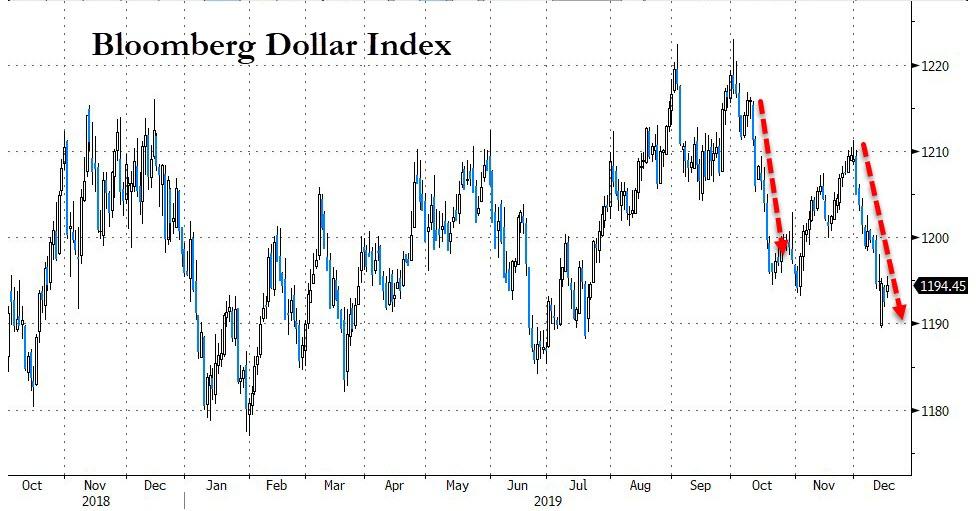

For reasons that appear to be getting way ahead of themselves, the dollar is the currency that analysts want to hate. Although, it’s worth noting how many are delaying the timing of the predicted weakening. That’s reality encroaching on wishful thinking. But they seem to have talked themselves into believing a weak dollar will be good for everyone and, in the interest of feeling good, are constructing suggested portfolios based on it.

It seems like we kick off every year expecting Europe to outperform. They might. Stranger things have happened. But let it play out first. The latest Chinese numbers, however, were impressive and a 6% growth target doesn’t look as far-fetched as it did not too long ago. India is another story. So is the notion that supply chain uncertainties will disappear and corporate investment suddenly materialize.

The U.S. currency has been probing the lower half of its trading range. So far, it has held support. Bloomberg’s compilation of analyst forecasts are for that not to be the case going forward. It will be crucially important to see if all of the central banks with easing biases begin to be more neutral. As of now, the numbers still are in the dollar’s favor.

It would appear that there is still plenty of money to be made or lost, even at this time of year. And technical levels are proving to be remarkably helpful guides. Double and triple tops and bottoms galore. Pivot levels begging to be relied upon. But, as we have learned time and again, often what happens in December, stays in December.

Tyler Durden

Tue, 12/17/2019 – 11:25

via ZeroHedge News https://ift.tt/35A5wju Tyler Durden