Unilever Shares Plunge After Sales Growth Forecast Lowered

Unilever NV shares trading on the Euronext Amsterdam have plunged 6% Tuesday morning following a warning from the company that it will miss full-year revenue growth targets, reported the Financial Times.

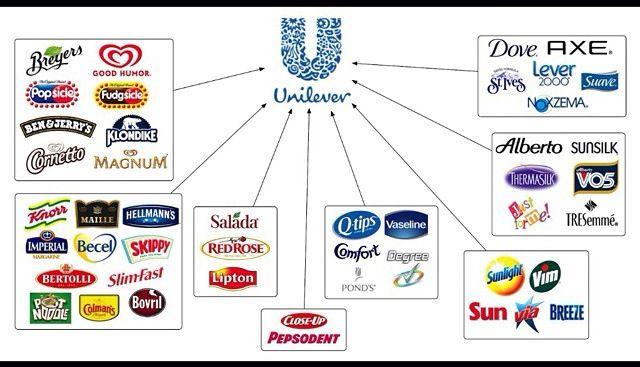

Unilever is a British-Dutch transnational consumer goods company, and one of the largest in the world, its products include food and beverages, cleaning agents, beauty products, and personal care products. Some of its most popular brands include Axe, Dove, Lipton, Pure Leaf, Magnum, Heartbrand ice creams, Rexona/Degree, Sunsilk, and Surf.

Unilever is a bellwether company for the global consumer, given the range of consumer staple products and geographical spread, has warned sales growth for 2019 will miss the 3-5% target, expected to come in below the lower end of the range (sub 3%).

The company is also forecasting another stagnate year for the consumer. Its growth is expected to print below 3% for 1H20 with full-year growth sub 3%.

“Due to challenges in certain markets, we expect a slight miss to our full-year underlying sales growth delivery. Growth remains our top priority and we are confident we have the right strategy and investment in place to step up our performance,” said Unilever’s chief executive Alan Jope.

Jope blamed a global synchronized slowdown that has deteriorated South Asian markets. He called the North American market “challenging.”

Stagnating consumers in developed economies have pressured sales in the last several quarters, where consumers are cutting back on spending as their respected economies decelerate.

The latest quarterly sales show developed markets fell 0.1%, with a 5.1% increase in emerging markets.

RBC analyst James Edwardes Jones said “Unilever is squarely blaming its markets . . . we think there’s more to it than that.”

Given the company’s consumer staple products and geographical reach, especially against the backdrop of a global slowdown, perhaps the weakness that has triggered a manufacturing recession across the world has finally transmitted weakness into consumers. If so, then this means the global downturn could be broadening.

Tyler Durden

Tue, 12/17/2019 – 05:42

via ZeroHedge News https://ift.tt/2rL07Yo Tyler Durden