China Is Facing A $400 Billion “Liquidity Hole” In January

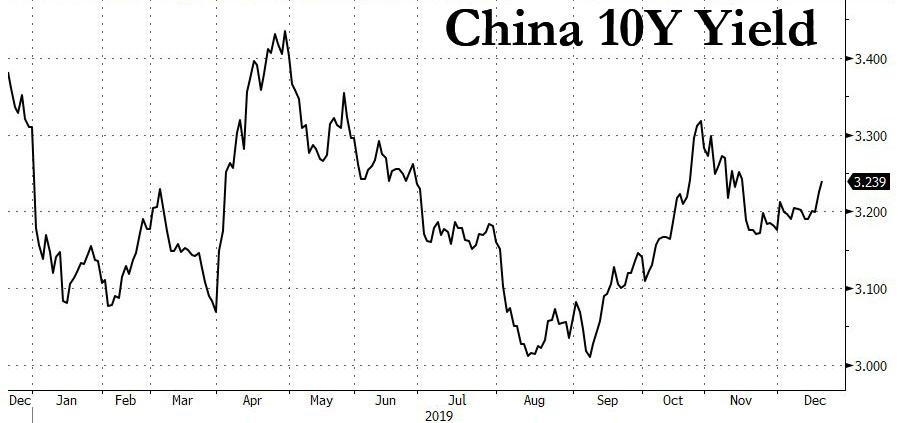

It’s not just the US which is facing an unprecedented liquidity crunch as a result of a shortage of reserves, which threatened to lock up the all-important repo market: China is also facing a potentially destabilizing “liquidity hole” of 2.8 trillion yuan ($400 billion) in January according to Guotai Junan Securities, as people across the nation will withdraw cash for the Lunar New Year holiday. That, according to Bloomberg, means bond traders expect the central bank to unlock funds to avoid the liquidity-driven panic seen in October, when the benchmark 10-year yield spiked the most in six months.

And just like in the US, where the Fed responded by backstopping nearly $500 billion in liquidity in the form of term and overnight repos to help dealers and banks bridge the gap to 2020, some analysts expect the People’s Bank of China to ease aggressively in the coming weeks, by cutting the RRR rate, reducing the amount of cash lenders must hold as reserves. It could also opt to inject funds through its daily open-market operations, according to others. But, as Bloomberg notes, no analyst is calling for a massive net liquidity injection or a benchmark interest-rate cut, as Beijing won’t want to risk inflating prices when the consumer price index is at a seven-year high largely due to soaring pork prices due to China’s ongoing struggle with the consequences of “pig ebola.”

“Bonds will get a short-term boost next month as China may cut reserve ratios to offset the liquidity drainage,” said Overseas-Chinese Banking economist Tommy Xie, adding that just like the Fed’s Not QE is not really QE4 (spoiler alert: it is), this can’t be viewed as the start of a broad easing cycle. “The central bank just wants to tailor the solution to the liquidity problem. The long-term outlook for the debt market will still hinge on China’s economy and the trade negotiations.”

Just like in the US, where year-end liquidity disappears every year due to balance sheet window dressing and regulatory requirements, in China cash supply tends to drain ahead of the week-long holiday, which in 2020 falls at the end of January, when households and corporates typically withdraw money from banks to pay for gifts and travel.

That alone will drain 1.5 trillion yuan from the financial system next month, Guotai Junan analysts wrote.

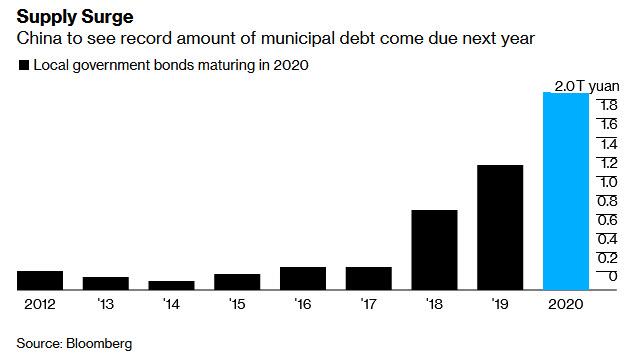

Another 1.3 trillion yuan will be drained due to factors such as banks buying newly issued local government bonds, according to China’s second-largest brokerage.

As we noted in October, when we pointed out that China’s bond market faces turmoil amid a maturity deluge, more than 2 trillion yuan in notes mature in 2020, and fresh debt to refinance the borrowing thus shoring up economic growth will probably start hitting the market soon.

Anticipating a potential liquidity crunch, in November China ordered local governments to speed up the issuance of “special bonds” earmarked for infrastructure projects.

And while the Fed has been addressing the liquidity shortfall largely through “temporary” repo operations, at least until the complaints from the Dealer community grew too loud and forced Powell to start buying up $60 billion in T-Bills every month to permanently inject liquidity, China’s easing has been similarly targeted with the central bank cutting the reserve requirement ratio (RRR) by 1% before the holiday in 2019, while also injecting more than 1 trillion yuan via open-market operations over a week. Similarly in 2018, a targeted RRR cut also went into effect before the celebrations, and thanks to the fresh liquidity, China’s 10-year sovereign yield dipped in the month before Lunar New Year in both years.

Already the PBOC is starting to gradually boost liquidity: on Wednesday, the PBOC injected a net 200 billion yuan into the financial system via reverse repurchase agreements (the Chinese equivalent of a US repo is called a “reverse repo”) after skipping those operations for 20 sessions. It also lowered the rate on 14-day reverse repos to 2.65% from 2.7%.

Quoted by Bloomberg, Citi economist Liu Li-gang said the central bank will cut RRR to unleash cash because it “can immediately inject massive liquidity to the system.” Meanwhile, Nomura’s chief China economist, Lu Ting, said Beijing is more likely to offer medium-term loans to banks instead.

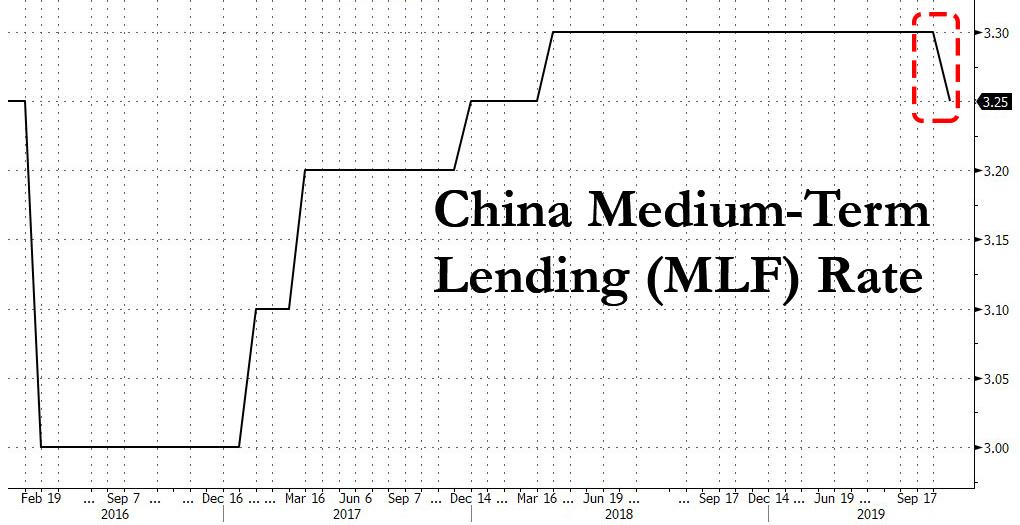

In both cases, however, rising consumer prices, fueled by the surging cost of pork, are seen capping how much liquidity Beijing can provide without further stoking inflation. This is something we discussed a month ago, when we said that the biggest issue facing the PBOC is how to trigger an economic boost, and add liquidity, without sending near record food prices even higher. While in early November, the PBOC modestly, and at long last, cut one of the central bank’s main lending rates (the MLF) by a tiny 5bps after the Fed had eased three times in 4 months …

… analysts are concerned that the PBOC will likely refrain from aggressive intervention in the market until food inflation is under control, amid fears of growing social discontent over pork hyperinflation. As Bloomberg also notes, “while further monetary stimulus would help companies struggling with weakening demand, deflation and higher tariffs, even faster inflation would hurt households more.”

This policy dilemma has left investors in Chinese government bonds cornered, with the yield stuck in a 7-basis-point range over the past month.

To be sure, if one goes off the economy, which is growing at its slowest pace since the 1990s, rates are headed even lower. However, November data was more encouraging; add the phase-one trade deal agreed with the U.S. last week, and Beijing has even fewer reasons to go aggressive on stimulus measures.

It all means that after a brief spell in the sun in January, a rally in Chinese sovereign debt is unlikely to last, at least according to Bloomberg. Indeed, the return of risk appetite is already hurting the notes, with the 10-year yield rising to the highest level in a month on Tuesday. The rate climbed 1 basis point to 3.24% as of 5:14 p.m. in Shanghai.

“In 2020, the bond market will be torn by transitory improvements in sentiment, triggered by the trade deal and economic data, and concerns on long-term growth and risks such as defaults,” said David Qu, an economist for Bloomberg Economics.

Which brings us to the humorous conclusion from RaboBank’s Michael Every who summarizes the liquidity trends in the US and China and juxtaposes them against… Star Wars:

So all is well in China and yet they are short USD400bn…and all is well in the US, but they are short USD500bn over the same time-frame, requiring the Fed to step in big-time repo- and NOT-QE-wise. Note this USD900bn figure is what Disney hopes ‘The Rise of Skywalker’ will make at the box office over the period: coincidence, or is it The Farce moving things? And note that even if one starts writing without knowing where it’s all going to end, it’s still possible to end up with a better conclusion than insiders hint Star Wars IX director Jar Jar Abrams has.

Tyler Durden

Wed, 12/18/2019 – 18:05

via ZeroHedge News https://ift.tt/2S3swU9 Tyler Durden