Cryptos Continue Collapse Overnight After Chinese Scammer Allegedly Liquidates

Crypto markets are under pressure for the 3rd day in a row making for another ugly week as the year comes to a close…

Altcoins are underperforming Bitcoin but they are all falling hard this week…

Source: Bloomberg

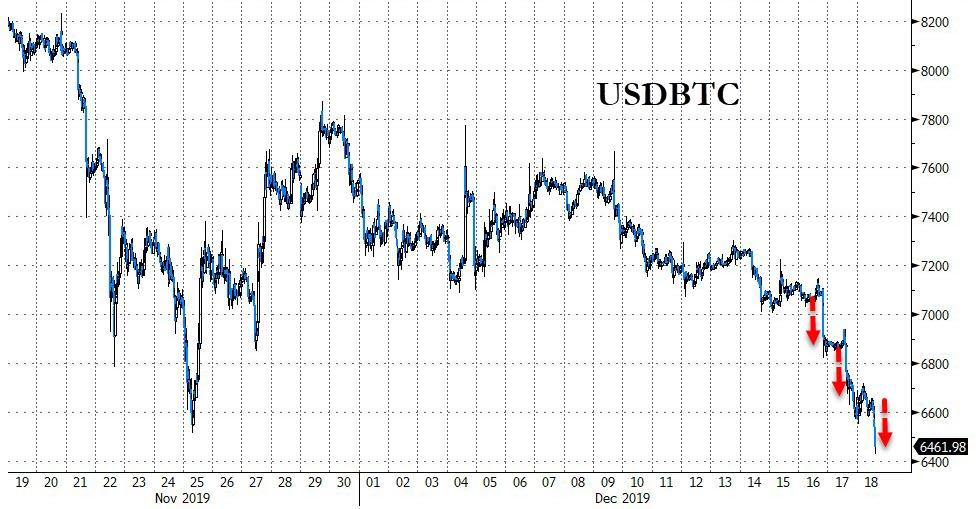

But, Bitcoin plunging close to the critical $6400 level…

Source: Bloomberg

The last three days have seen notable dumps overnight in Bitcoin…

Source: Bloomberg

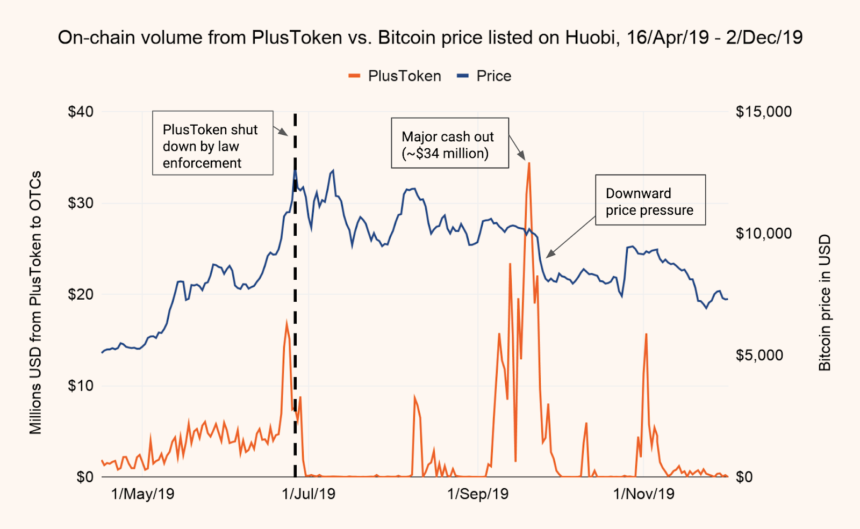

A lot of chatter over the catalyst for this systemic and major selling has been associated with a Chinese cryptocurrency scammer allegedly liquidated his stolen horde via over-the-counter markets. The initial sell-off by PlusToken caused a domino effect, causing mass liquidations.

As NewsBTC.com’s Yashu Gola reports, PlusToken, a fraud scheme that duped investors of more than $2bn, dumped huge bitcoin stockpiles from its anonymous accounts, according to Chainalysis.

The New York-based blockchain consultancy cited an internal investigation that showed PlusToken scammers on a systematic crypto liquidation spree. Some of them have been actively selling bitcoin since June – right after the cryptocurrency established a year-to-date high of circa $14,000.

It was the same period when the Chinese authorities nabbed people suspected to have been involved with the PlusToken scam.

“Since that time, market observers have often pointed to possible sales tied to PlusToken suspects not in custody as one of many reasons for price declines,” wrote Chainalysis.

The Cascading Effect

The latest bitcoin crash took the cryptocurrency’s rate down by close to 4 percent. The wild move downhill accompanied a sudden spike in volumes, validating an interim breakout that NewsBTC predicted in one of its analysis.

The sudden dump prompted bitcoin to come out a sideways trading range | Source: TradingView.com, Coinbase

Chainalysis noted that PlusToken had so far cashed out at least $185mn worth of bitcoin via OTC desks. Their cashout strategy, therefore, could have either manipulated the market dynamics directly or have indirectly changed the perception of traders towards bitcoin.

“We can say that those cashouts cause increased volatility in Bitcoin’s price and that they correlate significantly with Bitcoin price drops,” added Chainalysis.

PlusToken On-Chain volume against the bitcoin price | Source: Chainalysis

But the most fearsome takeaway remains the scammer’s likelihood of continuing the price dump. Chainalysis’s study shows that the entity still holds a massive stash of bitcoin that it might liquidate at a later stage. That raises the prospects of more price crashes unless there is an adequate demand to match the scammer’s supply flow.

Tyler Durden

Wed, 12/18/2019 – 08:28

via ZeroHedge News https://ift.tt/2Z24L0a Tyler Durden