Even With Low Unemployment, Borrowers Are Being Rejected For Car Loans

The government keeps telling us that the labor market is strong and unemployment is low. Yet, as SHTFplan.com’s Mac Slavo notes, regardless, borrowers are increasingly being rejected for vehicle loans while consumer debt continues to rise.

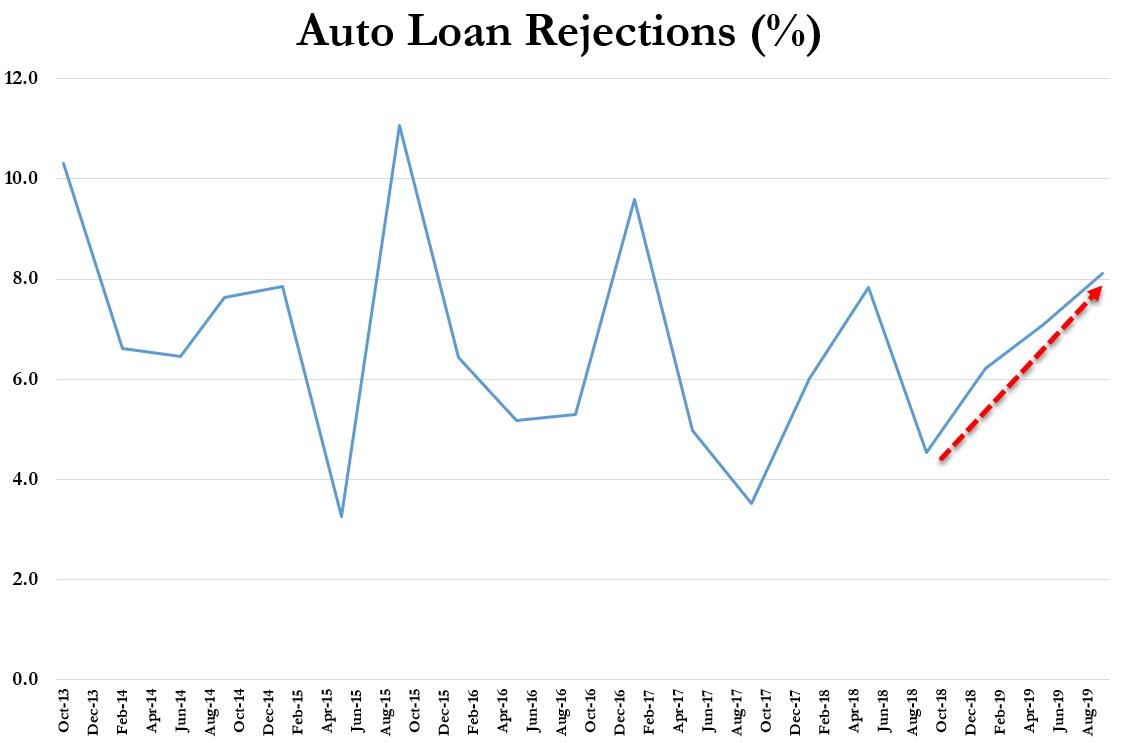

A Federal Reserve Bank of New York survey of consumer credit released Monday showed a spike in the rate of auto-loan rejections, to 8.1% in October from 4.5% in the same month last year. That means they have almost doubled. It could be that borrowers are “tapped out” when it comes to debt, as SHTFPlan reported yesterday.

Market Watch reported that this lined up with a small dip in the unemployment rate. November saw a surprise dip in the U.S. unemployment rate, to 3.5% from 3.6%, matching a 50-year low and fueling optimism that a strong American consumer can help keep the economy chugging along beyond its record 11th year of expansion.

“The reported rejection rates for credit cards, mortgages, and mortgage refinancing applications all declined compared to 2018,” according to the Fed’s snapshot of its annual survey, which covers consumer experiences when applying for auto loans, credit cards, credit-card balance increases, mortgages, and mortgage refinancing.

Now beyond the decade mark, these years of easy money policies have allowed consumers to rack up debt in the wake of the Great Recession. Easy auto credit has fueled concerns that U.S. households could be on the verge of yet another financing bubble, only a few years after many borrowers emerged from the worst foreclosure crisis since the Great Depression.

Consumer debt is also still rising. It grew 4.8% in October versus a year earlier, however, some analysts at Bank of America Global Research see a more stable picture forming next year. “We believe consumer debt will continue to grow but the pace will continue to moderate, with expectations for slower growth in consumer spending (+2.3% YoY in 2020) and relatively stable lending standards,” wrote a team of analysts, led by Chris Flanagan, in a weekly note to clients.

Brandon Smith, Founder of Alt-Market.com, adds that perhaps the problem of record high consumer debt can be explained by the fact that REAL unemployment is likely closer to 21% and high paying full time jobs have been slowly replaced with low paying part time service sector jobs .

The past two years have seen a massive spike in US debt levels in every sector including corporate, all while US consumer spending has started to decline. It also makes perfect sense that the rejection rates for loans are quickly rising as bank liquidity is shrinking and the Fed’s deliberately inadequate repo loans are only keeping the system from crashing at full speed (for now). Most car dealerships are middlemen or agents for the banks that provide car loans. When someone is rejected for a loan from a car dealership, they are actually being rejected by a bank whose cash pool is shrinking.

Tyler Durden

Wed, 12/18/2019 – 14:25

via ZeroHedge News https://ift.tt/2PypNjO Tyler Durden