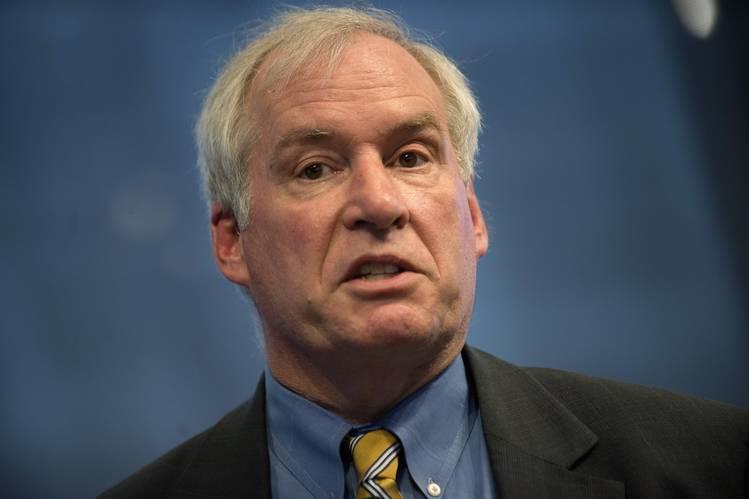

Fed President’s Shocking Admission: “We Need To Be Pretty Focused On Asset Prices, Not Just Inflation”

There was an stunning admission by Boston Fed head Eric Rosengren on Tuesday, when during an audience Q&A after a speech to The Forecasters Club of New York, the voting FOMC member (and chronic dissenter – Rosengren has voted against all three rate cuts made by the Fed this year) the former dove warned that lower rates could encourage excessive risk taking and over-leveraging, which would create great risks during a downturn. More importantly, he confirmed that high asset prices are a direct function of low rates, and thus Fed policy, and it is the Fed that is responsible for not only all prior bubbles, but the biggest one them all: the one right now.

“I do have concerns about that financial stability. I would prefer probably a different level of rates,” the Boston Fed President said, confirming that low rates will eventually result in a financial crisis, and that only higher rates can lead to a final outcome that is not apocalyptic.

Rosengren said that following three rate cuts this year and the launch of QE4, he remains worried that lower rates could encourage corporations to take on excessive risk and borrow too much. The policymaker said companies that are over-leveraged may have to lay off more workers in a downturn, which could amplify losses and cause more damage to the economy.

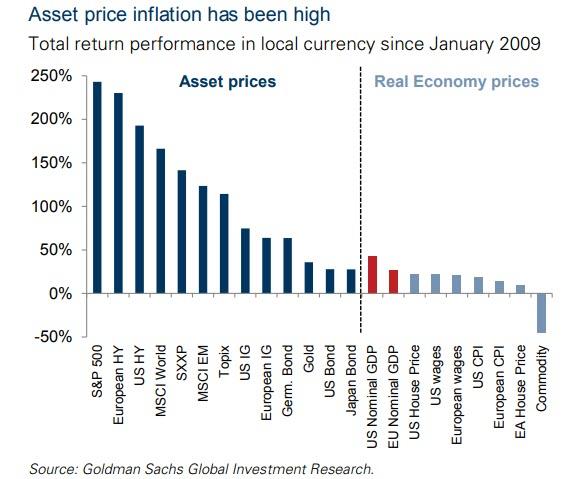

Most importantly, the Boston Fed confirmed what we have been saying all along: the Fed should be worried not just about economic inflation – which remains muted – but also asset prices, which have been gripped by runaway inflation over the past decade.

“If you look at the last two recessions, they were not situations where inflation got out of control. They were situations where asset prices went way up and then came way down. So if your goal is to avoid recessions, I think we need to be pretty focused on asset prices not just inflation“, Rosengren said in a moment of shocking candor and transparency.

He was referring, of course, to the chart below which we have shown on many prior occasions, yet which most of Rosengren’s peers refuse to admit even exists.

Rosengren’s conclusion, while spot on, to wit “If what you want to do is avoid recessions in the future, you have to be thinking about what is happening to asset prices as well”, will be ignored by everyone, from investors to policy makers, because if the Fed admits that Rosengren is right and the Fed has to start “paying attention” to the hyperinflation it has created across asset prices, then the party is over. It’s even worse when considering that the Fed has blown such an asset price bubble in equities and other assets, that the only possible outcome is either for the bubble to burst, or to keep growing exponentially, making the resulting crisis far worse.

Of course, while the Fed may still be ignoring what is so blatantly obvious to everyone else, the problem is that increasingly more ordinary people are realizing that in a time when the S&P is up 27% and wages are barely higher for the 10th consecutive year, there is something catastrophically wrong… and that thing is called monetary policy. And once the tipping point of populist anger finally arrives and an angry platoon of pitchfork-dragging discontents arrives at the Fed building in D.C., that’s the moment when the insanity of the past decade will finally be over. Insanity, which incidentally started with Ben Bernanke’s explanation in a WaPo op-ed just why the Fed’s true mandate is to push stock prices higher, because – somehow – it would stimulate the economy (recall: “higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending”). Instead, all the Fed’s mandate of levitating asset achieved was to make the top 0.01% richer than ever, crush the middle class, and unleashed a tidal wave of populist anger that will eventually culminate with an angry mob burning down the Marriner Eccles building. For the sake of everyone, we can only hope that said mob does not wait too long.

Tyler Durden

Tue, 12/17/2019 – 22:25

via ZeroHedge News https://ift.tt/34s8Pb6 Tyler Durden