FedEx FUBAR, Tesla Tops, Crypto Chaos, & The Steepest Yield Curve In 13 Months

Anyone else feel this way?

China was flat to lower overnight as the post-trade-deal euphoria has well and truly worn off…

Source: Bloomberg

Europe was mixed once again with Germany the biggest laggard and Italy leading…

Source: Bloomberg

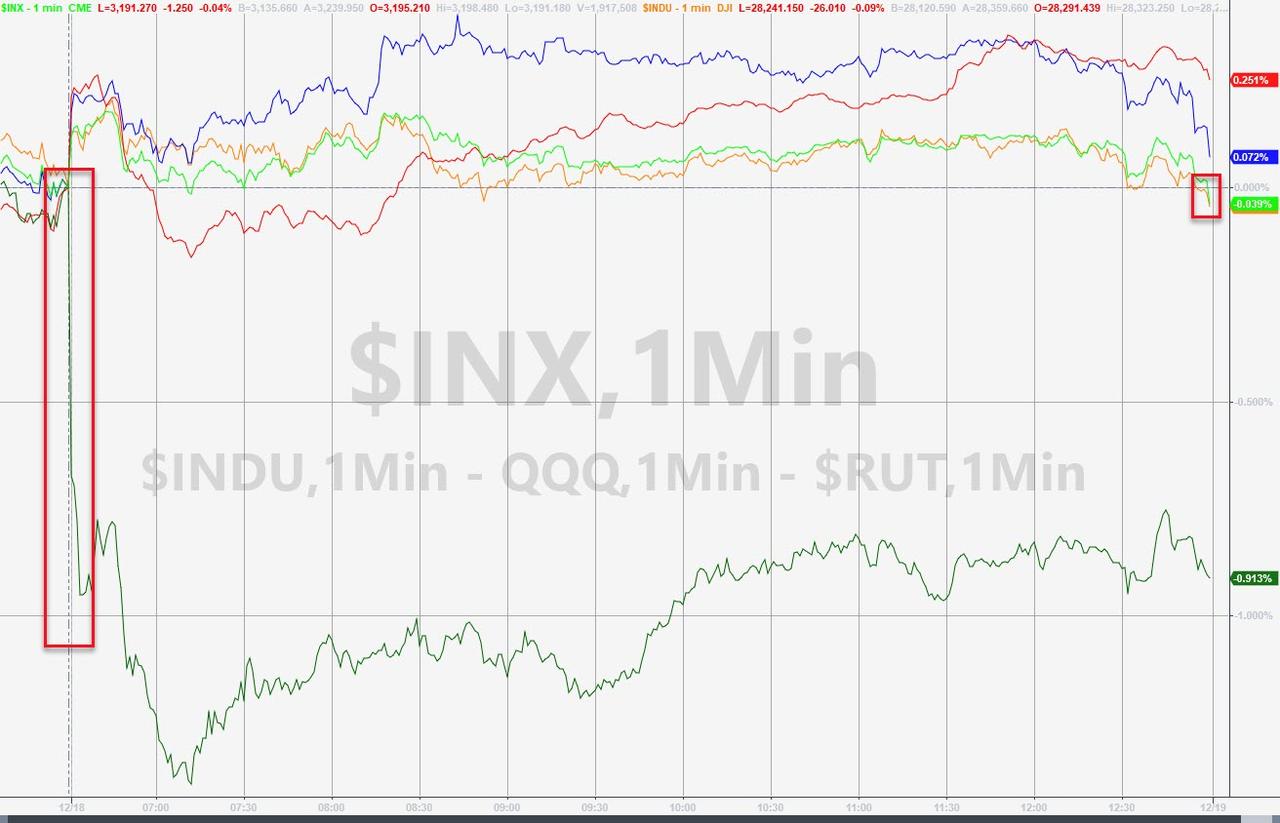

The Dow and S&P closed red – breaking their win streak but Nasdaq ended higher (6th day in a row – longest Nasdaq streak of gains since July), except for Transports…

Source: Bloomberg

Trannies were crushed by the clubbing of FedEx…

Source: Bloomberg

And Small Caps were lifted by yet another short-squeeze…

Source: Bloomberg

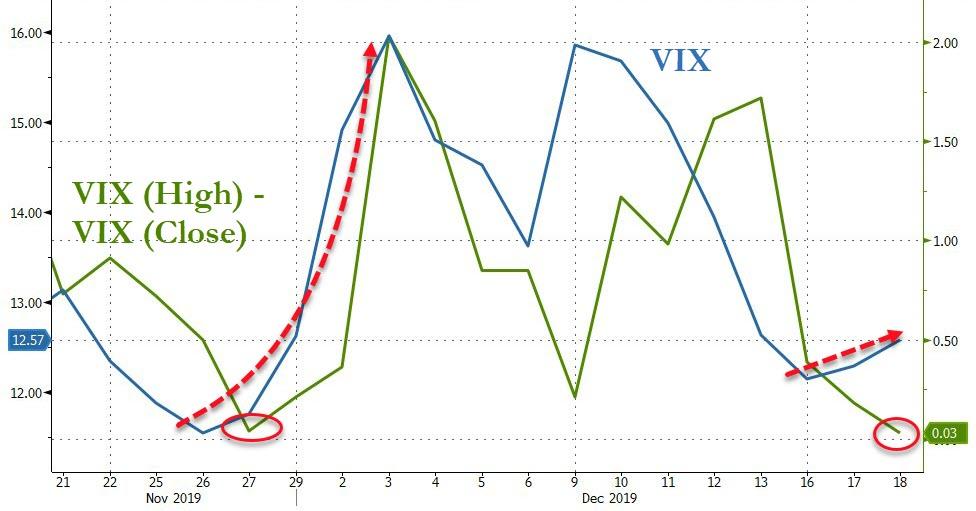

VIX was higher on the day, despite stocks being higher, and saw a second day in a row where vol spiked at the cash open (high gamma ahead of the big op-ex on Friday is causing chaos)…

And VIX closed at the highs of the day, notably decoupling from stocks this week ahead of op-ex…

Source: Bloomberg

The last time VIX closed this near its highs of the day was Nov 27th and VIX was also already rising that time – before spiking higher…

Source: Bloomberg

Defensives continue to lead this week’s gains…

Source: Bloomberg

While FedEx was a bloodbath, Tesla shares hit a new record high above $390 with an incredible performance (short-squeeze) in the last few months. It’s just that bonds have ignored the last push…

Source: Bloomberg

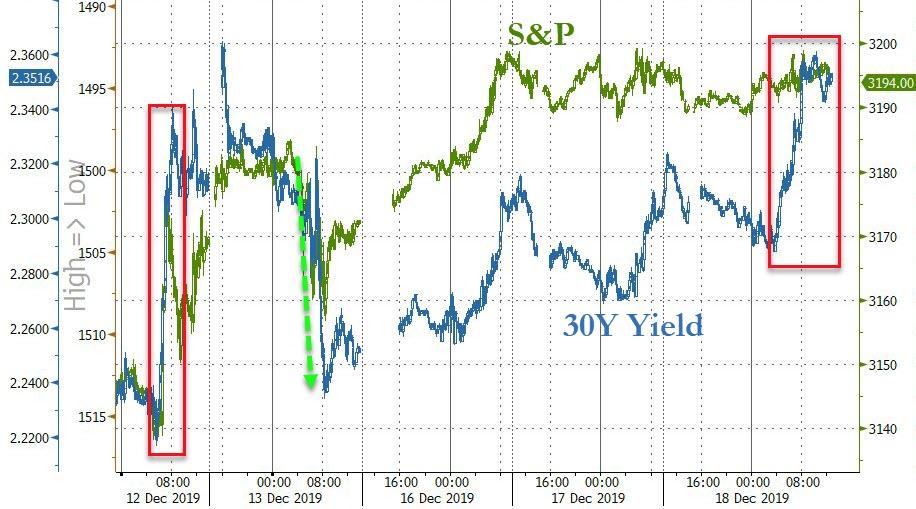

Treasury yields were higher again today, led by the long-end (30Y +4bps) as the short-end outperformed (2Y +1bp)…

Source: Bloomberg

30 Yields tracked up to test Friday’s opening highs, and rolled over. Note the pattern that keeps repeating – Asia buys bonds, Europe sells, US (late session) buys bonds again…

Source: Bloomberg

Bond yields caught up to stocks today post-trade-deal…

Source: Bloomberg

The yield curve has steepened dramatically – with 2s10s closing at its steepest since early November 2018…

Source: Bloomberg

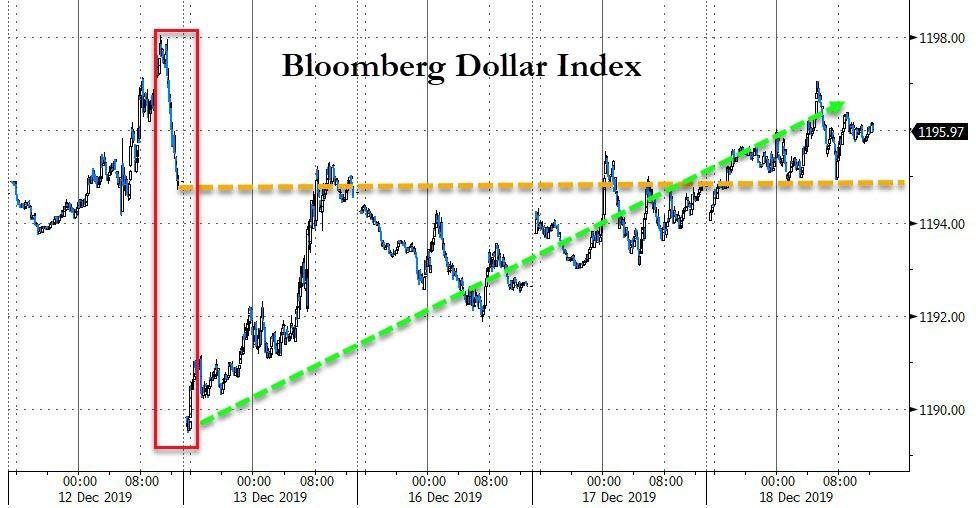

The Dollar Index rallied once again, erasing all the Thursday night plunge…

Source: Bloomberg

Offshore Yuan continues to go nowhere, hovering around 7.00/USD despite stocks surging…

Source: Bloomberg

Cryptos had a crazy volatile day, crashing overnight (again) then panic bid back during the US day session, with Bitcoin almost erasing all the week’s losses…

Source: Bloomberg

With Bitcoin dropping to $6425 before soaring back to almost $7100…

Source: Bloomberg

After an early drop, all commodities rebounded strongly with oil leading the way after a small crude draw…

Source: Bloomberg

WTI topped $61 for the first time since September – oil is up 11 of the last 13 days, but is accelerating notably out of its uptrend channel…

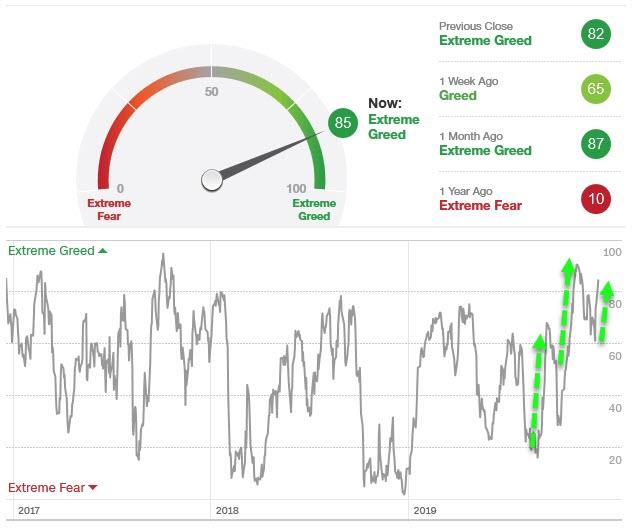

Finally, markets are at “extreme greed” levels once again…

Source: CNN

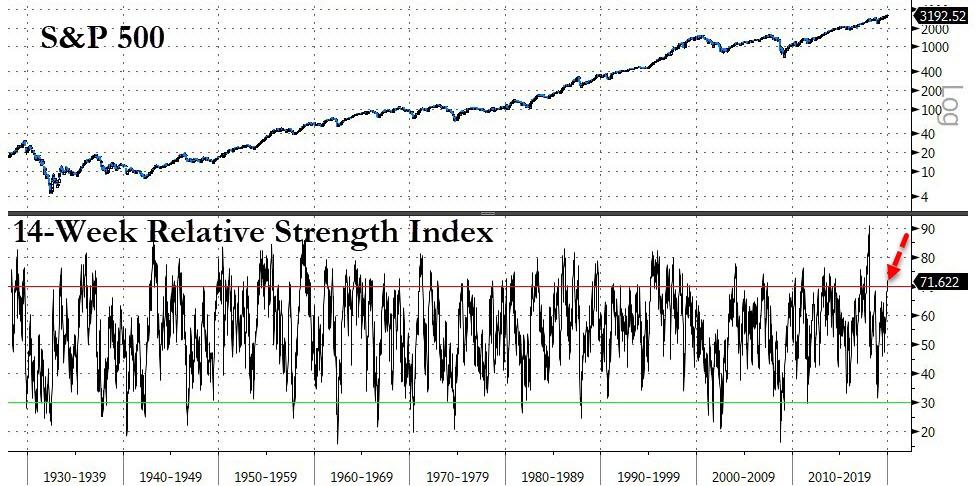

And are extremely overbought on a longer-term basis…

Source: Bloomberg

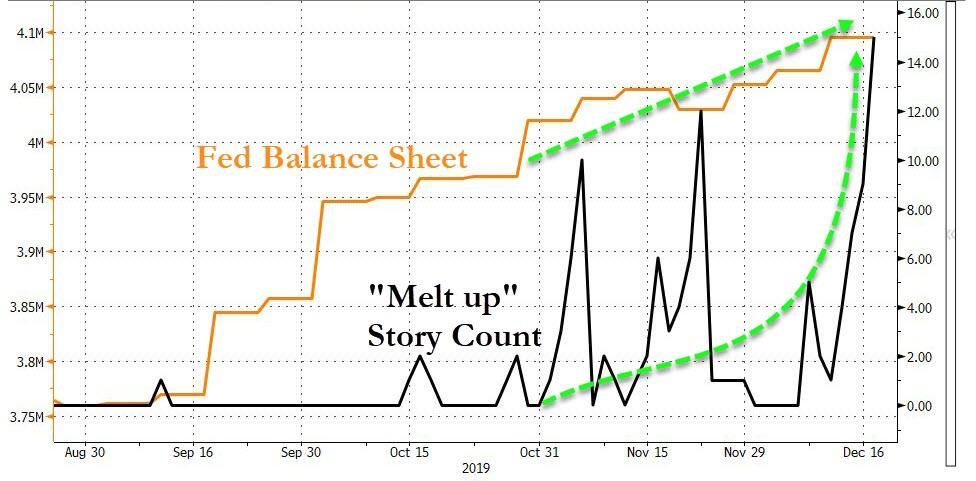

Does make you wonder…

Source: Bloomberg

Tyler Durden

Wed, 12/18/2019 – 16:02

via ZeroHedge News https://ift.tt/2tsaHUl Tyler Durden