“I Couldn’t Have Been More Wrong”: Why Stan Druckenmiller Became A “Coward” In A Market That Makes No Sense

For investors who are looking for some quality markets content to help distract them from the onslaught of impeachment day political news, Bloomberg TV released a lengthy interview with Stanley Druckenmiller, the macro legend who said last year that he had dumped all his stocks and piled into Treasuries because his economist friends feared “something wasn’t right”.

He definitely made money on that bond position, but any investing professionals who sat out this year’s torrid equity rally are probably doing some soul searching. So, like many other investing luminaries have since trade skepticism played out in the markets over the summer and fall, Druck is switching gears, and tentatively embracing risk once again.

Despite (barely) managing a double-digit return in 2019, the billionaire investor fears he’s becoming “too conservative” in his old age, according to an interview with Bloomberg’s Eric Shatzker.

As a result, Druck now believes he was mistaken when he thought he saw “warning signs” in prices and believed a period of “low returns” was coming: “I couldn’t have been more wrong.”

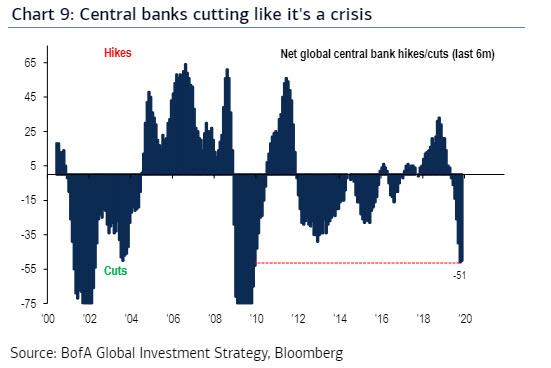

Indeed he couldn’t because what caused things to turn around was a full blown capitulation by central banks who are now easing at the fastest rate since the 2008 financial crisis, even though there is no actual looming crisis this time.

As a result of his monetary generosity, he’s opened several positions designed to take advantage of recovery in risk sentiment, i.e., central bank liquidity.

It’s not that Druckenmiller has sworn off taking risk. He owns copper and U.S. and Japanese equities, and he’s wagering on the Canadian and Australian dollars while shorting the yen and long-dated Treasuries – all positions that should profit in a stable-to-growing global economy.

And in recent weeks, anticipating a pro-Brexit vote in the U.K., he bought the pound and banks including Barclays Plc and Lloyds Banking Group Plc. Only he wishes he’d been bolder.

“I’m just too conservative in my old age,” Druckenmiller, 66, said in an interview on Bloomberg Television. “I was well-positioned, but very timidly.”

Setting aside whatever perceived negative signals Druck sees, and whether or not he agrees with the monetary policy espoused by central bankers (spoiler alert: he does not), the pragmatic billionaire points out that with the “unprecedented monetary stimulus” in place, “it’s hard to have anything other than a constructive view on the market’s risk“, which is also why Druckenmiller has now turned bullish… but only slightly:

“We have negative real rates everywhere and negative absolute rates in a lot of places,” he said. “With that kind of unprecedented monetary stimulus relative to the circumstances, it’s hard to have anything other than a constructive view on the market’s risk and the economy, intermediate term. So that’s what I have.”

A lengthy segment of the interview seemed to focus – as most BBG TV interviews seem to do now, for some reason – on the Democratic contenders for president, particularly Elizabeth Warren. Asked if he saw an opportunity for a “Warren hedge” – it would make a catchy headline, no doubt – Druck almost chuckled.

“You can just short stocks,” Druckenmiller responds. “It’s not real complicated. You could probably sell the dollar.”

And that’s probably good for Druckenmiller. Because while Druckenmiller concedes that Warren would be bad for the market, in theory, she could be good for his asset-management business.

Meanwhile, the billionaire also noted that the upside down market, manipulated by central banks, in which tape bombs from the Trump admin can land at any minute, has made traditional investing virtually impossible: “For reasons even he doesn’t fully understand, Druckenmiller said he’s “become a coward” since closing the hedge fund in 2010.

He finds he doesn’t trust himself as much or feel compelled to put on trades as fearlessly as when he was competing with rival managers. Add to that the unpredictability of everything from trade policy to geopolitics in the Donald Trump era and Druckenmiller isn’t sure anymore what investments are safe or secure.

“This administration, with wondering about where the hell the next bomb is coming from, just doesn’t allow me to take some of the positions I’ve taken historically where I just thought it was a one-way bet,” he said.

Druckenmiller has always outperformed during bear markets, so a Warren presidency would probably be “good for my business,” he concedes. But that doesn’t mean he’s going to vote for her.

Before affirming that he’s a believer in free-market capitalism and deeply suspicious of the surge in socialist passions that has gripped the American public in recent years, Druck went on to say he’s “a little offended” by a certain media narrative being pushed by leftists.

“All this complaining about failed capitalism and the need to improve capitalism and capitalism is a failure…I’m a dyed in the wool capitalist who believes in free markets, believes in creative destruction etc. and I’m a little offended by the narrative in the media, not that it’s anti-capitalist, but on the facts.”

He has a point: The media narrative is that wages are stagnating as the cost of living rises, supposedly guaranteeing that the millennial generation will be the first generation in modern history to enjoy a lower standard of living than their parents. And while there’s certainly some basis to that, as Druck points out, all of the socialists’ warnings about capitalism and endemic poverty simply have no basis in fact.

“I don’t think most people are aware, let’s just take poverty in the United States, it was 16% in the financial crisis, and it’s at 13% now. Is a 13% poverty rate low enough? Absolutely not. But do you think 99% of Americans would guess too high or too low on the change in the poverty rate over the last five years or ten years?”

Since 1999, when you had 1.7 billion people in the world in extreme poverty…the number today is 700 million…one billion people have been lifted out of extreme poverty in the last 20 years. Why? Because China adopted a free market model.”

But it’s not just the leftists who are dragging America away from its capitalist ideals, Druck warned. President Trump isn’t helping, the investor said, going so far as to compare his office to the Politburo. For the record, Druck would be okay with a measure of higher taxes. But he fears negative rates are killing capitalism.

“When you have a president of the United States who puts hundreds of billions in tariffs and then goes and picks and chooses individual economic actors who pay those tariffs and those who don’t, it might as well be the politburo,” Druckenmiller said. “When you have monetary policy around the world with negative rates, you cannot have capitalism if you don’t have a hurdle rate for investment.”

Incidentally, after warning a year ago that the Fed had hiked rates too far, today he thinks they’ve gone too far in the other direction, and tells Bloomberg that “with more certainty over U.S. trade policy and Brexit, and the unemployment rate at a historic low, the Fed should be raising its overnight rate target.” Of course that won’t happen, which assures that the current asset bubble – the biggest in history – will eventually pop with dire consequences:

“I will go to my grave believing that the financial crisis happened because of bubbles created by easy money,” Druckenmiller said in the interview. “And then this crazy president saying we need negative rates to compete with negative rates in countries where they clearly aren’t working. It’s the most anti-capitalist idea I could ever dream up.”

So Druck admits what we have been saying all along: the kind of centrally planned monetary insanity on display in Europe, Japan and now the US is tantamount to communism, and predictably, it will all end in tears again. But what does one of the greatest investors in history know: after all, there is always some fintwit “expert” who, for lack of an actual job, is eager to advise anyone else who listens that those warning about bubbles are idiots (just remember to again bail out these “experts” after the next crash).

That doesnt mean we cant see a bear market and a recession in the next year or two or three. Just means that those screaming about bubbles are idiots.

— Yield Curve (@TenYearNote) December 18, 2019

Despite his chronic anxiety, Druckenmiller remains an optimist, and hopes though philanthropies such as the Blue Meridian Partners organization he chairs, to create what he calls “economic mobility” for those less fortunate. As for stocks, he doesn’t think either Trump or Powell will do anything to upset the markets, in the near term.

“One of the reasons I’m pretty sanguine right now is I think we’re close enough to the election, at least we can breathe for a few months.”

The problem is that with the S&P at all time highs, everyone agrees with him. And it’s when everyone shares the same opinion, that the unexpected happens.

Tyler Durden

Wed, 12/18/2019 – 11:05

via ZeroHedge News https://ift.tt/2PyrbTr Tyler Durden