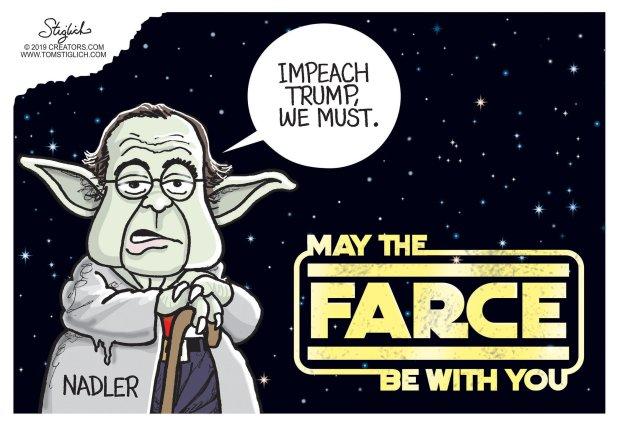

May The Farce Be With You

Submitted by Michael Every of Rabobank

For markets, yesterday was a continuation of what we saw Monday: US equities at record highs, leading many others upwards; bond yields off the highs of the day but also higher (US 10s at 1.88% at time of writing); and most big FX crosses seeing the USD edge lower, while CNY remains basically at Lucky Seven. Meanwhile, in the background to those markets today is the day we get to say May The Farce Be With You.

This is because the last Star Wars movie ‘The Rise of Skywalker’ is being released for early screenings after its premiere in Hollywood last night. Like most folks I love the first trilogy, which was mythic goodies vs. baddies; I wondered why the second trilogy involved taxation of trade routes and people saying “So this is how democracy dies…with thunderous applause” – until recent politics made George Lucas again look a visionary; and the latest trilogy is just expensive fan fiction so far. Indeed, the farce is that Disney started to make a pop-culture-defining, multi-USDbn movie trilogy without an idea of how it was all going to end! They have literally been making it all up as they go along, hoping obvious plot-holes and logic- and canon-defying “subverting” plot twists can be plastered over with special FX and marketing.

A bit like central banks, if you ask me.

Let’s hope Star Wars IX ends well, but even some of the industry shills carefully selected by Disney to watch it last night have given it the thumbs down.

Today is also likely to be the day US President Trump is impeached, which has been quite the epic saga with 1970s and 1990s precedents – and quite the farce. The day before this historically-important vote is taken, a US secret surveillance court has rebuked the FBI for its handling of its original application to wiretap former Trump campaign-advisor Carter Page. The judge stated the FBI’s actions were “antithetical to the heightened duty of candor” owed to the government by the Bureau, and moreover “The frequency with which representatives made by FBI personnel turned out to be unsupported or contradicted by information in their possession, and with which they withheld information detrimental to their case, calls into question whether information contained in other FBI applications is reliable.” Recall that without the Page wiretap there would almost certainly have been no Russia-gate, and from there no Ukraine-gate.

But back to Ukraine-gate, and to farce, as Trump declares the Democrats are “declaring open war on democracy” ahead of the historic House vote…which will be followed by an immediate Senate dismissal of the charges against him, according to Republican Senate Majority Leader McConnell. In other words, there looks almost certain to be no political pay-off for markets to worry about from this epic impeachment saga – except perhaps to enthuse Republican voters and make Trump 2020 more, not less, likely; and in McConnell’s eyes, to introduce the concept of destabilising, spurious impeachments into the US political canon (though one might argue they were already there.)

Of course, in the background Trump is still busy with the taxation of trade routes; and as we have pointed out repeatedly, while most markets are happy about how these are now going, the key USD/CNY cross refuses to budge from 7, which implies underlying fears the trade picture is already as good as it gets and that as soon as China slips up, “the negotiations will be short.” (A reference to anyone who survived ‘The Phantom Menace’.)

The Farce is an energy field created by all living things, not just a US phenomenon; it’s big everywhere – except China. In the UK, Eton-educated, Classics-spouting PM Boris Johnson has just announced he won’t be attending Davos this year to show his commitment to his new working-class voters. That’s good politics as well as farcical- but no less than when celebrities like Bono rock up to the Swiss village to sit next to central-bankers as they try to save the world. It also underlines why GBP just tumbled again despite BoJo winning the election so comfortably: Davos-man is no longer in the British, or US, cockpit. Of course, that doesn’t mean one can’t cosy up to local oligarchs…just not the international variety.

But did I just say China was a Farce-free zone? That may be true in terms of its lack of interest in Star Wars – but on all other fronts, The Farce Awakens. Flying round on Twitter yesterday was a chart showing the distribution of returns on equity for Mainland Chinese stocks vs. the US for 2016. In the latter case we see what one would expect, a bell-curve distribution centred around 10% with deviations as low as -30% and as high as 50% – which may or may not be fundamentally justified, but looks normal. In China we see a pattern of very few firms losing money, then a cliff wall shooting up as almost all firms make returns of 0-10%, and then a tail-off to returns as high as 50%. In other words, half a bell-curve and half a….curve-ball? Consider that as some struggling Chinese firms rush to sell properties to bolster their books and avoid delisting: 23-listed firms have announced plans to sell off real estate in Q4, for example.

Meanwhile, Bloomberg reports today that “China Liquidity Jitters Are About to Test Bond Market Yet Again”, adding there will be a liquidity gap of USD400bn over the new year, despite nobody losing money, and which might see the PBOC cut banks’ reserve ratios yet again.

So all is well in China and yet they are short USD400bn…and all is well in the US, but they are short USD500bn over the same time-frame, requiring the Fed to step in big-time repo- and NOT-QE-wise. Note this USD900bn figure is what Disney hopes ‘The Rise of Skywalker’ will make at the box office over the period: coincidence, or is it The Farce moving things? And note that even if one starts writing without knowing where it’s all going to end, it’s still possible to end up with a better conclusion than insiders hint Star Wars IX director Jar Jar Abrams has.

May The Farce Be With You – always.

Tyler Durden

Wed, 12/18/2019 – 09:21

via ZeroHedge News https://ift.tt/2S8m12j Tyler Durden