The SECURE Act: It’s Reality & What You Need To Know

Authored by Richard Rosso via RealInvestmentAdvice.com,

Like a thief in the night, in a rare bipartisan agreement, Congress passed the Setting Up Every Community for Retirement Enhancement Act or the SECURE Act. The most creative element of the act admittedly, is the name. All is needed now is the President’s signature which is a foregone conclusion. I’m torn by this Act.

There are several good elements to it; however, those who plan to leave significant wealth through non-spousal inherited IRAs are going to face formidable issues with this bill, which I will expand upon.

The possible passage of the Act is one of the reasons we’ve been expanding RIA’s initiative to help clients with surgical, occasionally aggressive, Roth conversions.

SECURE will take effect on January 1, 2020. Here are the highlights:

70 ½ and still working? We’ve got a solution for that.

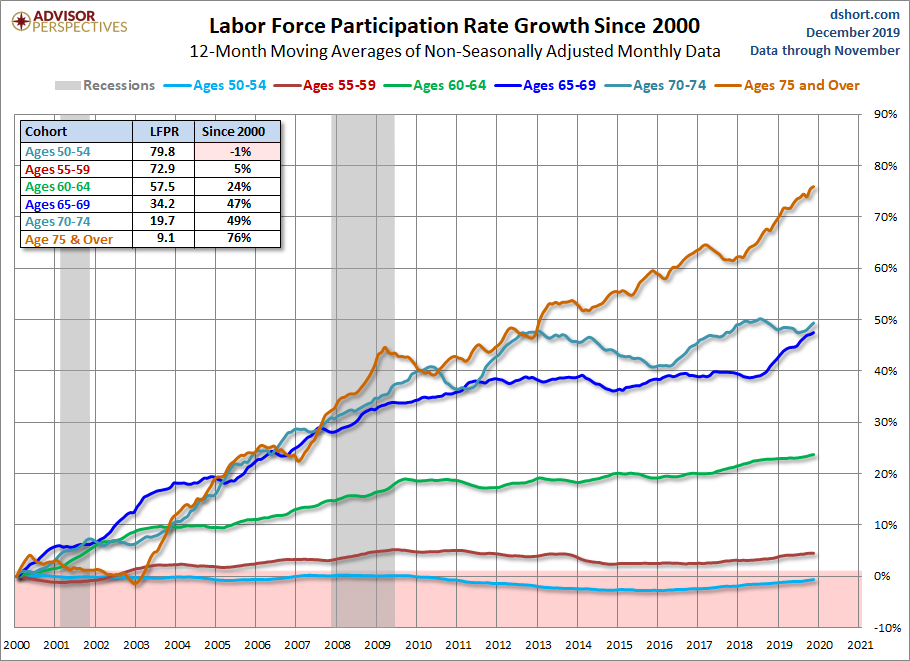

As we discuss in our Right Lane Retirement Classes, working past 70 is not a rarity for today’s ‘retiree.’

The Labor Force Participation Rate growth rate for those age 75 is up 76% since 2000. There are many reasons for this with the most prominent being this cohort needs the money.

The SECURE Act gets traditional IRAs in line with traditional 401(k) and Roth IRAs and will allow working older Americans, 70.5+, to continue to contribute to their pre-tax retirement accounts. Let me say this is no big deal. In fact, I’m very concerned this provision may lead retirees along with advice from mainstream financial professionals, to continue to overfund pre-tax accounts for absolutely no reason.

In other words, most older Americans past 70 shouldn’t be concerned about saving taxes today as they are about increased relief against taxes that cut into their consumption income, including Social Security. Why would I care to contribute to a pre-tax retirement account when I’m living it or close to living retirement or some phase of it, and income is my imminent lifeblood at this stage of life?

The only good thing I see about this change is the ability for continuation of backdoor Roth IRAs. However, by 70.5 most people have already rolled over their retirement accounts into IRAs which would diminish the positive effects of backdoor Roths anyway due to something called the pro-rata rule. Again, I consider this provision a way to clean up what should have been done previously and not a clear win for anybody except Wall Street and brokers.

If you haven’t turned 70.5 by December 31, there’s something for you!

Simply, if you haven’t turned 70.5 by the end 2019, you’ll be provided the privilege to wait until 72 to begin required minimum contributions. On a positive note, at least it’ll be easier for people to figure out when to begin their RMDs.

On a disappointing note, why older Americans who remain or return to the workforce are required to take distributions when they should be given the choice to wait is the most egregious ignorance of the tax elephant in the room and the issues seniors face today when it comes to making ends meet.

The Act should have allowed older employed Americans to postpone distributions until they, well, RETIRE. However, we will need to make the best of it. Along with reform around life expectancy tables expected in 2021, many taxpayers should experience a bit of relief on taxes as life expectancies have increased.

The bill permits penalty-free withdrawals from retirement plans for expenses related to the birth of a child or adoption.

I’m torn over this one as it adds another element of ‘leakage’ to accounts that shouldn’t be touched until retirement. However, if it assists a family to adopt a child, I’m compelled to support it. Now, Congress could have removed the penalty-free withdrawal provision for a first-time homebuyer as we believe at RIA, if you need to tap retirement accounts to make a down payment on a house you clearly can’t afford to own one. In addition, and I know we can argue about this all day, a primary residence is NOT an investment. It’s a consumption asset.

The bill creates a new three-year tax credit for small employers for startup costs for new pension plans that include automatic enrollment.

Occasionally, probably by accident, there’s a jewel among the government rubble. The new bill allows for a $500 tax credit for small employers to start retirement plans that must utilize automatic enrollment. Empirical studies outline how auto-enrollment has increased retirement plan participation.

Come together all small employers!

(Sec. 101) The bill amends the Internal Revenue Code to revise requirements for multiple employer pension plans and pooled employer plans. It provides that failure of one employer in a multiple employer retirement plan to meet plan requirements will not cause all plans to fail and that assets in the failed plan will be transferred to another plan. It also establishes pooled employer plans that do not require a common characteristic.

This Section will allow small employers to pool their resources to create 401(k) plans. A great dilemma we face as a country is lack of retirement plans available to employees of small companies. We hear about this issue all the time from radio listeners and blog readers. Hopefully, small employers should find it easier to establish plans and face lower costs; further details are pending.

Guaranteed Retirement Contracts are coming.

Rarely, are guaranteed lifetime income options in the form of annuities provided in company retirement plans. Now, that can change. I fully support this initiative, but the endorsement comes with a caveat. I’ll explain.

First, overall this is a positive. The loss of pensions has clearly created a retirement saving crisis in America. To offer a lifetime retirement income option among the sea of variable assets of stocks and bonds is indeed a positive ballast.

However, if you believe your employer does a challenging job with the selection of mutual funds, just wait to see what happens with annuities. It’s going to be absolutely crucial (and I cannot stress this enough), that you work with a fiduciary partner with extensive insurance experience that can help you assess the annuity your employer selects and whether or not you should consider it.

I leave the worst for last: The Death of the Stretch.

RIA was most concerned about this section; this is a significant change. The SECURE Act will require owners of larger pre-tax retirement accounts who plan to leave a legacy to family through IRAs, to review and possibly restructure their estate plans, ideas, in the coming years.

Currently, non-spouse beneficiaries such as children, can stretch inherited IRA distributions over their life expectancies. The SECURE Act beginning next year would require non-spouse beneficiaries deplete IRAs over a ten-year period. Non-spouse beneficiaries who are currently taking distributions should be grandfathered and not affected. Along with taxes, this change can be detrimental to your legacy planning.

Again, this is one reason why we focus so much on surgical Roth IRA conversions and favor Roth over traditional, pre-tax accounts in almost every circumstance. Sure, the accelerated distributions are the same. However, the acceleration of depletion due to taxes is a tremendous negative to the wealth you plan to leave to others.

Overall, I rate the SECURE Act a C+.

* * *

Sadly, it does very little to address the chronic retirement insecurity which faces most Americans. Bold actions are required to foster national financial literacy (not from Wall Street and companies like Acorns) and allow for ambitious creation of widescale guaranteed retirement income vehicles such as those proposed by Dr. Teresa Ghilarducci. Read more of her work here: https://realinvestmentadvice.com/is-capitalism-responsible-for-socialist-sentiment/

Our four Certified Financial Planners are well equipped to discuss concerns you may have over the Secure Act.

Watch for a webinar coming soon on the topic as information is provided.

Tyler Durden

Wed, 12/18/2019 – 08:45

via ZeroHedge News https://ift.tt/2S7kDwW Tyler Durden