The US Stock Market Hasn’t Been This Rich & Overbought Since 1933

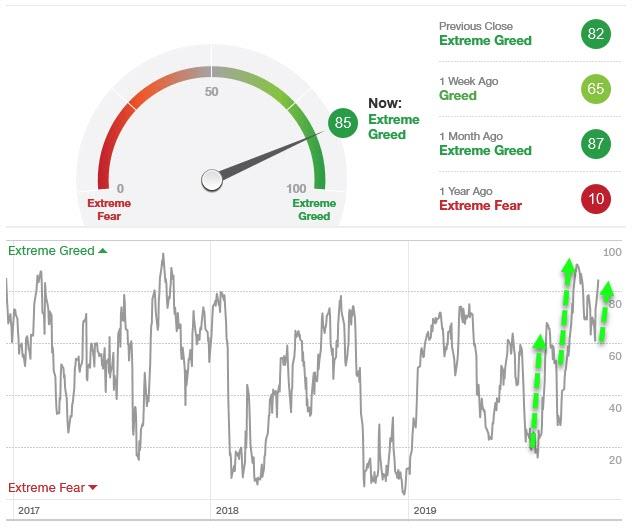

US investors are back in “extreme greed” mode as a China trade-deal (ish) combined with unprecedented year-end liquidity and the seasonal hype of the Santa Claus rally has raised FOMO to almost record high levels…

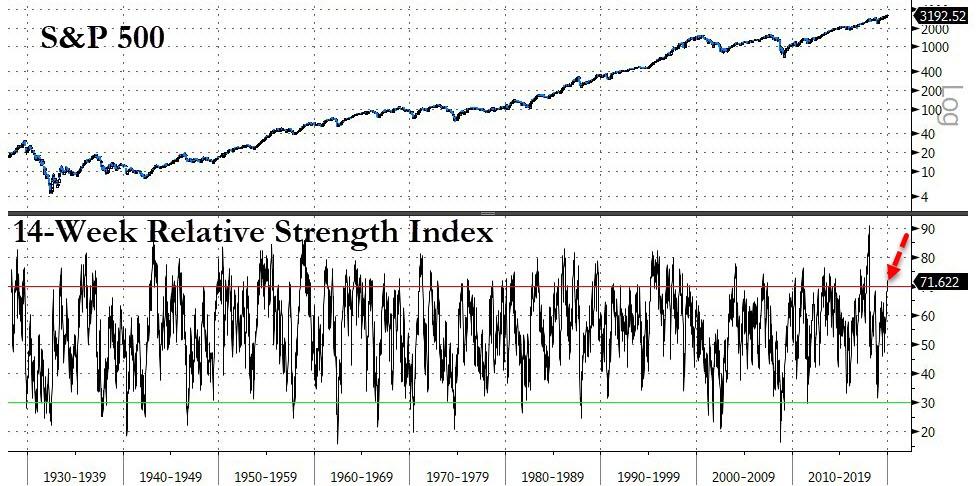

In fact, as Bloomberg notes, investors are chasing the rally in large-caps to heights not seen in almost a century.

According to data from Leuthold Group, the S&P 500’s 14-week relative strength index, just exceeded 70, a threshold analysts consider an extreme reading of exuberance.

Source: Bloomberg

Additionally, at Friday’s close, the benchmark traded at 26.3 times five-year normalized…

Source: Bloomberg

But critically, since 1933, similar RSI breakouts have occurred 27 other times, though never in a market priced this richly.

This is “the dilemma facing equity investors,” said Doug Ramsey, Leuthold’s chief investment officer.

“Momentum is so strong that it’s likely to persist, but investors are paying a higher price than ever.”

All year long, investors have ignored stagnant growth in corporate earnings…

Source: Bloomberg

…to focus on Federal Reserve easing and the progress over U.S.-China talks…

Source: Bloomberg

And for now, that momentum is winning – no matter the cost – but as Leuthold’s Jim Paulsen warns, perhaps the valuation issue deserves a new look since the economy has evolved into a different place.

“The current valuation of the stock market and, indeed, its ‘new valuation range’ during the last 30 years appears to be justified,” said Paulsen, chief investment strategist at Leuthold.

“Positioning portfolios today with maximal bullishness is not warranted; however, keeping the portfolio tilted to the bullish side does appear reasonable.”

In the meantime, “greed” remains “good” though, as we noted previously, we wonder what happens after Friday’s big option expirations.

Tyler Durden

Wed, 12/18/2019 – 14:05

via ZeroHedge News https://ift.tt/2sKHPX1 Tyler Durden