VIX Options-Whale ’50 Cent’ Re-Emerges As New Short-Vol ETF Appears

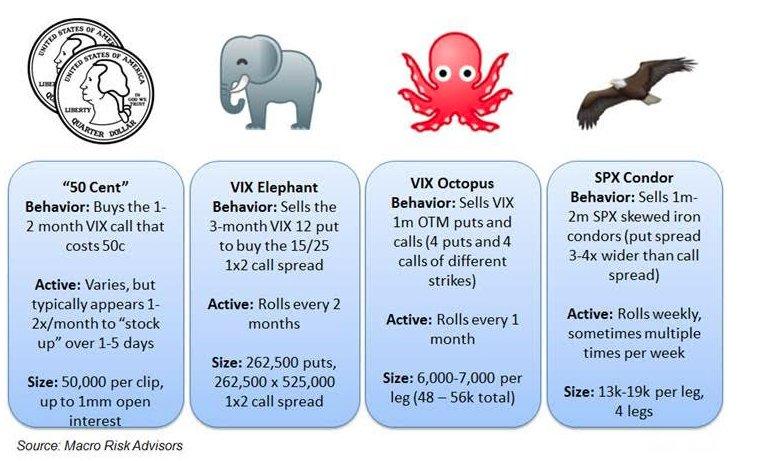

The last few years of constant vol suppression by central banks worldwide has been greeted by the emergence of a veritable bestiary of options whales, characterized by their respective trading patterns…

Perhaps the most infamous of them all is “50-cent” – so called for the price at which he is willing to buy VIX calls as VIX itself collapsed (as we have detailed here, here, and here)…

And, as Bloomberg reports, today saw his huge footprint re-appear as someone snapped up roughly 130,000 January $22 calls on the index for about 50 cents each.

Source: Bloomberg

“50 Cent” first came to the market’s attention by buying huge amounts of VIX calls during the market turmoil through 2017 and early 2018. The trading pattern reappeared last August as the S&P 500 was locked in a trading range with implied volatility trading around its highest levels of the year.

The familiar price point for buying VIX calls “will certainly lead to investors believing ‘50 Cent’ is back,” Chris Murphy, the co-head of derivatives strategy at Susquehanna Susquehanna Financial Group, said in a research note.

With the options maturing on January 22nd, there are still plenty of catalysts to trigger a spike in vol and a big payout for ’50-cent’ – including this week’s op-ex, the partial trade-deal falling apart, year-end repo/liquidity issues, and potentially bad news from the World Economic Forum in Davos early next year.

But, as 50-cent buys vol cheap in anticipation of a spike, another financial start-up appears to have gone full Einsteinian madness.

Bloomberg reports that Volatility Shares LLC has applied to Cboe Global Markets Inc. to register an exchange-traded fund that would give investors the ability to short futures on the Cboe Volatility Index, according to a new filing.

This is nothing less than a replacement for the XIV product that created volmageddon in February 2018 as vol spiked and the short-vol-ETN crashed and died…

Source: Bloomberg

Bloomberg reports that the new ETF’s design changes some of the attributes that may have contributed to the flame out of XIV.

“What happened on Feb. 5 was kind of a problem that I think the original architects of those products hadn’t foreseen,” said Barton.

“That left a gap in the markets, and we were asking people to provide a solution. Nobody stepped up, so we did the research and leg work and hope to bring that solution to market.”

SVIX would track the Short VIX Futures Index, whose backtest suggests a loss of just 30% on Feb. 5, compared to the 96% retreat in the indicative value of XIV.

However, this all has the smell of yet another penny-picking trade that will go well… until it doesn’t.

After XIV’s implosion, Devesh Shah, who helped invent the VIX index, said he didn’t know why these products existed — while predicting that a successor would soon emerge.

“And what’s going to happen as a result of this? Nothing, other than in a few months’ time someone’s going to come up with a new XIV, and everyone’s going to start putting money into that,” he said back in February 2018.

“That’s OK, that’s how the world goes.”

He was right, and simply put, if at first you don’t succeed in blowing up the world with leveraged short vol bets, try, try again…

Tyler Durden

Tue, 12/17/2019 – 20:25

via ZeroHedge News https://ift.tt/2syqr7X Tyler Durden