Will The Last 2 Weeks Of 2019 Be The Inverse Of 2018?

Authored by Erik Lytikainen via RealInvestmentAdvice.com,

Every professional investor knows that month-ending, quarter-ending and year-ending timestamps are important. Throughout the year, positions are hedged against these timestamps, and as a result, the year-ending option expirations almost always have the highest open interest. Generally, the higher the open interest the greater the volatility and financial risk.

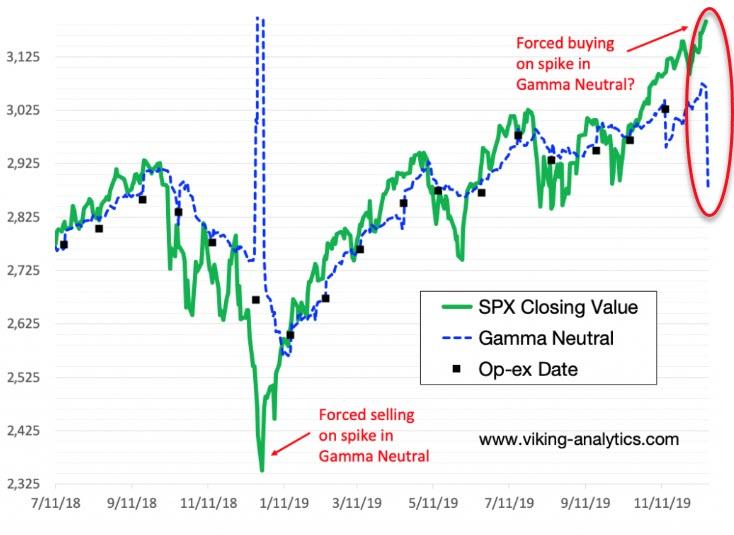

Last December, in and around the final option expiration of the year, the S&P 500 fell by nearly 300 points. This dramatic decline coincided with a spike in market gamma as shown below. It is my view that this decline was furthered by forced selling by the put sellers who needed to sell the S&P 500 index to cut their losses.

As we approach this year and the S&P 500 continues to grind higher, we may be facing the inverse of last year. Call sellers are beginning to feel more pain, as evidenced by a first-time spike in Forecast Gamma Neutral in my December 17th report. While I am not saying that stocks will melt up through the remainder of the year, the possibility of that scenario playing out is looking more likely. The chart below shows the relationship between the cash value in the SPX and the metric that I call Gamma Neutral.

SPX Value versus Prompt-Month Gamma Neutral

The Study of Market Gamma

There has been an increasing amount of attention to an “obscure” concept in the market called “gamma” over the past year. Last November, Bloomberg published an article titled: Two Words Which Sent the Oil Market Plunging: Negative Gamma. Since then, there have been an increasing number of market analysts – such as Nomura’s Charlie McElligott – who discuss the implications of gamma exposure in mainstream and other forms of financial media.

The study of “gamma” is akin to the study of market risk. When market gamma is relatively high, then financial risk is also high. When market gamma is relatively low, then financial risk is low. The study of gamma is based upon actual bets in the options markets—where hundreds of millions will exchange hands. In this way, the study of market gamma can be viewed as the ultimate “smart money” indicator. And, the gamma smart money indicator has a definitive time stamp, its option expiration date.

Option expiration this week for the S&P 500 week will occur at 9:30am and 4:00pm December 20th. At 9:30am, the SPX monthly options will expire, and at 4:00pm, the SPX, SPY and ES futures options will settle. The SPX monthly options expiring at 9:30am have several orders of magnitude more value-at-risk than the other option expirations.

Whereas other analysts tend to report on cumulative gamma, I tend to focus on discrete, time-stamp specific gamma metrics. The study of market gamma in all of its forms can provide context for mean-reversion events, Black Swan events, and intra-day volatility.

Gamma Implications For Year-End 2019

The graph above shows regular mean-reversion of the S&P 500 value back to the levels of Gamma Neutral, and that value is currently around 3,070, a 120 point drop from current levels. On the other hand, if call sellers in 2019 were to experience the same level of pain as the put sellers in 2018, then the level of the cash SPX would need to be at 3,295 today, a roughly 100 point increase from current levels.

So, from a “gamma” perspective alone, I will not be surprised to see a 100 point swing in SPX over the next week or so. Of course, there are other market risks such as China trade and impeachment proceedings. I will either be watching from the sidelines, or perhaps buy a straddle to profit from a big move in either direction.

* * *

Erik Lytikainen, the founder of Viking Analytics, has over twenty five years of experience as a financial analyst, entrepreneur business developer and commodity trader. Erik holds an MBA from the University of Maryland and a BS in Mechanical Engineering from Virginia Tech. You can learn more about his work on his website: www.viking-analytics.com.

Tyler Durden

Wed, 12/18/2019 – 12:25

via ZeroHedge News https://ift.tt/2S5VRNR Tyler Durden