Even Goldman Bristles As Junk Bond Rally Smashes All Records

Something remarkable has happened in the bond market over the past 12 months: investment grade and junk bonds yields have tumbled, spreads have collapsed, the differential between junk and IG bonds have vaporized and the spread per turn of net bond leverage is the lowest on record.

In short: despite corporate gross and net leverage hitting all time highs as profitability declined, the investing public has unleashed an unprecedented buying spree across the US corporate bond sector, in the process smashing virtually all records.

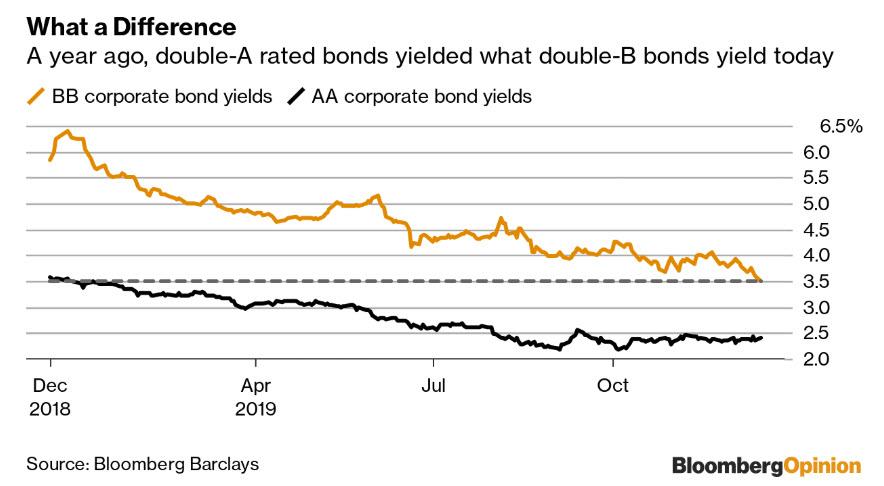

Nowhere is this dynamic more evident than the case study of AA and BB rated bonds. As Bloomberg first pointed out, earlier this week the average BB rated bond yielded just 3.51%, an all time low, sporting a spread of just 164bps to Treasurys. Now go back just 12 months ago to last December when the average AA rated corporate bond, such as those issued by Berkshire, Apple and Exxon, was yielding 3.58%, more than the yield one now gets for bonds whose rating is some 9 notches lower, in deep junk territory.

There’s more: as shown in the chart below, the scramble for anything with a yield, which these days tends to mean junk bonds, has meant that the spread between BBB and BB credits has collapsed to just shy of all time lows, as shown in the chart below.

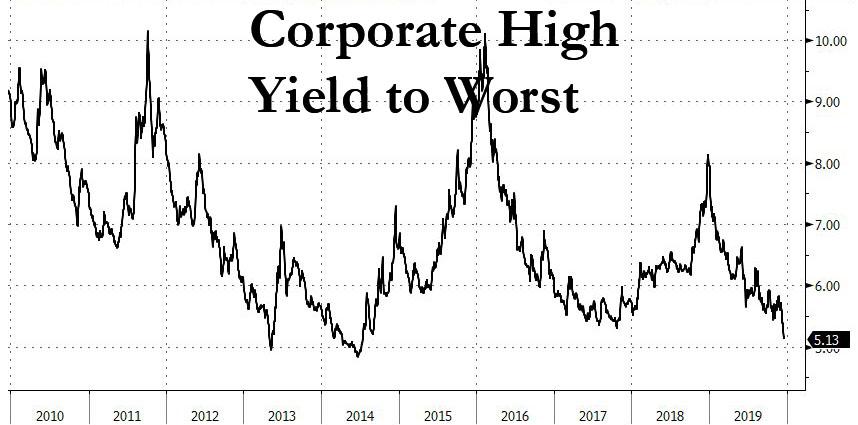

And speaking of junk bonds, the YTW on the Bloomberg Barclays sector is now down to the lowest level since 2014.

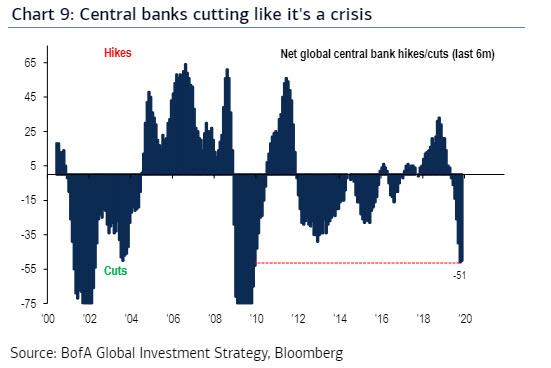

There are many factors behind this renewed euphoria for everything junk, including declining tail risks, supportive new issue technicals and improving funding conditions following the Fed’s sizable temporary open market operations. But most of all, it is the dramatic reversal by the world’s central banks who have sent global yields tumbling – just a few months ago, there was no less than $17 trillion in negative yielding debt – as a result of some 51 rate cuts in 2019: the most since the 2008 financial crisis, in fact as BofA said tongue-in-cheek, “central banks cutting like it’s a crisis.”

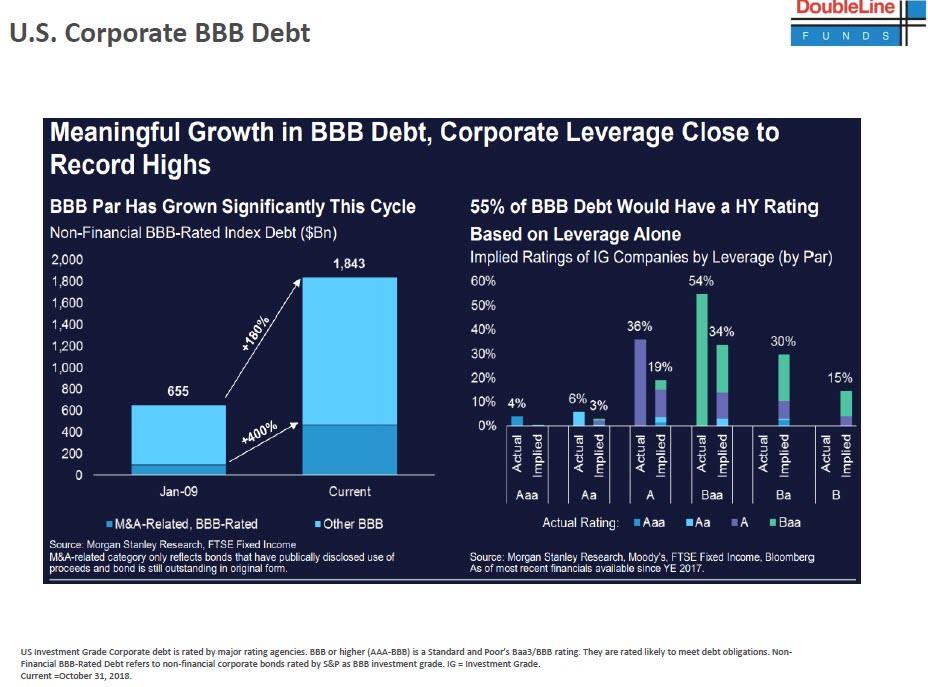

There are several remarkable observations about all of this. The first is that as we showed about a year ago, a majority, or 55% of BBB-rated investment grade bonds, would have a junk rating based on leverage alone.

Second, with such a tiny difference in spread between the lowest IG rating and the highest junk bond (and recall that junk bonds are that for a very fundamental reason: based on their financials, they are more likely to default in the next 10 years than to remain viable), is virtually non-existant. According to Bloomberg, investors now have a “golden opportunity” to upgrade double-B bonds to triple-B for the record-low trade-off of just 38 basis points. To upgrade to single-A, it’s just 91 basis points, and to double-A, it’s 113 basis points, both near the all-time lows set in June 2007.

But what is perhaps most remarkable about this literally flood to junk, is that none other than Goldman Sachs is warning it is unsustainable. In a report from Goldman’s chief credit strategist, Lotfi Karoui, he writes that since the local wides reached in early October, USD IG and HY spreads have tightened by over 21bp and 70bp to 99bp and 338bp, respectively, moving well below their first quartiles when benchmarked to the history of the past two decades.

As such, Karoui reiterates his bearish spread forecasts, which now imply 16bp and 82bp of widening in IG and HY spreads through the end of the first half of next year, respectively. As he explains, “the scope for additional spread tightening is quite limited, going forward. In addition to eroded valuations, fading support from monetary policy and potential resurfacing of policy uncertainty skew risks to the wider side from current levels.”

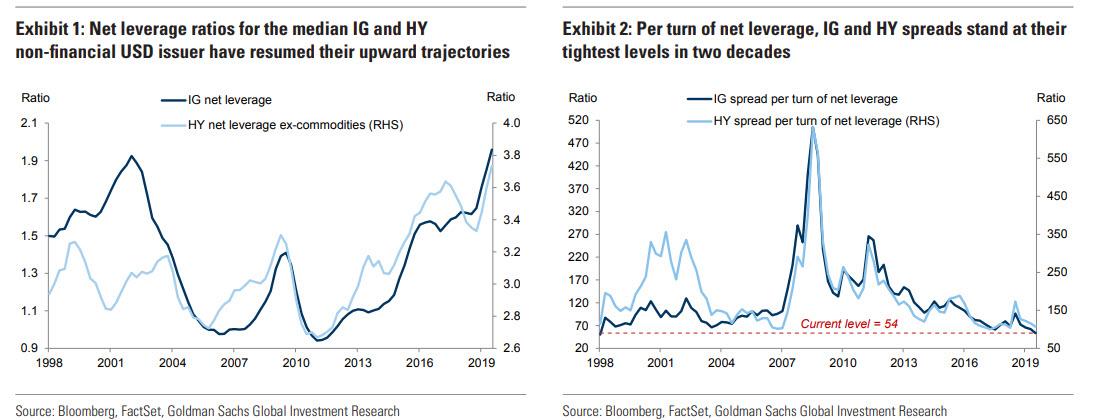

But the biggest challenge the ongoing rush into junk faces, according to Goldman, is the bank’s expectation of rising idiosyncratic risk in 2020, given the disappointing trajectory of balance sheet fundamentals in 2019 and the increased challenges faced by over-leveraged companies in their debt reduction plans. As Exhibit 1 shows, data through the end of

the third quarter suggest that net leverage ratios for the median IG and HY non-financial issuer have resumed their upward trajectories, making new highs in HY and approaching the peak reached in the late 1990s in IG. This meaningful uptick in net leverage ratios coupled with the significant spread compression in 4Q has pushed the level of spread per turn of leverage, a popular valuation metric among credit investors, to two-decade lows, in both the IG and HY markets.

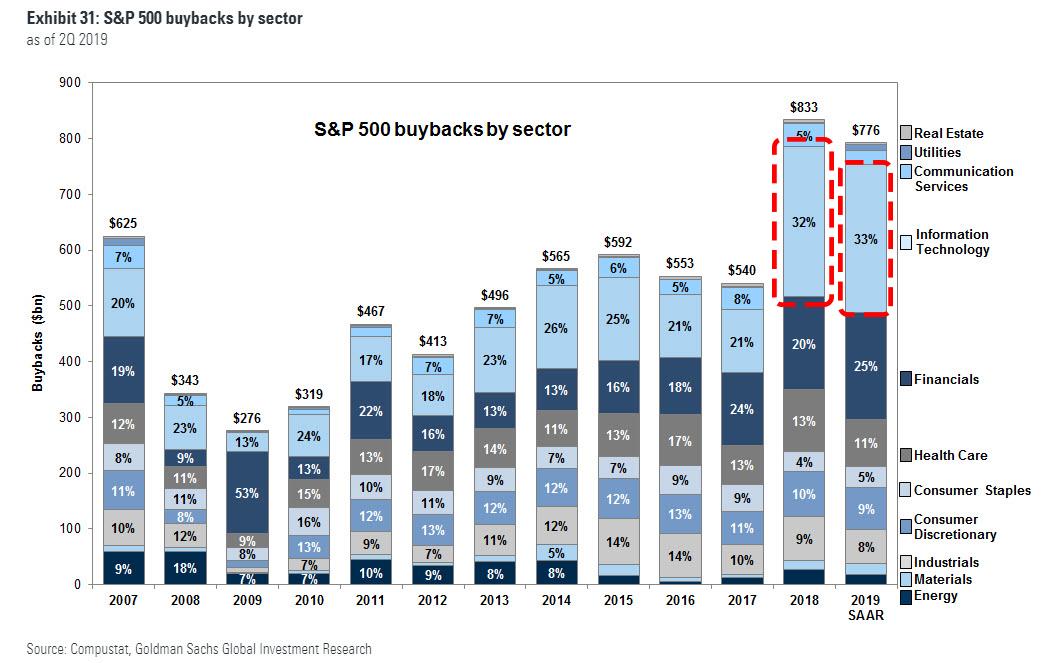

Said otherwise, the collapse in yields (and spreads) has emboldened management teams (especially of financial companies) to lever further into record territory, with much of the debt issuance proceeds used to repurchase record amounts of stock…

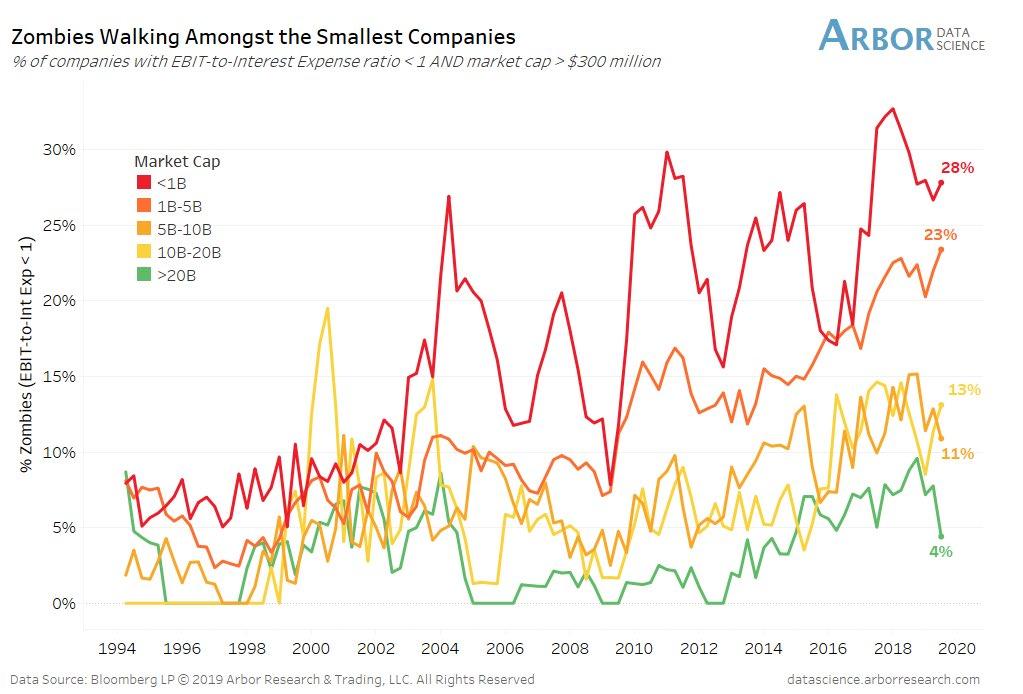

… which threatens the viability of corporations should a secular move higher in yields emerge, while a recession could be absolutely devastating as it would result in far lower cash flows, which would immediately threaten the ability of corporations to service their debt, especially those zombie companies which can barely cover their interest expense currently.

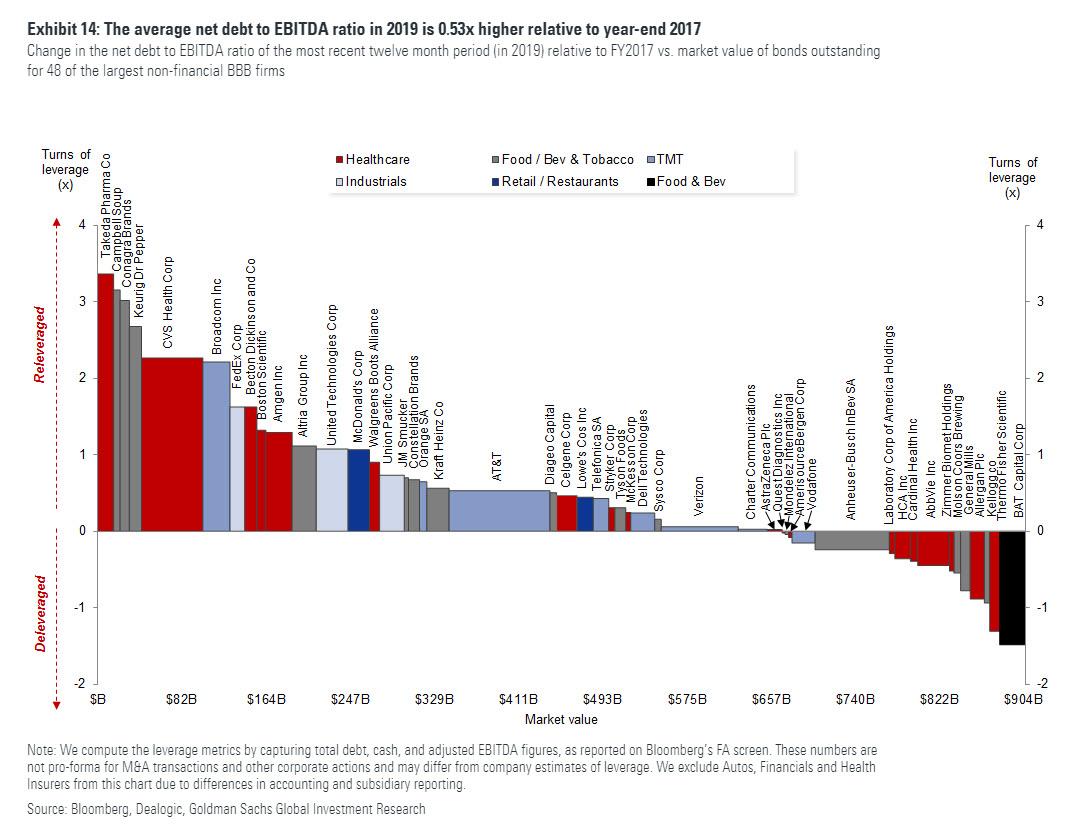

Even Goldman admits that this is a particularly ominous challenge. As Karoui warns, this year’s balance sheet re-leveraging has been largely driven by weak profitability across most sectors, and “has also occurred against a backdrop of a rather conservative mindset among managements. As we discussed recently, many acquisitive and over-leveraged BBB-rated non-financial firms continue to highlight progress on gross debt pay-down, mostly via asset sales and leverage-neutral liability management exercises (i.e., replacement of short-term with new longer-dated and cheaper debt), as a top priority.” But, as we showed before, this (alleged) continued focus on gross debt reduction among lower-rated IG-rated issuers has not translated into concrete balance sheet deleveraging, in fact quite the opposite.

As shown above, a review of 48 of the largest BBB-rated non-financial firms, which have a combined amount of index-eligible bonds outstanding of over $900 billion, suggests the average net debt to EBITDA ratio in the most recent 12-month period (2019) is actually 0.53x higher relative to year-end 2017, when the 2017 Tax Cut and Jobs Act (TCJA) passed. Further, only two issuers deleveraged by more than 1.0x turn, and only seven reduced leverage by more than 0.50x turn, since year-end 2017.

Here, the silver lining is that analysts are generally optimistic on both the economy, and corporate profitability into 2020. But here too Goldman has a caveat: “the forward earnings growth trajectory will be much flatter by post-crisis norms as profits adjust to a new reality where growth in unit labor costs outpaces price inflation”, in other words, rising wages will further erode corporate profitability and debt service capabilities. As such “for credit investors, this will likely mean more challenges in the debt reduction plans, particularly for issuers with weak pricing power, and thus more dispersion in returns.”

One final risk is political. As Goldman cautions, a potential headwind for sentiment is the narrative around a potential rollback of the Trump tax cuts. The main Democratic front-runners have proposed at least a partial repeal of the TCJA. Barring a unified government led by Democrats, US tax policy would likely remain unchanged at least through 2023. But if Democrats gain even a slim majority in the Senate, Goldman’s economists would expect an increase in the corporate tax rate, not to mention a collapse in the S&P to 2,600 as discussed previously.

On Goldman’s estimates, the median effective tax rate for US-domiciled issuers in the iBoxx IG bond index fell from 23.4% in 2017 to 18.7% in 2018. In addition to weighing on sentiment, if this legislation were reversed and marginal tax rates increased, the potential negative earnings shock would likely make debt reduction plans even more difficult to achieve.

Whether Goldman’s gloomy forecast materializes, remains to be seen, but as even Bloomberg admits, few Wall Street professionals believe this junk-bond bonanza can last. Bloomberg News’s Gowri Gurumurthy reported that Wall Street analysts are forecasting gains of between 1% and 7.5% for U.S. high-yield bonds, down from the 13.5% gain so far this year. Others, like Mohamed El-Erian, are advocating that investors get out of riskier securities while the market is strong.

“What I fear is that this is the prelude to something which is not going to be very comfortable for those investing in the lowest-quality segments of the credit market,” El-Erian said in a Bloomberg TV interview.

Joe Davis, head of the investment strategy group at Vanguard Group Inc., put it like this: “For savvy investors, the tighter credit spreads become, the more guarded they have to be in their strategy,” he said. “When the next recession hits, the downturn in the financial markets could be worse than the economic effects.”

In other words, the cascade of catastrophic consequences when the next recession hits, will once again be all the central banks’ doing – after all it is their monetary policies that pushed rates to such low levels, that the only place investors can find even remotely attractive yields, is junk bonds which offer a 3.5% yield, making a total joke of what was once called “high” yield.

Tyler Durden

Wed, 12/18/2019 – 21:25

via ZeroHedge News https://ift.tt/2M8av3l Tyler Durden