S&P Futures Trade At Record 3,200 After Trump Impeachment, Central Bank Bonanza

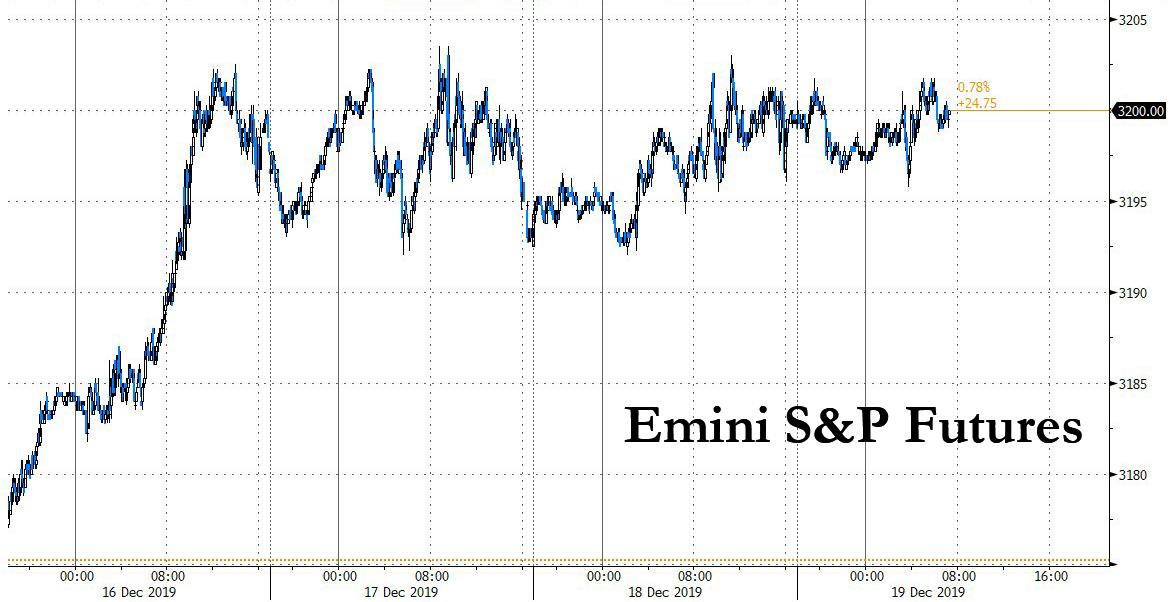

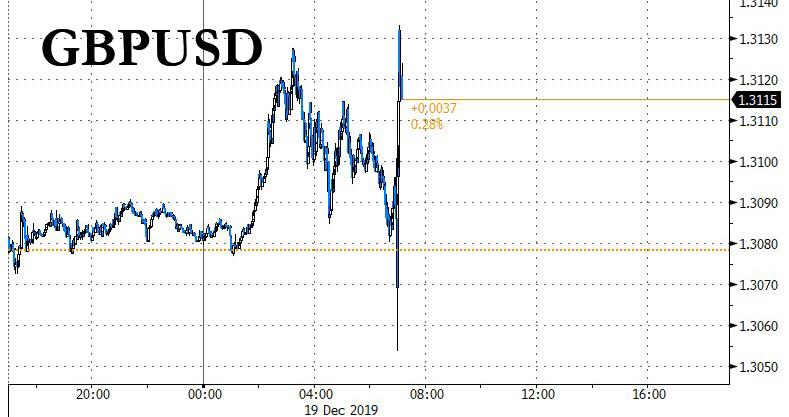

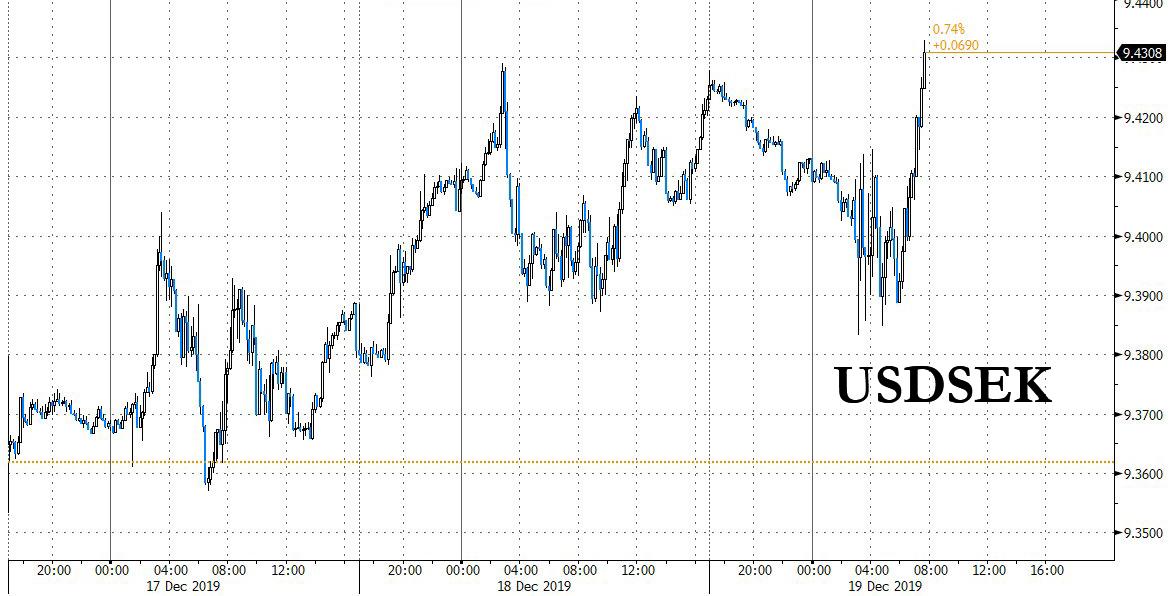

Global stocks hovered near all time high on Thursday following a barrage of central bank decision out of Japan, Taiwan, Norway, Sweden and the UK, with US equity futures trading at all time highs of 3,200 as jittery cable reacted to the BOE’s latest (unchanged) rate decision while the Swedish crown slumped despite the Swedish central bank’s decision to became the first central bank to raise interest rates from negative after a five year stint in NIRP territory.

Anyone who expected an adverse reaction to the historic Trump impeachment vote on Wednesday night was disappointed as Wall Street futures suggested the S&P 500 would barely budge, after rising to a fifth consecutive record high on Wednesday despite closing lower just fractionally by -0.04%. Market reaction was limited, since the Republican-controlled Senate is guaranteed not to convict Trump and remove him from office.

“Another day of phase-one trade agreement relief continued to support U.S. and indeed global equities,” said Matt Cairns, a strategist at Rabobank in London. Along with improving economic data and the House spending package “these factors are helping to weigh on Treasuries and bunds as the market ends 2019 with what we believe to be a misguided glass-half-full view of the world,” he said.

European equities were little changed in early trading, although they were pressured modestly as the trading day advanced. Britain’s pound recovered from the 3% loss it suffered as fear of a no-deal Brexit returned, after the BOE kept its rates unchanged but suggested it may hike rates in the future.

Europe’s Stoxx 600 index drifted in and out of the red, with gains in real estate shares offsetting declines in automakers while Britain’s blue-chip index traded inversely to how the cable reacted to the BOE’s announcement.

Earlier, Asian shares had pulled back from a one-and-a-half year peak as trading wound down before the end of the year. Asian stocks dipped, led by technology companies, after Donald Trump was impeached. Most markets in the region were down, with Taiwan and the Philippines leading declines, while India and Thailand rose. The Topix slipped for a second day as the Bank of Japan maintained its target for interest rates and asset purchases. The Shanghai Composite Index closed little changed, as a bank rally countered declines in technology firms. Stocks in China were unchanged after erasing the day’s losses as its central bank mounted another liquidity injection before a year-end cash squeeze. China has returned to the American market to buy soybeans on the heels of a partial trade deal with the U.S. India’s Sensex headed for a fresh peak, with Reliance Industries and Tata Consultancy Services driving the gains.

With year-end looming, traders leaving for vacation and liquidity collapsing, there were few new catalysts on the horizon to revive the equity rally and details of the trade deal remaining vague, keeping stocks in a holding pattern. Central banks were likewise on hold, with policy makers in Japan, Taiwan, Norway and the U.K. leaving interest rates unchanged on Thursday.

There was one notable central bank announcement: as previewed last night, the Swedish central bank raised its key rate to zero after five years in negative territory in a move that will provide relief to the finance industry and a test case for global counterparts with negative borrowing costs. Economists wondered whether Sweden’s hot-running economy would react badly and whether other sub-zero rate central banks in the euro zone, Japan, Denmark, Switzerland and Hungary would follow suit. The crown initially rose 0.2%, a gain that had been widely flagged, however as the session progressed the currency dropped to the lowest level in a week.

Here is a summary of the other key central bank announcements overnight, via RanSquawk:

- BoJ kept monetary policy settings unchanged as expected with NIRP held at -0.1% and 10yr JGB yield target at around 0%, while it maintained forward guidance that rates will remain at current or lower levels for as long as needed to guard against risk momentum for hitting price target may be lost. BoJ repeated its assessment that Japan’s economy is expanding moderately as a trend but cut the assessment on industrial production in which it states industrial output is falling due to impact of natural disasters. BoJ later announced plans decided in April to lend ETFs to markets under a special facility aimed at improving liquidity in the ETF market, while it will amend the scheme aimed at encouraging banks to increase lending and will allow borrowers to roll over lending under certain conditions.

- Riksbank hiked its Repo Rate by 25bps to 0.00%, as expected. Forecast for repo rate is unchanged, repo rate is expected to remain at 0% in the coming years. Deputy governors Breman and Jansson entered reservations against the rate hike. Improved prospects would justify a higher interest rate. But if the economy were instead to develop more weakly than forecast, the Executive Board could both cut the repo rate and take other measures to make monetary policy more expansionary. (Newswires)

- Norges Bank left its Key Policy Rate unchanged at 1.50%, as expected in a unanimous decision. Norges Bank left its rate path unchanged for 2020 and 2021 but upgraded 2022 to 1.60% from 1.50%. Norges noted that monetary stance has become less expansionary and a weaker-than-projected krone implies in isolation a higher policy rate path, whilst on the other hand, the upturn in the Norwegian economy appears to be a little more moderate than previously assumed.

And speaking of central banks, they are all that matters: “At the end of the day, this market doesn’t look at macro and earnings, it just looks at monetary developments,” said Stéphane Barbier de la Serre, macro strategist at Makor Capital Markets. “If the market thinks central banks (globally) are done with being dovish then we would see some volatility.”

Luckily for the bulls, central banks are not only not done, but they will remain dovish until they lose all credibility as a decline in the stock market is now barred by monetary policy.

Don’t tell that to bond traders, however, as government bonds fell around the world. Treasuries slipped along with sovereign bonds from London to Tokyo after the barrage of overnight monetary decisions. Germany’s benchmark 10-year bond yield crept towards the six-month highs it touched last week, with bond traders focussed on the day’s central bank meetings.

Elsewhere in FX, after Sweden’s move, Norway kept its rates at 1.5% and reiterated it was likely to stay there for some time. The dollar slipped against most major peers as Scandinavian currencies gained following central bank policy decisions in the region. The Australian dollar jumped by 0.36% to $0.6879 after better-than-expected labor-market data made interest rate cuts less likely. The yen barely moved from 109.58 per dollar after the Bank of Japan kept its quantitative easing in place and issued a gloomier assessment on factory output. Australia’s dollar climbed after jobs data for November beat forecasts.

In commodities, Brent dipped 0.1% to $66.10 per barrel. WTI also dipped 0.01% to $60.86 a barrel after U.S. government data showed a decline in crude inventories. Prices are likely to be supported by production cuts coming from the Organization of the Petroleum Exporting Countries and its allies, including Russia.

Expected data include jobless claims and existing home sales. Accenture, Darden, and Nike are among companies reporting earnings.

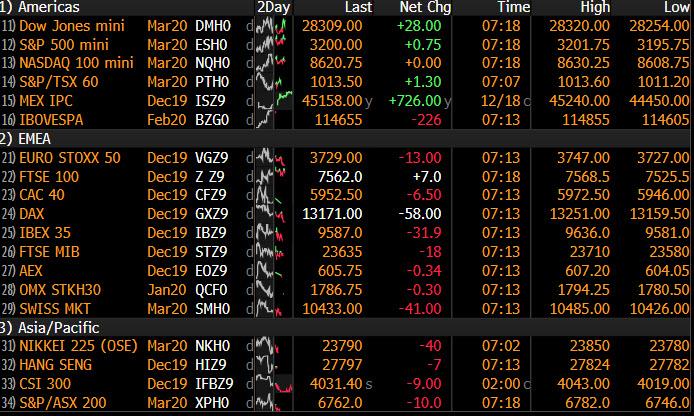

Market Snapshot

- S&P 500 futures little changed at 3,200.25

- STOXX Europe 600 up 0.01% to 414.42

- MXAP down 0.3% to 169.95

- MXAPJ down 0.4% to 548.78

- Nikkei down 0.3% to 23,864.85

- Topix down 0.1% to 1,736.11

- Hang Seng Index down 0.3% to 27,800.49

- Shanghai Composite unchanged at 3,017.07

- Sensex up 0.2% to 41,654.28

- Australia S&P/ASX 200 down 0.3% to 6,833.11

- Kospi up 0.08% to 2,196.56

- German 10Y yield rose 2.7 bps to -0.222%

- Euro up 0.2% to $1.1131

- Italian 10Y yield rose 6.5 bps to 1.169%

- Spanish 10Y yield rose 2.3 bps to 0.453%

- Brent futures unchanged at $66.17/bbl

- Gold spot little changed at $1,474.74

- U.S. Dollar Index down 0.1% to 97.29

Top Overnight News from Bloomberg

- The Bank of Japan left policy untouched Thursday as a government stimulus package, progress in U.S.-China trade talks and signs of a bottoming of the global slowdown brightened the economic outlook.

- Sweden’s central bank ended half a decade of subzero easing in a move that will provide relief to the finance industry and a test case for global counterparts experimenting with negative borrowing costs.

- Norges Bank kept its deposit rate at 1.50% on Thursday, as expected, and stuck to its main message that a tightening cycle started over a year ago has now been shelved.

- The European Central Bank may consider downgrading or jettisoning a key element of the Bundesbank-inspired architecture of its monetary policy, according to euro-area officials.

- Europe’s top court ruled on Thursday that a jailed Catalan secessionist leader has political immunity, complicating acting Prime Minister Pedro Sanchez’s effort to form a governing coalition in Spain.

- Sterling credit sales will likely make a fast-paced start to a potentially busy 2020 as issuers try to get ahead of another round of Brexit uncertainty.

Asian equity markets were lacklustre following an indecisive lead from US where the major indices finished flat due to a lack of drivers amid the pre-holiday lull. ASX 200 (-0.3%) was subdued by weakness in energy and the top-weighted financials sector, with early gains in the index wiped out after better than expected jobs data dampened February rate cut hopes, while Nikkei 225 (-0.3%) continued its marginal pullback from the 24k level amid a choppy currency and after a lack of fireworks at the BoJ policy meeting. Hang Seng (-0.3%) and Shanghai Comp. (Unch) traded indecisively and failed to take advantage of another substantial liquidity effort by the PBoC as well as expectations it may fine tune measures and use targeted stimulus next year, with some reports suggesting China’s private enterprises are facing the worst funding squeeze in more than two decades. Finally, 10yr JGBs were lower and prices eyed a test on the 152.00 level to the downside with demand subdued alongside an uneventful BoJ policy announcement where the central bank maintained all policy settings as expected and reiterated its forward guidance that rates will remain at current or lower levels for as long as needed.

Top Asian News

- BOJ Maintains Policy Rate, Keeps 10-Year Bond Yield Target

- PBOC Injects Largest Amount in Open Operations Since Jan. 17

- Indonesia Holds Interest Rate as It Sees Growth Rebound

- Shimao Is Said to Be in Talks to Rescue Debt-Laden Developer

A mostly uninspiring session for European bourses thus far [Euro Stoxx 50 -0.1%] – following on from a similarly lacklustre Asia-Pac session. Sectors are flat/mixed with defensives modestly firmer vs. their cyclical peers, with the exception of energy names who remain buoyed by yesterday’s advances in the complex. Individual stocks stories remain in focus given the lack of fresh macro catalysts. The IT sector failed to capitalise on optimistic earnings from Micron (+4.1% pre-market) late doors yesterday with STMicroelectronics (+0.3%), Micro Focus (-0.1%) and Dialog Semiconductor (-0.1%) all relatively unfazed. Elsewhere, NMC Health (-9.8%) has wiped out yesterday’s gains as the negative note from activist short-seller Muddy Waters continues to cause concern around the Co’s balance sheet. Swatch (-1.2%) and Richemont (-1.4%) are weighed on by a 3.5% YY decline in Swiss watch exports. In terms of other individual movers, Hugo Boss (-2.4%), Capita (-4.2%), TUI (-1.9%) trade near the foot of the Stoxx 600 amid negative broker action.

Top European News

- U.K. November Retail Sales Decline in Worst Run Since 1996

- Airbnb Wins EU Court Case Over French Real-Estate Rules

- Italy Referendum Raises Spectre of Early Elections Again

- German Lenders Start Sharing Branches in Cost-Cutting Move

In FX, the Aussie and Norwegian Krona are vying for pole position on the G10 grid following better than expected jobs data overnight and a final 2019 Norges Bank policy meeting that was fractionally less dovish than anticipated. Aud/Usd is back within striking distance of 0.6900, albeit off highs and hovering close to a decent option expiry at 0.6875 (1.1 bn), while Eur/Nok has maintained momentum under the psychological 10.0000 level and got close to support from early October (circa 9.9460) as the CB tweaked is rate path to flag 10 bp worth of tightening in 2022.

- GBP/EUR – The next best majors or beneficiaries of a flagging Dollar, as the DXY drifts down from a 97.421 high to just shy of 97.250, with Cable able to reclaim 1.3100+ status even though UK retail sales fell far short of consensus and the single currency pivots 1.1125 amidst firmer Eurozone bond yields alongside another rise in market-based inflation expectations. Back to the Pound, perhaps some underlying impetus from reports that the EU already has a trade proposal in hand for the UK to consider a day after Brexit on January 31 next year, but more immediately CBI trades loom before the BoE at high noon with the focus on any further dovish dissent or a more united MPC in wake of the election.

- JPY/CAD/CHF/NZD – All narrowly mixed vs the Greenback, as Usd/Jpy continues meander above 109.50 and the Yen gleans little fresh direction from the BoJ keeping policy unchanged and an easing bias, while Usd/Cad hovers in a tight band on the 1.3100 handle ahead of Canadian AWE and wholesale trade data. Elsewhere, Usd/Chf is still straddling 0.9800 with the Franc not really responding to a wider Swiss trade surplus as key watch exports fell, and similarly Nzd/Usd failed to get any lasting or clear impetus from NZ GDP data for Q3 as firmer than forecast q/q growth was offset by a y/y miss sharp downgrade to the former for the previous quarter.

- SEK – The Swedish Crown has been choppy between 10.4450-10.4805 parameters in wake of the Riksbank’s last hurrah for the year as a clearly signalled 25 bp repo rate hike was duly delivered, but not without 2 Board members voting against the move and with the accompanying statement caveated by the pledge to ease if the economy does not meet target.

- EM – Yet more pain for the Turkish Lira, as Usd/Try extended further to the upside through mid-October peaks and the high for that month overall before fading a fraction below Fib resistance awaiting CBRT minutes and unfolding Turkish-US developments on the diplomatic front.

In commodities, WTI and Brent futures remain flat within relatively narrow intraday parameters following the EIA-led upside seen across the complex yesterday. The former resides just under the USD 61/bbl mark, having traded on either side of its 100 WMA (USD 60.77/bbl) throughout APAC hours, while its Brent counterpart remains afloat above the USD 66/bbl mark after testing, but failing to breach support at the round figure overnight. Crude markets have seen little by way of fresh fundamental catalysts in recent days heading into the holiday period, albeit traders will be on the lookout for more “meat on the bones” regarding the China Phase One deal, given the lack of details post-announcement. That said, the thinned market conditions may prompt volatility in energy prices even with a lack of news-flow. Elsewhere, spot gold trades with mild losses and currently resides below the USD 1475/oz mark having dipping below its 50 DMA USD 1477.20/oz with technicians eyeing USD 1470-71/oz for potential support ahead if the 21 DMA at USD 1467.20/oz. Copper prices remain unchanged intraday below the USD 2.8/lb level given the tentative tone around the marketplace. Finally, Shanghai aluminium prices rose to their highest level in over three months and notched a third straight session of gains amid depleting stocks of the metal in Chinese warehouses.

US Event Calendar

- 8:30am: Current Account Balance, est. $122.0b deficit, prior $128.2b deficit

- 8:30am: Philadelphia Fed Business Outlook, est. 8, prior 10.4

- 8:30am: Initial Jobless Claims, est. 225,000, prior 252,000; Continuing Claims, est. 1.68m, prior 1.67m

- 9:45am: Bloomberg Consumer Comfort, prior 62.1; Bloomberg Economic Expectations, prior 51.5

- 10am: Leading Index, est. 0.05%, prior -0.1%

- 10am: Existing Home Sales, est. 5.44m, prior 5.46m; Existing Home Sales MoM, est. -0.37%, prior 1.9%

DB’s Jim Reid concludes the overnight wrap

In spite of markets increasingly winding down for Christmas now, central banks are going to be back on the agenda today for some of the last major policy decisions of 2019. One of the main highlights will come from the Bank of England’s decision later, at what will be Governor Carney’s penultimate meeting before he leaves the BoE at the end of January. While the market isn’t expecting any changes in rates at today’s meeting, our UK economics team actually changed their BoE view earlier this week (link here), and now see a 25bp cut at the subsequent January meeting, with the MPC remaining on hold thereafter.

Ahead of today’s BoE decision, sterling fell -0.40% against the US dollar yesterday to close below $1.31 for the first time in over two weeks, where it remains this morning. The moves came amidst continuing concerns that the government’s pledge not to extend the Brexit transition period beyond the end of 2020 will increase the chance that the UK ends up with another Brexit cliff-edge next year, as the UK could exit the transition period without reaching a trade agreement with the EU. Speaking of Brexit, today the Queen’s Speech is taking place here in the UK, which is where the monarch outlines the government’s agenda for the coming session of Parliament. Now that the Conservatives have a 80-seat majority in the House of Commons, in contrast to the previous hung Parliament, the government will have a considerably easier time when it comes to passing the legislation it wants to get through. That process will begin quickly, as Downing Street have said that the Withdrawal Agreement Bill to enact the Brexit deal will be returning to the House of Commons tomorrow.

The other main event to watch out for this morning is the Riksbank’s latest decision, where the consensus expectation is there’ll be an end to negative interest rates with a 25bp hike to 0%. Sweden has had negative rates since February 2015, but assuming the Riksbank hikes today, would be the first country to actually move out of them. It comes at a time when policymakers across Europe are increasingly taking note of the negative side effects of such policies.

Back to yesterday now, and the equity rally following the announcement of a US-China phase one deal petered out, with the S&P 500 breaking a run of 5 successive increases to close down -0.04%. The Dow Jones (-0.10%) also fell modestly, though the Nasdaq (+0.05%) managed to eke out a gain to reach a fresh record. We did get the news that the US House of Representatives had voted to impeach President Trump, but markets had little reaction thanks to Republican control of the Senate, where a two-thirds majority is necessary to remove the President from office, so it’s difficult to imagine that this will actually happen. Equity markets in Europe were a little weaker, with the STOXX 600 ending the session -0.13%, though German equities dragged on the index, with the DAX closing down -0.49%. Over in commodity markets, Brent crude was up +0.11% at a 3-month high.

In fixed income, sovereign debt sold off on both sides of the Atlantic, with 10yr Treasury yields up +3.7bps yesterday to 1.917%, their highest level in a month. Notably, the 2s10s curve was up +3.0bps to 28.4bps, which is the steepest the curve has been since November 2018. Meanwhile in Europe, 10yr bund yields closed +4.4bps, at their highest level in a month as well, while yields on OATs (+4.8bps) and BTPs (+6.5bps) also rose.

Sticking with the central bank theme, overnight the Bank of Japan left interest rates unchanged, with the policy balance rate remaining at -0.10% and the 10yr yield target at 0%. The BoJ’s statement said that “Japan’s economy is likely to continue on a moderate expanding trend, as the impact of the slowdown in overseas economies on domestic demand is expected to be limited”. It also said that “Downside risks concerning overseas economies seem to remain significant”, unlike in October where the statement said these downside risks “seemed to be increasing.” Moreover, the government’s recent fiscal stimulus announcement has further removed pressure on the BoJ to ease policy.

Elsewhere in Asia, equity markets are trading lower this morning, with the Nikkei (-0.27%), Shanghai Comp (-0.20%) Kospi (-0.18%) and the Hang Seng (-0.65%) all losing ground. In the US, S&P futures are down -0.04%.

Separately, Bloomberg reported this morning that the ECB might remove or downgrade the monetary analysis pillar in assessing the economy. Rather than focusing on money supply growth, the article cited officials who said that examining credit or monetary policy’s impact on financial stability could be more appropriate. The rationale according to the officials is that money supply growth has been of little guidance when it comes to inflation.

There wasn’t much in the way of data yesterday, though we did get the December Ifo survey from Germany, which beat expectations as the business climate indicator rose to 96.3 (vs. 95.5 expected), its highest level since June. In a promising sign, both the expectations (93.8) and the current assessment (98.8) readings rose on last month, and the increase contrasts with the flash composite PMI for Germany on Monday, which remained at 49.4 in December, still in contractionary territory.

We also had a number of inflation prints from around the world. In the UK, the November CPI inflation rate remained below the BoE’s 2% target at +1.5% (vs. +1.4% expected), while core CPI also stayed at +1.7%. Looking at the Euro Area, the final November CPI reading was confirmed at +1.0%, in line with the flash estimate. In spite of stubbornly low inflation there, interestingly we did see five-year forward five-year inflation swaps for the Euro Area rise to 1.3075% yesterday, closing above 1.30% for the first time in 3 months.

Finally, New York Fed President Williams said in a CNBC interview that “I do think where we’ve got monetary policy is in the right place”. Later on we also heard from Chicago Fed President Evans, who said that he was “personally worried that inflation has been too low”, and he said that overshooting the inflation target would “further reinforce a view that our objective is in fact symmetric”.

To the day ahead now, and as mentioned central banks will be the highlight, with decisions from the Bank of England and the Riksbank out today, along with the Banco de México this evening. We’ll also hear from the ECB’s Lane, and get the minutes from the Reserve Bank of India’s December meeting. Data releases include French business confidence for December, UK retail sales for November, and from the US, we can expect Q3’s current account balance, November’s existing home sales and leading index, and December’s Philadelphia Fed business outlook. Finally in the US, tonight sees the latest Democratic presidential primary debate, and as mentioned there’s the Queen’s Speech taking place in the UK.

Tyler Durden

Thu, 12/19/2019 – 08:03

via ZeroHedge News https://ift.tt/2PYKGDX Tyler Durden