“We Could At Most Hope For Stagnation:” German Economy To Contract In Q4

Global stocks have priced in a massive economic rebound from the US, Europe, and China for early 2020, with the latest Fund Manager Survey indicating the biggest jump in optimism on record. But is this optimism justified? Is it possible that after a brief push higher, deceleration resume as the world’s manufacturing complex remains mired in a deep recession.

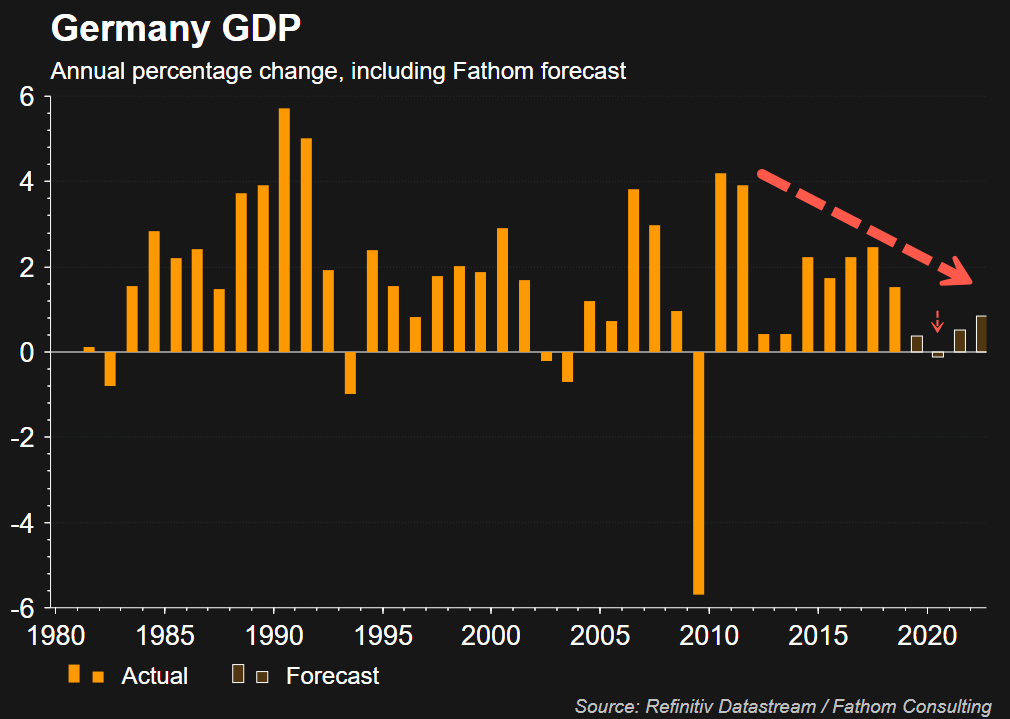

The German Institute for Economic Research, also known as DIW Berlin, warned Friday that Q4 export-oriented manufacturing continued to decelerate, according to Reuters. It’s expected that Europe’s largest economy will contract by 0.1% in the October-December period.

“We could at most hope for stagnation,” DIW economist Claus Michelsen said.

DIW’s forecast for Q4 is much different than Ifo institute’s forecast that predicts the quarter will expand by 0.2%.

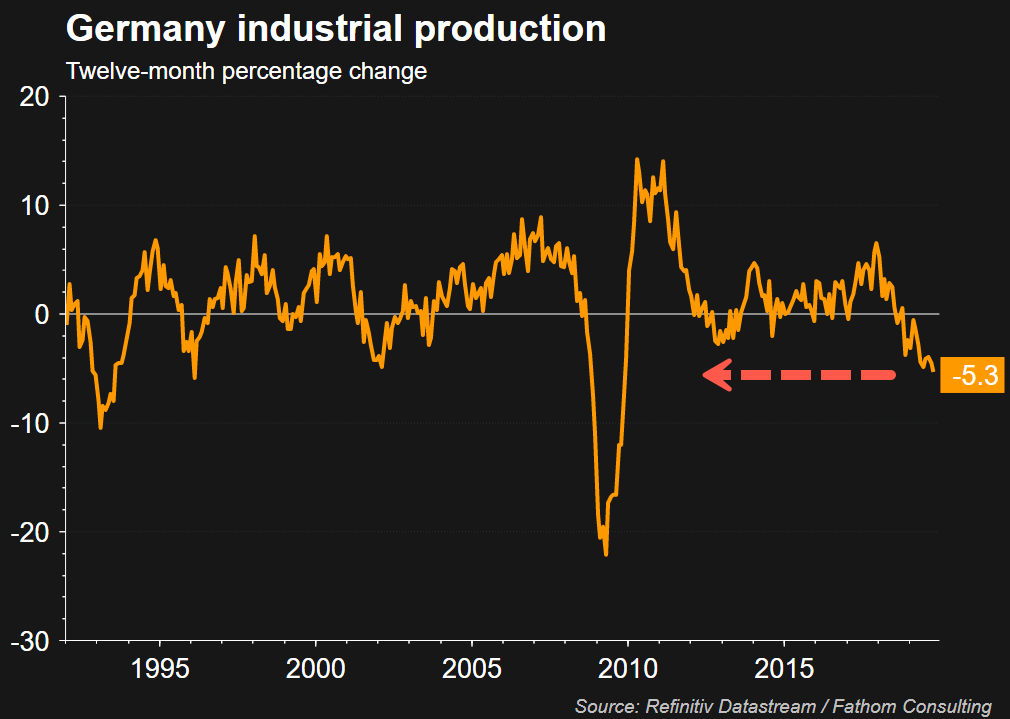

Germany’s export-dependent industry groups slashed production this year, citing a global synchronized slowdown that stared before the trade war. German manufacturers fell into a recession this year on the heels of economic deceleration in the US and China.

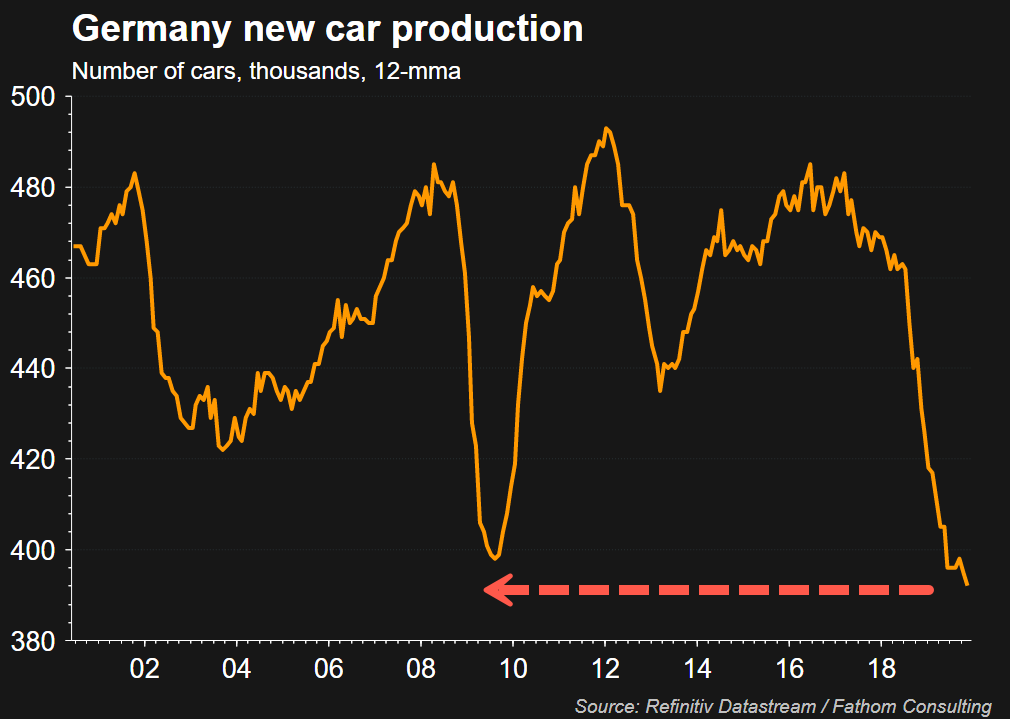

German manufacturers also cite the trade war and Brexit uncertainties. Still, one of the reasons why manufacturing has been in a recession is due to the collapse of the global car industry.

DIW said despite the gloom and doom, there’s hope that Germany’s economy can rebound in the year ahead.

“German companies are again looking positively into the future, especially when it comes to their international business,” said Michelsen.

German Economy Minister Peter Altmaier said Friday that the economy had averted a recession.

But the issue with Germany is that its economy is heavily export-driven and would need to see economic rebounds in the US and China for revival.

So far, despite equity markets across the world trading at all time highs and pricing in a recovery for early 2020 – there’s little evidence that suggests a rebound is imminent.

Tyler Durden

Fri, 12/20/2019 – 07:23

via ZeroHedge News https://ift.tt/2sJf11o Tyler Durden