NYC’S Billionaire’s Row Beats Out Hong Kong For Title Of World’s Top Luxury Street

They call it Billionaire’s Row for a reason.

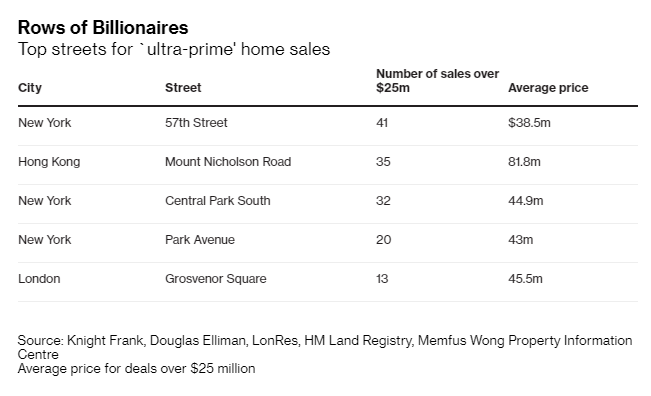

This year, that reason was clear: 57th street in New York City saw more houses bought for $25 million or more than any other road in the world, according to Bloomberg.

The area just south of Central Park beat out Mount Nicholson Road in Hong Kong’s Peak District for the title of most “ultra-prime” home sales. However, the Hong Kong area far trumped the average sale price on Billionaire’s Row, by a score of $81.8 million to New York’s $38.5 million.

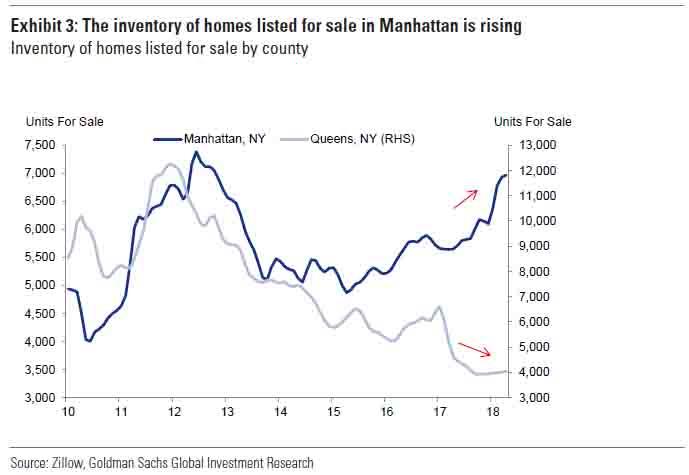

Meanwhile, New York is still dealing with a glut of super-luxury apartments that we have highlighted numerous times.

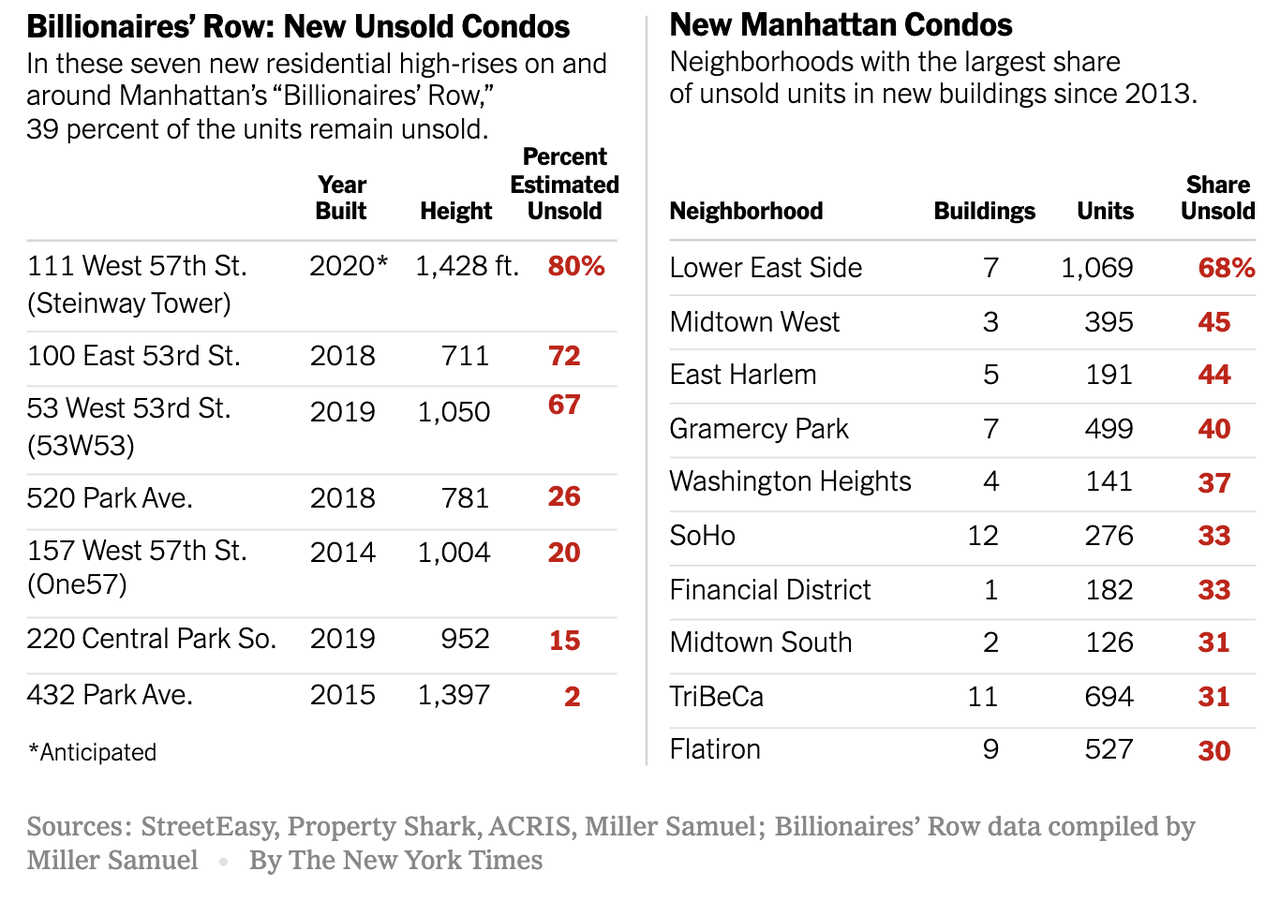

Recall, in early September, we noted that 1 in 4 luxury NYC apartments remained unsold over the past 5 years. We hadbeen documenting this trend for a few years now, and according to a new report by the website StreetEasy that was cited by the New York Times a couple months ago, there were more than 16,200 condo units across 682 new buildings completed in New York City that have appeared since 2013, and 25% remain unsold, roughly 4,050, most of them in luxury buildings.

In a city where brokers are accustomed to selling condos months, and even years, before construction is finished, this sudden freeze has left many confused as to the cause.

What’s worse, a growing share of condos sold in recent years have been quietly re-listed as rentals by the investors who bought them, the NYT reports. Just how reluctant are buyers to try their hand at flipping? Of the 12,133 new condos sold in NYC between January 2013 and August 2019, 38% have appeared on StreetEasy as rentals.

Regardless, developers continue to take advantage of new technology that allows “pencil-thin” towers to pop up on smaller lots. Areas with new luxury developments topped the global rankings as the wealthiest people in the world flocked to buildings with the most modern facilities.

But the supply glut is still causing price concessions. Developers have increased the amount of concessions they are offering to entice buyers into the backlog of high priced inventory spread across the city. The glut in NYC echoes the same issue in London, where tax hikes and political uncertainty have stifled the real estate market.

Tyler Durden

Sat, 12/21/2019 – 15:00

via ZeroHedge News https://ift.tt/391LZuA Tyler Durden