Revisiting 2019 Themes With Goldman Sachs

Goldman Sachs Revisits 2019 Themes…

As we head into year-end, Goldman Sachs continues its tradition of taking stock of Top of Mind themes and highlighting what to look for next year.

On the heels of a 2018 characterized by solid growth and poor asset performance, 2019 has delivered the reverse. Indeed, growth has slowed considerably over the past year with our global current activity indicator (CAI) currently running around 2.6% versus 3.4% on average in 2H 2018. Meanwhile, a simple US 60/40 portfolio had one of the best risk-adjusted returns since the 1960s.

The strong asset performance was driven in large part by the Fed’s dovish pivot early in the year. With other central banks around the world following suit, easier monetary policy pushed rates globally down to or beyond historical lows. These shifts marked a decisive turn in the equity market cycle with equity markets—feeling somewhat comforted by the so-called “Powell put”— reaching new highs. In fact, equities had one of their best years since the initial recovery from the Global Financial Crisis, but almost all of the gains came from multiple expansion rather than profit growth, which was close to flat or even negative across the major economies.

This large market disconnect – with bond yields at or near all-time lows and equity indices at all-time highs—raised questions about how markets were viewing the growth outlook, and whether that view differed between bonds and equities—with equities just more optimistic. Our short answer: no. That’s because, scratching under the surface, equities were pricing their fair share of growth concerns as reflected, for example, in the outperformance of defensive sectors for much of the year.

Indeed, growth concerns prevailed for most of 2019 owing largely to the ongoing US-China trade war, which escalated further when President Trump imposed new tariffs on China in September and threatened additional tariffs slated for later in a “currency manipulator” following a sharp depreciation in the Yuan, which has helped to somewhat offset the impact of the trade war on the Chinese economy. As a result, currency wars became a new front in the ongoing trade war. And this development has evolved beyond US-China relations; President Trump recently announced his intention to impose tariffs on metals imports from Argentina and Brazil in response to the large depreciation in those countries’ currencies, which he argues is harming US farmers that compete with South American producers (but no official action has been taken.)

Beyond trade-related tensions, geopolitical risk also flared elsewhere later in the year, with Brexit uncertainty rising as the October 31st deadline for the UK withdrawal from the EU approached with no clear way forward, and a drone attack on Saudi Arabia’s Abqaiq oil processing facility—the largest such facility in the world—led to the single-largest disruption in global oil supply in history.

But looking ahead to 2020, we believe that some of these political/policy uncertainties that loomed over economies and markets this year are set to fade. In recent days, the US and China agreed to a “Phase 1” trade deal in which China has committed to large purchases of US goods and services as well as structural changes in areas ranging from intellectual property to currency policy in exchange for a cancellation of the next tranche of US tariffs and some rollback of existing tariffs. In our view, this likely marks the end of tariff escalation in the current US-China trade war.

And, just as the good trade news hit, the Conservatives won a decisive victory in the UK general election, finally clearing the path for an orderly withdrawal of the UK from the EU. This major hurdle for Europe was overcome in a year in which European elections led to critical leadership transitions on the continent that—despite fears of a growing populist influence— largely saw outcomes consistent with policy continuity.

Overall, we expect this decline in political uncertainty— combined with a positive impulse from financial conditions, a resilient consumer and some fiscal expansion in places like Europe (though likely not as much as they need) to lead to a sequential growth pickup in 2020, with global growth rising to 3.4% (from about 3.1% this year), led by the US and the UK.

We believe this sequential improvement should provide a broadly supportive environment for risky assets in 2020. That said, in recent months, markets have already begun to price a better growth outlook, which has been reflected, for example, in a sharp rotation towards pro-cyclical assets, and which has already pushed risky assets to relatively rich levels. And we don’t think monetary policy will provide a similar tailwind to markets this year given our expectation that the Fed—as well as the ECB and the BOJ—will keep interest rates on hold despite continued White House pressure for easier monetary policy. Although this pressure continues to raise concerns about central bank independence, with the Fed nevertheless recently pausing rate cuts, fears of political influence in central bank decision making doesn’t seem to be playing out so far (although we still view the bond markets as an indirect channel for such influence.)

In our view, all of the above suggests positive but lower returns across assets in 2020, with total equity returns across the major regions ranging from the mid-to high-single digits, US 10yr Treasury yields rising modestly above 2% and the Dollar index remaining relatively rangebound in the near term before weakening moderately on signs of improving global growth.

But while the growth and policy outlooks provide some reasons for mild optimism, of course political uncertainty is not entirely behind us. There is little doubt that the 2020 US presidential election in particular will be a major market focus throughout the year with policies on everything from taxes, to trade, to healthcare to buybacks (where we’ve still seen a fair amount of Congressional attention but no legislative action) all in question. But here we continue to emphasize that the outcome of the Congressional elections will likely be just as important as the presidential election in terms of material policy changes in most of these areas (save trade!).

In the words of the wise

“Central banks should have constrained missions centered on maintaining monetary system stability…The more they stray into other areas, the greater the distributional effects, and so the greater the temptation-or even the need-to re-politicize them by the back door.”

– Sir Paul Tucker, Former Deputy Governor, Bank of England

“People underestimate how reliant on liquidity the global financial system has become; at almost 40% of GDP, global liquidity is crucial.”

– Rick Rieder, CIO of Global Fixed Income, BlackRock

“There is now only a limited amount of stimulant left in the bottle, and the sooner we use it, the sooner it will run out.”

– Ray Dalio, Founder and Co-CIO, Bridgewater Associates

“Fundamentally…not much has changed… it’s just that the market swung from looking at things optimistically to looking at them pessimistically.”

– Howard Marks, Co-founder and Co-Chairman, Oaktree Capital Management

“It is crucial to have a group of people who analyze the economy with respect to the long-run goals of economic policy…politicians have a much shorter timeframe in mind than is consistent with achieving these goals.”

– Donald Kohn, Former Vice Chair, US Federal Reserve

“There is no shortage of things to worry about. I would simply say…that as the US continues to pull back, its alliances grow weaker, and international institutions fail to keep up with new challenges, instability is likely to go up in the world. So the future is likely to be far more turbulent than the recent past.”

– Richard Haass, President, Council of Foreign Relations

“At the ELB—when monetary policy is constrained—the case for fiscal policy to support demand and help maintain output at potential becomes compelling.”

– Olivier Blanchard, former Chief Economist, IMF

“Given the behavior of the past several years, I would not rule out additional [ECB] policy mistakes, such as a rate hike even if it is unwarranted…there seem to be other factors-legal challenges, politics-that influence [ECB] decisions.”

– Athanasios Orphanides, former member, ECB Governing Council

“ If a company buys back stock for the wrong reasons and good investments are turned down, that is troubling. But addressing that problem requires a scalpel not a bludgeon.”

– Aswath Damodaran, Professor, NYU Stern School of Business

“Trapping resources in larger and older businesses not only inhibits the overall size of the pie…but also tends to reinforce the unequal distribution of the pie.”

– Steven Davis, Professor, The University of Chicago Booth School of Business

“The reality is that the EU is a challenging project. But even today the forces of integration are stronger than the emboldened forces of disintegration.”

– Jose Manuel Barroso, fmr. President of European Commission

“The US is underestimating the influence of the hardliners, or hawks, in China and the degree to which Chinese nationalism and anti-American sentiment has grown since the early 1990s. This is the biggest mistake we have made over the last several decades.”

– Michael Pillsbury, Director for Chinese Strategy, Hudson Institute

“While I don’t think the Fed is cutting rates because the White House is telling them to, you can’t completely separate the politics from the market signals feeding into the Fed’s decision-making.”

– Jan Hatzius, GS Chief Economist

“ The complexity for the US is that the more the US intensifies the trade war, the more pressure there is for a weaker Yuan. And the challenge for the world is that if China tries to offset weak trade with the US with a weaker Yuan, that puts more pressure on other economies to depreciate their currencies in order to avoid losing out to China.”

– Brad Setser, Senior Fellow, Council on Foreign Relations

“Trump’s actions have led to a more unified nationalist resentment of the US-and a view that not just Trump, but American society, is trying to contain China’s rise.”

– Susan Shirk, Chair, 21st Century China Program

“The likelihood that President Trump wakes up and says it’s time to go to war with Iran is probably zero. His lack of desire for another war in the Middle East is one of the few positions he’s maintained consistently from the get go.”

– Richard Nephew, Senior Research Scholar, Columbia University

“I think we should keep a longer-term perspective. Yes, interest rates are low, and they may be low for a while, but they won’t be low forever. And when they rise of course the cost of debt will increase again.”

– Alberto Alesina, Professor, Harvard University

“Just because manipulation is a smaller concern today doesn’t mean it will stay that way. I worry that it will be a problem in the next recession.”

– Joseph Gagnon, Senior Fellow, Peterson Institute for International Economics

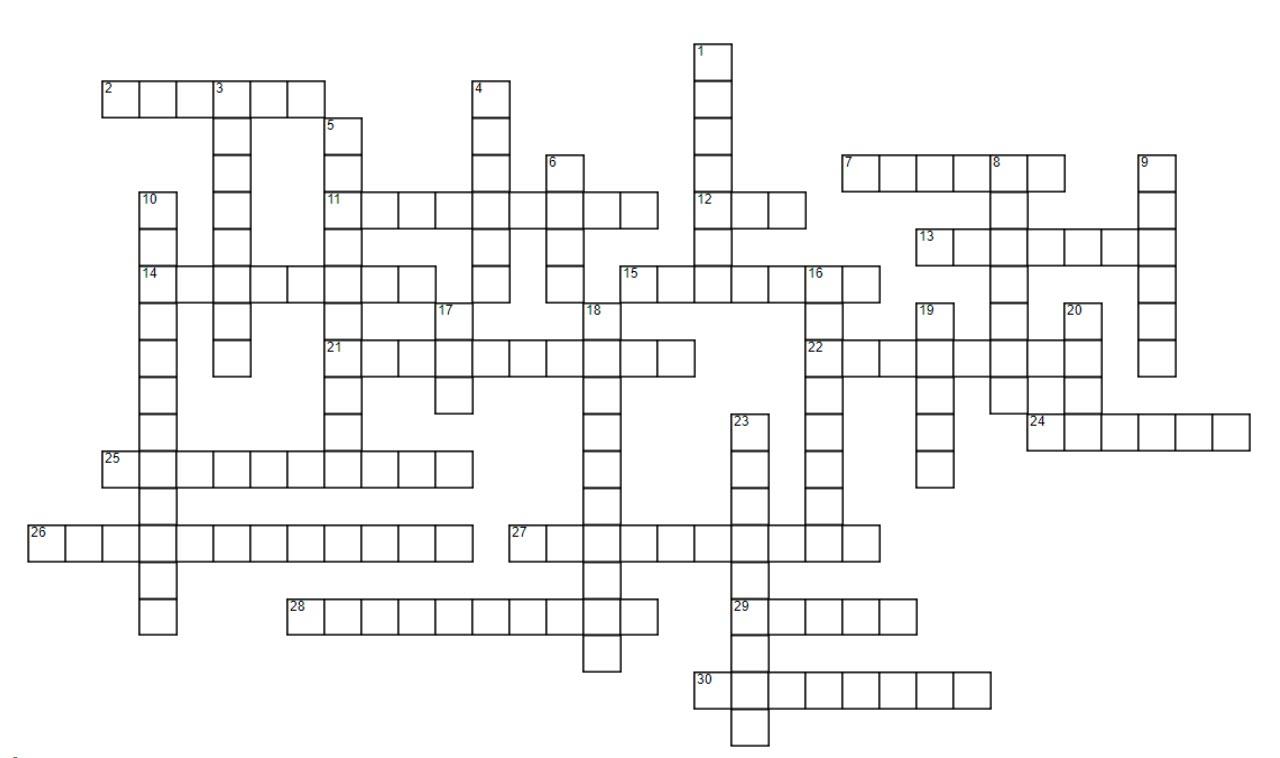

Revisiting 2019 Themes… Crossword Style

Source: Goldman Sachs

Across:

2. This treaty that was implemented in 2009 gave expanded powers to the European Parliament (Issue 78).

7. According to Richard Haass, President of the Council on Foreign Relations, the Middle East matters for many reasons beyond just _____ resources (Issue 83).

11. After rate cuts and quantitative easing programs, the financial world is now often described as awash with _____ (Issue 80).

12. Athanasios Orphanides, fmr. member of the ECB Governing Council, believes that the _____ guided inflation too low by not allowing its balance sheet to expand sufficiently after the global financial crisis (Issue 76).

13. In 2014, government purchases of _____ currencies declined significantly as the global economy recovered (Issue 82).

14. Ray Dalio, Founder and Co-CIO of Bridgewater Associates, is concerned that _____ policy will be dangerously low on power in the next few years (Issue 80).

15. Michael Pillsbury, Director for Chinese Strategy at the Hudson Institute, argues it is imperative that China earn its way out of _____—a view that President Trump has consistently held (Issue 79).

21. Steven Davis, Professor at the University of Chicago Booth School of Business, believes that buybacks don’t affect the level of _____ in the economy; they only affect its distribution (Issue 77).

22. The Federal Reserve does not have a mandate to target the _____ rate (Issue 82).

24. With markets performing well after the Fed’s dovish pivot, some observers have suggested that there is “a _____ put” on the S&P 500 (Issue 76).

25. Howard Marks, Co-Founder and Co-Chairman of Oaktree Capital Mgmt., believes that over the past two years, markets were excessively _____ (Issue 75)

26. Joseph Gagnon, Senior Fellow at the Peterson Institute for International Economics, worries that currency _____ will be a problem in the next recession (Issue 82).

27. Given substantial evidence of a large tax _____, Alberto Alesina, Professor of Political Economy at Harvard University, believes that any fiscal expansion should focus on cutting taxes rather than on increasing spending (Issue 84).

28. The notion that debt accumulation reduces capital formation is only true when the economy is at full _____ (Issue 84)

29. _____ took out an ad in the NY Times in 1987 to discuss how the US was being disadvantaged by foreign countries in the trade area (Issue 79).

30. Support for _____ parties has increased significantly across Europe (Issue 78).

Down:

1. The Trump administration’s policy toward Iran included pulling out of the 2015 _____ agreement (Issue 83).

3. The Federal Reserve set itself an inflation target under the chairmanship of _____ (Issue 81).

4. Buybacks have been the single largest source of US _____ demand each year since 2010 (Issue 77).

5. Over the past several years, rising _____ were the main drivers of global equity returns (Issue 75).

6. Historically, the Federal Reserve has had to cut rates by roughly_____ percentage points on average during recessions (Issue 80).

8. This country has the largest amount of seats in the European Parliament (Issue 78).

9. The Federal Reserve ended its balance sheet _____ sooner than expected (Issue 76).

10. Olivier Blanchard, fmr. Chief Economist of the IMF, does not blame fiscal or monetary policy for weak growth in Japan, instead saying it has to do with _____ (Issue 84).

16. Aswath Damodaran, Professor at the NYU Stern School of Business, thinks of buybacks as _____ dividends, in that they can vary from year to year depending on how much cash a company has (Issue 77).

17. US economic recoveries have never lasted more than this many years (Issue 75).

18. Susan Shirk, Chair of the 21st Century China Program at UC San Diego, believes that _____ technologically from China will ultimately weaken US technological innovation (Issue 79).

19. Sir Paul Tucker, fmr. Deputy Governor of the Bank of England, regards central banks as the _____ pillar of unelected power (Issue 81).

20. US sanctions imposed on Iran over the past two years have included a demand that oil exports effectively go to _____ (Issue 83).

23. Donald Kohn, fmr. Vice Chair of the US Federal Reserve, believes that central bank independence is still important today despite an environment of low _____ (Issue 81).

* * *

Finally, here’s Howard Marks

“I don’t believe that we’re in a bubble, and I don’t think we’re going to have a crash…But for an investor, I think the next five years simply aren’t going to be as good as the last ten.”

– Howard Marks, Co-Founder and Co-Chairman, Oaktree Capital Management

* * *

Tyler Durden

Tue, 12/24/2019 – 11:10

via ZeroHedge News https://ift.tt/2MonuxM Tyler Durden