Treasury Yields Plunge After Stellar 2Y Auction

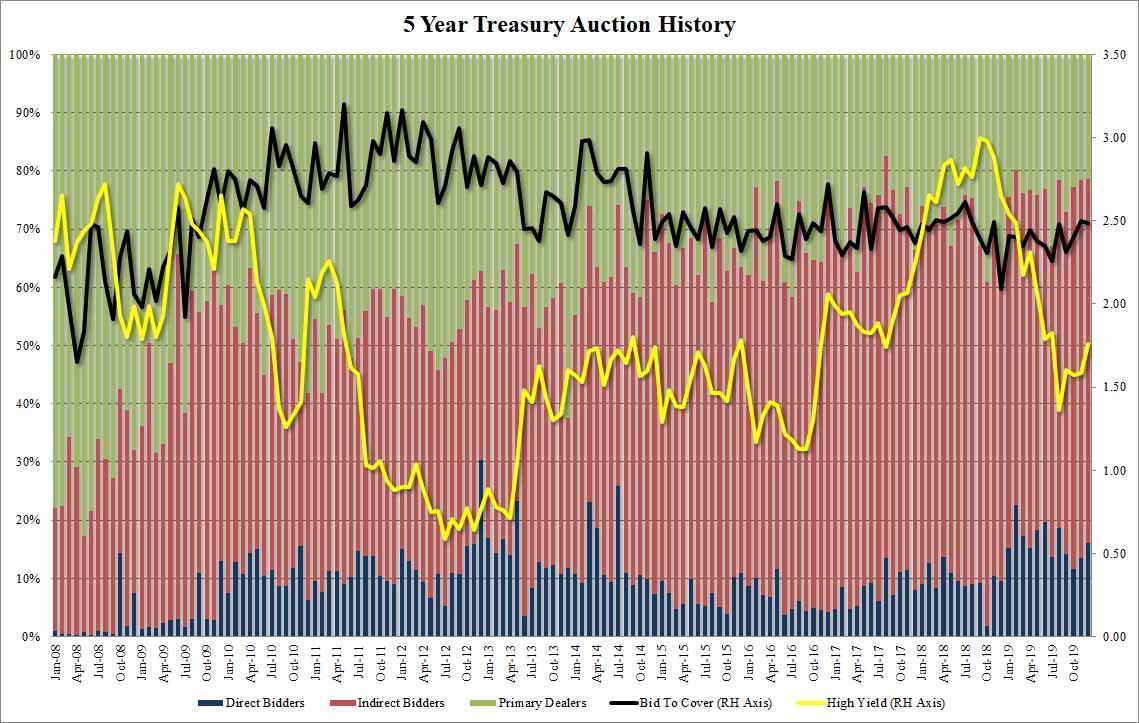

After yesterday’s dismal 2Y auction, which printed at the lowest bid to cover since 2008, few were looking forward to today’s 5Y auction which would come in an environment of even worse liquidity coupled with a continued selloff across the Treasury complex this morning.

Yet to everyone’s surprise, the sale of $41 billion in 5Y notes was nothing short of stellar, with the high yield coming in at 1.756%, which while above last month’s tailing stop of 1.587%, stopped through the When Issued 1.772% by a whopping 1.6bps, the biggest stop through since February 2016!

Also unlike yesterday’s disappointing 2Y auction, the internals today were quite impressive, with the bid to cover virtually unchanged from November’s 2.50, at 2.49, the second best since July 2018, and well above the 2.38 six auction average.

Finally the takedown was also on the strong side, with Indirects taking down 62.4%, above the recent average of 59.9%, and with Directs taking down 16.1%, the most since August 2019, Dealers were left holdings 21.5%.

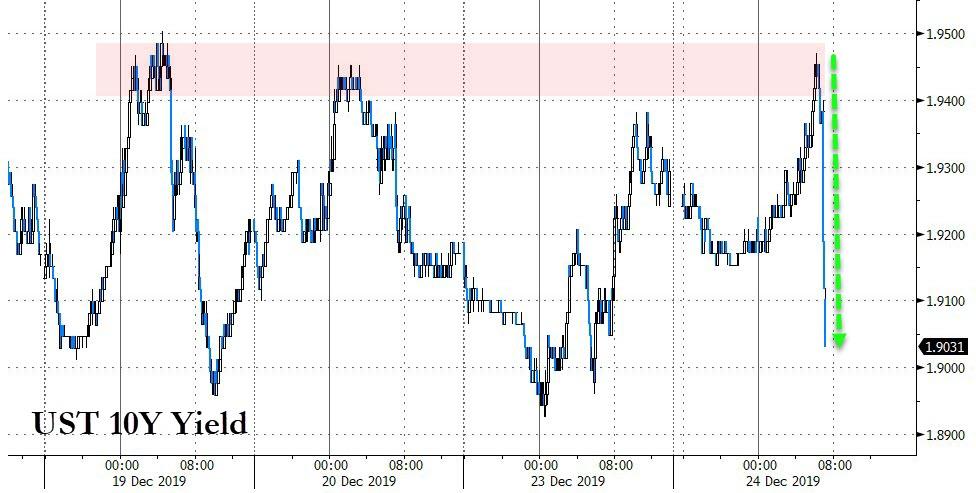

In kneejerk response to the stellar 5Y auction, yields have tumbled across the curve which was to be expected for an illiquid session, yet the 10Y rate plunging from 1.94% just before the auction to a sub 1.90% print shows just how little liquidity there is in the bond market at this moment.

Tyler Durden

Tue, 12/24/2019 – 10:15

via ZeroHedge News https://ift.tt/39bmPcY Tyler Durden