Boxing Day Bid For Bitcoin, Bonds, & Bullion As Nasdaq Soars

With most of Europe closed, celebrating Boxing Day…

US Small Caps lagged today as Nasdaq was the day’s big winner (again)

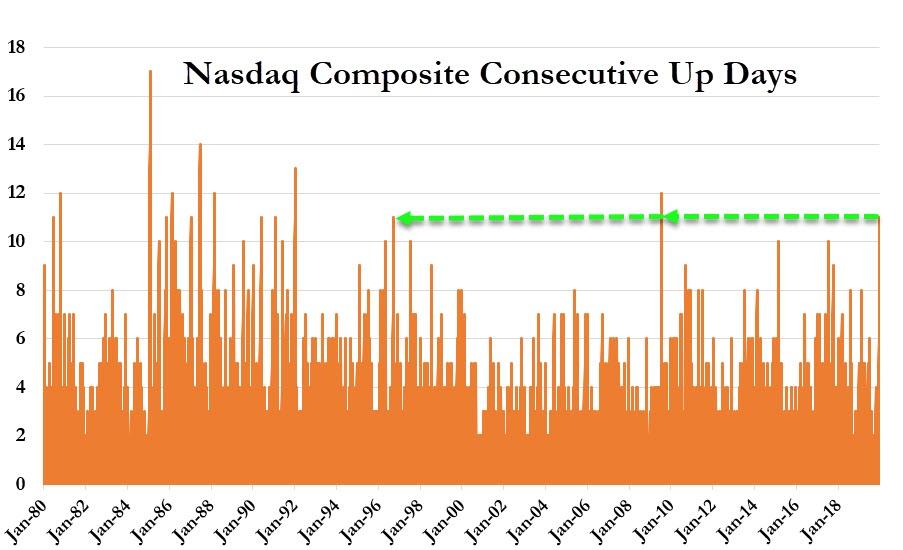

Nasdaq completed its 11th consecutive rally day today – the longest such streak since July 2009…

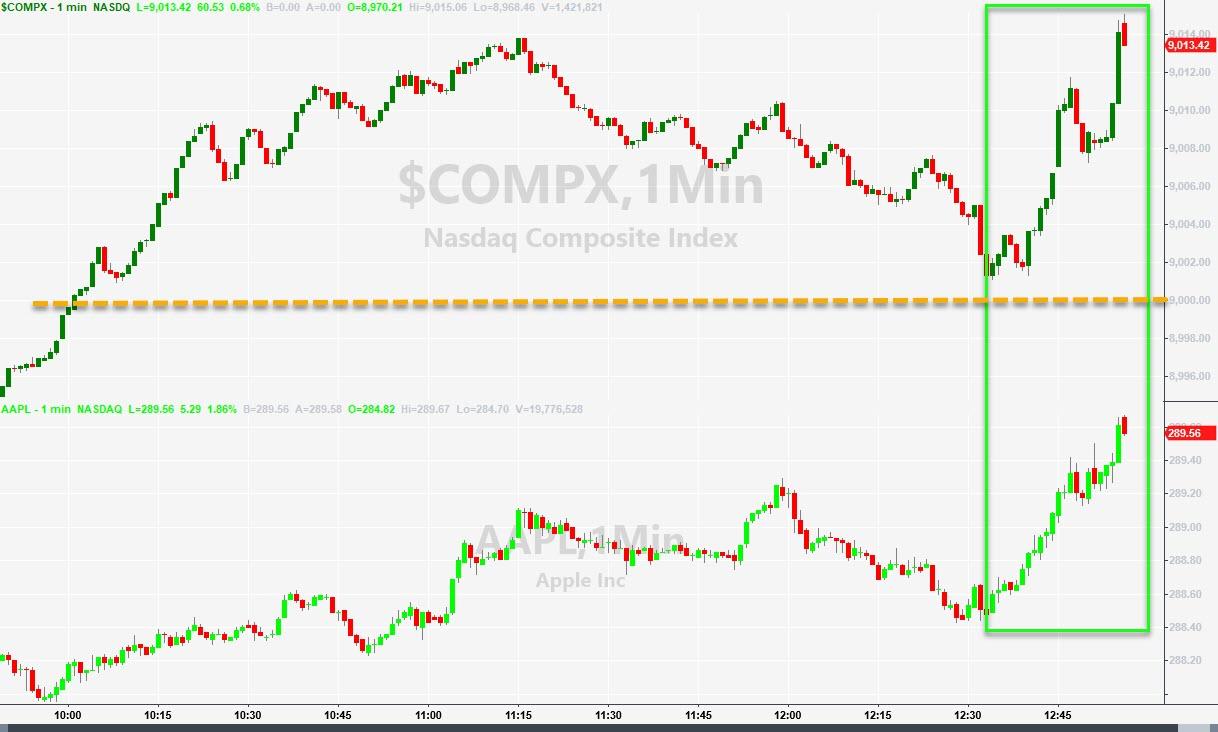

Breaking above 9,000 for the first time ever (up 18 of the last 23 days)…

Source: Bloomberg

As Nasdaq dipped back towards 9,000 in the last few minutes, AAPL was ramped once again to rescue it with ‘ye olde 330 Ramp’…

The Nasdaq is back to pre-dotcom-crash levels relative to the S&P 500…

Source: Bloomberg

US Cyclicals outperformed today…

Source: Bloomberg

Shorts were squeezed out of the gate but faded the rest of the day, having run out of ammo to support Small Caps…

Source: Bloomberg

Chinese stocks were higher overnight, extending gains from Xmas Day…

Source: Bloomberg

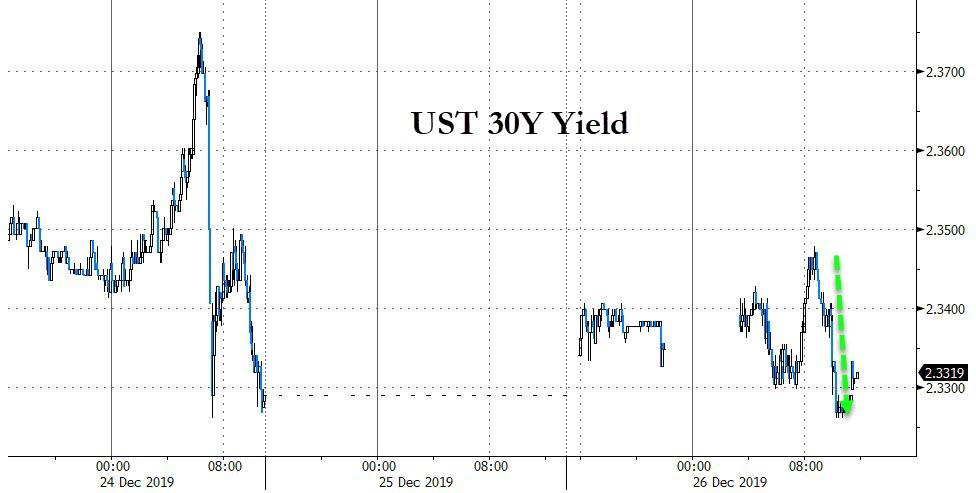

Bonds were bid today after a strong auction…

Source: Bloomberg

And 10Y yield was back below 1.90…

Source: Bloomberg

And Bullion extended its recent gains…

Gold is also having a banner year, up almost 18% in 2019 so far…

Source: Bloomberg

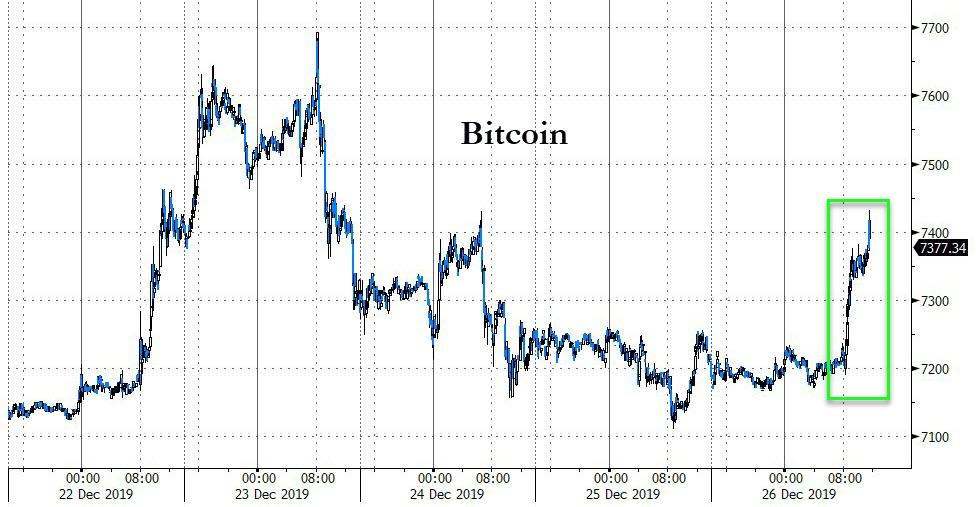

Bitcoin spiked today after resting for Christmas Day…

Source: Bloomberg

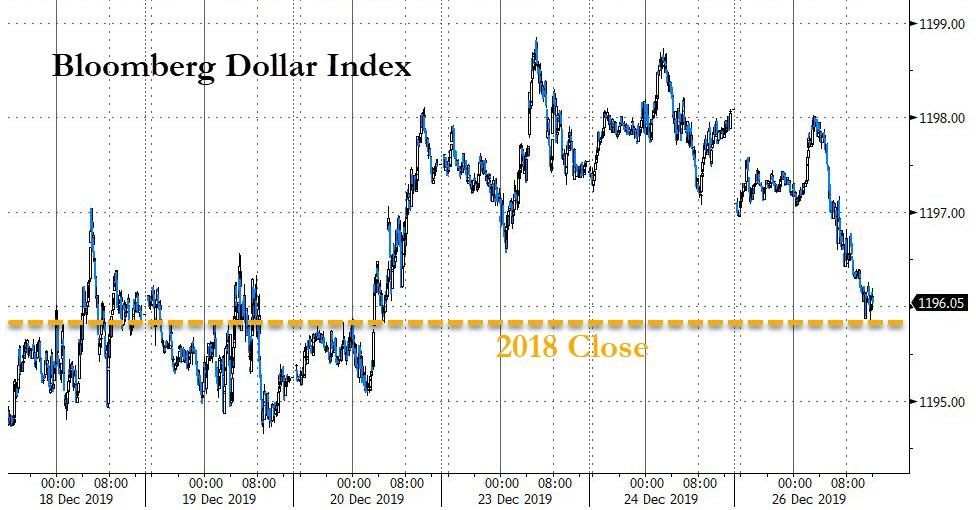

The dollar slipped lower today, back in the red YTD…

Source: Bloomberg

Finally, “Extreme Greed” went to 11 today (well a new cycle high of 93)…

“probably nothing”

Tyler Durden

Thu, 12/26/2019 – 16:00

via ZeroHedge News https://ift.tt/354zds4 Tyler Durden