Bond Worries And Gold

Authored by Alasdair Macleod via GoldMoney.com,

There is evidence that US Treasury bond yields may continue to rise, exposing the debt trap in which the US government finds itself. Market participants don’t realise it yet, but the dollar-based monetary system is spinning out of control. This will become obvious as the crisis stage of the credit cycle, which we now appear to be entering, becomes evident.

The outlook for monetary inflation is dire. Not only will governments fund themselves through QE, but central banks will be forced to inflate even more to pay for government deficits significantly greater than currently forecast. And when markets stop taking government statistics on inflation as the Gospel Truth, the interest cost of government funding will rise and rise, reflecting an increasing rate of time preference for fiat currencies which will be losing their purchasing power at an accelerating rate.

In a world where all fiat currencies will face enormous challenges, using yardsticks such as trade weighted indices will be misleading. The best gauges of the slide in fiat currencies will be commodities, particularly commodity monies, gold and silver.

Introduction

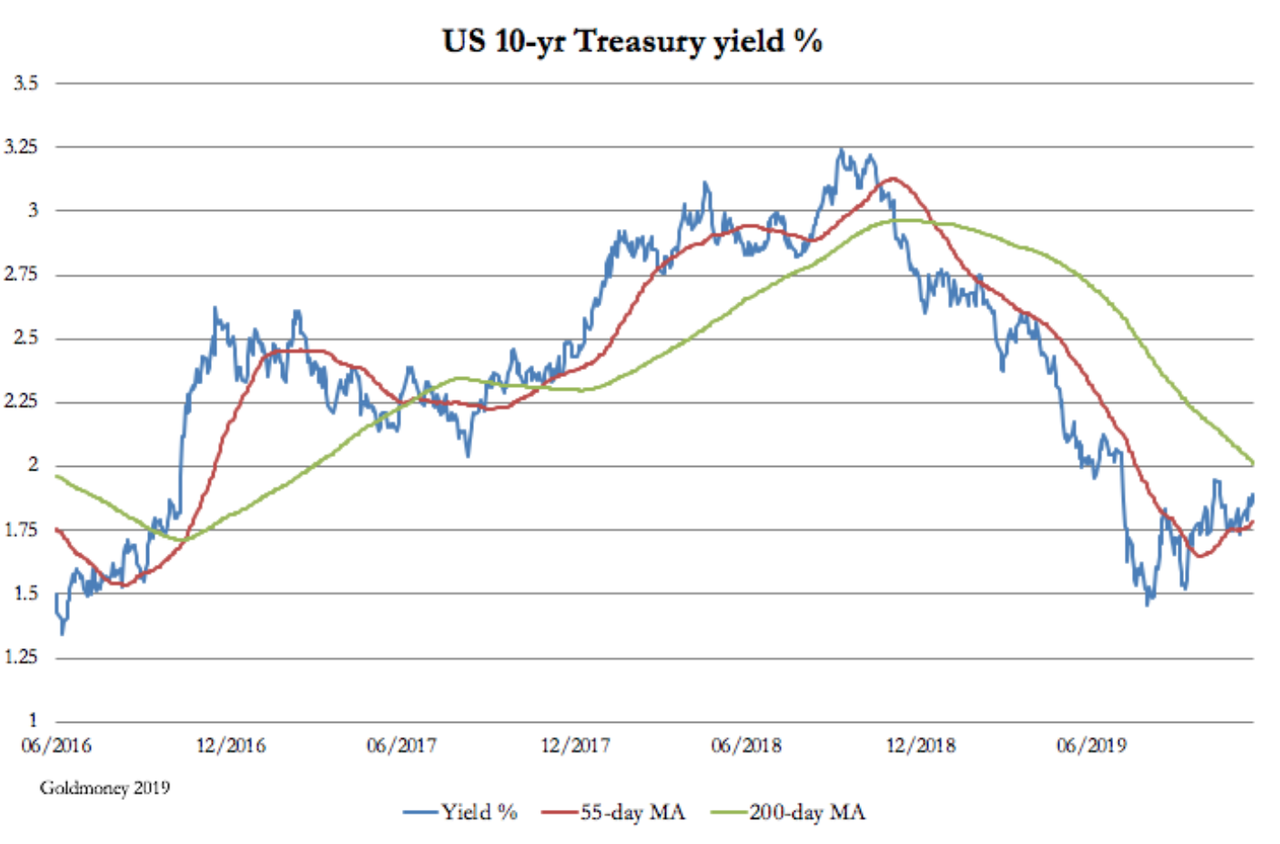

The chart above, of the US 10-year Treasury yield is shows that its yield bottomed at the end of August, when it had more than halved from the levels of October 2018. What, if anything, does it mean? Some would argue that it is good to see a positive yield curve again, implying the recession, or the risk of one, has gone away. But if US Treasury yields have bottomed out, then in the fullness of time they will continue to rise. Chartists might even claim it is setting up for a bullish golden cross, like the one earlier in the chart on 17 November 2016, which marked the beginning of a significant rise in bond yields.

That would be a worry, since equity markets have flown to places where bond yields don’t exist. But there are more solid concerns about the course of bond yields, other than charting ephemera. Despite the massive expansion of money and credit since the Lehman crisis, there is a shortage of liquidity, because the Fed is having to inject half a trillion dollars into the banking system to keep overnight levels suppressed at the Fed Funds Rate target.

Informed opinion suggests that there is indeed a liquidity crisis. The banking system in New York has become strained through banks loaded with US Government debt and providing repos to hedge funds who have shorted euros and yen to buy T-bills and short-dated government coupon debt. The shortage has occurred because the largest banks, designated globally systemically important banks (GSIBs) must demonstrate excess reserves to cover obligations thirty days out. The strains for this Basel III requirement are expected to increase at the next quarter-end, i.e. 31 December.

These strains first became evident in the repo market, which blew up three months ago, on the day Deutsche Bank completed the sale of its prime brokerage to BNP. We don’t know if these events were related, but as any investigating detective will tell you, pure coincidence must be dismissed until proven otherwise. In any event, the problems in the repo market have continued, so having noted that perhaps the Deutsche Bank sale did not go as planned, we must go with the GSIB excess reserves explanation.

Looked at in this light, the persistent rise in UST bond yields is threatening. Unless the Fed simply floods the markets with liquidity, they seem set to rise further. If the Fed does not, the GSIBs have two courses of action, and they may be forced to take both. First, they could be forced to sell down their US Treasuries in order to create intraday liquidity needs by releasing some of their required reserves to be categorised as excess. Second, they can refuse to roll hedge fund repos, forcing hedge funds to sell US Treasuries and T-bills and then sell their dollars to close their shorts in euros and yen. The withdrawal of liquidity could wipe out one or more major relative value (RV) funds, invoking the ghost of Long-Term Capital Management, which ran into trouble in 1998.

All this is now known, so it would be surprising if the Fed fails to act to contain a year-end crisis. But its actions are limited to providing liquidity for the banks. It will be up to the banks if they decide to use that liquidity to continue to accommodate the RV funds.

Foreign buyers hold the dollar key

Let us assume for a moment that we get through the year end without mishap. We will not have dealt with the underlying problem, which is who is going to buy the $1–1½ trillion of US government debt to be issued in 2020. In the past it has been principally foreigners, banks and RV hedge funds as described above. On a net basis the US saver has not been involved for a very long time, except passively through managed pension funds.

According to US Treasury TIC data, in the year to October major foreign holders added $580.5bn to their holdings of Treasury bills, T-Bonds and Notes. The balance will have come directly and indirectly from domestic credit expansion, including the banks and the RV hedge funds. But from August, foreign investors have been net sellers to the tune of $77.4bn. Until then, every successive month had seen an increase, so it appears foreign demand is stalling, which could have fed into the repo crisis as the GSIB banks in New York and RV funds ended up with too much US Government paper.

Foreign dollar demand is almost certainly affected by the sharp slowdown in global trade. This has happened for two reasons: President Trump’s tariff war against China and others has stalled international trade and at the same time, having been expanding for the last nine years, the credit cycle is due to run out of steam. Together they are recessionary headwinds, probably synergistic, which reduce the level of dollars in in the correspondent banking system foreigners need to hold for liquidity.

China is the second largest holder of US government paper and has been reducing her position in recent months. As to her future reserve policies, commercial considerations are being complicated by politics. She understands that America is desperate for global investment flows to finance US Government debt, and that China’s infrastructure plans would compete for them which explains America’s hidden agenda over Hong Kong. China bungled her management of that situation, and apparently is now exploring the use of Macau as an investment channel for foreign inward investment.

It is probably too late, the damage to investing in China having been done. But it is hard to see why China should just roll over on this issue and continue to buy US government bonds. More likely US Government debt will now be viewed as a source of funds to replace lost inward investment through Hong Kong.

We can now see a best and worst case for the dollar and US Treasury funding. The best case is stagnating demand from abroad, which throws the onus onto domestic investment, which, in the absence of an increase in savers, will be through QE and the inflation of bank credit.

The worst case will see not only stagnant foreign demand, but active selling down of current positions, due to slumping economies and China in particular selling actively. American investors seem generally complacent about this possibility, arguing that foreigners will always need dollars, and more so in a credit crisis. While there is some force in this argument, it ignores the fact that foreign ownership of dollars and dollar investment is already very high at roughly $23 trillion of which over $4 trillion is in deposit accounts, while US ownership of foreign currency liquidity is a relatively trivial figure.

Bearing all this in mind, we must assume that at a minimum US banks and hedge funds between them will be funding all the budget deficit and may even have to absorb existing stock from foreigners. But surely, one imagines a critic asking, in the absence of a change in the savings ratio, a budget deficit is a matter of an accounting identity and will give rise to a similarly sized balance of payments deficit, and so long as dollars accumulate in foreign hands, they must form the capital inflows that finance the budget deficit. Therefore, dollars will continue to accumulate in foreign hands, and they must be invested.

The accounting identity argument is correct, but there is more than one way to skin a rabbit. Dollars received by foreigners can always be sold in the foreign exchanges instead of being reinvested, which given the relative lack of foreign currency liquidity in the hands of domestic Americans, could have a dramatic effect on the exchange rates.

Alternatively, the gap can be closed by the inflation of money through quantitative easing and the expansion of bank credit. In effect, the existing stock of dollar deposits is diluted to bridge the shortfall between a budget deficit and the lack of inward capital flows recorded in the balance of payments.

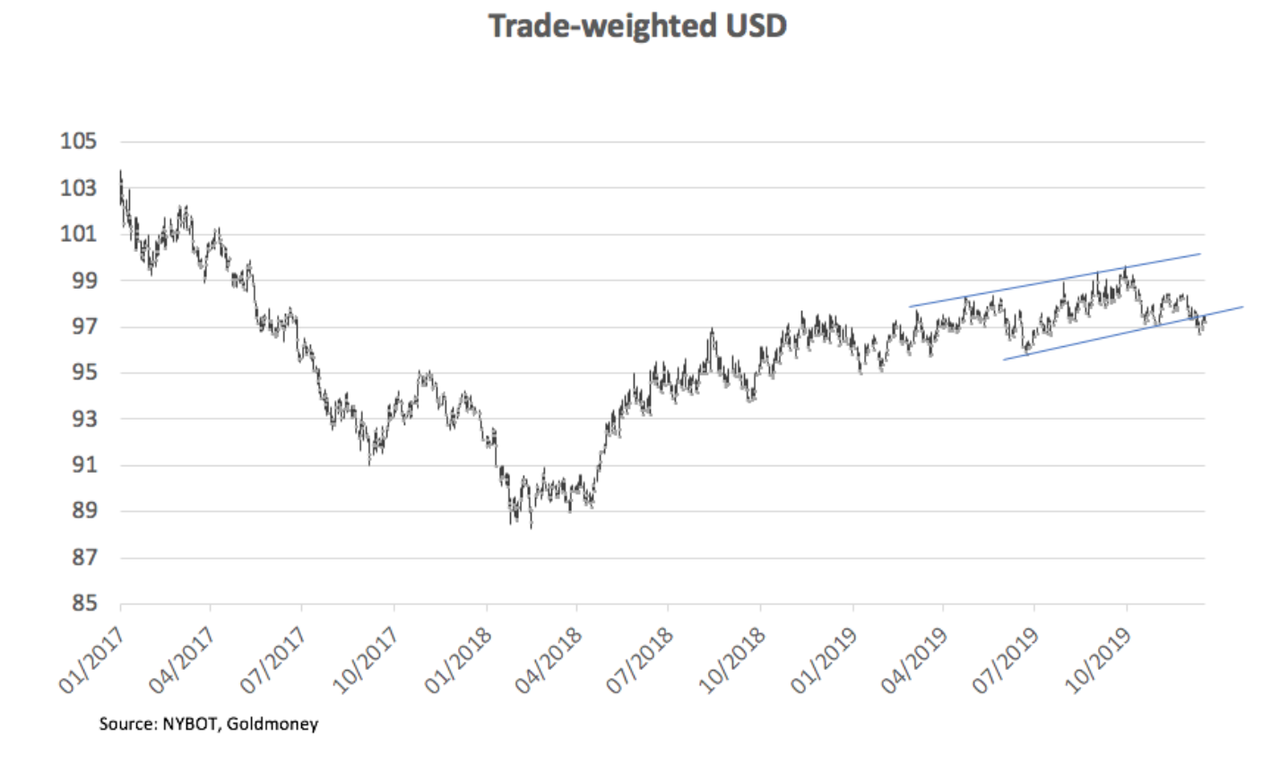

In this context, the chart below of the dollar’s trade-weighted index appears to show the dollar is struggling to advance and may be losing the bullish momentum that developed shortly after President Trump was elected.

If, as the chart suggests, the dollar could be heading lower, it would fit in with a diminution of foreign capital inflows. But the major component of this index is the euro, so it is not an accurate representation of the dollar’s weighting with respect to trade imbalances, which are the normal source of capital flows. But in the case of the euro, it has already been sold down by RV hedge funds to strip out the interest differential by selling euros short and buying dollars. According to Hedgeweek.com, six months ago this form of hedge fund arbitrage stood at $865.6bn, a truly significant sum, most of which will have accumulated since 2018 Q1, when the dollar’s bull phase commenced.

Not all of it would have involved selling down the euro, because in the past the Japanese yen has been the short leg of choice in an interest rate arbitrage. It is clear that the repo crisis tells us that by financing this speculation the US GSIBs have expanded their balance sheets too much and will need a substantial increase in their excess reserves to continue to finance this trade, thereby avoiding a crash in both the US bond market and the dollar. While this problem has surfaced at this year-end, it will be a continuing problem thereafter.

This brings us back to our first chart, of the 10-year T-bond yield. The reasons why it may have bottomed and will rise further are becoming clear. If a rising bond yield is accompanied by a falling dollar it will be because markets recognise an acute funding crisis is upon the US government, reminiscent of the 1970s in sterling markets.

A falling dollar will be the signal, so we must watch the trade-weighted index and, more importantly, the gold price.

The gold price particularly acts as the canary in a coal mine, and in that context Comex open interest is hitting record levels, which without the price rising indicates a suppression operation is already in place. It is therefore reasonable to suggest the combination of the lack of excess reserves in the GSIBs and the suppression of gold is circumstantial evidence that a financial crisis is already on its way.

Markets will take control from central banks

When the funding difficulties of the US Government become more obvious, investment strategists are bound to rethink the course of interest rates in other fiat currencies, which face similar pressures from increasing budget deficits. Being aware that monetary policies are not working as intended, central banks have already encouraged their governments to deploy additional fiscal stimulus. Even before welfare costs rise and tax income falls due to a developing global recession, it appears that government borrowing world-wide is set to accelerate.

With the credit cycle on the turn, one thing is for sure, and that is what central banks call the business cycle will follow. The mistake made by all mainstream commentators and economists is to not appreciate that the problem is one of the central banks’ own making, and that once the credit cycle is set in motion it cannot be simply stopped by reducing official interest rates. We saw this proved ten years ago, when the Fed and other central banks had to inflate the quantity of money by however much base money was required and by taking failing institutions into public ownership. In the UK the only significant bank which successfully resisted needing a government bail-out was Barclays, and executive directors at the time are still having to answer for their actions in the courts. It seems that not only is failure rewarded, but a major bank not failing has become a criminal act.

The fact that some central banks have unsuccessfully imposed negative rates has not yet led to a realisation that attempting to control the cycle in this way simply does not work. The periodic credit and systemic crises are increasingly destabilising and the dynamics behind the next one indicate it will be on a scale significantly greater than the Lehman crisis eleven years ago. The banking scene is set for a reversion from incautious greed to abject fear, fear of lending to anyone and to any other bank. And the weakest banks are to be found in the Eurozone. Even in the EU’s strongest economy, the two largest private banks, Deutsche Bank and Commerzbank, by their share prices are signalling a slidetowards bankruptcy.

At some stage, and it could only be a matter of weeks or even days, the global outlook will cause all GSIB banks to become considerably more cautious, withdrawing lending facilities from smaller banks, financial speculators (hedge funds), and businesses alike. Lending to the last category ceases in two ways. In capital markets banks begin to cut their high levels of exposure to sub-investment grade bonds and syndications, and they withdraw working capital facilities for medium and small businesses. The crisis phase of the credit cycle is then irreversible.

The credit-induced recession will be proportional to the scale of the preceding credit expansion. It feeds through to an escalation of government borrowing in all welfare-dependent nations, because of the fall in tax receipts and the increase in welfare costs.

If US bond yields rise, they will do so either because foreigners are selling the dollar, or because domestic prices, reflecting a fall in the dollar’s purchasing power, begin to rise at a faster pace. It is already an open secret that official price inflation figures bear no relation to reality and only financial markets are wedded to the CPI myth. In fact, not only are government statistics inaccurate, but all statistics are reported in funny money. When US dollar markets wake up, the same will be true of markets in other currencies, and the greater the level of interest rate distortion the more severe the crisis is likely to be.

How it plays out in different nations and their currencies is not so much down to the scale of government borrowing in deteriorating circumstances, but whether savers respond to the financing demands of their governments. For this reason, monetary inflation rates will be offset by a tendency for Japanese and Chinese savers to increase their bank deposits rather than spend. In the Eurozone and Britain, this is less the case. Increasing monetary inflation will end up fuelling rising eurobond and sterling bond yields more rapidly than their equivalents in Japan and probably China.

Commodities and commodity money

The point has been already made in this article that measuring the dynamics behind a credit crisis is distorted by government statistics not fit for the purpose and by the elastic nature of fiat currency. Furthermore, monetary planners, portfolio managers and the commentariat inhabit a Keynesian fantasy land and only understand rising prices to be directly related to increased demand, and falling prices to falling demand. Presumably, this explains why they associate a CPI rising at two per cent with a healthy economy.

The key to understanding the error is that money is only objective in its value for the purpose of individual transactions. But give money a temporal context and it becomes clear that money’s purchasing power varies as well as the cost of anything.

If it is expected that the rate at which a currency loses purchasing power is about to increase, then commodity prices measured in that currency will rise without any improvement in demand. Demand can even fall, and prices rise, if the purchasing power of the currency declines sufficiently. This condition can be temporarily overcome by an investors’ panic when they sell assets, such as bonds and equities, in order to escape falling prices, but once that initial effect has quickly worn off, the relationship between money and goods will adjust to the public’s general desire to hold money as opposed to goods.

We have a contemporary example. At the time of the Lehman crisis the price of gold declined from $1,000 in March 2008 to $700 the following October, before rising to $1,920 three years later. But this time is likely to be different, because the rate of monetary inflation before the Lehman crisis varied little in the preceding few years, compared with subsequently. Following Lehman, all major central banks expanded money quantities very rapidly, so the next crisis comes against a background of already inflated currencies before a further acceleration in supply. Depending how the next credit crisis evolves, there may not be a dip in the gold price at all.

Instead, gold and other commodity prices, precious or otherwise, will be bought and sold against a background of rapidly debasing currencies. We know this, because renewed monetary expansion in the form of quantitative easing is taking place even before any crisis materialises. And when we hear luminaries such as Christine Lagarde at the ECB talking about QE to finance eco-friendly infrastructure developments directly, we know that central bankers and their governments now view monetary inflation much as it was in the Weimar Republic: an infinite source of funds.

Despite attempts by the bullion banks to suppress the evidence from the gold price of what is likely to turn out to be the early stages of a widespread fiat currency collapse, if matters progress on the lines described in this article, gold, silver and other commodities will rise priced in fiat. Initially it is likely to reflect the fact that such assets are under-owned. But then another effect is likely to take over, as the public begins to realise what is going on and start dumping fiat currencies for gold, silver and even bitcoin.

Ninety years ago, it was called a crack-up boom, the last dash out of currency for anything not printed by the government. It will happen differently this time, because it always does. But now that inflationary financing is not only required to balance governments’ books but to finance the expansion of their spending, happen it will.

Tyler Durden

Thu, 12/26/2019 – 22:15

via ZeroHedge News https://ift.tt/3642wfm Tyler Durden