“Everything Is Surging”: Stocks Hit New Record High As Traders Capitulate To Year-End Meltup

With just three trading days left in the year, global stocks and S&P futures hit fresh all time highs led by tech stocks as investors capitulated to the year-end meltup. The S&P is now set to surpass the 29.6% full year return of 2013 at which point 2019 will be the best year in 22 years, since the 31% return posted in 1997.

“Everything is surging” was the only comment from a lonesome prop trader surrounded by algos on Friday morning, and with nothing tangible to explain the latest bout of euphoria, some used the same strawman that has been used to justify the rally for much of the past year: trade optimism. Indeed, as Reuters notes, traders returned from their Christmas and Boxing Day break “to digest comments from Beijing that it was in close contact with Washington about an initial trade agreement. Earlier, U.S. President Donald Trump had talked up a signing ceremony for the recently struck phase-one trade deal.

Needless to say that was enough, and after yesterday’s furious tech meltup, the rally has continued on the last day of the week, with global markets a sea of green.

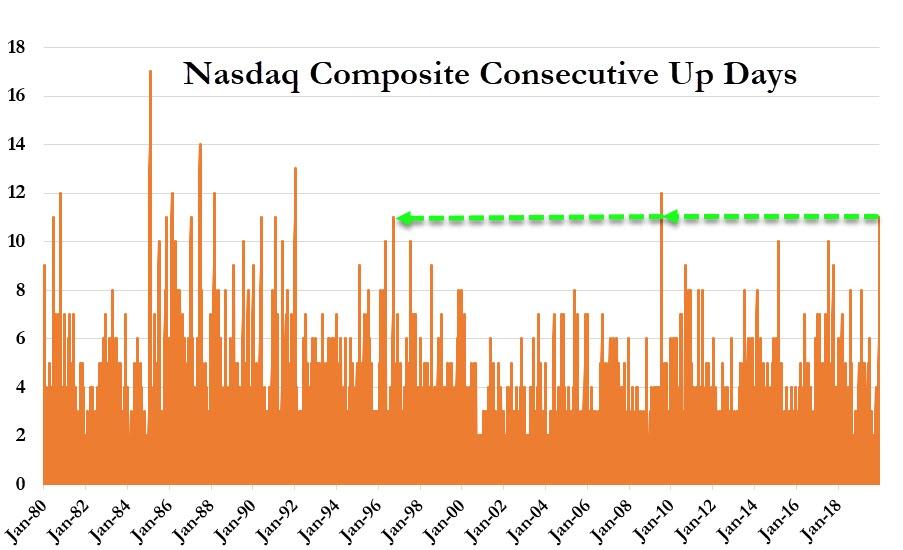

After hitting a record high of 9,000 on Thursday, the tech-heavy Nasdaq Composite was set for a 12th consecutive up day, the longest such stretch since 2009, buoyed by computer and retail stocks, with Amazon.com Inc.’s “record-breaking” holiday season, while AAPL is now up more than 100% from its January 3, 2019 lows.

Amazon surged on Thursday following reports of strong holiday-season revenue, with e-commerce sales surging according to Mastercard SpendingPulse, which reassured investors that U.S. consumers are feeling confident. A solid rebound for industrial profits in China also buoyed sentiment, with investors now looking to the initial U.S.-China trade deal to sustain gains in the new year.

Equities rose across Europe, except in Italy, with the Stoxx Europe 600 index helped by gains in export-heavy German shares, and set for a third all-time closing high, hours after gains in communications-services shares drove up Asian markets. European shares were on course for their best year since the financial crisis. The UK’s FTSE 100 was set for its best run in three years, adding 0.4%. Mining companies provided the biggest boost, with Glencore and BHP Group climbing about 2% each.

The positive tone was set earlier in Asia, where the MSCI index of Asia-Pacific shares ex-Japan jumped 0.8% to 555.39, a level not seen since mid-2018. It is up 15.5% so far this year. Asian stocks gained, led by communications and technology shares, after the technology sector pushed U.S. indexes to new records. The MSCI Asia Pacific Index gained 0.2%, with most markets in the region in the green. Hong Kong’s Hang Seng Index gained 1.3% and India’s S&P BSE Sensex Index rose 0.8%, while China’s Shanghai Composite dropped 0.1%. China’s National Bureau of Statistics said the industrial profit outlook remains uncertain as the Chinese economy is still facing relatively heavy downward pressure despite industrial profits rising at the fastest pace in 8 months. China’s blue-chip was down 0.1%, although for the week the index was up 0.1%.

Profits at industrial companies in China in November rose 5.4%, growing at the fastest pace in eight months, breaking a three-month declining streak, as production and sales quickened. But broad weakness in domestic demand remains a risk for earnings next year, say analysts.

As a result of the euphoria across Asia, Europe and US futures, world stocks also scaled fresh record highs on Friday and oil prices stayed buoyant in a holiday-shortened week, as optimism grew that a U.S.-China trade deal would soon be signed.

The Fed’s unprecedented dovish reversal, somewhat stronger economic data, and corporate profits have helped lift stocks this year, along with trade-related optimism. Markets are now waiting for January’s fourth-quarter financial results to see whether sentiment among companies has improved. But some analysts are wary about risks ahead in 2020.

“The trade war … is far from over,” Piotr Matys, FX strategist at Rabobank, wrote in a research note. “In our view, this is just a temporary truce. Another unsolved major issue is Brexit. Geopolitical risk can suddenly resurface.”

“Investors in the last 12 months – with all the uncertainty – actually have had a defensive posture,” Alphabook Chief advisors Martin Malone told Bloomberg TV. “Cash levels are just too high, and people are going to have to invest. We probably are going to continue very solid gains in the next quarter.”

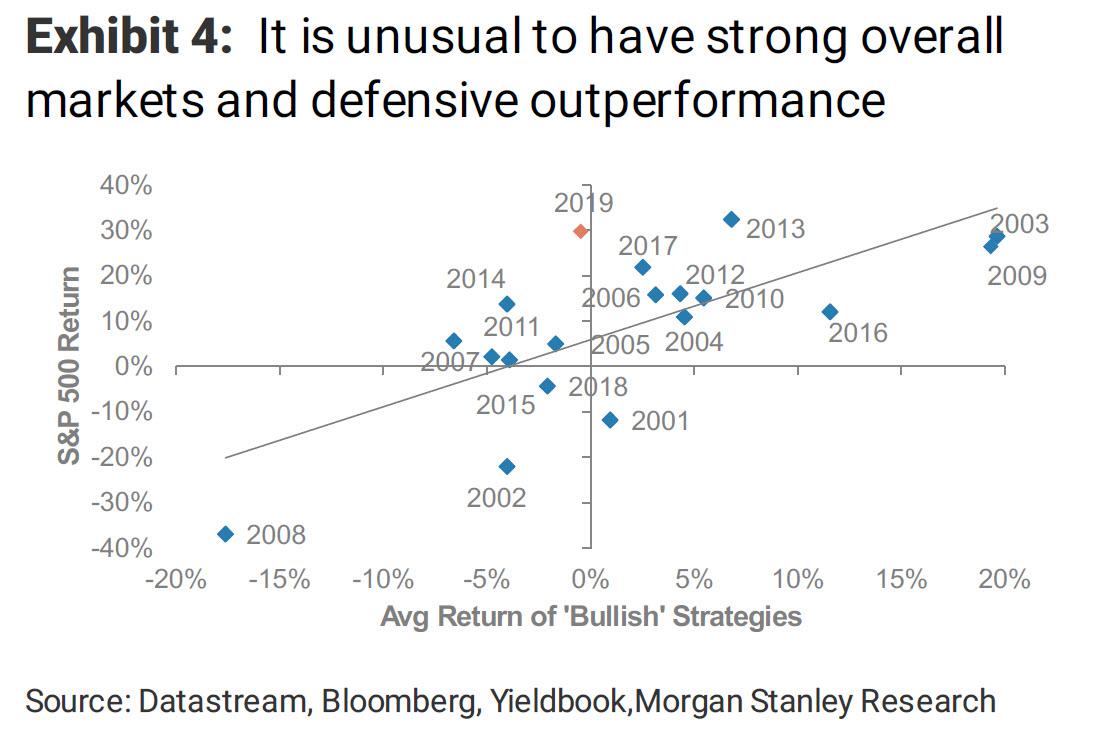

Here’s the bizarro observation he is referring to: in a year of near-record performance, bullish strategies posted a negative return!

In FX, the dollar drop continued, as the greenback slid against all its major peers Friday. The Bloomberg dollar index is now below the level where it started 2019.

After being battered during 2019 by hedge funds betting on its weakening, the euro rose on Friday to an eight-day high of $1.1142. Easing uncertainty about Britain’s exit from the European Union helped sterling gain to a four-day high of 85.17 pence against the euro. The rise was helped by European Commission President Ursula von der Leyen’s saying the EU may need to extend the deadline for talks about a new trade relationship with Britain.

The dollar also dipped against the Japanese yen, falling 0.2% to 109.48 yen. But the dollar was not far off the six-month high of 109.73 yen it reached at the beginning of this month. Finally, the trade-sensitive Aussie dollar rose as high as $0.6958 against its U.S. counterpart, a five-month high.

In commodities, oil prices hit three-month highs, with Brent rising to $68.14 per barrel, extending gains for a fourth session, while WTI gained 22 cents to $61.90 a barrel. Brent has rallied about 25% in 2019, supported by supply cuts in oil-exporting countries. Finally, gold prices eased from a near two-month high hit earlier in the session as investors booked profits amid thin holiday trade. It was still on course for its biggest weekly gain since early August. Spot gold was 0.01% down to $1,510.80 per ounce.

Market Snapshot

- S&P 500 futures up 0.2% to 3,249.25

- STOXX Europe 600 up 0.2% to 419.83

- German 10Y yield fell 1.4 bps to -0.256%

- Euro up 0.3% to $1.1133

- Italian 10Y yield unchanged at 1.26%

- Spanish 10Y yield fell 3.3 bps to 0.403%

- MXAP up 0.5% to 171.12

- MXAPJ up 0.7% to 555.27

- Nikkei down 0.4% to 23,837.72

- Topix up 0.1% to 1,733.18

- Hang Seng Index up 1.3% to 28,225.42

- Shanghai Composite down 0.08% to 3,005.04

- Sensex up 0.9% to 41,548.02

- Australia S&P/ASX 200 up 0.4% to 6,821.65

- Kospi up 0.3% to 2,204.21

- Brent Futures up 0.5% to $68.23/bbl

- Gold spot little changed at $1,511.69

- U.S. Dollar Index down 0.3% to 97.29

Top Overnight News from Bloomberg

- China’s economic performance improved in December for the first time in eight months, according to a group of earliest-available indicators compiled by Bloomberg.

- Gold is heading for its biggest weekly advance in more than four months as it powers toward its best year since 2010. The precious metal is up 18% this year as central banks reduced interest rates, and the to-and-fro between the U.S. and China over trade boosted demand for havens.

- Banks around the world are unveiling the biggest round of job cuts in four years as they slash costs to weather a slowing economy and adapt to digital technology. This year, more than 50 lenders have announced plans to cut a combined 77,780 jobs, the most since 91,448 in 2015.

- Prime Minister Narendra Modi’s government has set itself on a collision course with those protesting against a new religion-based citizenship law, leading to fears of deepening polarization across the country at a time when the economy is sputtering.

- A Turkish criminal court convicted at least seven staffers at the Sozcu newspaper on terrorism-related charges, the latest such ruling targeting journalists critical of President Recep Tayyip Erdogan and his policies.

Top Asian News

- New Sri Lanka Central Bank Chief Holds Rate as Growth Risks Fade

- China’s Economy Picked Up in December, Early Indicators Show

- SoftBank Loses Veteran Board Member as Uniqlo Founder Exits

- Taiwan Dollar Erases Advance as Traders Suspect Intervention

- Modi Hardens Stance Against Protesters, Who Vow to Hold the Line

Top European News

- Qiagen Tumbles on Plan to Pursue Stand-Alone Strategy

- Von Der Leyen Says Brexit Transition May Not Happen by End 2020

In FX, the Bloomberg Dollar Spot Index sank 0.3%. The British pound climbed 0.6%. The euro climbed 0.4% to $1.1147. The Japanese yen strengthened 0.1% to 109.50 per dollar. The onshore yuan was little changed at 6.995 per dollar.

In commodities, West Texas Intermediate crude gained 0.2% to $61.82 a barrel. Gold sank 0.1% to $1,510.13 an ounce.

LME nickel sank 2% to $14,050 per metric ton. LME zinc surged 1.2% to $2,301.50 per metric ton.

US Event Calendar

- Nothing major scheduled

Tyler Durden

Fri, 12/27/2019 – 07:35

via ZeroHedge News https://ift.tt/37ffoQ9 Tyler Durden