Indian IPOs Plunge To Four-Year Low Amid “Great Slowdown”

Several months ago, we reported how the global IPO market went bust in 2019. Now a new report via Reuters provides more insight into the trend, more specifically, taking a look at the IPO bust in India.

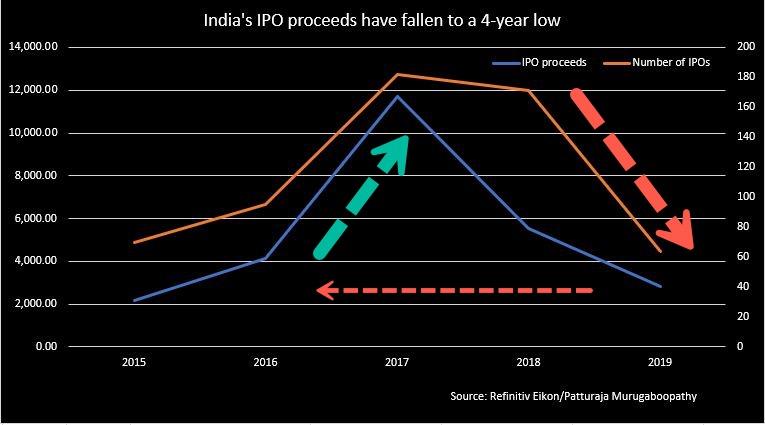

Indian IPOs plunged to a four year low by value in 2019 as the global and domestic economy continues to slow.

Refinitiv data shows funds raised by Indian IPOs fell to $2.8 billion this year, the lowest since about 2016. IPO proceeds soared in 2017 to $11.7 billion and $5.5 billion in 2018 during a synchronized recovery across the world.

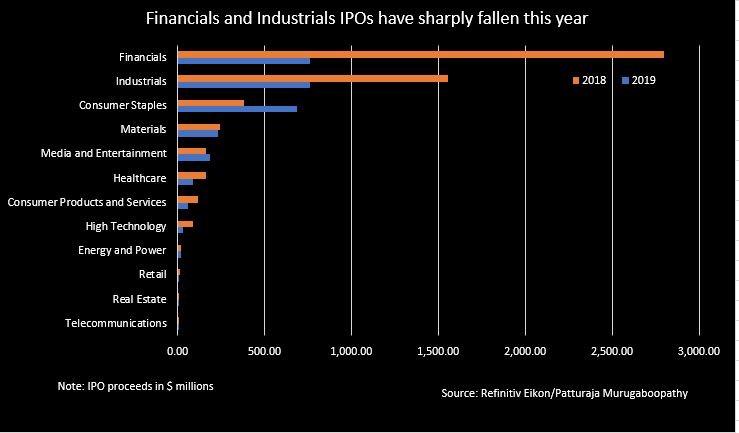

Financial, industrial, and consumer staple sectors led IPOs in 2018 and 2019, but the amount raised compared to last year is significantly less.

With a synchronized downturn across the world and an Indian economy in crisis, investors have been pulling back on speculative IPOs:

“2019 has been the worst year from an IPO market perspective,” said Sandip Khetan, a partner at consultancy EY.

“Because of different types of disruptions, such as corporate failures and bankruptcies, things have slowed down considerably,” he said.

Over the weekend, Arvind Subramanian, the former chief economic adviser to the Narendra Modi government, told NDTV that “this is not an ordinary slowdown… it is India’s great slowdown.”

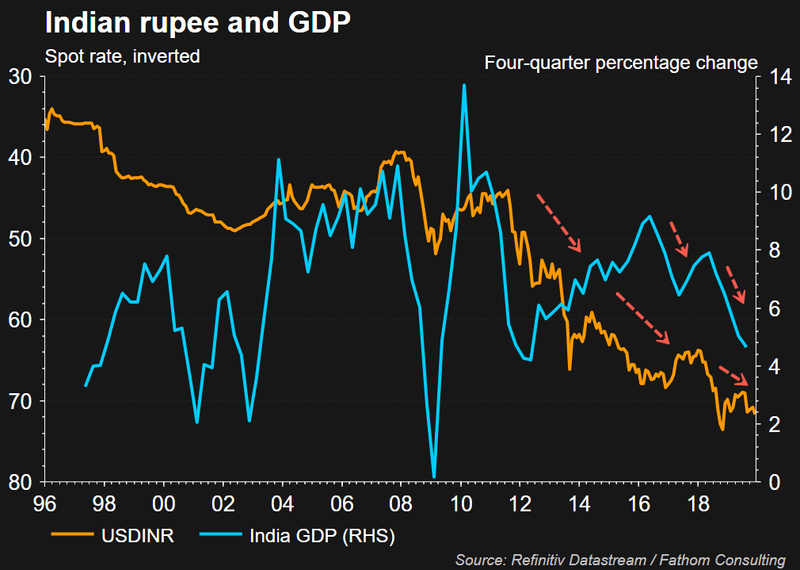

India’s GDP has fallen for seven consecutive quarters, dropping to 4.5% in 2Q19; it stood at 8% in 1Q18.

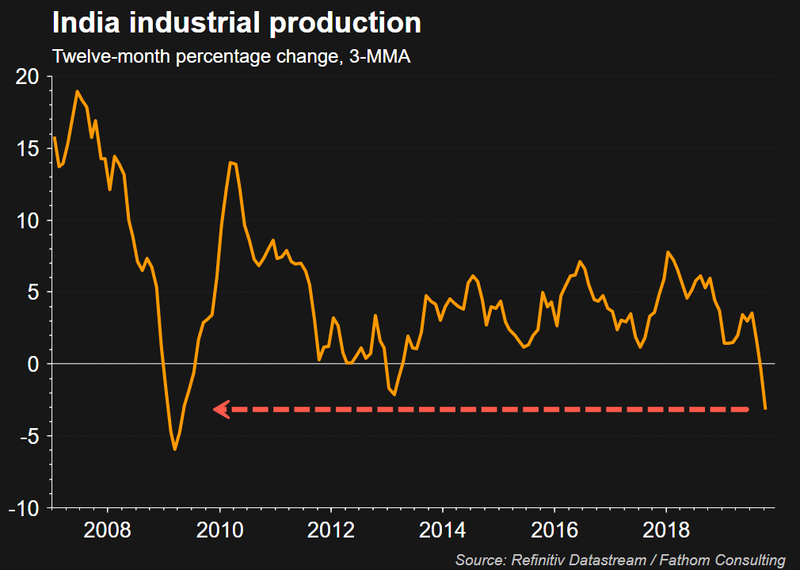

Industrial production growth is at the weakest level in a decade.

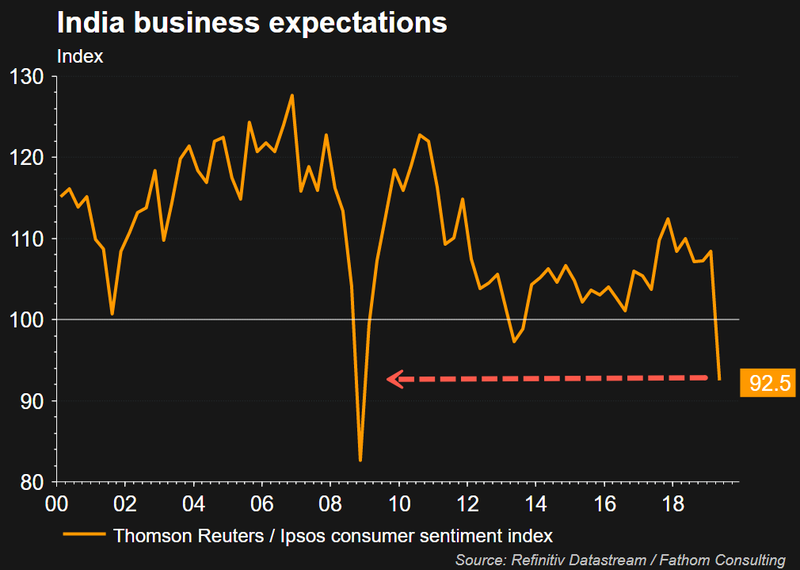

Business confidence has also plunged to decade lows.

“…they (key indicators) are either in negative growth or barely positive growth territory… the comparison is to the real sector of the economy… growth, investment, export, and import… which matter for jobs. It is also a matter of how much revenue the government has to spend on social programs,” Subramanian said during the interview, adding, “The real sector economy is slowing… jobs, you know, people’s incomes, people’s wages and of course government revenues”.

Indian investors are ditching speculative IPOs as the global and domestic economy continues to falter. So far, there are no “green shoots” in India — likely continued deceleration into early 2020.

Tyler Durden

Thu, 12/26/2019 – 21:00

via ZeroHedge News https://ift.tt/34SOTOU Tyler Durden