WTI Rebounds On Bigger Than Expected Crude Draw

Oil has retraced some of the gains from light trading yesterday, but prices are still set for the biggest monthly gain in almost a year amid optimism on trade and speculation that supplies are shrinking.

“A lot of the recent strength in oil prices has been speculative fund flows and short covering in the front months into year-end 2019.” said Leo Mariani, an analyst at Keybanc Capital Markets.

“We think there is a good chance that oil prices will be higher in several years as non-OPEC production growth slows materially into the next decade.”

Notably, API reported that U.S. stockpiles dropped 7.9 million barrels last week (gasoline +566k, distillates +1.68mm), while Russia cut crude output.

Olivier Jakob, managing director of consultant Petromatrix GmbH, adds that a “weekly stock draw could provide a final boost for the end-year print,” referring to the government report.

DOE

-

Crude -5.474mm (-1.5mm exp)

-

Cushing -2.393mm

-

Gasoline +1.963mm

-

Distillates -152k

After the huge API reported crude draw, DOE confirmed it with a bigger than expected 5.474mm drop in inventories (and Cushing stocks down for the 7th week in a row)…

Source: Bloomberg

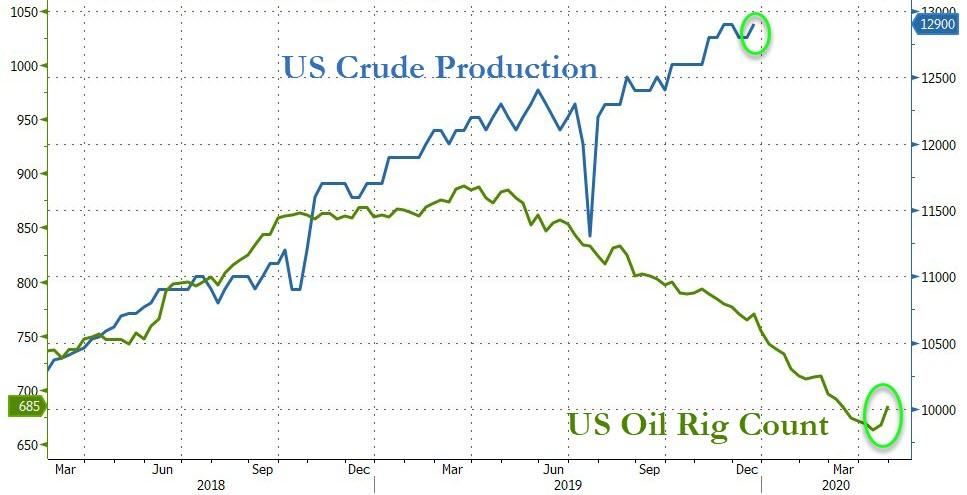

Crude production hovered near record highs and we note that the oil rig count unexpectedly surged by 18 last week – the biggest weekly jump since Feb 2018…

Source: Bloomberg

WTI rallied on the API data, reverted lower overnight before surging back to new cycle highs as stocks opened yesterday. The opposite has happened so far today with a pre-open spike that just failed to tag $62, and then WTI tumbling as stocks rolled lower. But the bigger than expected crude draw sent prices higher…

Tyler Durden

Fri, 12/27/2019 – 11:06

via ZeroHedge News https://ift.tt/2rwH4ke Tyler Durden